US CPI

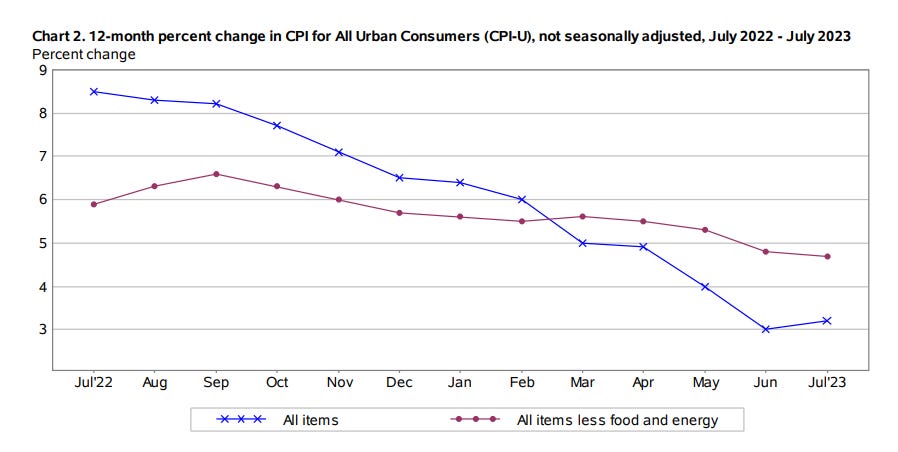

Disinflation looks to have taken a break in July as most of the data reflect no major progress on prices during the month. The US CPI grew 0.2% MoM and 3.2% YoY in July, up slightly from the 3.0% YoY in June. The string of slight CPI gains suggests that inflationary pressures continue to persist, although the rate of increase has slowed dramatically.

The headline food index was only up 0.2% MoM and 4.9% YoY, which is one of the only segments that saw significant improvement from the previous month (5.7% YoY in June). The report indicates that the cost of food at home experienced a MoM growth of 0.3%, and this growth was fairly evenly distributed across four out of the six grocery food groups, each seeing slight gains. Of note is the 2.4% MoM increase in beef prices, which was a bit of an outlier. The cost of food away from home showed more modest growth, with a 0.2% increase MoM, but was still up a significant 7.1% increase YoY. This YoY increase in food away from home remains much higher than the 3.6% YoY growth in food-at-home prices.

Energy CPI remained relatively stable in July, with the gasoline index showing a slight MoM increase of 0.2%. Despite this, gasoline prices are still notably down by -19.9% YoY, reflecting the steep decline that we have seen in energy commodities over the past year. In contrast, the natural gas index rebounded with a 2.0% MoM increase after five consecutive declines. Offsetting that was the electricity index which experienced a slight MoM decrease of -0.7%.

The housing sector, a significant contributor to overall inflation, saw a MoM growth of 0.4% in July. This increase primarily stems from the shelter component, which remains the largest contributor to core inflation. However, the monthly increases have slowed significantly. Additionally, prices for services such as vehicle insurance, recreation, and education also witnessed increases. The YoY services inflation saw a minor slowdown of -0.1 percentage points, resting at 6.1%. Price pressures in the services sector appear to be broad-based still though they are not as intense as they were at the beginning of the year. Base effects are keeping the YoY rate from rising.

Goods prices, excluding energy, marked negative monthly growth for the second consecutive month, down -0.3% MoM. New vehicles recorded a MoM decrease of -0.1%, while used vehicles saw a more substantial decline of -1.3%. Apparel prices remained unchanged. Thanks to these MoM decreases, the YoY gain in goods prices exhibited a moderation, declining by -0.5 percentage points to 0.8%. Ice cold goods inflation reflects the persisting manufacturing contraction in the US and across the world.

July’s CPI report demonstrates the gradual process of disinflation that is happening in a US economy that is caught between services resilience and manufacturing deterioration. In many areas, there is slowing price growth or none at all. The Supercore (CPI ex-energy, good, used cars, shelter) inflation rate reflects that as it showed a second consecutive month of no monthly gain. Despite that, the YoY rate only fell -0.1 ppts to 3.4% YoY. There is still a stark contrast between services and goods prices. Services (ex-rent) were up 3.3% YoY, a slight acceleration from 3.2% YoY in June. Meanwhile, durable goods fell another -0.3% MoM and are down -1.4% YoY. If the Fed is not happy with the gradual disinflation trend, then it may choose to hike one more time. However, it can easily continue the pause in September as there is enough evidence to suggest that the inflation problem will soon be minimized.

Still to come…

10:30 am (EST) - US EIA Natural Gas Report

4:30 pm - US Fed Balance Sheet

Morning Reading List

Other Data Releases Today

Japan's PPI grew 0.1% MoM and 3.6% YoY in July, down from 4.3% YoY in June. Import prices declined -0.3% MoM and -14.1% YoY, down from -11.4% YoY. Export prices declined YoY for the 1st time after the pandemic (-0.2% YoY).

The Bank of India has kept policy rates unchanged at 6.5%. Despite the pause, the RBI says that "while inflation has moderated, the job is not done." The RBI remains committed to "align CPI inflation to the 4% target on a durable basis."

Italy's CPI inflation in July was downgraded slightly from 6.0% YoY to 5.9% YoY with a monthly change of 0.0% MoM, down from 0.1% MoM previously.

The downgrade came on a slight revision lower in food and non-energy goods inflation.

Jobless claims grew 21,000 to 248,000 last week. The insured unemployment rate was unchanged at 1.1%. Continued claims fell -8,000 to 1.68 million.

Reserve Bank of India Announcement

India: RBI holds repo rate steady (ING) - Not one of the 42 economists forecasting this Reserve Bank of India (RBI) meeting expected any change in the repurchase rate, and the RBI didn't disappoint. Things could get more interesting next month as food-price inflation surges.

US

Panic or Panacea?: The Economic Impact of Artificial Intelligence, Part II - Prospects for Capital Spending (Wells Fargo) - The present moment of possibility in the field of generative artificial intelligence (AI) is the culmination of a decades-long transition in business spending away from industry and toward technology. In this second installment of our series, we develop a framework to think about the outlook for capital spending in coming years. Specifically, we split business fixed investment spending on equipment and intellectual property products into AI-related spending, potentially AI-related spending and non-AI related spending.

Does Labor Market Tightness Vary across States? (St Louis Fed) - On a national level, the labor market appears tight. But how is “tightness” measured, and how much do states vary in their level of tightness?

Europe

Sweden July 2023 Inflation Preview (Danske Bank) - Again, and despite last month's miss, we expect Swedish July inflation to print close to Riksbank's forecsts (n.b. CPIF 6.6 % yoy and CPIF ex. Energy 7.8 % yoy), where we expect 6.5 % yoy and 8.0 % yoy).

NOK Update: Inflation is key (Nordea) - This week’s US inflation data will either make or break markets’ perception of a soft landing. In Norway, CPI will be key going into next week’s Norges Bank meeting. We lean toward a weaker NOK after the data release.

Research Global - Are Nordic companies deglobalizing? (Danske Bank) - According to the IMF, large multinational firms have recently expressed a growing interest in reshoring production. We conducted a similar text-mining study for renowned Nordic companies based on annual reports in lieu of earnings calls, and find somewhat different results. Undeniably, Nordic businesses have lately discussed supply chains more often compared to the pre-pandemic period.

Inflation in the Czech Republic on track to hit 2% target (ING) - Headline inflation is falling as expected in the Czech Republic and the likelihood of the central bank hitting its 2% target early next year is rising. The inflation profile is tricky for the coming months but we believe it will be sufficient for the Czech National Bank's first rate cut in November.

Asia

Philippines: 2Q GDP disappoints as revenge-spending fades and rate hikes finally weigh on momentum (ING) - 2Q23 GDP grew 4.3%YoY, much slower than the market expectation of a 6% gain.

Canada

Canadian consumer: Cracks beginning to show (CIBC) - The resilience of the Canadian consumer has been one of the biggest surprises of 2023 so far, and a key factor behind the Bank of Canada restarting its rate hike campaign in June. Indeed, stronger-than-anticipated household consumption has accounted for the entirety of the upgrade to the BoC’s GDP forecast since the start of the year.

Mexico

Mexico | Banxico will remain hawkish and backward looking (BBVA) - Banxico should start a rate cut cycle in 4Q to avoid a further tightening of the monetary policy stance. Some hints about the roadmap for the rate cut cycle will be useful, but seem unlikely in the short term.

Inflation

Inflation’s here to stay, say European consumers (ING) - Inflation is a major concern for consumers, and policymakers should worry that they think it's a long-term problem. Our latest ING Consumer Research survey indicates that people in eight European countries not only expect inflation to stay high for at least three more years but also expect those same goods to keep getting more expensive.

Real Estate

Mortgage Activity Decreases for Third Straight Week (NAHB) - Per the Mortgage Bankers Association’s (MBA) survey through the week ending August 4th, total mortgage activity decreased 3.1% from the previous week and the average 30-year fixed-rate mortgage (FRM) rate rose 16 basis points to 7.09%. The FRM rate has fluctuated between 6.9% and 7.1% over the past month.

PMI

Monthly PMI Bulletin: August 2023 (S&P Global) - The global economic expansion decelerated at the start of the second half of 2023 on the back of a deepening manufacturing downturn and cooling of service sector growth. Despite this, selling price inflation ticked higher, hinting at service sector-led stickiness of inflation.

Outlook

CIBC Forecast Updates: August 2023 - US and Canada interest rate and exchange rate forecasts and US and Canada economic forecasts.

Looking for a way to take advantage of higher interest rates? I recommend SoFi’s high-yield savings account which has a yield of 4.5% (subject to change) and includes FDIC deposit insurance for both its checking and savings accounts just like a traditional bank. Use my referral link to get a sign-up bonus and start earning that rate today. (This is also a great way to support me since I get a bonus too!)

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website. You can also see my feed on the PiQSuite platform as a partnered feed.