China Sees Deflation for the First Time Since February 2021

Economic news and commentary for August 9, 2023

China CPI & PPI

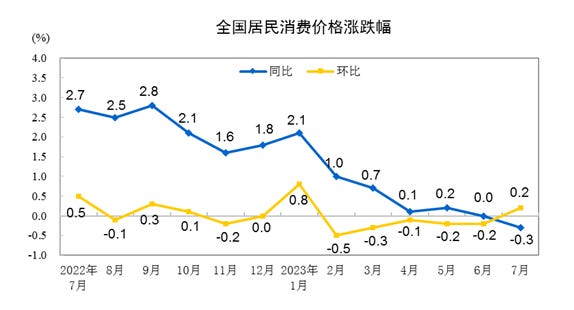

Chinese consumer inflation has taken an unexpected dip, slipping into negative territory for the first time since February 2021. This downturn comes as a stark indicator of unforeseen weakness in the Chinese economy. China's CPI for July demonstrated a mixed bag of figures. While the MoM change showed a modest growth of 0.2%, the YoY comparison revealed a significant decline of -0.3%, marking a drop from the already subdued 0.0% YoY in the preceding month of June. One of the primary drivers behind the negative YoY CPI was the ongoing slump in food prices. Food prices saw a drop of -1.0% MoM, contributing to a substantial contraction of -1.7% YoY. Alternatively, the non-food segment remained stagnant at 0.0% YoY. Energy prices, too, faced challenges, plummeting by -13.2% YoY. However, there was a rebound in July, with a strong increase of 1.9% MoM.

The impact of these volatile trends had a significant effect on the switch to deflation in the headline index. Excluding these, the core segments portrayed a more favorable picture. Core CPI increased by 0.5% MoM and 0.8% YoY, reflecting a level of resilience amid the turmoil. For the YTD period, core prices managed to post an increase of 0.7% YoY, showcasing a degree of stability amidst the broader uncertainty. A clear divide has emerged between goods and services prices, highlighting the nuanced weaknesses within the Chinese economy.

Consumer goods prices saw a dip of -0.1% MoM and a more significant fall of -1.3% YoY. Particularly noteworthy were the substantial drops in categories such as household appliances (-1.8% YoY) and vehicles (-4.4% YoY), indicating a trend of financial constraints impacting spending on larger purchases. This vulnerability in larger goods prices can be attributed to various factors. Chinese households appear to be grappling with financial pressures that are limiting their capacity to invest in high-ticket items. Furthermore, these price declines are, in part, consequences of the downward trajectory of raw materials and processing producer prices, with respective YoY declines of -7.6% and -3.8%. A confluence of factors has contributed to these developments. The contraction in exports, combined with sluggish domestic consumption, has left Chinese businesses with thinner order books, thereby influencing CPI movements in this direction. However, there were some silver linings in the form of non-durable goods prices, which remained relatively stable. Categories such as clothing (1.0% YoY) and other supplies/services (4.1% YoY) demonstrated a more positive outlook.

Alternatively, services prices emerged as the strongest segment within the CPI composition. Robust growth of 0.8% MoM was accompanied by a relatively strong increase of 1.2% YoY in July. This category includes notable gains in medical services (1.1% YoY) and home services (1.8% YoY), indicating the resilience of these sectors amidst the broader economic downturn. Of particular interest was the surge in travel prices, witnessing a remarkable 10.1% MoM growth and an even more impressive surge of 13.1% YoY. This surge underlines the post-pandemic desire among Chinese consumers to spend on travel and vacation experiences, revealing that services is a key area of spending for consumers.

China’s rebound story in 2023 continues to disappoint. The big miss on exports yesterday shows just how much the Chinese economy is struggling which means that CPI deflation could be extended past July. Despite attempts by the PBoC and the government to spark growth, tighter global financial conditions are being transmitted to the local economy through trade. A sharp decline in trade volumes abroad means the foreign share of demand for Chinese goods has declined as well which explains why the Chinese goods sector is seeing weak prices. On the other hand, services exports are not significant to the demand situation in that sector and the late lifting of COVID restrictions is still causing domestic demand for services to be strong which is also a story we see in the CPI data. This momentum is keeping China from severely missing growth targets and forecasts, but it cannot be sustained forever which means that unless something improves on the goods side, growth will underwhelm in Q3 and Q4.

Still to come…

10:30 am (EST) - EIA Petroleum Status Report

7:50 pm - Japan PPI

Morning Reading List

Other Data Releases Today

Mortgage credit availability continued to weaken in July. The MBA Mortgage Credit Availability Index fell -0.3% MoM to 96.3 which is its lowest level since 2013. Lenders continue to pull back on underused loan programs as demand for credit weakens with higher rates.

The German truck toll mileage index edged up 0.4% MoM in July but is still down -2.1% YoY. This is up from the trough of -6.3% YoY in Dec 2022 but still signaling weak industrial activity.

US NFIB

Small Business Optimism Index Improves as Inflation Concerns Ease (TD Bank) - Sentiment among small business owners remains downbeat relative to historical patterns, but the main story here is the recent improvement, with the index up modestly for the third month in a row in July. A less negative view on future economic conditions is encouraging. Moreover, small businesses remain very much in hiring mode. A net 42% of firms had open positions in July, and some 17% plan create jobs in the three months ahead – not far off the 20% average in the pre-pandemic period.

Small Business Optimism Strengthens in July: Receding Inflation Lifts the Economic Outlook (Wells Fargo) - Small business optimism bested expectations in July, notching its third consecutive improvement to reach 91.9. Yet context is important, especially when sentiment remains sour. The Small Business Optimism Index has now spent 19 straight months below its historical average of 98. Small business owners seem to be perking up on the recent string of strong economic data, however they are simultaneously pulling back on hiring plans and expressing concern over the path of future credit conditions.

US Trade

The Trade Deficit in Goods and Services Came in at $65.5 Billion in June (First Trust Portfolios) - The trade deficit in goods and services fell to $65.5 billion in June as both imports and exports declined. We like to focus on the total volume of trade, imports plus exports, as it shows the extent of business and consumer interactions across the US border. This measure fell by $3.5 billion in June and is down 6.3% versus a year ago. These declines are consistent with our forecast that the US is headed toward a recession.

Trade Deficit Narrows in June & Presents Potential Downside to Q2 GDP (Wells Fargo) - The U.S. trade balance narrowed as expected in June as a plunge in imports outpaced a more modest decline in exports. Trade flows remain volatile, but the trend in both exports and imports is clearly lower. June real goods imports imply some downside risk to the second estimate of Q2 GDP growth.

Canada Trade

Canada's Trade Accounts Record Another Deficit in June (TD Bank) - June's trade data provided further input for how net exports are shaping up in the second quarter of the year. Recall that in the first quarter, export volumes held up impressively well, up 10% quarter-on-quarter (q/q) annualized, while imports remained effectively flat. That trend appeared to be erased in the second quarter as real export volumes (-0.4% q/q) were outpaced by real imports (+0.9% q/q). This suggests that trade activity could be a net drag on second quarter GDP, due for release at the end of this month.

Canadian trade (June): Further into the red (CIBC) - After being a surprisingly strong positive contributor to growth in the second half of 2022 and the first quarter of this year, net trade appears to have turned into a slight drag on the economy in Q2. Export volumes for agricultural products appear to be normalizing again, after having risen sharply following the outbreak of the war in Ukraine last year, while the recovery in auto trade has slipped into a lower gear.

A Weight-y Month for Trade (BMO) - Canada’s merchandise trade deficit widened again in June as the country has now spent four of the past five months in shortfall. Trade looks to weigh on second quarter growth, with momentum at the end of the quarter pointing to a weak handoff to Q3.

US

Macro Digest: The Coming Stagflation Light (Saxo Bank) - SaxoStrats is changing its outlook for the US from non-recession to stagflation, and this has consequences for our outlook for interest rates and stock markets. We see a 1 in 3 chance of FED (and ECB) cutting rates before yearend and a 2 in 3 chance it will happen during Q1/Q2-2024. The main changes stems from the big increase in real rates which leaves funding costs for US almost too high to carry as seen by recent Fitch debacle, but also the big increase in cost-of-consumption.

Home Stretch: How Untapped Equity Could Sustain the Consumer (Wells Fargo) - As excess household savings dry up and as consumer credit is both more expensive and harder to get, households have become more reliant on income growth. But many households today have the benefit of a second line of defense to support spending should the need arise. Homeowners have more equity in their homes today than they did at any point in the 35 years between 1987 and 2022.

Podcast: Will US CPI report accelerate bets on rate cuts? (Saxo Bank) - Today we discuss the possibility of stagflation in the years to come as our Chief Investment Officer Steen Jacobsen laid out the arguments for why such a scenario could play out. In daily grind of financial markets we discuss tomorrow's US July CPI report which is expecting to see another month of core CPI at 0.2% m/m. If US inflation continues to ease it could mark the peak in the Fed Funds Rate and accelerate bets on rate cuts next year.

Consumer Debt Growth Slows as Inflation Cools and Lending Standards Tighten (NAHB) - Consumer credit outstanding growth slowed to 4.0% in the second quarter 2023 (SAAR) according to the Federal Reserve’s latest G.19 Consumer Credit report, as revolving and nonrevolving debt grew at 7.1% and 3.0%, respectively. Revolving credit growth has decelerated as of late, a result of both cooling inflation and increasingly tight lending standards.

Texas shows signs of slowing; price pressures ease despite buoyant services (Dallas Fed) - Texas job growth slowed in June, though it still exceeded the U.S. rate. Meanwhile, the state economy continued to expand despite the downshift in employment and weakness in manufacturing.

The bull, the bear and the supply (Saxo Bank) - This week’s US Treasury auctions and good CPI numbers might drive US Treasury yields lower, but their uptrend will likely remain intact. If current market levels hold, the new 10- and 30-year US Treasury bonds will price at the highest yield in fourteen and eleven years, attracting high investor demand. Solid bidding metrics will temporally remove concerns regarding an increase in upcoming Treasury supply.

Europe

To hike or to hold? Three scenarios for the Bank of England’s next steps (ING) - A repeat 25bp hike is largely priced for September, but markets are also factoring in an almost 20% chance that the Bank of England keeps rates on hold.

Can European equities continue to ignore the bad news? (Saxo Bank) - Economic growth in Europe is the lowest since the years 2011-2013, if the early months of the pandemic are excluded, and a new energy crisis this winter cannot be ruled out. With Germany already in a recession and its industry on its knees for how long can investors ignore the bad signs? Earnings growth in Europe has been negative for three quarters and confirmed in the Q2 earnings season.

Euro Area Macro Monitor: Will the benign Q2 growth mark a turning point for the European economy? (Danske Bank) - After sluggish growth, GDP rebounded in Q2 increasing 0.3% q/q. Despite the bright surprise, the print is subject to revisions as flash estimates usually are based on incomplete data. Hence, the rebound should be viewed cautiously coupled with the fact that the growth was significantly attributed to an Irish GDP gain of 3.3%.

Swedish July inflation preview: Slight relief (Nordea) - Inflation harmonised with the Riksbank forecast in July after the surprisingly high reading in June, according to our forecast.

China

China Update: Investing in China's High-Quality Development Initiatives (Saxo Bank) - China's economic strategy is now focused on high-quality development, emphasizing technology, innovation, food security, and social stability over short-term stimuli. China aims to address technological chokepoints and achieve self-reliance. The elevation of scientists to influential roles in the political landscape reflects their recognition of the interplay between governance, science, and national development goals.

Australia

Australia: How to ride a bumpy disinflationary path (ING) - Australia's growth outlook has cooled, but the labour market remains too tight and the decline in inflation has been primarily due to base effects. We disagree with the market's expectation that we have seen the peak in rates, and expect at least one more hike. This should help a recovery in the undervalued (in the short and medium-term) Aussie dollar.

NAB Economics Monthly Data Insights: July 2023 (NAB) - Consumer spending, according to NAB’s transaction data, remained resilient in July, rising 0.5% m/m overall. Estimated spending in June was also revised up, now showing an increase of 0.9% m/m. Retail spending however remains under pressure.

NAB Australian Housing Market Update: August 2023 (NAB) - The national Home Value Index rose 0.7% in July marking a fifth consecutive month in the recovery trend to-date. Since finding a floor in February, the national index is up 4.1%, following a -9.1% decline from record highs in April 2022.

Inflation

Inflation Monitor for August 8 (BMO) - Inflation pressures are easing, on net, though interest rates will likely stay high for longer.

Commodities

Commodities Eye Soft Landing (BMO) - Commodity markets have taken comfort in the ongoing resilience of the U.S. economy and signs that rate hikes are bearing fruit. Sentiment has been lifted further by a raft of measures by China’s authorities to revive its struggling economy.

PMI

Global upturn loses further momentum at start of third quarter, hiring spree cools (S&P Global) - The global economy continued to lose growth momentum in July, according to the S&P Global PMI surveys, based on data provided by over 27,000 companies. A further cooling of a recent revival of service sector growth, which had been buoyed by a post-pandemic tailwind of increased spending, waned for a second month in a row, accompanied by a deepening manufacturing downturn.

Emerging Markets

Emerging-market countries insulate themselves from Fed rate hikes (Dallas Fed) - The Federal Reserve has engaged in its fastest tightening cycle since the early 1980s. The 5.25-percentage-point increase in the federal funds rate from March 2022 through July 2023 far exceeds the 3 percentage points of Fed tightening in 1994 and is only eclipsed by the 10-percentage-point increase in the first year-and-a-half of the Volcker Fed, 1979–80.

Financial Markets

Tracking Global Financial Stability Risks From Higher Interest Rates (IMF) - Financial-sector assessments are gauging the effects of elevated borrowing costs, and the prospect that central banks may keep policy rates higher for longer than investors expect.

Big swings in 2023, but global sustainable finance remains in rude health (ING) - Sustainable finance has seen some remarkable trends so far in 2023 – exceptional growth in green issuance, contrasting with big falls in US and Asian issuance, for example. We think there are many reasons to be more upbeat about the months ahead, including a bounce in US issuance.

Looking for a way to take advantage of higher interest rates? I recommend SoFi’s high yield savings account which has a yield of 4.5% (subject to change) and includes FDIC deposit insurance for both its checking and savings accounts just like a traditional bank. Use my referral link to get a sign up bonus and start earning that rate today. (This is also a great way to support me since I get a bonus too!)

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website. You can also see my feed on the PiQSuite platform as a partnered feed.