9 Things We Learned about the US Economy Last Week

Economic news and commentary for September 25, 2023

Here are the main points gleaned from the latest commentary about the US economy after a huge week full of economic data points and central bank announcements:

Monetary Policy Divergence: Central banks globally are not acting in unison, with varying monetary policies. This could lead to unpredictable impacts on global trade, currency values, and investment flows.

US Economic Resilience: The US economy has shown impressive resilience, with high-frequency data indicating a controlled landing. Labor market conditions remain healthy, though they are cooling, and wage growth is moderating.

Potential Economic Shocks: The resumption of student loan payments, potential government shutdown, and auto workers strike could pose significant challenges to the US economy, potentially impacting GDP growth in Q4.

Housing Market: There's a slowdown in the housing market, with rising mortgage rates potentially impacting future growth. The resumption of student loan payments might further strain potential homebuyers.

Labor Market: While the August jobs report was positive, there are signs of a cooling labor market with softer hiring trends and a slight increase in the unemployment rate.

Consumer Behavior: Consumers are becoming more conservative in their spending due to factors like inflation, higher interest rates, and slowing labor market gains. The depletion of excess savings and tight credit conditions could further impact consumer spending.

Inflation: While inflation remains a concern, there's a slowdown in its momentum. The easing demand for goods and services, combined with softer home and rent price inflation and cooling wage growth, might lead to further disinflation.

Federal Reserve's Stance: The Federal Reserve has maintained a hawkish bias, indicating that interest rates might remain high for a more extended period. While there's speculation about further rate hikes, the material suggests that the tightening cycle might be complete.

Risks: The main upside risk is the resilience of the labor market. However, stronger economic activity could prompt the Federal Reserve to maintain high interest rates, increasing recession risks. Other risks include a potential government shutdown, the resumption of student loan repayments, and global factors like slowdowns in Europe and China.

In summary, the US economy is showing signs of resilience but faces several imminent challenges. While certain sectors like the labor market remain robust, there are several potential headwinds, including policy decisions, global economic slowdowns, and internal economic shocks, that could impact growth and stability.

Still to come…

10:30 am - US Dallas Fed Manufacturing Survey

Morning Reading List

Other Data Releases Today

The German ifo Business Climate Index fell -0.1 pts to 85.7 in September. The Situation index fell -0.3 pts to 88.7, and the Expectations index edged up 0.2 pts to 82.9.

The CBI Distributive Trades Survey for September 2023:

Retail sales volumes index: -14% (Aug: -44%)

Suppliers orders index: -19% (Aug: -37%)

Wholesale sales volumes index: -23% (Aug -23%)

Germany Ifo

German Ifo index drops again in September (ING) - The Ifo index dropped marginally in September after an upward revision of the August number. This seems to be another reflection of the German economy's current stagnation.

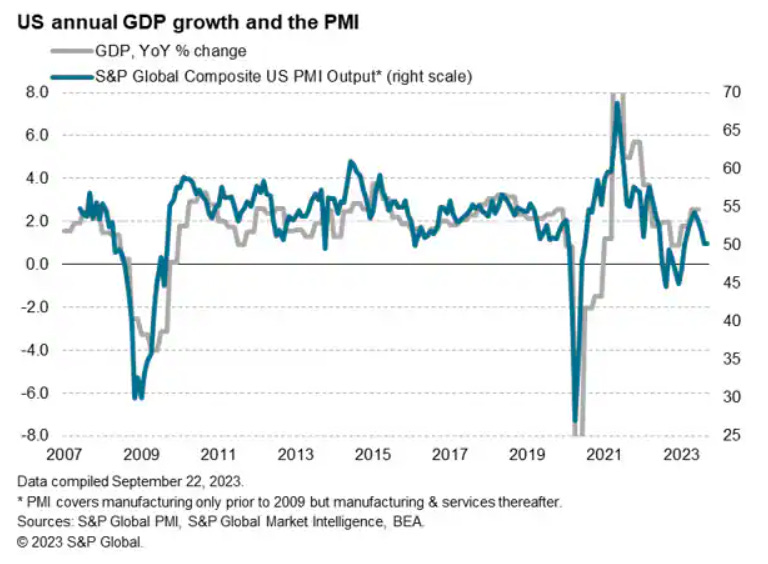

PMIs

US flash PMI points to slowing economy expansion amid stubborn price pressures (S&P Global) - US business activity growth remained close to stalled for a second month in a row in September, according to flash PMI data compiled by S&P Global, suggesting that the pace of economic growth has weakened in the third quarter.

US

U.S. Economy Still Resilient, but Headwinds Building (Wells Fargo) - It was a relatively light week on the U.S. economic data front. A slate of housing data offered additional evidence that high mortgage rates and limited inventory are weighing on housing market activity. Jobless claims remained low, but a still-declining LEI and a further climb in Treasury yields and oil prices suggest economic growth will slow in the months ahead.

The New York Fed DSGE Model Forecast— September 2023 (Liberty Street Economics, NY Fed) - This post presents an update of the economic forecasts generated by the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (DSGE) model. We describe very briefly our forecast and its change since June 2023. As usual, we wish to remind our readers that the DSGE model forecast is not an official New York Fed forecast, but only an input to the Research staff’s overall forecasting process. For more information about the model and variables discussed here, see our DSGE model Q & A.

School’s (Not) Out for Debtors (BMO) - On top of a potential escalation of the auto workers strike and partial shutdown of the federal government, the U.S. economy will need to fend off one other shock that looms with certainty. Starting October 1, tens of millions of student loan borrowers will resume making payments for the first time in 3½ years (interest started accruing on September 1). Average payments are expected to run between $200 and over $300 per month. Roughly half of 43 million student loan borrowers made regular payments prior to the moratorium on payments in March 2020, with most of the others either delinquent or subject to a grace period while in college. A wide range of estimates suggests total payments will amount to between $5 billion and $10 billion per month, or $60 billion to $120 billion per year.

Collaboration Toward Increased Resilience of the Treasury Market (Michelle Neal, New York Fed) - Michelle Neal, Head of the Markets Group at the New York Fed remarks at ISDA/SIFMA AMG Derivatives Trading Forum New York: The Path to Resilient Treasury Markets, New York City.

Fed Policy Rates: Whether a Hallowmas Hike It’s Higher for Longer (BMO) - The FOMC kept the fed funds target range unchanged at 5.25%-to-5.50% on September 20, as was widely expected, after lifting it by 25 bps last meeting. This repeats the first part of the skip-hike sequence established three months ago. And, the Fed left the door open for a potential second-leg rate hike come next announcement on November 1. But it’s uncertain whether the Committee will ultimately cross the sill.

Walking Out On The Auto Industry (Northern Trust) - After a summer of unsuccessful negotiations, the United Auto Workers (UAW) initiated strikes against the three large U.S. car makers last Friday. 13,000 walked off their assembly lines, with more of the UAW’s 146,000 members potentially to follow in the weeks ahead. If the strikes continue for a period of weeks, they will scramble economic measures like industrial output and employment.

Shifting Foreign Holdings of U.S. Debt (Northern Trust) - Each month, the U.S. Treasury updates its International Capital (TIC) reports of cross-border financial flows, including a report of foreign holdings of U.S. debt. Through June, TIC shows an overall steady demand for sovereign debt, but with a shifting composition.

What Are the Types of Trade Barriers Found in the U.S.? (St Louis Fed) - In past decades, globalization steadily reduced trade barriers, which hinder the free flow of goods and services across borders. Yet there are still significant trade barriers in place, even in the U.S. What do such barriers look like?

Macro and FX: Can the higher for longer narrative continue? (Saxo Bank) - Last week ended with both equities and bonds lower following the Fed's hawkish message with rates staying higher for longer to deal with inflation and the strong economy which lifted the longer end of the US yield curve.

Europe

The euro area labour force: recent developments and drivers (ECB) - One notable recent development in the euro area labour market has been a strong rebound in the labour force. In particular, over the last year and a half, the main source of employment growth has been the strong inflow of people joining the labour force rather than a sharp decline in the number of unemployed.

India

What’s Holding Back India’s Economy? (Northern Trust) - India has been one of the fastest-growing major economies for the past decade, with an average annual growth rate of real gross domestic product (GDP) of 5.7%. It has stood out for its economic resilience during a time of global macroeconomic uncertainty and volatility. This year, India is clocking an impressive 7% real growth rate at a time when its peers are slowing down. It has managed a transition from being a “Fragile Five” member a few years ago to the world’s fifth largest economy today.

Why India is bucking the global slowdown trend (ING) - India is the fastest-growing major economy this year. While others in the region look to be struggling, there are few clouds on the horizon for India. Inflation is high, but falling, and the rupee is one of the strongest currencies in the region, which will be further helped as Indian government bonds are set to be included in global indices next year.

Canada

Pie in the Sky on Housing Supply (BMO) - To clear the air at the outset, we are not supply denialists. Given Canada’s robust population growth, rapidly rising rents and lofty home prices, there is no debate that the nation requires a strong and steady supply of new homebuilding. The record 1.2 million increase in the population over the past year simply reinforces that stark reality.

Singapore

Singapore economy continues to be hit by slumping exports (S&P Global) - Singapore's economic growth momentum in 2023 year-to-date has slowed significantly compared with annual GDP growth of 3.6% in 2022. A key factor driving the weakness of economic growth has been contracting manufacturing output and exports.

Inflation

The least bad (CIBC) - Three major economies got fresh news on inflation in the last week and a half, but judging by how two-year yields reacted, the one with the worst news was the most blessed, and the one that looked the least bad is in the most trouble. That alone suggests that market participants need to look beyond their own backyard to gain bit more perspective on where things actually sit in their own country.

Global | Inflation and Bottlenecks Chartbook. August 2023 (BBVA) - Headline inflation has been trending down but recently this trend has halted. Core inflation remains sticky. Our supply bottlenecks indicator shows no sign of supply disruptions.

Central Banks

Banks Central to Diverging Monetary Policy Theme on Display (Wells Fargo) - A key theme across currency and fixed income markets over the last few years has been diverging paths for monetary policy between central banks around the world. This monetary policy divergence theme was on full display this week. Many G10 central banks met over the course of the week, and while nuanced differences were communicated, policymakers are not necessarily acting in unison. In the emerging markets, local institutions are drifting further from G10 central banks, but also intra-EM divergences have become more observable just this week. In this report, we recap this week's central bank decisions and offer views on the monetary policy outlook for certain institutions going forward.

Hike! Hold! Cut! (BMO) - The FOMC, the BoE and the SNB are on hold; Norges Bank hiked 25 bps; the Riksbank hiked 25 bps. Oh, and the BoJ is still on hold but the JPY is now nearing ¥150 with no sign of the MoF, except to say that it is watching currency markets with “a high sense of urgency”. Discuss amongst yourselves.

Weekly Focus - Taking stock of central bank week (Danske Bank) - This week was all about central banks with monetary policy meetings around the globe. In the US, the Fed maintained the policy rate unchanged at 5.25%-5.50% as widely anticipated, but surprised hawkishly with higher median rate projections (dot plots). Bank of England (BoE) decided to leave the policy rate unchanged at 5.25% and step up QT as five members voted for a pause and four for a hike. The Bank of Japan kept its QQE with yield control unchanged as expected.

Commodities

Commodity weekly: Precious metals up despite the Fed’s ‘higher for longer’ message (Saxo Bank) - Commodities suffered a broad but relatively small setback this past week, driven by a hawkish FOMC hurting risk sentiment and the combination of a long overdue correction across the energy sector, continued weakness in the grain market as the northern hemisphere harvest season end, and another setback across industrial metals. Precious metals led by silver where among the surprise winners in a week that saw bond yields spike and expectations for future rate cuts lowed, and we conclude that the breakdown in normal correlations is likely due to a market in search of a hedge against the FOMC failing to deliver a soft, as opposed to a hard, landing or even stagflation.

The Commodities Feed: Oil fundamentals remain supportive (ING) - The oil market remains well supported on the back of constructive fundamentals, and Russia’s ban on diesel and gasoline exports also adds support. The calendar this week is looking fairly quiet.

Outlook

US economic outlook, September 2023: Adapting to a ‘higher for longer’ paradigm (EY Parthenon) - High-frequency data indicates the economy is experiencing a controlled landing, with healthy but cooling labor market conditions, moderating wage growth, and increasingly conservative consumer and business spending. With real GDP on track to grow robustly in Q3, a recession isn’t on the near-term horizon, but the economy faces imminent risks. The triple threat from the resumption of student loan payments, a government shutdown and a strike by auto union workers could significantly weigh on GDP growth in Q4 and add to downside risks already impacting the economy including elevated prices, rising interest rates and tighter credit conditions. We see real GDP growing 2.2% in 2023 and expanding at a muted 1.3% pace in 2024, though a gradual rebound in economic momentum is expected in the second half of next year.

US core PCE, Eurozone inflation and China PMIs to watch (S&P Global) - A series of economic releases will be the highlight in the coming week ahead of worldwide manufacturing and services PMI updates at the start of October. Noteworthy indicators to watch in the coming week includes US core PCE and eurozone inflation readings for the latest inflation updates in these major developed economies. Final Q2 GDP readings from the US and UK will also be due while tier-2 data such as personal income and durable goods orders figures from the US will also be closely monitored. Ahead of the Golden Week holidays in mainland China, both NBS and Caixin PMIs will also provide insights into September business conditions.

Markets

It’s Fall, Except for Yields (BMO) - There is no mystery whatsoever behind the latest market angst—bond yields ratcheted higher again this week, with the 10-year Treasury yield cracking the 4.5% threshold for the first time since 2007. While Friday saw some relief, yields are still up massively in a matter of months—recall 10s were below 4% as recently as the end of July, and 3.5% in mid-May.

Fed Up (BMO) - Equity markets slumped this week as the ongoing reality of higher-for-longer interest rates set in deeper. The S&P 500 fell 2.9%, with all sectors in the red. Consumer discretionary posted the deepest decline, down more than 6%, while banks and technology were also weak. Meantime, the TSX slid 4.1% as higher-beta sectors (see technology and health care) were down sharply, while rate-sensitives also struggled.

Macro & Markets: A peek at the peak (Nordea) - While some central banks are still hiking rates and others are not, most are probably at least near peak rates. Market pricing has moved clearly also longer out, and rates are expected to remain higher for longer.

Green

The missing piece in the net zero puzzle (Allianz) - The ClimateTech industry is set to grow threefold, reaching a market size of USD600bn by 2030. However, Europe’s position in this emerging market cannot be taken for granted – without further efforts, Europe is likely to lose the race against the US and China.

Looking for a way to take advantage of higher interest rates? I recommend SoFi’s high-yield savings account which has a yield of 4.5% (subject to change) and includes FDIC deposit insurance for both its checking and savings accounts just like a traditional bank. Use my referral link to get a sign-up bonus and start earning that rate today. (This is also a great way to support me since I get a bonus too!)

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website. You can also see my feed on the PiQSuite platform as a partnered feed.