Canadian Producer Prices: A Shift from Decline to Incline

Economic news and commentary for September 18, 2023

Canada PPI

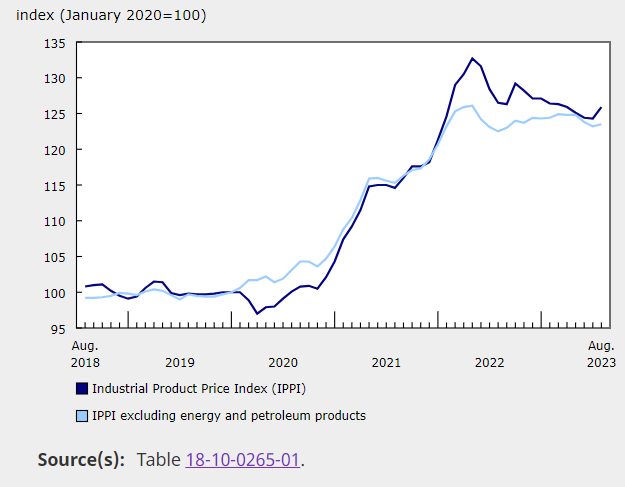

After witnessing a consistent downtrend over the past two years, Canada's producer prices are showing signs of resurgence. In August, the Producer Price Index (PPI) in Canada witnessed a significant jump of 1.3% MoM. However, on a YoY basis, it was still down by -0.5%, a lingering effect of the base numbers from 2022. Similarly, the Raw Material Price Index, which had been grappling with a sharp decline in commodity prices, rose by 3.0% MoM but remained down by -4.3% YoY.

A major factor behind this monthly surge was the spike in prices for refined petroleum energy products, which soared by 10.6% MoM. This includes notable gains in diesel and other motor gasoline prices, pushing the index up by 8.4% YoY. This trend is becoming a growing concern for businesses that heavily rely on energy. However, the energy sector wasn't the only one witnessing a surge. Chemicals and chemical products saw a 3.5% MoM increase, meat, fish, and dairy products prices climbed 1.2% MoM, and pulp and paper products experienced a 1.8% MoM rise. On the flip side, lumber prices, reacting to the substantial 15.5% MoM increase in July, declined sharply by -6.0% MoM. The Raw Materials Price Index echoed similar trends, with energy commodity price volatility playing a significant role in the month-to-month fluctuations.

To get a clearer picture of the cost fluctuations for Canadian businesses, it's essential to look at the PPI (ex-energy) changes, which offer insights with reduced volatility. This index marked a growth of 0.2% MoM, the highest monthly increase since March and the second-largest this year. Annually, after four months of negative YoY growth from March to June, the PPI (ex-energy) turned positive for the second consecutive month, albeit at a modest 0.8% YoY.

The era of declining producer prices in Canada seems to be phasing out, giving way to a mild upward trend. As base effects cease to influence the YoY comparisons, Canada is likely to experience a slight reflation in the coming months. Commodity prices are no longer a boon to the deflation trend, and the effects of the Bank of Canada’s policy rate hikes will become more clear in the near future.

Still to come…

10:00 am (EST) - US Housing Market Index

9:30 pm - RBA Meeting Minutes

Morning Reading List

US Industrial Production

Manufacturing Activity Ticked Up in August, but Unlikely to Be Sustained (Wells Fargo) - Industrial production surprised to the upside in August, with a pop in mining output accounting for half of the 0.4% gain in overall production. Manufacturing activity was stronger than the 0.1% monthly gain would suggest, as autos held back activity. Still, we are cautious to expect this will be sustained as unfavorable conditions will limit a recovery in manufacturing for some time.

US

Will the Auto Strike Drive the Economy off a Cliff? (BMO) - The first strike by North American auto workers in four years began Friday with the UAW announcing walkouts at three plants, while threatening wider-scale action. This is the first-ever strike simultaneous against all three major automakers, though it is currently limited to less than 13,000 workers. Depending on duration and scope, the strike could derail the expansion and complicate the central bank's already-tricky job of piloting a soft landing.

Fed Preview: Done, Or More To Be Done? (Northern Trust) - We’ve had a vigorous debate within the Economics Department over whether the Federal Reserve has reached the end of its tightening cycle. While there is consensus that interest rates will be left unchanged at the Federal Open Market Committee (FOMC) meeting next week, opinions diverge from there.

Macro & Markets: Disinflation or Reinflation? (Nordea) - The August CPI data out of the US and oil prices climbing back above 90$/barrel are timely reminders that inflation might not continue to fall effortlessly towards 2%.

The Best of Summer Gone, and the New Fall Uncertain (Wells Fargo) - The Consumer Price Index picked up 0.6% in August—the largest monthly gain since June 2022. The outturn was broadly expected amid the surge in gasoline prices last month. Short-term and long-term consumer inflation expectations declined, suggesting consumers are more convinced that inflation is cooling.

Third Quarter 2023 Quarterly Macro Themes (Guggenheim) - Quarterly Macro Themes, a new quarterly publication from our Macroeconomic and Investment Research Group, spotlights critical and timely areas of research and updates our baseline views on the economy.

Bridging the Gap: The Economic Progress of Hispanic Americans (Wells Fargo) - To commemorate National Hispanic Heritage Month, we take a look at recent trends in employment, income and wealth in the Hispanic community. As we noted in our 2021 report, the number of individuals who identify as Hispanic or Latino grew more than five-times as fast as the non-Hispanic population between 2010 and 2020. Demographers expect these trends to continue in the current decade.

Europe

European Central Bank Hikes Rates, Signals Extended Rate Pause (Wells Fargo) - The European Central Bank (ECB) delivered a tenth straight rate hike this week, raising its Deposit Rate 25 bps to 4.00%. However, many other elements of the ECB's announcement were dovish and, in particular, the ECB gave its clearest indication yet that the peak in policy interest rates might have been reached.

A dovish hike from the ECB (ABN AMRO) - The ECB raised its key policy rates by 25bp, with the deposit rate reaching 4%. Although the Governing Council will remain data dependent going forward, it did hint that based on the existing outlook, it may have done enough and the rate hike cycle may now be over, though it expects interest rates to remain at these levels for a while.

Europe | End of the cycle? (BBVA) - Unlike previous moves, which were clearly telegraphed to the markets, this time around there was considerable uncertainty over the ECB’s decision on interest rates: to pause or to hike? Notably, President Christine Lagarde’s press conference following the meeting revealed that the decision was indeed a split one.

Norges Bank Preview: The last hike, probably (Nordea) - We expect Norges Bank will deliver a hike by 25bp to 4.25 % next week and signal a very small upside bias ahead. Neither rate nor FX markets should be surprised.

Swedish inflation expectations: Under control (Nordea) - Longer-term inflation remained close to the inflation target in September, which is good news for the Riksbank.

Riksbank preview: SEK support (Nordea) - The weak SEK exchange rate pushes the Riksbank to hike interest rates next week. Moreover, the door seems to be wide open for another hike in November. The Riksbank will likely start to hedge its currency reserves, which means buying SEK.

Japan

Research Japan - Data supports BoJ tweak, not bold moves (Danske Bank) - The inflation target has been met for 16 consecutive months but the reflation narrative has lost some steam recently. We think the data supports another tweak of the yield curve control (YCC) this year, most likely in October, as one last step ahead of completely dismantling YCC.

China

China - August data bring more signs of stabilisation (ABN AMRO) - China Macro: Growth momentum picked up in August, property market data still weak. Piecemeal monetary easing continues.

Inflation

US & eurozone wage pressures ease, even as headline inflation rebounds (ABN AMRO) - Headline inflation rebounded in August in the US, tracking the recent rise in oil prices. However, more important for the medium term inflation outlook is that wage pressures are easing, and the labour market is softening.

Backlogs of work hint at further global economic weakness, but also lower inflation (S&P Global) - As policymakers stress the need for further insights into developing economic trends, awaiting to learn the lagged impact of prior interest rate hikes, the coming week's timely flash PMI survey data should provide useful guidance on economic growth and inflation.

Central Banks

ECB is Done, BoE is Close, BoJ is Mincing Along (ECB) - It is the beginning of the end. No, not of the world as we know it. Don't be silly. Rather, the end of the ECB's tightening campaign. It probably did a little more than needed, but that is neither here nor there.

Weekly Focus - Central banks remain in focus as rates peak (Danske Bank) - Next week, focus turns to Federal Reserve which we expect to keep rates unchanged despite an upside surprise in August core CPI this week. The uptick in core was driven by faster services inflation, particularly airfares, but overall, underlying price pressures seem to have remained slightly higher than anticipated in early Q3.

Trade

The Many Faces of De-Risking (ECB) - No matter the precise definition of de-risking, there is little doubt that the U.S. and other major economies are actively reconsidering all manner of their relationship with China. And in many cases that means limiting and/or reducing involvement. In turn, China is also working to reduce the tight interdependence with the U.S. and aiming for self-sufficiency in a variety of sectors. But is the disentangling having a macro effect?

Global | EU-Latam relations (BBVA) - This presentation addresses the EU-Latam relationship and its structural challenges, as well as focusing on the analysis of the levers for productivity growth and how both regions can better address the challenges ahead by shoring up their relations on multiple fronts, building on many strengths.

Markets

Gassed (BMO) - Equity markets gave up solid gains late this week alongside a decent run of economic data, but another move higher in oil prices. The S&P 500 dipped 0.2%, led by banks and utilities, while industrials and technology lagged. The TSX, however, churned out a solid 2.7% gain as materials, banks, industrials and utilities all posted gains above 3%.

Looking for a way to take advantage of higher interest rates? I recommend SoFi’s high-yield savings account which has a yield of 4.5% (subject to change) and includes FDIC deposit insurance for both its checking and savings accounts just like a traditional bank. Use my referral link to get a sign-up bonus and start earning that rate today. (This is also a great way to support me since I get a bonus too!)

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website. You can also see my feed on the PiQSuite platform as a partnered feed.