Econ Mornings: April 15th, 2025

Macro releases and commentary released the morning of April 15th, 2025

(all times are in EST)

RBA Minutes Suggest Return to Inflation Target by Mid-2025

Released: April 14, 2025 19:30 - Link

In today's monetary policy update from the RBA, the minutes revealed that underlying inflation is expected to return to the 2-3% target range by mid-2025, with recent CPI data suggesting trimmed mean inflation may fall below 3% in Q1. Wage growth has eased slightly, but unit labour costs have risen sharply YoY, complicating the inflation picture and posing two-sided inflation risks. The labour market remains tight, but signs of easing, including softening in quits rates, may suggest reduced inter-firm competition for labour, although the RBA is still uncertain about capacity levels. Overall, GDP growth picked up QoQ in Q4 2024, driven by private and public demand, with household consumption recovering as real incomes and debt servicing costs fall. However, policy remains cautious due to increased global trade uncertainty and domestic effects not yet material, with the cash rate held steady at 4.10% for now and a data-dependent approach expected, with May's decision point looming due to incoming data and revised forecasts.

Japan's Mixed Signals: Retail Sales Slow While Wholesale Sales Surge

Released: April 14, 2025 23:30

In today's macro update, Japan's latest survey of commerce revealed mixed signals on consumer spending. Retail sales growth slowed to 0.4% MoM and 1.3% YoY in February, down from the preliminary reading of 0.5% MoM and 1.4% YoY, but this was still a positive result given the economic backdrop. Wholesale sales, however, showed significant improvement, increasing by 0.7% MoM after being revised up from 0.2% MoM in the previous update. Notably, machinery & equipment sales surged 3.8% MoM, the largest increase in over a year, while apparel & accessories also saw substantial growth of 4.2% MoM.

India’s WPI Contracts Amid Surprise Drop

Released: April 15, 2025 01:30

The Indian Wholesale Price Index (WPI) reported a surprise contraction of -0.19% MoM in March, coming in below market expectations for a 2.5% YoY increase, but still beating February's reading. The raw goods segment led the decline, falling -1.07% MoM, driven by drops in crude petroleum & natural gas (-2.42% MoM) and non-food articles (-2.40% MoM). Meanwhile, manufactured product prices rose 0.42% MoM and 3.07% YoY, with 16 of the subindexes increasing in March, while the Food Index fell -0.11% MoM for the fifth consecutive month, its growth slowing sharply from a peak of 12.15% YoY in October last year.

UK Labour Market Shows Resilience Amid Mixed Employment Figures

Released: April 15, 2025 02:00 - Link

In a surprisingly resilient labor market, the UK added 206k jobs in QoQ to reach 75.1% employment rate, up 0.2 ppts, and maintained an unchanged unemployment rate of 4.4%. The economic inactivity rate fell -0.7 ppts YoY, while the redundancy rate rose 0.2 per thousand. Total job vacancies plummeted -35k from pre-pandemic levels, marking the first time below this threshold since March to May 2021. Average weekly total pay growth remained unchanged at 5.6% YoY, with regular pay growth (excluding bonuses) increasing to 5.9% YoY, but payroll employment estimates took a surprising -78k drop in early March, the largest monthly decline since May 2020.

German Wholesale Prices Slow Down Amidst Food and Energy Price Pressures

Released: April 15, 2025 02:00 - Link

In the latest macro update from Germany, wholesale prices declined -0.2% MoM in March, beating expectations of a 0.2% MoM increase and marking a slowdown from February's -1.6% QoQ decline. The annual rate eased to 1.3% YoY, largely due to the continued upward pressure on food, beverages, and tobacco (+4.4% YoY), while non-ferrous ores, metals, and semi-finished products surged +27.3% YoY, offsetting some of this growth with a -3.0% YoY decline in mineral oil products.

French Inflation Remains Steady at 0.8% YoY in March

Released: April 15, 2025 02:45 - Link

France's CPI inflation remained steady in March, coming in at 0.8% YoY, as expected. The MoM reading also held firm, sitting at 0.2%, unchanged from February. While manufactured goods prices posted a slight uptick of 1.1% MoM, this was largely offset by a -0.2% YoY decline, while services prices remained flat but increased 2.3% YoY. Core CPI inflation and the HICP inflation rate also held steady at 1.3% YoY and 0.9% YoY respectively, both unchanged from February's readings and maintaining their recent low levels.

Euro Area Banks Anticipate Further Credit Tightening in Q2

Released: April 15, 2025 04:00 - Link

In the latest Euro Area Bank Lending Survey Q1 2025 data, banks reported a small net tightening of credit standards for loans to firms at 3%, down from 7% in Q4 2024. However, this decrease was largely offset by easing of credit standards for housing loans (-7%) and consumer credit (3%), with the latter also seeing lower net tightening compared to Q4 2024. Loan demand from firms declined MoM, while housing loan demand surged +41% and consumer credit demand increased moderately +10%, driven by declining interest rates and rising consumer confidence. Despite this, banks expect further tightening in Q2 across all loan types, with a 5% net tightening expected for firms, 7% for housing loans, and 7% for consumer credit, although they also forecast higher loan demand (+4% for firms, +20% for housing, +6% for consumer credit).

ZEW Economic Sentiment Hits New Lows After Significant Decline

Released: April 15, 2025 05:00 - Link

This morning's macro data saw significant declines in economic sentiment indicators, with the ZEW Indicator of Economic Sentiment for Germany plummeting -65.6pts to -14.0, marking its largest decline since Russia invaded Ukraine in 2022, while expectations were lower than expected at 9.5pts. The Eurozone also witnessed a major downturn, falling -58.3pts to -18.5, and the US index dropped further, down -22.8pts to -71.5. ZEW noted that US trade policy changes are driving uncertainty globally, with reciprocal tariffs having a significant impact on expectations for both Germany and the Eurozone, leading to a sharp decline in economic sentiment.

Euro Area Industrial Production Beats Expectations

Released: April 15, 2025 05:00 - Link

The Euro Area Industrial Production data beat expectations with a 1.1% MoM and 1.2% YoY gain in February, as economists had anticipated a smaller 0.3% MoM growth and a negative -0.8% YoY rate. Notably, non-durable consumer goods led the way with a 2.8% MoM surge, followed by capital goods at 0.8% MoM and intermediate goods at 0.3% MoM. However, energy production declined by 0.2% MoM, while durable consumer goods suffered an even steeper drop of 0.3% MoM. It's worth noting that Ireland's industrial production surged 10.8% MoM, which could skew the overall euro area data.

Indian Consumer Prices Post Their Lowest Annual Increase Since 2019

Released: April 15, 2025 05:30 - Link

The Indian Consumer Price Index (CPI) reported a -0.26% MoM decline in March, marking the fifth consecutive month of contraction and the lowest since August 2019. The YoY increase was 3.34%, below expectations and falling short of the previous peak of 10.87% YoY in October 2024. Notably, food prices led the decline, with the Consumer Food Price Index falling -0.86% MoM, while health (+4.26% YoY) and personal care (+13.50% YoY) subsegments saw notable increases, albeit with small weights. The weakest annual rate was seen in fuel & light at 1.48% YoY.

Canada's Housing Market Sees Significant Slowdown

Released: April 15, 2025 08:15

This morning's macro data saw a significant slowdown in Canada's housing market, with total starts plummeting -3.3% MoM to 214,200 units in March, missing expectations and marking the lowest level since August last year. The decline was led by a -2.8% MoM drop in urban starts to 203,300 units, while rural starts fell to just 10,900 units. Notably, the 6-month moving average also declined -0.7% MoM to 235,000 units, indicating a continued trend of slower growth in the Canadian housing sector.

Canada's Manufacturing Sales Surge to Highest Level Since September 2023

Released: April 15, 2025 08:30 - Link

In a surprise turn of events, Canada's manufacturing sales rebounded by 0.2% MoM in February, marking the highest level since September 2023. The gain was largely driven by increases in 11 subsectors, with primary metal and chemical product seeing the largest boosts (+8.3% and +6.7%, respectively). However, the petroleum and coal product subsector took a hit, declining -5.2% MoM due to lower demand and prices. Notably, total manufacturing inventories reached a record $122.0 billion in February, while capacity utilization decreased from 78.7% to 77.3%.

Empire State Manufacturing Survey Beats Expectations with Surprising Improvement

Released: April 15, 2025 08:30 - Link

The Empire State Manufacturing Survey showed a surprise beat in April with the General Business Conditions index rising to -8.1 from March's drop, exceeding forecasts of -14.5. New Orders and Shipments indexes rebounded, increasing by 6.1pts to -8.8 and 5.6pts to -2.9, respectively, while Unfilled Orders rose 6.1pts to 4.1, its highest value since mid-2022. Prices Paid and Received extended their upward trends, rising 5.9pts to 50.8 and 6.3pts to 28.7, both near three-year highs. However, the Employment index remained negative at -2.6, while the average workweek indicator worsened, falling -6.6pts to -9.1.

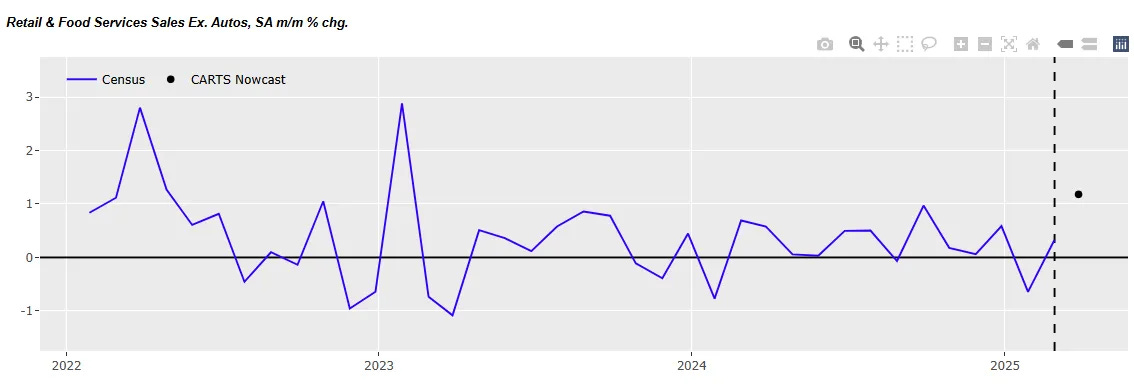

March Retail Sales Forecasted to See Strongest Monthly Gain Since January 2023

Released: April 15, 2025 08:30

The Chicago Fed's CARTS report showed a stronger-than-expected 1.2% MoM increase in retail & food services sales (ex autos) growth in March, reaching 3.7% YoY, the highest monthly gain since January 2023. This uptick is attributed to strong transaction data, which contributed 81 basis points to the nowcast, with Census data and foot traffic making smaller contributions. Notably, price growth in this sector declined by -0.4% MoM and -0.2% YoY, leading to an inflation-adjusted gain of 1.6% MoM.

March US Import Prices Show Slight Decline as Energy Costs Plummet

Released: April 15, 2025 08:30 - Link

US import prices declined -0.1% MoM in March, marking a rare monthly drop, while export prices remained unchanged but YoY growth eased to 2.4%, down from a QoQ gain of 2.1%. The decline was largely driven by weak energy prices, with fuel imports falling -2.3% MoM and oil products down -1.5% MoM. In contrast, industrial supplies and materials import prices increased 0.4% MoM, driven by strong gains in nonfuel industrial supplies, while exports saw no change over the month but maintained a firmer YoY gain of 2.4%, with nonfuel industrial supplies & materials export prices up 11.1% YoY. The underlying details suggest diverging trends across sectors, shaped by energy market softness and volatile tariff policy, with import activity grinding to a halt at the end of Q1 2025 ahead of upcoming tariffs, potentially leading to higher import prices in the future.

Canada's CPI Sees Slight Deceleration Amid Shift in Energy Prices

Released: April 15, 2025 08:30 - Link

Canada's CPI rose 0.3% MoM in March, down from 2.6% YoY in February, marking a slight deceleration from the previous month. The decline was largely driven by a sharp drop in gas prices, which fell -1.8% MoM and -1.6% YoY, reversing the 5.1% YoY increase seen last month. Food prices rebounded with a 1.7% MoM gain, while CPI excluding food and energy decreased 0.2% MoM, down from 2.9% YoY in February. The core inflation rate, which excludes volatile energy components, remained steady at 2.4% YoY, as goods prices edged up 0.3% MoM and services prices gained 3.1% YoY, albeit with weakness in certain sectors such as household operations & goods (-0.3% MoM) and recreation & education (-0.8% MoM).

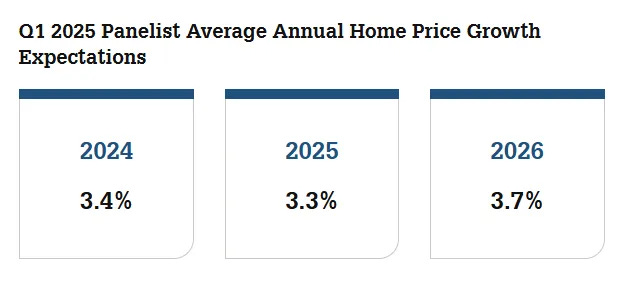

Fannie Mae Slows Home Price Growth Expectations

Released: April 15, 2025 10:00 - Link

In this morning's macro updates, we're seeing a slowdown in expected home price growth from Fannie Mae's Q1 2025 survey, which now forecasts national home prices to average 3.4% MoM and 3.3% QoQ for 2025 and 2026 respectively, following a 5.8% gain in 2024.

Other data releases and commentary:

IEA Gas Market Report: Q2 2025, Released: 04/15/2025 05:00

IEA Oil Market Report: April 2025, Released: 04/15/2025 05:00

Bid-Ask Spreads Widening in IG Credit Markets, Released: 04/15/2025 07:00

IEA Monthly Gas Statistics: April 2025, Released: 04/15/2025 05:00

IEA Monthly Oil Statistics: April 2025, Released: 04/15/2025 05:00

Jet Fuel Price Monitor: Week of April 11th, Released: 04/15/2025 12:00