Econ Morning: May 20th, 2025

Macro releases and commentary released the morning of May 20th, 2025

(all times are in EST)

RBA Cuts Interest Rates, Revises Growth Forecasts

Released: May 20, 2025 00:30 - Link

The Reserve Bank of Australia surprised markets by cutting its cash rate target by 25 basis points to a two-year low of 3.85% at its May meeting, marking the second reduction this year and signaling a shift towards a more accommodative monetary policy stance. This decision, driven by moderating inflation and heightened uncertainty surrounding international trade developments, prompted a significant response in the bond market. Updated forecasts released alongside the decision reveal downward revisions to growth expectations, particularly for 2025, reflecting softer global demand, while the labor market outlook remains relatively resilient. Inflation forecasts were substantially revised lower, largely attributable to declining energy commodity prices and the anticipated disinflationary impact of trade friction, suggesting the RBA anticipates further easing if current trends persist, but remains prepared to respond to adverse developments.

German Producer Prices Decline Amid Mixed Trends

Released: May 20, 2025 02:00 - Link

German producer prices continued their downward trend in April, with the headline PPI declining 0.6% MoM and 0.9% YoY, reflecting a substantial drop in energy costs, particularly natural gas and electricity. While energy prices weighed heavily on the overall index, excluding this component revealed underlying price pressures, with non-durable consumer goods, notably food items like coffee and beef, experiencing notable increases. Gains in capital and durable consumer goods prices were modest, and intermediate goods showed minimal inflation, suggesting a complex picture of disinflationary forces countered by some rising input costs within specific sectors.

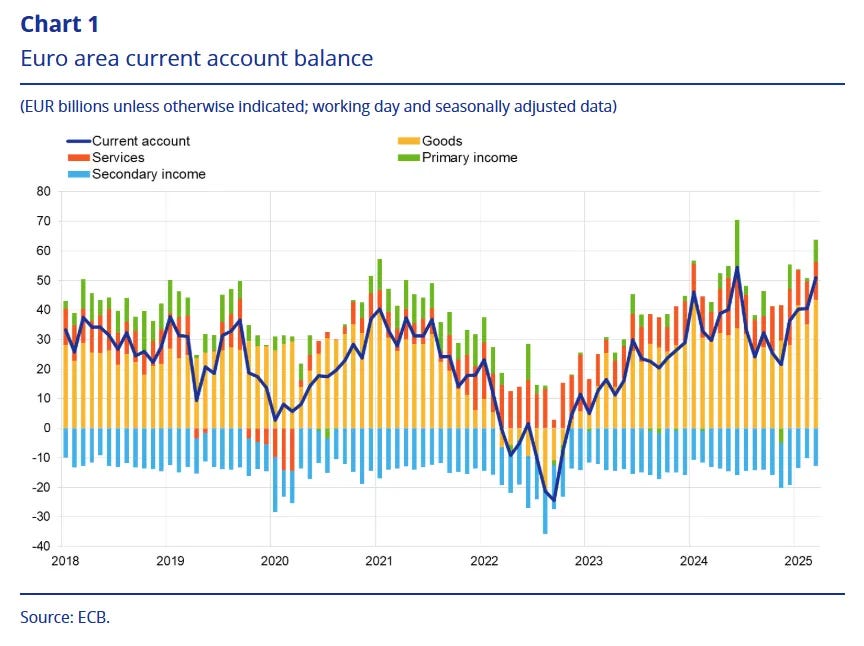

Euro Area Current Account Shows Strong Surplus

Released: May 20, 2025 04:00 - Link

The Euro area's current account demonstrated robust health in March, registering a €51 billion surplus that exceeded expectations and built upon February's gains, contributing to a substantial 12-month surplus of €438 billion, or 2.9% of GDP. This strength was underpinned by rising goods, services, and primary income surpluses, alongside significant portfolio investment flows with residents investing €698 billion abroad while attracting €782 billion in non-resident purchases. Notably, direct investment showed a divergence with resident outflows exceeding non-resident disinvestment, and the Eurosystem's reserve assets benefited from a considerable gold price appreciation, highlighting a period of increased external financial strength for the region.

Italian Construction Shows Mixed Signals

Released: May 20, 2025 04:15 - Link

Italian construction output experienced a modest contraction of -0.4% MoM in March, a slowdown after a robust start to the year. Despite this recent dip, the sector demonstrated underlying strength, evidenced by a 2.6% QoQ increase in Q1 2025 and positive year-on-year growth, with the calendar-adjusted index rising 4.1% and the unadjusted index climbing 6.2% in March. Overall construction activity for the first quarter registered a 3.4% YoY increase on a calendar-adjusted basis, albeit a more moderate 1.4% YoY rise when considering the unadjusted data, suggesting a nuanced picture of the sector's performance.

Euro Area Construction: Mixed Performance in March

Released: May 20, 2025 05:00 - Link

Euro area construction output demonstrated uneven performance in March, with a slight 0.1% MoM increase masking an ongoing contraction of -1.1% YoY. While civil engineering provided a notable boost with a 4.1% MoM and 0.8% YoY rise, building construction continued its downward trend, falling -2.9% YoY despite a 0.9% MoM gain. Geographic disparities were significant, as strong growth in Austria, Romania, and Czechia contrasted sharply with contractions in Portugal, Slovenia, and Poland. This mixed picture suggests persistent headwinds for the construction sector, even as some segments and nations experience short-term positive momentum.

Philadelphia Nonmanufacturing Shows Mixed Signals

Released: May 20, 2025 08:30 - Link

The Philadelphia region's nonmanufacturing sector demonstrated a mixed picture in May, with the General Business Activity index edging closer to positive territory despite remaining in contraction for the fourth consecutive month. While new orders continued to weaken, sales showed modest gains, and firms added significantly to full-time employment, offset by a decline in part-time roles. Notably, input price pressures eased considerably, though selling prices saw a slight uptick, and expectations for both near-term and long-term inflation accelerated sharply, alongside heightened anticipated compensation growth, suggesting underlying cost pressures remain a concern despite the current weak regional activity and pessimistic near-term regional outlook.

Canadian Inflation Eases in April

Released: May 20, 2025 08:30 - Link

April's CPI data revealed a continued easing of inflationary pressures in Canada, with the headline figure registering 1.7% YoY, a notable decline from March's 2.3% YoY and the lowest reading since September 2024, despite slightly exceeding expectations. While the broad moderation was primarily driven by a substantial drop in energy prices, particularly gasoline, which fell significantly MoM and YoY, the exclusion of energy saw a more persistent 2.9% YoY increase. Elevated food prices from stores, alongside increases in travel tours and services CPI, partially offset the overall slowdown, although goods CPI continued its downward trend. Core CPI also ticked higher, suggesting underlying price pressures remain somewhat elevated.

Euro Area Consumer Sentiment Improves

Released: May 20, 2025 10:00 - Link

April's preliminary data revealed a surprising uptick in Euro Area economic sentiment, as the European Commission's consumer confidence index rose 1.4 points to -15.2, surpassing consensus forecasts predicting a more modest improvement. This suggests a renewed sense of optimism among consumers, potentially signaling a softening in the previously observed headwinds impacting household spending and offering a cautiously positive signal for near-term economic activity within the region, although further data is needed to confirm the sustainability of this shift.

Transpacific Freight Rates Surge Amid Tariff Easing

Released: May 20, 2025 12:00

The temporary easing of tariffs between the US and China, alongside reciprocal pauses with other trading partners set to expire in July and August, is triggering a rapid frontloading of goods and a surge in transpacific ocean freight demand. This initial spike, coupled with constrained capacity due to repositioning of vessels and containers and ongoing congestion at Chinese ports, is driving aggressive general rate increases (GRIs) from carriers, pushing spot rates on the Asia-US West Coast to approximately $4,400/FEU and the East Coast to $2,800/FEU. While some experts anticipate a rebound in demand ahead of the August deadline, the enduring 30% China tariff and shifts in air cargo capacity, previously dedicated to the transpacific, continue to shape market dynamics and introduce volatility across freight modes.

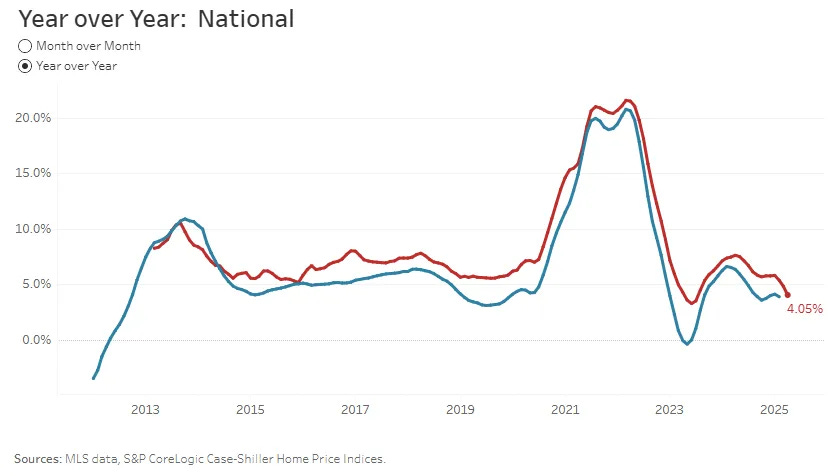

Housing Market Shows Signs of Moderation

Released: May 20, 2025 12:00 - Link

The Redfin Home Price Index revealed a softening housing market in April 2025, with prices experiencing a modest -0.1% MoM decline, the first since September 2022, and a slowing YoY growth rate of 4.1%, the lowest since July 2023. While the monthly contraction is slight and subject to potential revisions, the data indicates a broader deceleration, evidenced by declines in a significant number of major metro areas, notably Charlotte, Virginia Beach, and Miami. These developments suggest a potential shift in the housing market, mirroring previous instances following aggressive interest rate hikes, though regional variation remains apparent, with gains observed in Nassau County, Warren, and New York.

Other data releases and commentary:

10 Downside Risks to the US Economic Outlook, Released: 05/20/2025 07:00