Econ Mornings: April 18th, 2025

Macro releases and commentary released the morning of April 18th, 2025

(all times are in EST)

Japan's Inflation: Mixed Signals in March CPI

Released: April 17, 2025 19:30

March's CPI data reveals a complex picture for Japan's inflation, with the headline figure easing slightly to 3.6% YoY despite a 0.3% MoM increase. While the Bank of Japan's core inflation measure accelerated to 3.2% YoY, aligning with expectations, the broader picture is nuanced by moderating food inflation, driven by declines in fresh food, though offset by consecutive monthly increases when excluding this element, and persistently elevated energy prices remaining at 6.6% YoY. Strong performance in discretionary spending categories like culture & recreation, clothing, and furniture contributed to the overall CPI increase, suggesting underlying demand remains a factor even as broader inflationary pressures show signs of cooling.

French Business Creation Slows

Released: April 18, 2025 02:45 - Link

French business creation activity weakened further in March, with total starts declining 2.3% MoM, extending a concerning trend of four consecutive monthly decreases. This deceleration was broad-based, driven by contractions in conventional and self-employed business formations, and particularly acute within the transportation & storage and industrial sectors, suggesting a possible immediate response to anxieties surrounding potential US tariffs. While three-month business starts are down 2.9%, the annual figure remains positive, up 1.7%, implying that the recent slowdown has not yet erased gains made earlier in the year.

Italy's Trade Balance Improves Amid Shifting Patterns

Released: April 18, 2025 04:00 - Link

Italy's February trade balance significantly improved, posting a €4.466 billion surplus, exceeding consensus estimates and reversing January's deficit. Export growth, rising 3.5% MoM and 0.8% YoY, outpaced import growth of 1.7% MoM and 4.1% YoY, fueled by gains across both EU and non-EU trading partners. However, underlying trends reveal a concerning shift in trade relationships, with exports to and imports from the US experiencing notable declines in the first two months of the year, while imports from China have surged dramatically, suggesting a potential restructuring of Italy's international trade patterns.

Italian Construction Output Remains Positive

Released: April 18, 2025 04:15 - Link

Italian construction output demonstrated resilience in February 2025, edging up 0.3% MoM despite a substantial upward revision to January's initially reported 5.9% MoM gain, now placed at 4.7% MoM. Over the past three months, construction activity has expanded by a noteworthy 2.6%, and the annual rate of growth has strengthened considerably, rising to 6.0% YoY from a prior 4.2% YoY, suggesting continued, albeit moderating, momentum within the sector.

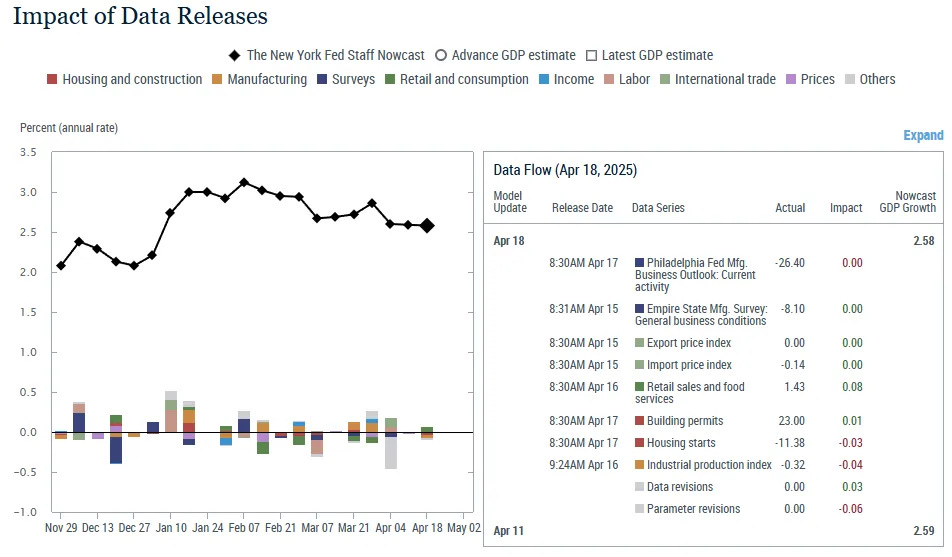

Q1 2025 GDP Growth Remains Stable

Released: April 18, 2025 11:45

The New York Fed's latest nowcast indicates Q1 2025 GDP growth remains steady at 2.58%, with minor adjustments this week. While a pullback in housing starts and industrial production exerted downward pressure, gains in retail sales and building permits partially compensated for these headwinds. The overall change was minimal, reflecting a mixed picture of economic activity and suggesting underlying growth remains relatively stable, albeit with uneven contributions across sectors.

Other data releases and commentary:

US Makes Up Only 14% of Chinese Exports, Released: 04/18/2025 07:00

Happy Easter weekend!