Econ Mornings: April 24th, 2025

Macro releases and commentary released the morning of April 24th, 2025

(all times are in EST)

Japan Services Inflation Remains Elevated

Released: April 23, 2025 18:50 - Link

March data reveals a continued, albeit moderating, inflationary trend within Japan's services sector, with the PPI rising 0.7% MoM and 3.1% YoY, a deceleration from the prior month. Excluding international transport, the pace of price increases accelerated slightly to 3.2% YoY, driven primarily by substantial gains in passenger transport costs across air, rail, and road. Notable contributions also came from a rebound in real estate services and broad-based increases within "other services," particularly hotel services and charges for engineering and architectural work, suggesting renewed demand and cost pressures within these segments of the economy.

Japanese Investors Return to Overseas Assets

Released: April 23, 2025 18:50

Japanese investors demonstrated a resurgence in overseas asset acquisition during the week ending April 19th, notably returning to net purchases of foreign long-term debt after a month-long hiatus, alongside a fifth consecutive week of substantial investment in foreign equities. This shift in Japanese investor behavior occurred amidst significant inflows into Japanese assets, with foreign investment in Japanese equities and long-term debt reaching ¥705.6 billion and ¥1,000.7 billion, respectively, suggesting a possible reassessment of global risk appetite and potential Yen depreciation pressure.

EU Car Registrations Show Mixed Trends

Released: April 24, 2025 00:30 - Link

March new car registrations across the EU displayed a cautiously positive trend, with a modest -0.2% YoY decline, the shallowest contraction observed this year despite a broader -1.9% YoY drop in Q1 2025. While EU registrations alone faltered, including the EFTA and UK resulted in a 2.8% YoY increase for March and a slight -0.4% YoY decrease for the first quarter. Disparities emerged among major economies; Germany and France experienced significant YoY contractions of -3.9% and -14.5% respectively, while Italy and Spain demonstrated surprising gains of +6.3% and +23.4% respectively. Notably, electric vehicle registrations continued their upward trajectory, climbing 17.1% YoY, supported by strong hybrid sales, while registrations for petrol and diesel vehicles both experienced double-digit declines.

French Consumer Confidence Signals Economic Concerns

Released: April 24, 2025 02:45 - Link

April's consumer confidence data for France reveals a mixed picture of household sentiment, with the headline index holding steady while underlying indicators point to growing anxieties. While expectations regarding unemployment improved and major purchase intentions saw a welcome uptick, suggesting a possible easing of immediate consumption headwinds, consumers are increasingly pessimistic about France's future standard of living. A concerning decline in expected savings capacity and intentions, coupled with stagnant perceptions of current finances, signals that households are prioritizing immediate needs despite some tentative signs of improved spending appetite, potentially dampening broader economic momentum.

Spain's PPI Declines, Signaling Moderating Inflation

Released: April 24, 2025 03:00 - Link

Spain's Producer Price Index (PPI) registered a notable -3.9% MoM decline in March, though the annual rate still sits at a positive 4.9%, a deceleration from February's 6.7% reading. While energy prices continue to rise on a YoY basis, up 16.8%, the pace of increase has eased considerably owing to drops in electricity, oil refining, and gas, with monthly declines of -19.2%, -6.5%, and -3.8% respectively. Conversely, consumer goods saw a -1.8% YoY decline, and the core IPRI, excluding energy, retreated -0.1% YoY, indicating moderating inflationary pressures within the industrial sector, despite gains in certain food product categories and locomotive production.

German Business Climate Improves Amid Mixed Signals

Released: April 24, 2025 04:00 - Link

Germany's ifo Business Climate Index edged higher in April, surpassing forecasts and marking its strongest reading since mid-2024, though the underlying detail reveals a mixed picture for the German economy. While the Situation index climbed to its best level in nearly a year, the Expectations index softened, signaling lingering concerns about future growth. Notably, manufacturing and trade sectors experienced declines, with heightened uncertainty and pessimism particularly impacting wholesalers, while construction demonstrated surprising resilience fueled by improved expectations. The service sector showed modest gains, reflecting current satisfaction offset by cautiously skeptical outlooks, suggesting uneven progress and potential headwinds despite the headline improvement.

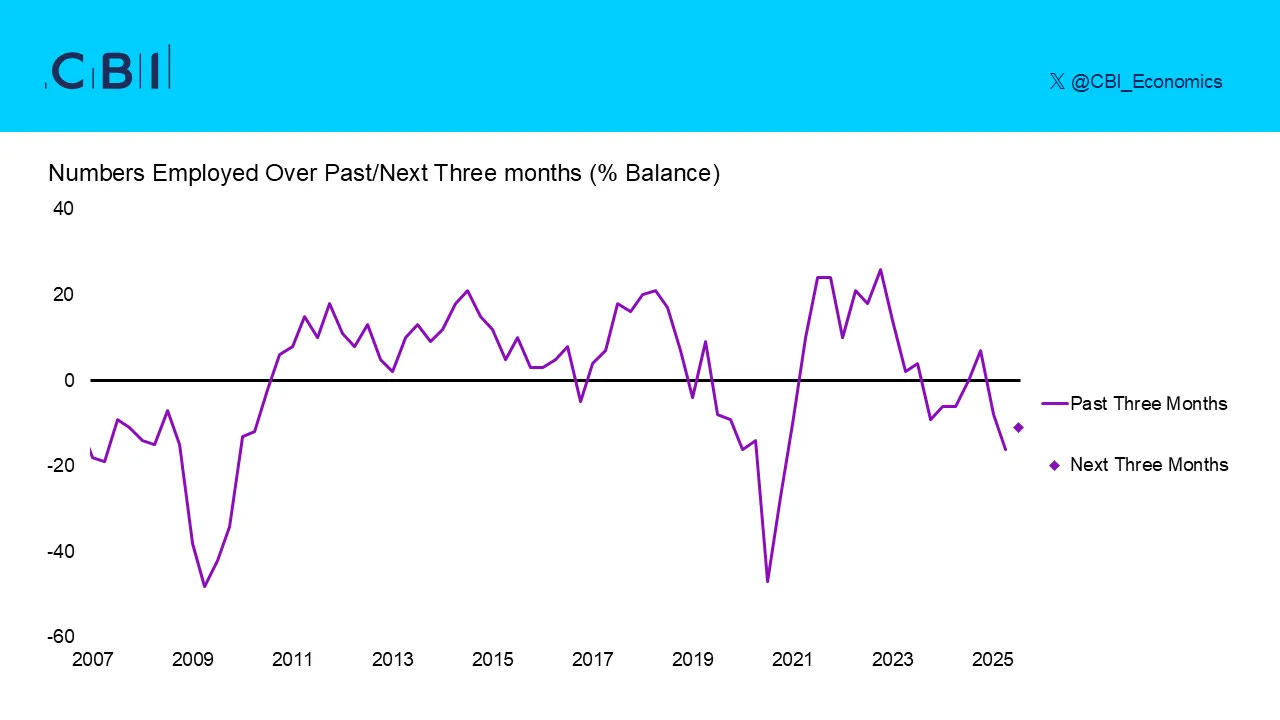

Weakening UK Manufacturing Outlook

Released: April 24, 2025 06:00 - Link

The April CBI Industrial Trends Survey paints a concerning picture for UK manufacturing, revealing stagnant output alongside deteriorating order books and weakening sentiment. While the headline output balance improved QoQ, the underlying data highlights persistent weakness in domestic and export demand, with expectations pointing to further declines in both over the next three months. Export order books experienced a significant deterioration, reaching levels not seen since late 2020, and headcount reductions accelerated, reflecting ongoing pressures. Rising average costs, anticipated to intensify further, coupled with diminished business and export optimism, subdued investment intentions, and widespread concern regarding external economic and political headwinds, collectively suggest a challenging outlook for the sector.

U.S. Economic Activity Decelerates

Released: April 24, 2025 08:30

March's CFNAI release reveals a noticeable deceleration in U.S. economic activity, with the headline index dropping to -0.03, mirrored by a corresponding decline in the CFNAI-MA3. This softening was primarily driven by a significant pullback in production and sales-related indicators, offsetting a modest improvement in employment. While personal consumption and housing demonstrated resilience, contributing positively to the index, the overall picture suggests a cooling trend as various sectors experience adjustments; however, the breadth of the downturn appears contained.

US Labor Market Shows Mixed Signals

Released: April 24, 2025 08:30

The latest unemployment insurance data reveal a mixed picture of the US labor market. While initial jobless claims edged up to 222k, aligning closely with forecasts, unadjusted figures remained relatively stable compared to the prior year. A notable decline in continued claims, falling below anticipated levels, suggests persistent underlying labor demand, although the unchanged insured unemployment rate indicates a stable overall picture. Increases in federal employee claims and pronounced upticks in Kentucky, Michigan, and Missouri, specifically tied to manufacturing sector layoffs, warrant further observation as potential early indicators of localized economic headwinds.

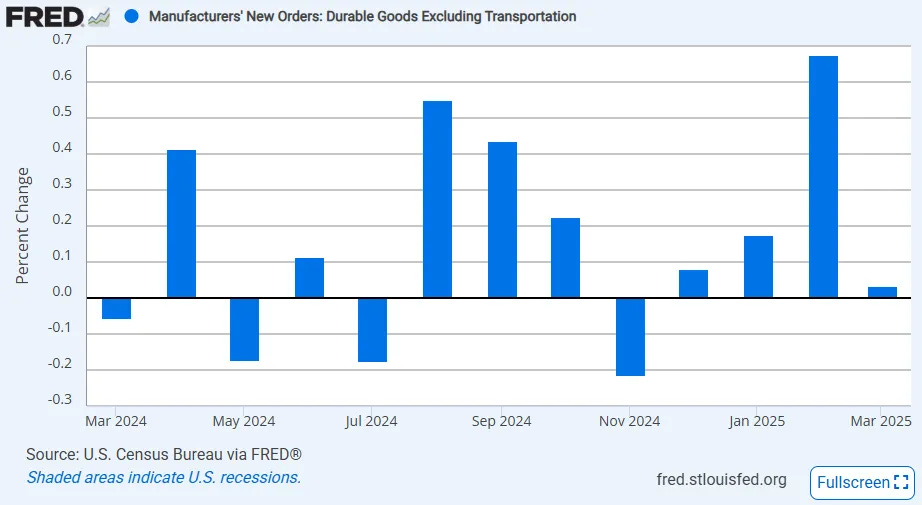

Durable Goods Orders Mask Manufacturing Weakness

Released: April 24, 2025 08:30

March durable goods orders demonstrated surprising strength with a 9.2% MoM increase and a robust 11.9% YoY gain, fueled primarily by a significant surge in nondefense aircraft orders. However, a closer examination reveals underlying weakness within the broader manufacturing sector, as orders excluding transportation were essentially unchanged MoM, with several key segments experiencing declines. The recent acceleration in core capital goods orders and shipments observed in Q1 2025 appears to be a consequence of firms front-running anticipated tariff increases, a trend unlikely to persist into Q2 2025. Forward-looking indicators, including the S&P Flash PMI and regional manufacturing surveys, point to a substantial deceleration in industrial activity, characterized by falling export orders and declining sentiment, suggesting a challenging macroeconomic environment ahead.

Container Shipping Rates Decline to Three-Year Low

Released: April 24, 2025 09:45

Container shipping rates experienced a notable downturn last week, with the Drewry World Container Index dropping 2% WoW to $2,157, marking a three-year low. Broad weakness was evident, particularly on key routes from China to the US, with the Shanghai-LA and Shanghai-NY routes seeing declines of 2% and 3% WoW, respectively, while the NY-Rotterdam route bucked the trend with a slight increase. The downward pressure is expected to persist in the near term as market participants navigate the complexities of escalating reciprocal tariffs, contributing to ongoing rate instability.

Auto Sales Surge Driven by Anticipation of Tariffs

Released: April 24, 2025 10:00 - Link

April 2025 new-vehicle sales are forecast at 1,519,900, representing a robust 10.5% YoY increase, driven primarily by a 14.7% YoY rise in retail sales and anticipatory consumer behavior ahead of expected tariff-related price hikes. This accelerated demand has resulted in 83,000 additional sales in March and 139,000 in April, offsetting a 7.8% decline in fleet sales and subsequently lowering fleet volume's share of total sales to 15.5%. Rising retail inventory, now at 2.15 million units with a 63-day supply, is contributing to an average transaction price of $45,764, up $887 YoY, while overall retail spending is projected to reach $55.8 billion, a $9.8 billion increase from last year.

Housing Sales Cool Amid Rising Inventory

Released: April 24, 2025 10:00 - Link

March existing home sales demonstrated a cooling trend, declining -5.9% MoM and -2.4% YoY to a SAAR of 4.02 million, reflecting broader headwinds in the housing market. While the median home price reached a record $403,700, showing continued upward pricing pressure, the volume of sales across both single-family and condo/co-op segments weakened. A notable rise in inventory, climbing 8.1% MoM to 1.33 million units and bolstering months' supply to 4.0, alongside a slight lengthening of time on market, suggests a shift towards a more balanced market. The share of first-time buyers held steady, while the modest uptick in distressed sales hints at nascent challenges within the broader economy.

Natural Gas Storage Build Signals Price Moderation

Released: April 24, 2025 10:30

Last week's natural gas storage data revealed an unexpected 88 Bcf build, exceeding market expectations and suggesting a potential softening of price pressure. While inventories remain below the five-year average, the pace of depletion has slowed, as evidenced by the reduced year-over-year deficit narrowing from -20.6% to -19.8%, indicating a shift from the trend observed previously.

Kansas City Manufacturing Declines Amid Inflationary Pressures

Released: April 24, 2025 11:00 - Link

The Kansas City region's manufacturing activity weakened in April, with the composite index declining to -4, driven by declines in production and employment, with the latter hitting a two-year low. While new orders showed a marginal improvement, a significant erosion of optimism regarding future production and shipments, coupled with a substantial rise in prices paid and received, both current and anticipated, suggests persistent inflationary pressures are impacting the sector. Heightened uncertainty among firms, with nearly 53% reporting increased economic anxieties, and weakening demand expectations across the region point toward a challenging outlook for the months ahead, potentially signaling broader headwinds for regional economic growth.

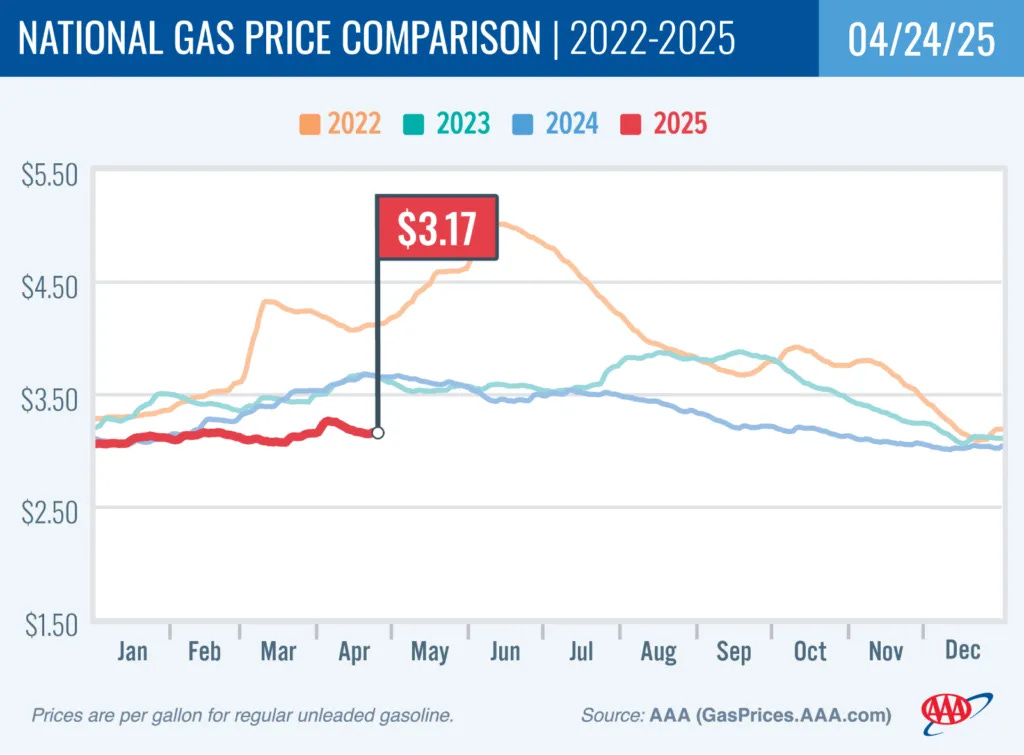

Gasoline Prices Rise Slightly Amidst Yearly Decline

Released: April 24, 2025 12:00 - Link

Gasoline prices saw a modest increase last week, with the AAA national average rising 0.4 cents to $3.171, reflecting a broader trend of rising demand related to seasonal factors. While prices are up 4.4 cents MoM, they remain significantly lower, down 48.9 cents, compared to the same period last year, largely attributable to a decline in crude oil prices, which currently sit at $62 per barrel, a substantial decrease from $82 a barrel YoY.

Other data releases and commentary:

Depreciating the Dollar to Grow the Manufacturing Sector, Released: 04/24/2025 07:00

BoE Weekly Report: 4/23/2025, Released: 04/24/2025 08:00

April showers haven’t dampened spending yet, Released: 04/24/2025 09:00