Econ Mornings: June 20th, 2025

Macro releases and commentary released the morning of June 20th, 2025

(all times are in EST)

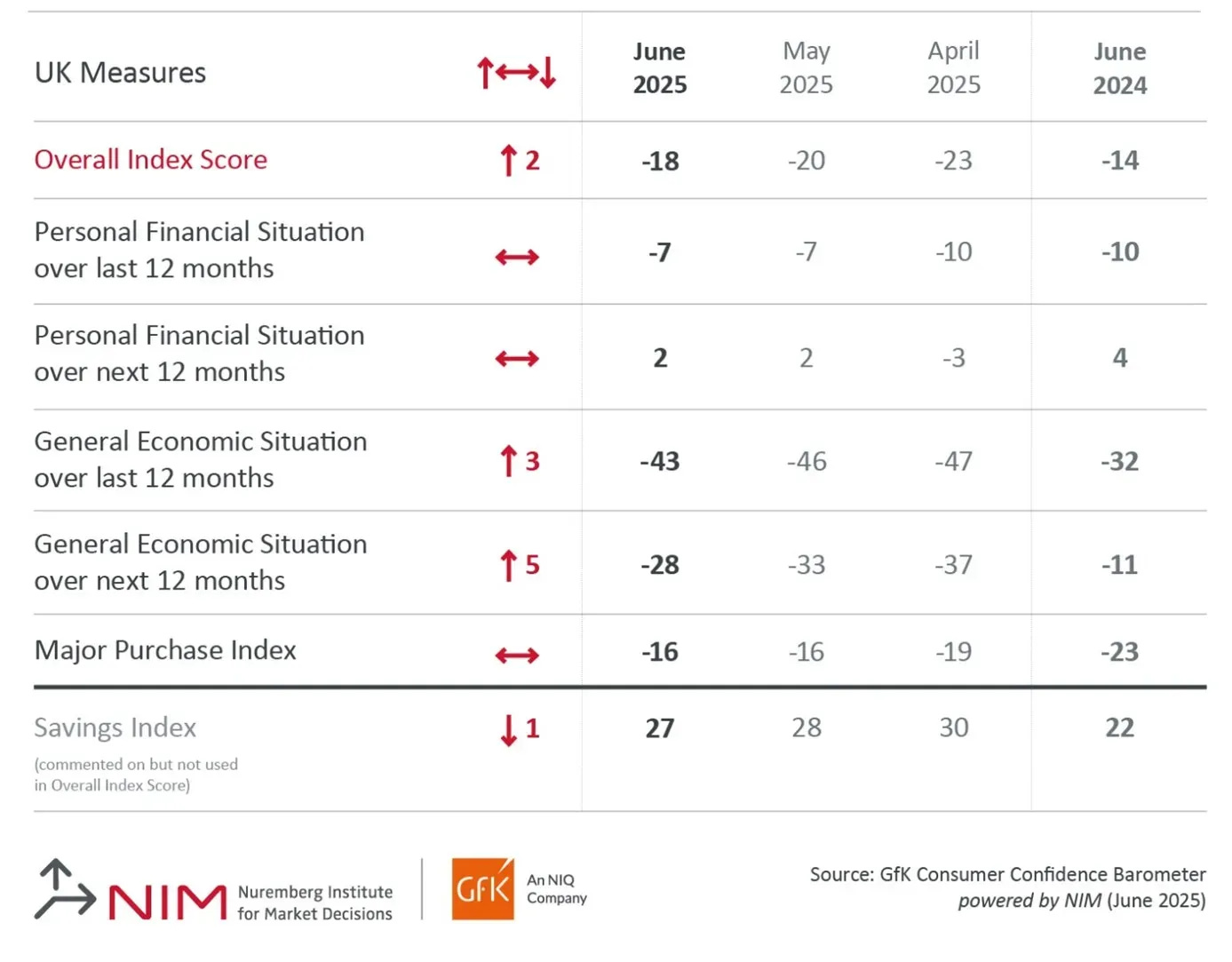

UK Consumer Confidence Shows Modest Gains

Released: June 19, 2025 19:00 - Link

The GfK UK Consumer Confidence Index edged up to -18 in June 2025, extending a three-month positive trend despite remaining below last year's reading, with improvements primarily driven by heightened expectations for the broader economy, although still down significantly YoY. While sentiment regarding the past year improved modestly and forward-looking personal finances remain cautiously optimistic, the unchanged personal financial situation scores signal persistent anxiety regarding current household budgets. The Major Purchase Index demonstrated an encouraging 7 pt YoY rise, but the decline in the Savings Index and commentary from GfK, highlighting the impact of escalating geopolitical tensions and ongoing tariff concerns, underscore the fragility of the recovery and the potential for renewed headwinds.

Japanese Inflation Shows Mixed Signals

Released: June 19, 2025 19:30

May's inflation data for Japan revealed a complex picture, with the headline CPI rising 0.3% MoM and 3.5% YoY, primarily fueled by persistent gains in energy prices, which climbed 1.9% MoM and remained elevated at 8.1% YoY. While headline inflation saw a slight deceleration from the previous month, core inflation, excluding energy, held steady at 1.6% YoY, and the broader measure of CPI less fresh food showed accelerating annual inflation at 3.7% YoY, the highest since January 2023, suggesting underlying price pressures remain notable despite mixed performance across other consumer categories.

China Holds Loan Rates Steady

Released: June 19, 2025 21:15 - Link

China's central bank opted to hold its loan prime rates steady this month, maintaining the 1-year rate at 3.0% and the 5-year rate at 3.5%, a departure from the modest reductions implemented in May. This decision suggests a reassessment of the effectiveness of prior easing measures and likely reflects a desire to observe the impact on economic activity before initiating further monetary stimulus. The pause in rate adjustments could also signal a focus on other policy tools to support growth, particularly given ongoing concerns about property sector headwinds and potential impacts on broader credit conditions.

German Manufacturing Orders Rise, Signaling Inflation Risks

Released: June 20, 2025 02:00 - Link

German manufacturers experienced a positive April, with the stock of orders climbing 0.8% MoM and a robust 4.0% YoY, primarily fueled by strong demand in automotive and transport equipment, where order backlogs expanded 2.6% and 0.8% MoM respectively. Growth was broad-based, with foreign orders outpacing domestic gains at 1.1% and 0.4% MoM, though a decline in intermediate and consumer goods orders (-0.7% MoM each) tempered the overall increase. A notable feature was the rise in capital goods orders, up 1.3% MoM and extending the average order holding time to 7.8 months overall, with capital goods reaching 10.7 months, suggesting sustained production activity and potentially hinting at future inflationary pressures.

German PPI Disinflation Continues

Released: June 20, 2025 02:00 - Link

German producer price inflation continued its disinflationary trend in May 2025, with the headline PPI declining -0.2% MoM and -1.2% YoY, reflecting ongoing weakness in energy and intermediate goods prices, particularly electricity, natural gas, metals, and basic chemicals. While energy prices exerted a significant downward pressure, excluding energy, the PPI was flat MoM and increased 1.3% YoY, suggesting underlying price pressures remain in certain sectors. Notably, non-durable consumer goods saw inflationary pressures with significant annual increases in staples like coffee, beef, and butter, alongside modest increases in capital and durable goods, hinting at shifting consumption patterns and potential cost pass-throughs.

UK Borrowing Exceeds Projections, Debt Rises

Released: June 20, 2025 02:00 - Link

May 2025 public sector net borrowing landed at £17.7 billion, exceeding Office for Budget Responsibility projections and marking the second-highest figure for the month on record, fueled by a significant rise in both tax revenues and social contributions alongside increased departmental spending and inflation-linked benefit payments. While the current budget deficit narrowed YoY, bolstered by rising net investment, overall borrowing through May 2025 reached £37.7 billion, the third-highest on record, and pushed the public sector net debt to 96.4% of GDP.

UK Retail Sales Signal Softening Demand

Released: June 20, 2025 02:00 - Link

May's UK retail sales data revealed a concerning downturn, with volumes falling significantly more than anticipated, marking the steepest monthly decline since late 2023 and the lowest level in nearly six months. Food store sales experienced a particularly abrupt contraction, offsetting prior gains, while weakness also permeated non-food retailers and online spending, despite a slight increase in the online share. Although quarterly figures showed a modest increase, the sharp MoM drop, coupled with the disappointing YoY performance, suggests softening consumer demand and introduces uncertainty regarding the broader economic outlook.

Mixed Signals in French Business Climate

Released: June 20, 2025 02:45 - Link

France's business climate indicator registered a modest June increase to 96.1, reflecting a mixed picture across sectors. While services demonstrated resilience with gains in demand and workforce expectations, the manufacturing sector experienced a pullback, evidenced by declining production expectations and rising inventories alongside a sharper contraction in order books. Construction activity now mirrors its historical average, and despite a positive contribution from stronger retail ordering, the overall sentiment is tempered by a significant rebound in the employment climate, primarily fueled by improved hiring expectations within the services sector, suggesting potential labor market adjustments rather than broad-based optimism.

French Retail Sales Decline in May

Released: June 20, 2025 02:45 - Link

French retail sales experienced a concerning -0.3% MoM contraction in May 2025, reversing April's modest gain and reflecting broad-based weakness across food and manufactured goods categories. While specific areas like games & toys, pharmaceuticals, and clothing saw positive contributions, significant declines in DIY, books, and auto equipment, coupled with weakness in hypermarkets, supermarkets, and small retailers, weighed heavily on the headline figure. Despite this monthly setback, a review of the broader trend reveals a 0.4% QoQ increase in retail sales, primarily supported by a 0.7% rise in manufactured goods, suggesting underlying resilience within the consumer landscape despite the immediate downturn.

Italian Construction Activity Shows Strong Momentum

Released: June 20, 2025 04:15 - Link

Italian construction activity demonstrated robust momentum in April 2025, with monthly production climbing 2.4% and contributing to a 1.7% QoQ increase over the preceding three months. The calendar-adjusted index reflects a significant 5.9% YoY expansion, while the unadjusted measure shows a more moderate 3.9% rise. Examining broader trends, year-to-date construction output, adjusted for calendar effects, advanced 3.9% YoY, suggesting a sustained, albeit uneven, recovery within the sector.

China FDI Shows Divergent Trends

Released: June 20, 2025 05:00 - Link

China's foreign direct investment picture remains challenging, with overall YTD investment declining -13.2% YoY through May, a deepening from April's -10.9% decline. However, this broad trend masks a bifurcated landscape, as investment from the ASEAN region surged 20.5% YoY, alongside significant gains from developed economies including Japan, the UK, South Korea, and Germany. This renewed interest appears focused on specific sectors exhibiting robust growth, notably e-commerce services, aerospace and equipment manufacturing, chemical manufacturing, and medical equipment manufacturing, signaling a potential shift in investor priorities and areas of future expansion within the Chinese economy.

Canadian Housing Prices Continue to Decline

Released: June 20, 2025 08:30 - Link

May's new housing price index data revealed a continuing softening in Canada's construction sector, with a slightly worse-than-anticipated MoM decline of 0.2% and a more pronounced YoY drop of 1.0%, marking the steepest annual decrease since January 2024. This acceleration in the YoY contraction signals sustained downward pressure on new home values, suggesting persistent headwinds impacting the housing market and potentially broader economic activity.

Canadian Retail Sales Show Modest Gains, May Decline Expected

Released: June 20, 2025 08:30 - Link

Canadian retail sales edged higher in April 2025, climbing 0.3% MoM to $70.1 billion, driven primarily by strength in motor vehicle and parts sales, which saw new car dealers lead the increase. While overall sales growth was modest, volume sales outperformed, rising 0.5% MoM, and e-commerce continued its upward trend, now representing 6.2% of total sales. Core retail activity showed a mixed picture with pockets of strength in sporting goods and electronics offset by weakness in clothing; however, the preliminary data for May indicates a potential downturn, suggesting a 1.1% MoM decline.

Canadian Industrial Prices Show Mixed Signals

Released: June 20, 2025 08:30 - Link

May's industrial price data reveal a complex Canadian economic picture, with the IPPI experiencing a second consecutive MoM decline despite a positive YoY reading of 1.2%. Broad sectoral weakness was evident in lumber and energy, offset by gains in meat and non-ferrous metals, including a substantial rebound in copper. Simultaneously, the RMPI showed MoM softness driven by crude energy concerns, although excluding this segment, the index demonstrated robust MoM and significant YoY growth fueled by tight crop supplies and rising metal ore prices, particularly gold.

Philly Fed Survey Signals Manufacturing Weakness

Released: June 20, 2025 08:30 - Link

The Philadelphia Fed's June survey reveals a persistent contraction in regional factory activity, with the General Activity Index holding steady at -4.0, underscoring weaker-than-anticipated economic conditions. While shipments registered a positive reading for the first time in months, a significant decline in new orders and a sharp drop in employment, reaching levels last seen in May 2020, highlight ongoing headwinds. Moderating prices paid and received suggest easing inflationary pressures, but dwindling future expectations, alongside widespread reports of reduced Q2 production and persistent operational constraints stemming from labor supply and uncertainty, paint a concerning picture for the near-term manufacturing outlook.

Fragile Economic Signals & GDP Outlook

Released: June 20, 2025 10:00 - Link

May's Leading Economic Index decline of -0.1% MoM, coupled with downward revisions to April's reading and a -2.7% six-month drop, signals continued economic fragility stemming from softening consumer sentiment, decreased manufacturing activity, and a slowdown in housing, partially offset by positive equity market performance. While the Coincident Index demonstrated resilience with a 0.1% MoM rise and a 1.3% six-month increase driven by employment and income gains, and the Lagging Index rebounded from a previous downturn, the Conference Board's maintained GDP growth projection of 1.6% for 2025 acknowledges downside risks tied to ongoing trade barriers, suggesting a potentially more challenging economic landscape ahead.

Euro Area Sentiment Rebound Muted

Released: June 20, 2025 10:00 - Link

Preliminary data indicate a muted rebound in Euro Area economic sentiment during June 2025, as the European Commission's consumer confidence index edged up just -0.2 pts MoM to -15.3, undershooting market consensus. While any uptick suggests some easing of consumer pessimism, the shortfall from anticipated gains points to persistent headwinds impacting household outlook and potentially signaling a slower-than-expected recovery in consumer spending, a critical component of overall Euro Area growth.

GDP Nowcast Signals Economic Softening

Released: June 20, 2025 11:45

The New York Fed's latest GDP Nowcast reflects a softening economic trajectory, with the Q2 2025 estimate now at 1.91%, a considerable downward revision from the prior 2.34% projection. This adjustment is primarily attributable to concerning data across several key sectors, including a notable decline in building permits and housing starts, alongside weaker industrial production falling 0.22% MoM. Additionally, disappointing readings from the Empire State and Philadelphia Fed surveys, coupled with a slide in retail sales and food services, and a 0.92% MoM drop in export prices, all contributed to the revised outlook, highlighting emerging headwinds for near-term growth.

Manufacturing Activity Softens Amid Moderating Inflation

Released: June 20, 2025 12:00 - Link

June's MTSI Manufacturing PMI Composite Index fell to -1.03, signaling a softening in manufacturing activity after a brief recovery in May, largely driven by a reversal of the prior month's robust New Orders performance. While employment saw a positive trajectory in May, a disappointing Philadelphia Fed survey partially offset that progress. Importantly, early indications suggest inflationary pressures on both inputs and outputs have moderated after April's peak, offering some relief within the broader economic landscape during the second quarter.

Other data releases and commentary:

Spain Services Sector Activity Indicators: April 2025, Released: 06/20/2025 04:00

Spain Industrial Turnover Indices: April 2025, Released: 06/20/2025 04:00

US trade policies and the activity of US multinational enterprises in the euro area, Released: 06/20/2025 05:00

Economic Bulletin Issue 4, 2025, Released: 06/20/2025 05:00

CPI Data Quality Declining, Released: 06/20/2025 07:00

NY Fed DSGE Model Forecast: June 2025, Released: 06/20/2025 09:00

China is not blinking, Released: 06/20/2025 12:00