Durable Goods New Orders Shows Mixed Picture as Transport Orders Cause Surging Growth

Economic news and commentary for June 27, 2023

US Durable Goods New Orders

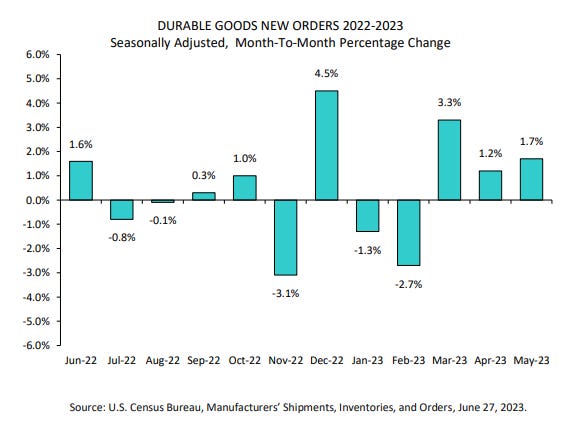

Durable goods activity in the United States has been on a hot streak, with robust growth recorded over the past three months. In May, durable goods new orders increased by 1.7% MoM, following a 1.2% MoM increase in April. The average growth rate of overall durable goods new orders over the last three months stands at an impressive 2.1% MoM. While this figure paints an optimistic picture, it is important to note that the strong growth was primarily driven by robust orders in the transport sector.

Excluding the transport category, new orders saw a more modest growth of 0.6% MoM in May. On a yearly basis, non-transport orders increased by only 0.4% YoY. However, within the non-transport segment, there were solid increases in machinery orders (1.0% MoM) and electrical equipment orders (1.7% MoM), while other sectors experienced little to no growth. Zooming in on the core group of orders, specifically non-defense capital goods orders excluding aircraft, we observe a solid gain of 0.7% MoM in May, following a 0.6% MoM increase in the previous period. This category of orders has shown more notable growth, up by 2.7%YoY.

A significant portion of the backlog in unfilled orders is attributed to aircraft orders. Non-defense capital goods unfilled orders, including aircraft, have increased by 7.7% YoY, while non-defense capital goods unfilled orders without aircraft have seen a more modest growth of 0.5% YoY. Furthermore, it is worth noting that non-aircraft inventory remains somewhat bloated, showing an increase of 6.3% YoY. This suggests that there may be excess inventory in sectors beyond the aircraft industry thanks to some downturn in demand in those areas.

While the good news is that demand in durable goods orders looks strong enough to avoid a recession, the bad news is that it does not look supportive of anything more than meager growth in the near term. The disentanglement of supply chains has mostly been played out as unfilled orders are mostly drawn down with the exception of aircraft unfilled orders. While inventory growth of core capital goods is still shrinking (down 6.8% YoY in April to 6.4% YoY in May), that trend could reverse soon as the labor market weakens.

Still to come…

9:00 am (EST) - US Case-Shiller Home Price Index

9:00 am - US FHFA House Price Index

10:00 am - US Consumer Confidence

10:00 am - US New Home Sales

10:00 am - US Richmond Fed Manufacturing Survey

Morning Reading List

Other Data Releases Today

Italy's Consumer Confidence Climate index increased to 108.6 in June (highest since 2021), up from 105.1 in May. The Current Climate index increased only 2.0 pts to 102.0 while the Future Climate index jumped 5.8 pts to 118.4.

Italy's Business Climate index edged down -0.3 pts to 108.3 in June, the lowest so far this year. While the construction sector improved, all 3 other sectors declined.

The services sector index returned to yearly lows as momentum fades.

Canada's CPI was up 0.4% MoM and 3.4% YoY in May, down from 4.4% YoY in April. This is the smallest YoY gain since June 2021.

Core CPI: 4.0% YoY (0.4% MoM)

Food: 8.3% YoY (0.8% MoM)

Energy: -12.4% YoY (-0.8% MoM

Goods: 2.1% YoY (0.1% MoM)

Services: 4.6% YoY (0.5% MoM)

Italy Consumer Confidence

Italy: Confidence data points to a mixed economic outlook (ING) - June's confidence data paints a mixed picture for Italy's economy, with consumers increasingly upbeat and businesses remaining less optimistic. We're hopeful for continued growth in the second quarter, but expect some softening off the back of weaker net exports

US

Shifting Sands: U.S. Inflation’s Changing Dynamics (TD Bank) - Inflation climbed to a 40-year high last year as strong demand for goods overwhelmed global supply-chains. Goods prices have slowed since then, but services are now playing a leading role in driving inflation.

Burns or Volcker? (First Trust Portfolios) - Ultimately Fed Chairman Powell has a decision to make: would he prefer to be remembered like Arthur Burns or Paul

Volcker? Burns kept monetary policy too loose and let inflation reignite; he was respected at the time but now his name is Monetary Mudd. Paul Volcker tightened monetary policy to what was then considered excruciating levels in the

early 1980s. Despised by many at the time, he’s now considered a great leader at the Fed, the slayer of the inflation dragon that Burns let loose.

Texas economic growth outpaces nation despite persistent downside risks (Dallas Fed) - Texas employment growth advanced in May, continuing to surpass the national average. Meanwhile, price and wage pressures remain elevated, according to the Texas Business Outlook Surveys (TBOS). Employment growth is projected to slow later this year, while price and wage pressures are expected to ease following Federal Reserve monetary policy tightening.

Summer Schooled: A Supreme Challenge & Payments Set to Resume (Wells Fargo) - Households with student loans face two major developments this summer. The first is the possibility that the debt forgiveness plan will be struck down by the Supreme Court. The second is the coming expiration of a payment moratorium that has allowed debts to go unpaid for more than three years. This report considers what these student loan developments mean for consumer spending.

US Weekly Economic Commentary: Single-family housing activity forms a bottom (S&P Global) - Reports last week reinforced the view that single-family housing activity has formed a bottom. The National Association of Homebuilders Housing Market Index rose in June for the sixth consecutive month to the highest level since last July. Housing starts surged in May by nearly 300,000 units, to 1.63 million, the highest since last May, with starts of both single-family and multi-family units rising sharply.

Europe

Inflation is falling, growth is hesitant: Economic Outlook - June 2023 (Insee) - By mid-2023, the global economy seems less constrained than a year ago by the direct consequences of the shocks experienced in recent years (notably the Covid-19 pandemic, and the war in Ukraine). Health restrictions have been lifted completely in China. Supply chains in industry are now less disrupted. Energy prices and the prices of many commodities have fallen back significantly from the peaks of spring 2022.

Geopolitical radar - Making sense of what is happening in Russia (Danske Bank) - This is an extra edition of our Geopolitical radar with a focus on the armed mutiny in Russia and its potential implications. We stress that the situation is fluid and visibility is poor. What is likely is that geopolitical uncertainty will return as a key market driver for now, adding to market volatility and weighing on risky assets.

Toasted, roasted and grilled? Walking the talk on green monetary policy (Allianz) - At this week’s ECB Forum on Central Banking in Sintra, climate change risks and their impact on monetary policy will feature prominently on the agenda. One of the awarded academic papers investigates how the transition to a net-zero emissions economy can affect the transmission of monetary policy. This follows on the heels of ECB President Lagarde’s recent comments at the Future Investment Initiative in Riyadh/Saudi Arabia last week that “we will be toasted, roasted and grilled” if societies fail to effectively tackle climate change.

Canada

Parsing Canada’s productivity gap (CIBC) - Higher productivity is a straightforward way to limit inflationary pressures, and it doesn’t come along with the negative ramifications of higher interest rates, which are currently heading to levels that will stall growth on both sides of the border over the remainder of the year. Canada’s underperformance in productivity has worsened since the onset of the pandemic, with the impressive pace of employment growth not having been matched by gains in GDP, which is working to amplify inflationary pressures through higher unit labour costs.

Latin America

Latam | Overcoming the challenge of high inflation (BBVA) - The past couple of years have posed significant challenges for the world economy and Latam. The hike in inflation and monetary policy response are exerting significant presure on activity, with the region growing below the world. Inflation is abating, showing the positive print of the improved institutional framework.

Inflation

Inflation Monitor for June 26 (BMO) - Consumer price pressures remain elevated with internal conflicts in Russia threatening to disrupt global commodity supplies.

Real Estate

The Housing Market May Have Found a Floor. Where is the Ceiling? Housing Activity is Starting to Percolate Despite Higher Mortgage Rates (Wells Fargo) - In the press conference following the June 13-14 FOMC Meeting, Chair Powell remarked that "we now see housing putting in a bottom, and maybe moving up a bit." Indeed, residential real estate activity looks to have steadied so far this year following 2022's dramatic decline. On balance, new and existing home sales, builder sentiment and new residential construction have all improved in 2023.

Bank Failures Having Some Effect on Builders (NAHB) - The failure of several banks in 2023 and the ensuing stress in U.S. financial markets have had an effect that some builders and developers are beginning to notice, according to two recent NAHB surveys. In one of the surveys, roughly three-in-five builders and developers reported that loans for land acquisition, land development and speculative single-family construction have become more difficult to obtain specifically as a result of the aforementioned financial stresses.

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website.