Econ Mornings: April 17th, 2025

Macro releases and commentary released the morning of April 17th, 2025

(all times are in EST)

Japan's March Trade Balance Narrows to Largest Surplus Since 2021

Released: April 16, 2025 18:50 - Link

Japan's March trade balance fell ¥544.1 billion, narrowly missing expectations of a decline to ¥485.3 billion, but still marking the largest surplus since March 2021. Exports rose 7.2% MoM and 3.9% YoY, albeit below the 4.5% YoY increase forecasted, while imports increased 8.2% MoM and 2.0% YoY, also underestimating the 3.1% YoY growth anticipated. Notably, exports to the US declined -1.5% MoM, contrasting with a +4.4% MoM rise in imports from the US, while imports from Asia and China saw a surprisingly strong +11.4% YoY and +15.9% YoY jumps, respectively.

Japan's Foreign Bond Investment Sees Sixth Consecutive Decline Amid Market Shifts

Released: April 16, 2025 18:50

Japan's latest macro data highlights ongoing market trends: Long-term foreign bond investment fell -¥512.0 billion MoM, marking the sixth straight decline and the second largest in that series, while short-term foreign bond holdings declined by ¥234.8 billion QoQ, contributing to overall declines. However, Japanese investors showed signs of recovery with total foreign equity investment rising ¥258.1 billion for a fourth consecutive week, driven by an increase in total foreign investment in Japanese equities up ¥1,043.7 billion QoQ.

Australian Labor Market Remained Solid in March

Released: April 16, 2025 19:30 - Link

This morning's macro data out of Australia saw a slightly softer-than-expected employment report for March, with a +0.2% MoM increase in total employment that missed the projected 40k growth. While full-time employment rose by 15k and part-time jobs increased by 17.2k, the unemployment rate edged up to 4.1% on a 3k rise in the number of unemployed, as did the participation rate, which fell short of expectations at 66.8%. Notably, total hours worked plummeted -0.3% MoM to 1.97 million, marking the weakest annual increase since August 2024 at 0.7% YoY.

Germany's Manufacturing Orders Show Modest Upward Trend

Released: April 17, 2025 02:00 - Link

This morning's release of Germany's manufacturing order books for February 2025 revealed a modest upward trend in demand, with the order backlog rising 0.3% MoM and 1.3% YoY. Automotive orders led the increase at 0.8% MoM, while machinery and equipment also saw gains of 0.4% MoM, though basic metals fell -1.1%. The overall range of the stock of orders expanded to 7.7 months, up from 7.6 months in January, driven by capital goods producers now holding a 10.5-month backlog.

German PPI Drops Sharply Amid Energy Price Plummet

Released: April 17, 2025 02:00 - Link

Germany's Producer Price Index (PPI) fell -0.7% MoM and -0.2% YoY in March, marking a significant miss from expectations of a -0.1% MoM drop and a 0.4% YoY increase. The decline was largely driven by energy prices, which plummeted -2.8% MoM and -3.6% YoY, overshadowing the slight increases seen in capital goods (+0.1% MoM, +1.9% YoY) and intermediate goods (+0.3% MoM, +0.5% YoY). Within consumer goods, non-durables prices edged up 0.3% MoM and 2.6% YoY, while durables saw a more modest increase of 0.2% MoM and 1.3% YoY.

UK Credit Availability Sees Slight Upswing as Lenders Anticipate Further Growth

Released: April 17, 2025 04:30 - Link

The Bank of England Credit Conditions Survey revealed mixed trends in credit availability in Q1 2025. Lenders reported a slight increase in secured credit to households MoM, with expectations of further growth over the next three months to Q2. Unsecured credit to households saw an increase both MoM and YoY, with Q2 expectations of further growth. Corporate sector credit availability also rose slightly QoQ, with small and medium-sized businesses experiencing a notable boost while large businesses remained unchanged. Demand for corporate lending from all sizes of businesses increased in Q1, with expectations of slight increases in Q2 except for smaller businesses, which saw only minor gains.

Energy Markets Experience Mixed Growth Amid Increased Renewable Use

Released: April 17, 2025 05:00

Total OECD electricity generation rose 2.9% MoM to 1,015.1 TWh in January 2025, driven by increases in renewable sources (4.2% YoY). Notably, solar generation surged 29.5% YoY, with the Americas and Europe seeing significant growth. In contrast, hydropower generation declined 2.7% YoY in the OECD, while nuclear power output rose 6.5% YoY, led by a notable increase in Korea. The shares of natural gas, coal, and oil as fuels for electricity generation remained relatively stable.

OECD Unemployment Rates Hold Steady

Released: April 17, 2025 06:00 - Link

The OECD unemployment rate held steady at 4.8% in February, mirroring January's unchanged reading across 22 countries, with declines in 7 and increases in just 2 others. The G7 unemployment rate also remained stable at 4.3%, while EU and euro area rates continued to hit record lows. Employment and labour force participation rates stood pat at 70.2% and 73.9% in Q4 2024, with the OECD employment rate ending 2024 up slightly from 2023 by 0.2 ppts, driven mainly by an increase in labor force participation.

Canadian Small Businesses Show Slight Rebound in Optimism But Outlook Remains Weakened by Tariffs

Released: April 17, 2025 07:00

This morning's macro data revealed mixed signals for small businesses in Canada. The CFIB Business Barometer's April 2025 report shows a slight rebound in optimism, with the 12-month index rising to 9.3 points from March, but still below average and near pandemic-era lows. Expectations for price increases remained elevated at 3.5%, while wage growth plans returned to 2.2%. Full-time staffing plans also recovered slightly, but remain below normal levels, with 14% planning to hire and 17% estimating layoffs over the next year. Tariff pressures worsened, with 70% of SMEs reporting negative impacts, while confidence in international trade remained lower than domestic counterparts.

European Central Bank Cuts Interest Rates Again

Released: April 17, 2025 08:15 - Link

The European Central Bank (ECB) cut its three policy interest rates for the third consecutive quarter point cut, bringing the deposit rate to 2.25%, main refinancing rate to 2.40%, and marginal lending rate to 2.65%. This move follows progress on inflation, with services inflation easing and becoming a driver of disinflation, supporting the ECB's expectations for underlying inflation trending towards its 2% medium-term target. However, uncertainty from rising US trade policy volatility remains a concern, with potential tariffs bringing negative demand shock and downside risks to growth. The ECB's dovish stance is evident in its lack of guidance on rate path, leaving room for further cuts at the June meeting, suggesting that this cut was more driven by positive inflation outlook than weaker economic conditions.

US Jobless Claims Fall as Economy Shows Resilience

Released: April 17, 2025 08:30

US jobless claims fell MoM by -9k to 215k last week, beating expectations of initial claims at 225k. Not seasonally adjusted claims rose 3.1k to 219.7k, while total insured unemployment increased 41k to 1.885 million, marginally above projections of a smaller increase. The insured unemployment rate remained steady at 1.2%. On the federal level, total employees claims (UCFE) surged by 34 to 542, up from 327 last year. In state-level data, manufacturing layoffs were reported in Virginia, Florida, and Washington.

US Housing Starts Plummet by 11.4% in March

Released: April 17, 2025 08:30

US new residential construction data for March disappointed with housing starts plummeting -11.4% MoM to 1.324 million, missing expectations of an increase at an annual rate of 1.420 million. Single-family starts were particularly weak, down -14.2% MoM and -9.7% YoY, while multifamily starts remained unchanged monthly but surged 45.8% YoY. The Q1 total, however, showed a less severe decline, with single-family starts down -5.6% YoY, although overall housing starts were still down -1.5% YoY and building permits ticked up 1.6% MoM but down -0.2% YoY, suggesting a tight supply dynamics continue to shape the market.

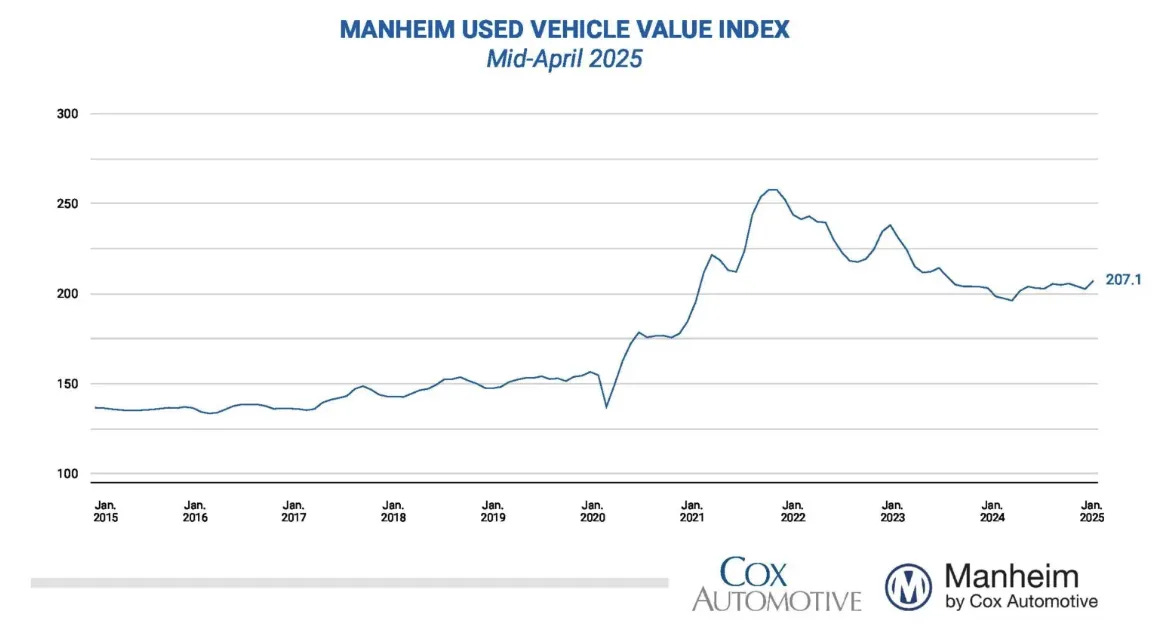

Manheim Used Vehicle Values Rise Sharply Due to Tariff Effects

Released: April 17, 2025 09:00 - Link

In line with expectations, the Manheim Used Vehicle Value Index showed a surge in wholesale used vehicle prices, with values jumping 2.2% MoM and 4.3% YoY in the first two weeks of April. The non-adjusted price change increased by an additional 0.7% MoM, bringing the full-month average up 1.3 ppts, a notable increase influenced by tariff-related effects on new vehicles. Notably, the Three-Year-Old Index saw stronger appreciation trends than normal, rising 2.5% YoY versus its long-term average of 0.2%.

Container Shipping Rates Fall

Released: April 17, 2025 09:45

Container shipping rates continued their downward trend, falling -3% MoM last week to $2,192. All but two routes declined, with the Shanghai-LA rate experiencing a notable drop of -5% WoW, driven by weakening trade ties between the US and China. Slowing global economic activity and ongoing tariff uncertainty are expected to keep rates under pressure, with Drewry forecasting further declines in the coming week.

Philadelphia Fed Manufacturing Survey Hits Low Point as Activity Declines

Released: April 17, 2025 10:00 - Link

The Philadelphia Fed Manufacturing Business Outlook Survey saw a significant downturn in April, with the General Business Conditions index plummeting -38.9 pts to -26.4, its lowest reading since April 2023. A substantial 39% of firms reported declines in activity this month, while new orders fell sharply MoM from 8.7 to -34.2, marking its lowest reading since April 2020. However, prices paid edged up to 51.0, the highest since July 2022, with almost 54% of respondents reporting input price increases. On the other hand, current shipments and prices received ticked down MoM by 11 pts and 1 pt respectively, with only a small percentage of firms reporting price increases for their own goods.

Natural Gas Storage Reaches New Low After Record-Breaking Build

Released: April 17, 2025 10:30

The latest Natural Gas Storage Report revealed a lower-than-expected build of 16 Bcf, increasing inventory levels to 1,846 Bcf. This marks a decrease of 20.6% YoY and 3.9% MoM from the 5-year average, with a notable drop of 0.6% compared to the previous week's decline of -2.1%.

Gas Prices Decline Amid Waning Spring Break Travel and Low Crude Oil

Released: April 17, 2025 12:00 - Link

Notable macro updates from the morning include softer demand for AAA gas, leading to a -5.5 cent drop in national average prices to $3.167 last week, with MoM changes of 8.9 cents and YTD declines of 49.3 cents. The decrease in gas prices is attributed to the waning spring break travel period, with crude oil remaining low, potentially setting the stage for continued pump price drops as summer approaches.

Other data releases and commentary:

Bank of England Bank Liabilities Survey: Q1 2025, Released: 04/17/2025 04:30

Term Premium Rising, Released: 04/17/2025 07:00

BoE Weekly Report: 4/16/2025, Released: 04/17/2025 08:00