A Downside Surprise in Core CPI is Significant Evidence for Disinflation

Economic news and commentary for July 12, 2023

US CPI

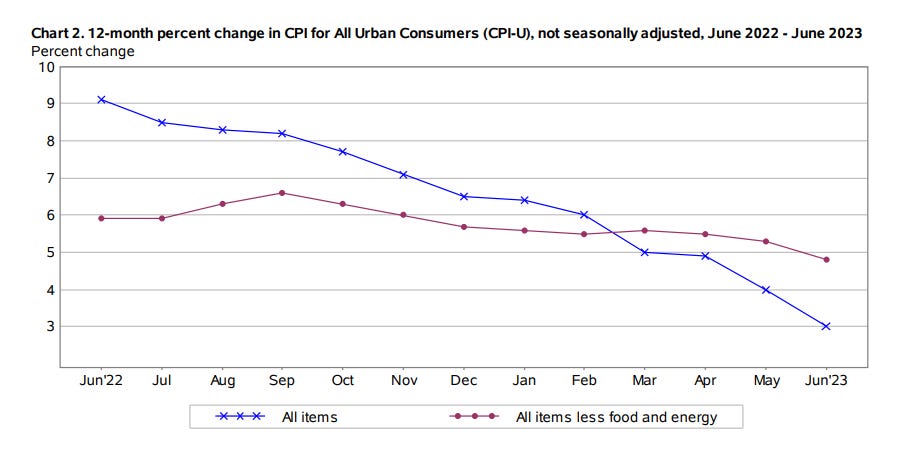

This morning’s June CPI report is one of the more significant signs of disinflation so far this year. The CPI grew by just 0.2% month-over-month (MoM) which was just a 3.0% year-over-year (YoY) increase, compared to a YoY growth rate of 4.0% in May. This is the lowest YoY growth rate in over two years, indicating an easing of inflationary concerns. The three-month average of the monthly rate of increases in CPI is now just 0.23% which comes out to an annual rate of just 2.8% YoY.

One significant trend observed in the data is the cooling of food inflation. In June, food prices increased by a mere 0.1% MoM and 5.7% YoY, showing a decline from the 6.7% YoY growth rate recorded previously. The food at home index remained unchanged on a monthly basis, rising by only 4.7% YoY. Conversely, food away from home experienced a 0.4% MoM growth. Energy prices exhibited a rebound in June, rising by 0.6% MoM after a sharp decline in May. The gas index saw a recovery of 1.0% MoM following a -5.6% MoM decline in the previous month. However, natural gas prices continued their downward trend, falling by -1.7% MoM which is the fifth consecutive month of declines.

Core inflation, which excludes volatile food and energy prices, dropped below the significant 5% mark, primarily due to a modest 0.2% MoM increase. This cool monthly gain helped push the annual pace down by -0.5 ppts to 4.8% YoY. A noteworthy factor contributing to the moderation of core CPI growth was a deflationary impulse from goods inflation. Notably, used car prices fell by -0.5% MoM, contributing to a -0.1% MoM decrease in goods prices. Consequently, the annual rate of growth for goods remained below 2% at 1.3% YoY. Excluding used cars, core goods remained flat on a monthly basis and increased by only 3.1% YoY. The services sector also experienced a slight deceleration in price increases, with a monthly increase of 0.3% MoM. This marks the lowest monthly increase so far this year and led to a -0.4 ppt decrease in the annual rate to 6.2% YoY. Similarly, the shelter index saw a smaller monthly increase of 0.3% MoM, though the annual rate remains high at 7.8% YoY.

Some special aggregates help us to look beyond these specific components into what the Fed is focused on. The Supercore index, which excludes shelter, energy, food, and used cars, remained unchanged on a monthly basis and increased by only 3.5% YoY, down from 4.2% YoY which is a significant improvement. Another interesting index out of the CPI report is the “all items less food and shelter index”. In June, it turned negative, declining by -0.6% YoY. This aggregate measure highlights broad disinflation, emphasizing the two areas where inflation remains more prevalent.

Overall, the latest June CPI data indicates a notable slowdown in inflationary pressures in the US economy. Factors such as cooling food inflation (offset by a slight rebound in energy prices) and a decline in core inflation contribute to this trend. Suddenly, it feels like the Fed doesn’t have much ammunition for a rate hike in July as the numbers from June are a lot more convincing in arguing against sticky inflation. This is the first time in awhile that core inflation has surprised to the downside, so it may be time for the Fed to surprise to the downside in their hawkishness.

Still to come…

10:00 am (EST) - Bank of Canada Announcement

10:00 am - Atlanta Fed Business Inflation Expectations

10:30 am - US EIA Petroleum Status Report

2:00 pm - US Beige Book

11:00 pm - China Trade

Morning Reading List

Other Data Releases Today

Machinery orders fell -2.9% MoM in May with private sector orders down -5.3% MoM. The decline came in non-manufacturing orders which fell -19.4% MoM.

Orders are still forecasted to grow 6.3% QoQ in Q2 with a 2.8% QoQ increase in private orders.

Japan's PPI fell -0.2% MoM and was up 4.1% YoY in June, down from 5.2% YoY in May. Lumber product prices (-22.2% YoY) is pushing PPI lower, while food (7.4% YoY), machinery (4.4% YoY), and metal (9.4% YoY) product prices are rising.

The MBA Mortgage Applications Composite Index grew 0.9% WoW. The Purchase Index grew 1.8% WoW, and the Refinance Index fell -1.3% WoW.

The unadjusted Purchase Index decreased -19% vs the prev week and was -26% lower than 1 yr ago.

German exports to the US in the Jan-May 2023 period are up 7.0% compared to the same period last year. Accounting for a 9.8% share in total exports, the US continued to be Germany's most important trading partner.

India's CPI grew 1.0% MoM and 4.8% YoY in Jun, up from 4.3% YoY in May.

Food: 4.6% YoY (May 3.3% YoY)

Fuel & Light: 3.9% YoY (May 4.6% YoY)

Household Goods & Services: 5.5% YoY (May 6.1% YoY)

US NFIB Small Business Optimism

Small Business Optimism Index Jumps Up in June (TD Bank) - NFIB's Small Business Optimism Index rose 1.6 points to 91.0 in June, coming in above market expectations for a more moderate uptick to 89.8. The index hit its highest level since November but remains below its long-run average of 98.

Small Businesses Get a Dose of Optimism in June: Inflation and Labor Remain Concerns, but Brighter Outlook Lifts Sentiment (Wells Fargo) - The NFIB Small Business Optimism Index shot up 1.6 points to 91.0 in June, the largest over-the-month upswing since August 2022. The economic outlook also brightened for small firms. The percentage of owners expecting the economy to improve over the next six months rose 10 points to a net -40% in June. Although still historically low, the share is up from a low of -61% in June 2022. The net proportion of owners that believe the next three months would be a good time to expand also improved three points to 6%.

US

Monetary Policy since the Onset of the COVID-19 Pandemic: A Path-Dependent Interpretation (Cleveland Fed) - Some argue that the Fed underreacted to rising inflation in 2021 after the US economy started to recover from the COVID-19 crisis. By using data from the Summary of Economic Projections (SEP), we surmise that the FOMC expected to keep the federal funds rate near zero by the end of 2021, but at the same time, the committee also expected to make the policy rate catch up to inflation over the next two years.

Consumer Credit Growth Slows to 30-Month Low (NAHB) - Consumer credit outstanding growth slowed to a 30-month low of 1.8% in May 2023 (SAAR) according to the Federal Reserve’s latest G.19 Consumer Credit report, as revolving and nonrevolving debt grew at 8.2% and -0.4%, respectively. Credit growth for March and April—each of which were initially reported at 5.7%–were revised down to 4.8% and 5.0%, respectively. Total consumer credit outstanding stands at $4.82 trillion (not seasonally adjusted), with $1.21 trillion in revolving debt and $3.62 trillion in non-revolving debt (NSA).

How Exposed Are U.S. Banks’ Loan Portfolios to Climate Transition Risks? (Liberty Street Economics, NY Fed) - Much of the work on climate risk has focused on the physical effects of climate change, with less attention devoted to “transition risks” related to negative economic effects of enacting climate-related policies and phasing out high-emitting technologies. Further, most of the work in this area has measured transition risks using backward-looking metrics, such as carbon emissions, which does not allow us to compare how different policy options will affect the economy.

Europe

Eurozone Country Update: More accidents on the road to recovery (ING) - The eurozone economy is languishing and each country faces unique challenges that will make the road to recovery a hazardous one. But there are some signs of hope, as we explain in our latest update.

Eurozone house prices record second consecutive quarterly decline (S&P Global) - The rapid tightening of financing conditions and continued feed-through of higher interest rates to consumers, plus an increase in inflation to levels last observed half a century ago, are weighing on the housing market. Eurozone house prices declined for the second consecutive quarter in the first quarter of 2023.

European Retail: a cocktail of lower spending and tighter funding (Allianz) - One year on since Russia’s invasion of Ukraine, retail sales in Europe have proven more resilient than expected despite record-high inflation and poor consumer confidence. Income growth has (partially) cushioned the inflation shock. In particular, strong gains in labor income, mostly from strong job creation in France and higher wages in Germany, Italy and Spain, have supported household purchasing power. Overall, accumulated pandemic savings have had a secondary effect to support consumption spending, and credit only contributed marginally in France and Italy. However, consumption is only likely to pick up steam after the second half of 2024.

Mexico

Mexico seeks to solidify rank as top U.S. trade partner, push further past China (Dallas Fed) - Mexico became the top U.S. trading partner at the beginning of 2023, with total bilateral trade between the two countries totaling $263 billion during the first four months of this year. Mexico's emergence followed fractious U.S. relations with China, which had moved past Canada to claim the top trading spot in 2014. The dynamic changed in 2018 when the U.S. imposed tariffs on China’s goods and with subsequent pandemic-era supply-chain disruptions that altered international trade and investment flows worldwide.

Mexico | Consumption rebounds in June with the Hot Sale (BBVA) - The BBVA Research Big Data Consumption Indicator grew 6.8% MaM in June, with real seasonally adjusted figures, after the contraction in May.

Inflation

Inflation: here to stay? (DWS Group) - The four D's (demographics, decarbonization, digitalization and deglobalization) are often cited as the reason why the inflation rate in advanced economies will remain elevated in the long term. This argument overlooks the influence of monetary policy. Central banks will not abandon their 2% target. However, we will probably have to live with missed targets for a while.

The Anchoring of US Inflation Expectations Since 2012 (Cleveland Fed) - The stabilization, or anchoring, of inflation expectations at a target can help a central bank meet its goals. This paper develops a measure of expectations’ anchoring that combines the deviation of a consensus forecast from an inflation target with forecaster disagreement. We apply the measure to survey-based forecasts of PCE price inflation at medium- and longer-run horizons.

PMI

Monthly PMI Bulletin: July 2023 (S&P Global) - The global economic expansion decelerated at the end of the second quarter as a renewed contraction in manufacturing output was accompanied by the slowest growth of service sector activity growing for four months. Diverging sector prices trends also persisted, keeping overall global price inflation elevated, albeit moving lower.

Banking

Banking risk monthly outlook: July 2023 (S&P Global) - Easing monetary policy will likely lead to broad-based loan growth in mainland China. Chinese banks lowered deposit interest rates and the central bank reduced the medium-term lending facilities rate in July 2023, signaling further monetary policy easing in the coming quarter, including both a cut in the reserve requirement ratio (RRR) and a loan prime rate (LPR) reduction.

Trade

Global trade falls at fastest rate for five months in June (S&P Global) - The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a sixteenth monthly fall in export orders for goods and services at the end of the second quarter. At a five-month low of 48.3, down from 48.8 in May, the seasonally adjusted PMI New Export Orders Index signalled a steepening downturn in global trade, as falling goods trade was accompanied by a softening expansion of services exports.

Commodities

Gold in search of fresh momentum (Saxo Bank) - Gold trades higher after spending the past couple of weeks fending off sellers looking for lower prices in response to a recent jump in US Treasury yields after the US FOMC kept its hawkish stance. Having found support in the $1900 area, the potential for an upside extension will require continued softness in economic data, starting with today's US inflation print.

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website.