Fed Preview

There are no major data releases today. Instead, you should prepare yourself for a busy few days where the Fed and ECB will both make monetary policy announcements in the same week as their major inflation releases. At the next tier of significance, data for US retail sales, US PPI, UK employment, and Chinese industrial production & retail sales are also released

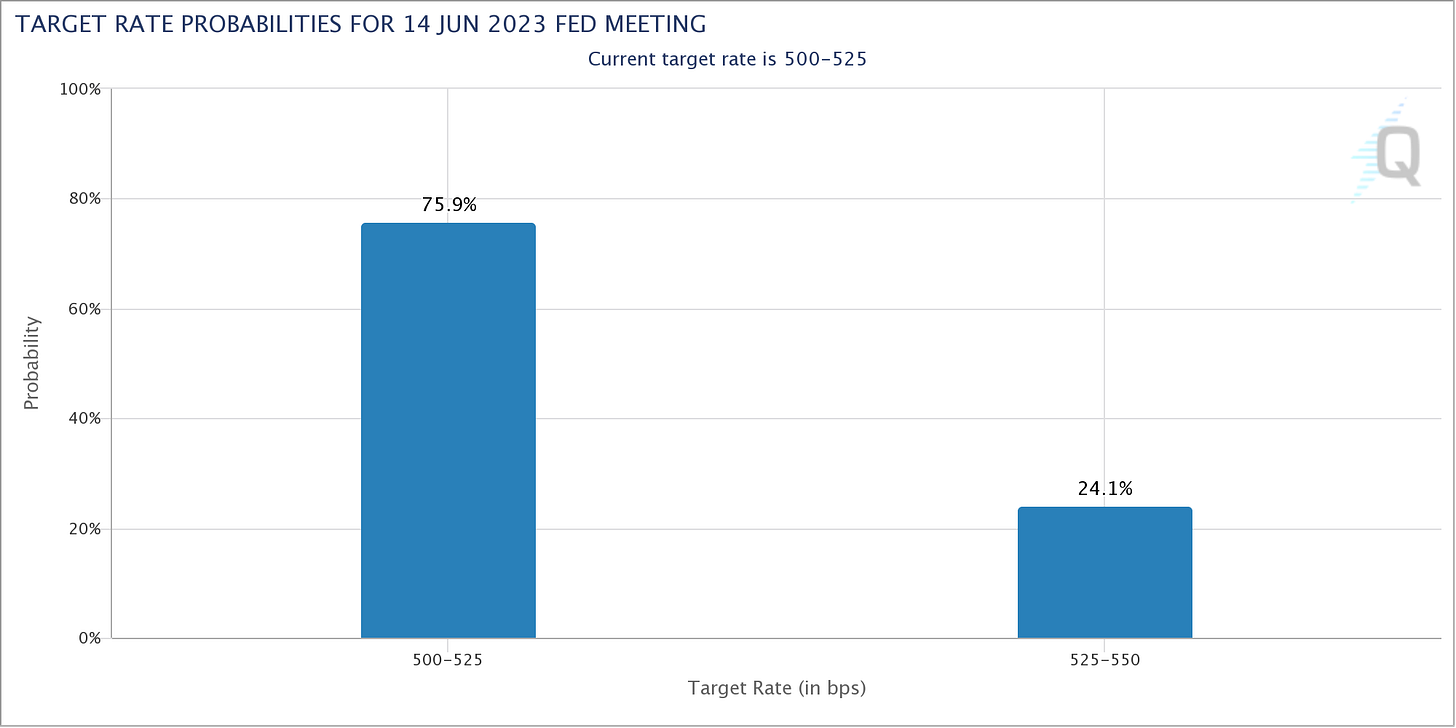

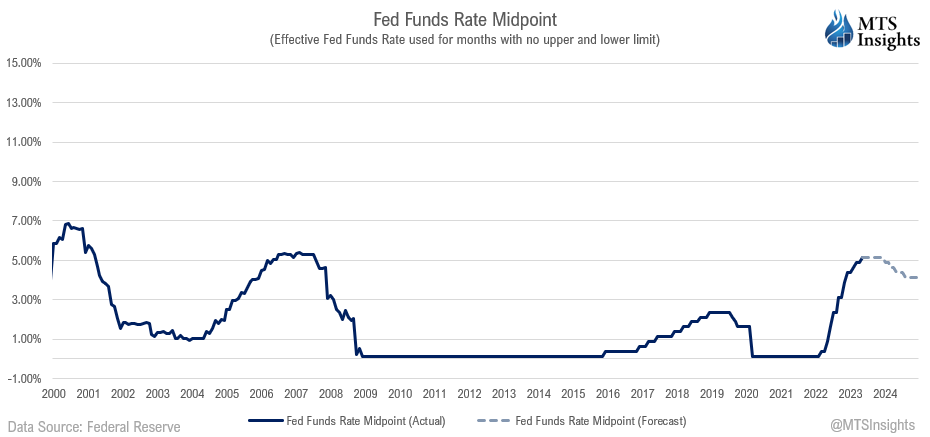

As of the morning of June 12th, the market has mostly decided that the Fed will keep rates unchanged this week. Fed Fund futures pricing assigns a probability of 76% to a Fed pause with the other 24% assigned to a 25 bps hike. This is unchanged from a week ago but down slightly from the 84.5% Fed pause probability a month ago in May. The truth is that the current likelihood of a pause or a hike could see a major shift after the CPI release on Tuesday morning. This is a symptom of being largely data-dependent despite Fed Chair Powell hinting that the FOMC would start to pull back from hikes starting in the summer.

So all eyes turn to May CPI. The consensus forecast is for there to be a slight increase of 0.2% MoM in the headline rate which will see it decline further to just 4.1% YoY. Core inflation is expected to continue to be more sticky, dropping just 0.2 ppts to 5.3% YoY. The monthly growth rate is just a tad lower than the most recent three-month average of 0.3% MoM and would come out to an annualized rate of 2.4% or just above the Fed’s pace. If these consensus conditions were met, it would likely be enough for the Fed to move forward with a pause.

My CPI estimates are in agreeance with the consensus. In previous months when the monthly pace of inflation beat estimates, there was a stronger services sector behind it. The results of the most recent May ISM Services PMI, which pointed to slow new order growth and a slight employment contraction as well as a deceleration in the increase of prices, suggest a slower monthly CPI pace can occur. My estimates of MoM headline inflation and MoM core inflation are 0.2% MoM and 0.3% MoM respectively. As these are consistent with a Fed pause, I stick with my initial forecast of that scenario playing out this week.

Wild Card: The Bank of Canada surprised hawkishly last week with a 25 bps hike when many thought that there was a good chance for a pause. On top of that, the communication from the BoC was that "monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target" which suggested that if there are no changes in the incoming inflation data, there might be another hike in July. The Fed has most definitely been observing this posturing and could take cues from it, especially since Canadian price and jobs data looked more dovish than the corresponding US data. Powell & Co. are undoubtedly separate from their peers at the BoC but much of central bank policymaking is being done in unison as no one wants to diverge from major trends and get punished (see the BoJ and the yen).

Still to come…

8:30 pm (EST) - Australia Westpac Index of Consumer Sentiment

8:30 pm - Australia NAB Business Survey

Morning Reading List

Other Data Releases Today

Japan's PPI fell -0.7% MoM in May but was still up 5.1% YoY, down from 5.9% YoY in April. Export prices (1.7% MoM) and import prices (2.2% MoM) both increased after falling from peaks in late 2022.

India's CPI increased 0.5% MoM and 4.3% YoY in May, down from 4.7% YoY in April.

Food: 3.3% YoY

Fuel & Light: 4.6% YoY

Household Goods & Services: 6.1% YoY

Recreation: 3.7% YoY

U.S. Economy: Flow of Resilience (BMO) - The current cycle isn’t tracking the usual playbook, whereby higher interest rates cause financial conditions to weaken and the economy to buckle. As discussed in this week’s Feature, one reason recession calls keep getting pushed out is the large number of buffers that are currently supporting activity, including excess savings, revenge spending, and labour hoarding. This week, another report landed on the table, highlighting an additional source of resilience for the U.S. economy: solid balance sheets.

Where’s the Recession? (BMO) - The conventional wisdom for much of the past year has been that the North American economy has punched a one-way ticket to recession. But heading into the summer, growth on both sides of the border is holding up well, and expectations for a downturn continue to get pushed out.

Next week's debt bonanza will test markets (Saxo Bank) - Poor subscription at yesterday’s 4-week auction might be an early sign of liquidity strain. It is not a coincidence that T-bill auctions clearing with a yield close to or higher than 5.15% were better participated than those clearing with a lower yield. That’s the yield that the Federal Reserve pays on Bank Reserves. Therefore, bills must pay above 5.15% to be appealing for excess reserves at the Fed. If that's why the 4-week auction was poorly subscribed, the Fed has a problem.

Revolving Consumer Credit Growth Remains Near 25-Year High (NAHB) - Consumer credit outstanding grew at a seasonal adjusted annual rate of 5.7% in April 2023 per the Federal Reserve’s latest G.19 Consumer Credit report, as revolving and nonrevolving debt grew at 13.1% and 3.2%, respectively (SAAR). Total consumer credit outstanding stands at $4.8 trillion (not seasonally adjusted), with $1.2 trillion in revolving debt and $3.6 trillion in non-revolving debt (NSA).

Europe

Weekly Focus - ECB hike coming up, what about the Fed? (Danske Bank) - We are entering a big central bank week, with rate decisions from the US Federal Reserve, the European Central Bank and the Bank of Japan. It seems highly likely that the ECB will deliver another 25bp rate hike, but the Fed outlook is a bit more uncertain. We expect that this will be the first FOMC meeting since January 2022 where there is no rate hike, but market pricing is not ruling out a hike on Wednesday.

ECB and BoJ... Divergence Continues (BMO) - We know what the goal is—2% inflation—but there are a few paths to get there. There are a couple of central banks that had been hiking rates, then took a break, realized they didn’t like what they saw, and resumed hiking again. Then there are some central banks that are on a one-way road to 2% and will aim to get there, come hell or high water.

More needs to be done… (Nordea) - …by central banks to bring inflation under control. The ECB will hike by 25bp while the Fed will likely take a pause. Norges Bank needs to step up their game while BOJ will take its time.

Sticky UK wage growth means no rate cuts for the Bank of England until 2024 (ING) - UK wage growth is peaking and on its own, that doesn’t scream a need for the Bank of England to keep hiking much further. But the downtrend is likely to be gradual, and that suggests UK rate cuts will come later than in the US.

Riksbank’s Business Survey: Mixed picture (Nordea) - The economic situation is expected to remain weaker than normal in the coming six months, according to the Riksbank’s May Business Survey. But developments are mixed, both in terms of economic activity and the need to continue raising sales prices.

Canada

Bank of Canada Resumes Rate Hikes (Wells Fargo) - Bank of Canada policymakers surprised at today's monetary policy announcement, lifting the policy interest rate 25 bps to 4.75% at today's meeting. The statement contained some hawkish signals, particularly around policymaker concerns that CPI inflation could get stuck above the 2% target and that the economy remain in excess demand. As a result, we have adjusted our Bank of Canada forecast and now believe another 25 bps rate hike to 5.00% will be delivered in July.

Blame Canada (CIBC) - There were lots of references to that South Park song this week, as New York and other major east coast cities were blanketed with smoke from Canadian forest fires. But the most unusual headline we saw wasn’t in reference to air quality, but to a dip in the US equity market that was attributed to a Bank of Canada rate hike on Wednesday. Governor Macklem must be surprised that his actions carry so much weight in New York.

Canada's labour market sheds jobs in May (TD Bank) - The Canadian labour market shed 17.3k positions in May, with full-time employment down 32.7k and part-time employment up 15.5k.

Canadian Employment (May) — No Youthful Exuberance (BMO) - The headline was clearly weak, but the details weren't nearly as soft. Still, while all the losses were among youth, the higher jobless rate suggests the labour market loosened a touch. We'll still get another jobs report before the July meeting, so the BoC will likely take this mixed report in stride and wait for more data.

Canadian employment (May): Cracks begin to show (CIBC) - Some cracks appeared within the Canadian labour market in May, but these may not yet be wide enough to convince the Bank of Canada that inflation is about to meaningfully cool off. Employment fell by 17K (consensus +21K), which led to a two-tick increase in the unemployment rate to 5.2%, despite a slight reduction in participation. However, with much of the weakness in employment driven by the youth category, which can be volatile at this time of year, and with wage growth continuing to run strong, policymakers may still need to see further signs of softening ahead to prevent a follow-up interest rate hike.

MENA

Middle East, North Africa Vulnerable to Rising Fiscal Risks (IMF) - Stronger risk management can reduce budgetary surprises and allow the region to plan better for development.

Trade

Fragmented Globalization (Northern Trust) - The existing globalization model has worked well since the 1990s, when the world started to become more interconnected. Easing restraints on flows of goods, services and people has boosted growth, developed several emerging markets (EMs) and pulled millions out of extreme poverty. In advanced economies, it delivered lower prices, a particular benefit to low-income consumers. Despite established benefits, discontent with the model has been growing.

Energy

Crude Oil Outlook: Fear versus Fundamentals (BMO) - These are perplexing days for the oil market as benchmark crude prices have not responded to Saudi Arabia’s unilateral decision last weekend to cut production by a hefty 1.0 mb⁄d (or ~1% of global oil supply). For now, it appears that fears over a (major) global economic downturn and, in turn, weaker global oil demand are offsetting any lift from the supply cut.

Real Estate

For Builders, Lot Shortage Eases But is Still a Problem (NAHB) - Obtaining lots to build on remains a challenge for many of NAHB’s builders, although the shortages are not quite as widespread as they were in 2021. Responding to special questions on the May 2023 survey for the NAHB/Wells Fargo Housing Market Index (HMI), 42 percent of single-family builders characterized the supply of lots simply as low, and another 25 percent said the supply was very low, for a total of 67 percent of builders reporting some type of shortage.

Markets

Blame Canada? (BMO) - Equity markets held firm this week, with little in the way of major market-moving data. The S&P 500 gained 0.4%, led by consumer discretionary stocks, while technology dipped. Meantime, the TSX slipped 0.7% as health care, consumer staples and industrials lagged.

From local to global and how to trade it (Nordea) - Danish covered bullets are now trading much more in sync with the credit market. This can be used for hedging and to exploit views on direction. We give a thorough walkthrough of how to trade CDS contracts.

Research

Market Concentration in Fintech (Philadelphia Fed) - This paper discusses concentration in consumer credit markets with a focus on fintech lenders and

residential mortgages. We present evidence that shows that concentration among fintech lenders is significantly higher than that for bank lenders and other nonbank lenders. The data also show that the overall concentration in mortgage lending has declined between 2011 and 2019, driven mostly by a reduction in

concentration among bank lenders.

The FDIC Studies “Options for Deposit Insurance Reform” (St Louis Fed) - The bank runs and financial stress of March 2023 motivated the FDIC to consider and explain options for deposit insurance reform. Recent technological advances have increased the risk of bank runs by making it easier to get and spread information about a bank's problems or potential problems through social media and to withdraw one's money very quickly from a troubled bank with online banking.

Outlook

R is for Resilience and Rising Rates (BMO) - With the debt ceiling out of the way and the economy showing pockets of strength, we were again forced to delay our call for a mild economic slump. For every indicator fitting the recession mold of late, at least another is flashing resilience.

Global | Economic environment: good in 2023, less so in 2024 (BBVA) - The recent resilience of activity does not imply that the economic scenario for next year will be any better. In fact, it will most likely complicate the outlook for 2024.

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website.