Econ Mornings: April 22nd, 2025

Macro releases and commentary released the morning of April 22nd, 2025

(all times are in EST)

Persistent Inflation Signals in Japan

Released: April 22, 2025 00:00

February's Japanese inflation data presented a mixed picture, with both trimmed mean and weighted median CPI remaining steady at 2.2% and 1.4% YoY, respectively, despite a 0.2 ppts increase in mode CPI inflation to 1.4% YoY. While these core measures offer a degree of stability, the accelerating breadth of price pressures is notable, as evidenced by the rise in the share of increasing CPI items to 80.5% in March, the strongest reading since April 2024, signaling persistent, albeit uneven, inflationary pressures within the Japanese economy.

Spain's Business Turnover Growth Slows

Released: April 22, 2025 02:00 - Link

February's Spanish Business Turnover Index reflects a moderating growth trajectory, with a slight MoM increase masking a notable deceleration in the YoY rate, falling from 5.5% to 3.8% after seasonal adjustments. While electricity and water supply exhibited robust growth at 21.0% YoY, and trade turnover showed a positive MoM gain, other sectors demonstrated mixed signals. Market non-financial services experienced a pullback in activity, declining -0.7% MoM despite a positive YoY result, and extractive and manufacturing industries saw only modest gains of 1.0% YoY, suggesting a complex and potentially uneven economic landscape.

Spanish Services Sector Slows

Released: April 22, 2025 03:00 - Link

February's Spanish services sector experienced a concerning downturn, with production declining 0.5% MoM, the softest reading in nearly a year, despite maintaining a positive, albeit slowing, 2.4% YoY expansion. While trade turnover continues to demonstrate resilience, rising 3.6% YoY, and other services show modest growth at 2.2% YoY, the deceleration in the broader services production figure, falling from 4.3% YoY in January, signals a potential moderation in domestic economic momentum and warrants closer monitoring of underlying demand conditions.

Spain's Trade Deficit Narrows in February

Released: April 22, 2025 04:00 - Link

February's international trade data for Spain reveals a welcome narrowing of the trade deficit to -�3.42 billion, despite remaining the largest for the month since 2022. The improvement was driven by a robust 7.4% MoM jump in exports and a corresponding 1.6% MoM decline in imports, although import volumes remain historically elevated, marking record highs for both February and the year-to-date. While energy imports have marginally decreased YoY, the overall trade picture is complicated by a 5.7% YoY increase in non-energy imports, suggesting persistent underlying demand pressures.

ECB Survey Signals Modest Economic Outlook

Released: April 22, 2025 04:00 - Link

The European Central Bank's latest survey of professional forecasters signals a modestly altered economic outlook, primarily driven by the ongoing effects of trade barriers and increased defense expenditures. Inflation expectations have seen a slight upward adjustment, with headline HICP now projected at 2.2% for 2025 and 2.0% for both 2026 and 2027, while core inflation expectations also ticked higher across all horizons. Concurrently, real GDP growth forecasts were revised down for 2025 and 2026 before recovering in 2027, despite longer-term expectations remaining stable. The survey suggests a marginally improved labor market, with the unemployment rate anticipated to average 6.3% through 2027 before gradually declining further.

UK Consumer Sentiment Declines Amid Economic Caution

Released: April 22, 2025 04:30 - Link

April's S&P Global UK Consumer Sentiment Index registered a notable decline to 44.5, reflecting broad-based concerns about household finances and future spending despite a welcome uptick in Labour Market Sentiment to a 4-month high of 52.7. A simultaneous weakening in both unsecured credit availability and sentiment surrounding debt, now at an 8-month low of 49.1, suggests that potential easing of financial pressures is not translating into increased confidence. Furthermore, a significant 42% of households now expect tighter monetary policy, a reading not seen in almost eighteen months, indicating a growing sense of economic caution that could restrain consumption and dampen overall growth.

Euro Area Finances Show Mixed Signals

Released: April 22, 2025 05:00 - Link

Euro area government finances demonstrated mixed signals in Q4 2024, with the headline deficit narrowing to -3.2% of GDP, despite a 0.4 ppts decline in revenue to 46.6% of GDP and a slight increase in expenditure to 49.9% of GDP. While Spain saw a modest deficit improvement, Germany and France held steady at -2.5% and -6.1% of GDP respectively. Encouragingly, overall government debt decreased to 87.4% of GDP, although this remains 0.1 ppts higher YoY. The broader picture revealed that the annual deficit for 2024 reached a post-pandemic low of -3.1% of GDP, reflecting both increased revenue and steady spending.

Philadelphia Nonmanufacturing Sector Weakens

Released: April 22, 2025 08:30 - Link

The Philadelphia region's nonmanufacturing sector experienced a marked deterioration in April, as evidenced by a sharp decline in the General Business Activity index to its lowest level since May 2020, accompanied by broad-based contractions in regional activity, new orders, and unfilled orders. While the New Orders index saw a partial recovery, revenue declines persisted, and inventories continued to shrink. Notably, input price pressures intensified, with the Prices Paid index reaching its highest level since February 2023, fueling expectations of rising material costs across the sector. Diminished optimism regarding future activity and reduced projections for employee benefit spending suggest firms are bracing for ongoing headwinds and are likely to implement cost-cutting measures, including potential labor cost adjustments, to mitigate inflationary pressures.

Canadian Inflation Shows Unexpected Upward Pressure

Released: April 22, 2025 08:30 - Link

March's Producer Price Index (PPI) data revealed surprising upward pressure on Canadian inflation, with the headline index climbing 0.5% MoM and 4.7% YoY, surpassing anticipated gains. While a significant 3.8% MoM drop in energy and petroleum product prices tempered the overall increase, broad-based price pressures remained evident, particularly in primary non-ferrous metals, which saw a fourth consecutive monthly rise. Excluding energy, the IPPI accelerated to 1.0% MoM and 6.1% YoY, indicating persistent underlying inflation. The Raw Materials Price Index experienced a pullback MoM, though remains elevated YoY, with a pronounced disparity between crude energy products, which continue to decline, and other raw materials exhibiting considerable price strength.

Downgraded Global Economic Outlook

Released: April 22, 2025 09:00 - Link

The IMF's latest World Economic Outlook reflects a significantly downgraded global economic outlook, driven primarily by the recent escalation in US trade policy and associated uncertainty. Growth forecasts were revised downward across numerous economies, including -0.5 ppts to 2.8% for 2025 and -0.3 ppts to 3.0% for 2026 globally, with US growth expectations now at 1.8% and 1.7% respectively. This slowdown is directly tied to a substantial decline in global trade volumes, with emerging markets facing particularly sharp contractions in import and export growth. While a decrease in oil prices is expected to offer some respite for inflation, the outlook remains clouded by persistent services inflation, potential disruptions from tariffs, and a risk of financial instability stemming from a strong US dollar and rising interest rates.

Richmond Fed Survey Indicates Manufacturing Weakness and Inflation

Released: April 22, 2025 10:00 - Link

The Richmond Fed's April survey signals a concerning pullback in Fifth District manufacturing, with the headline index plummeting to -13 and reflecting weakness across key indicators like shipments, new orders, and local business conditions. While vendor lead times shortened, a worrying trend emerged with accelerating prices paid, registering at 5.37% MoM and expectations climbing further to 8.38% YoY, mirroring a similar increase in prices received and anticipated future growth. This combination of weakening demand and rising price pressures suggests persistent inflationary headwinds impacting the region's manufacturing sector, and introduces a degree of uncertainty regarding a sustained economic recovery.

Richmond Service Sector Weakens

Released: April 22, 2025 10:00 - Link

April's Richmond Fed Services Survey reveals a weakening regional service economy, characterized by deepening contractions in both current and expected revenues and demand. While current employment held steady, future expectations and wage growth outlooks deteriorated significantly, reflecting broader pessimism among firms. Although prices paid growth moderated slightly MoM, future input cost pressures are re-accelerating, and expectations for future prices received remain elevated, suggesting persistent inflationary headwinds despite a slowdown in realized prices. The pronounced declines in local business conditions and forward-looking indicators point to a challenging environment for Richmond-area service providers, signaling potential spillover effects on broader regional economic activity.

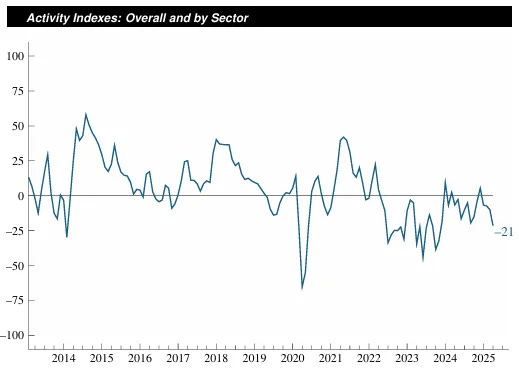

Chicago Fed Survey Signals Economic Slowdown

Released: April 22, 2025 10:00

April data from the Chicago Fed survey paints a concerning picture of slowing economic momentum, with the headline Activity Index sharply declining and both manufacturing and nonmanufacturing activity indexes experiencing contraction. A significant deterioration in the Activity Outlook, coupled with deepening pessimism regarding future economic activity among survey respondents, underscores this trend. While expectations for capital spending saw a slight uptick, the index remains firmly in negative territory, and a considerable percentage of businesses anticipate decreased activity. Intensifying, albeit still negative, labor and nonlabor cost pressures further suggest a weakening economic environment and potential headwinds for the months ahead.

Container Port Throughput Shows Mixed Regional Trends

Released: April 22, 2025 10:00

February's Drewry Global Container Port Throughput Index retreated -1.4% MoM, despite a robust 8.8% YoY increase, with the rolling 12-month average growth rate settling at 6.5%, suggesting continued underlying strength in global trade. Regional performance was varied; Greater China throughput plummeted -9.2% MoM due to post-CNY holiday slowdowns, while European ports demonstrated notable resilience, experiencing a 6.9% MoM surge and a strengthened 5.9% rolling 12-month average. Conversely, the Middle East and South Asia region saw subdued growth of just 0.4% MoM, weighed down by significant contractions in key Indian ports, though still posting a strong 9.7% YoY gain. Drewry's nowcasting model anticipates a rebound in March with a 2.8% MoM rise and a 6.5% YoY increase.

Euro Area Consumer Sentiment Declines

Released: April 22, 2025 10:00 - Link

April's preliminary data reveal a worrying trend in the Euro Area, as consumer sentiment deteriorated noticeably, dropping 2.2 points MoM to a deeply concerning -16.7, marking its lowest level since November 2023 and undershooting consensus forecasts. This decline suggests a growing pessimism among households, potentially reflecting concerns about the economic outlook, and could foreshadow weaker consumer spending in coming quarters, impacting broader economic growth across the region.

Staffing Demand Shows Modest Uptick

Released: April 22, 2025 10:30 - Link

The ASA Staffing Index advanced 0.7% WoW to 84, signaling a modest uptick in demand during the week of April 7-13, though staffing employment remains significantly depressed, down -6.2% YoY. While new starts improved 0.8% WoW and a slightly larger proportion of firms reported assignment gains, the four-week moving average remains subdued at 83, with associated employment declining -7.0% YoY. Encouragingly, the gap in YoY staffing job losses is shrinking, narrowing from -6.7% last week, suggesting a tentative shift in the labor market. However, the ASA continues to highlight persistent weaknesses, citing low turnover and rising unemployment as factors contributing to ongoing fragility in the staffing sector's recovery.

House Price Growth Decelerates

Released: April 22, 2025 12:00 - Link

March's Redfin Home Price Index signals a notable shift in the housing market, with prices increasing just 0.2% MoM, the mildest rise in nearly two years. While YoY growth remains positive at 4.6%, it continues a concerning trend of deceleration, marking the eleventh consecutive month of slowing annual gains. This moderation is being driven by waning buyer confidence amid anxieties surrounding a potential economic slowdown and the impact of rising tariffs, evidenced by price declines in twenty major metros, including a 0.7% drop in Columbus. Redfin's assessment suggests further price softening is possible as heightened costs and buyer apprehension continue to exert downward pressure.

Freight Market Volatility Signals Nascent Turnaround

Released: April 22, 2025 12:00 - Link

March's decline in the ATA Truck Tonnage Index, falling 1.5% MoM, suggests continued volatility within the freight market despite a broader upward trend. While the index registered a modest 0.2% YoY increase and benefited from robust manufacturing activity, particularly in the automotive sector, the recent pullback partially offset February's gains. Encouragingly, Q1 2025 demonstrated the first sequential and annual quarterly gains in two years, signaling a nascent turnaround in freight activity, albeit at a restrained pace, according to ATA, and highlighting an improving, though still precarious, economic landscape.

U.S. M&A Activity Declines in March

Released: April 22, 2025 12:00 - Link

March witnessed a contraction in U.S. M&A deal activity, with the number of announcements declining 5.9% MoM to 892, despite a 49.9% QoQ increase in aggregate spending. While certain sectors, namely Technology Services, Health Technology, Energy Minerals, Miscellaneous, and Government, experienced rising deal counts over the past three months YoY, a broader trend of reduced activity emerged across 16 sectors, with Commercial Services, Finance, Consumer Services, Distribution Services, and Producer Manufacturing exhibiting the most significant declines in deal volume.

Other data releases and commentary:

ECB Survey of Monetary Analysts: April 2025, Released: 04/22/2025 05:00

Main findings from the ECB’s recent contacts with non-financial companies, Released: 04/22/2025 05:00

How Are Imports from China Used in the US?, Released: 04/22/2025 07:00

Global Financial Stability Report: April 2025, Released: 04/22/2025 10:15