Econ Mornings: June 23rd, 2025

Macro releases and commentary released the morning of June 23rd, 2025

(all times are in EST)

Global Growth Diverges: Germany Rebounds, US Softens

Released: June 23, 2025 00:00

June's S&P Global Flash PMIs reveal a mixed global picture, with momentum building in Germany, where the composite reading reached a three-month high driven by a strong rebound in manufacturing sentiment and a rise in new orders, offset by softening conditions in the US. While US manufacturing output showed encouraging gains, the composite index edged lower amid surging goods price inflation, fueled by tariffs, and a concerning QoQ contraction in services export demand. Domestic US job growth accelerated, yet business confidence cooled, particularly among service providers apprehensive about policy headwinds and backlogged work.

Spanish Business Turnover Shows Mixed Trends

Released: June 23, 2025 02:00 - Link

April 2025 data reveals a mixed picture for Spanish business turnover, with the adjusted index rising 3.3% YoY while the unadjusted series registered a slight -0.3% decline. Monthly turnover contracted -0.8% MoM, largely driven by declines in extractive and manufacturing industries, trade, and electricity/water supply, the latter experiencing a significant -10.2% MoM drop despite robust 22.4% YoY growth. Underlying economic strength remains apparent in market non-financial services and utilities, which demonstrated encouraging YoY expansion, though the overall monthly contraction warrants close monitoring.

Spain's Trade Deficit Narrows in April

Released: June 23, 2025 04:00 - Link

April's trade data revealed a welcome narrowing of Spain's trade deficit to €3.88 billion, the best result for the month in four years, driven by larger declines in imports compared to exports. While export values dipped 4.7% MoM and 4.4% YoY, the sharper 8.1% MoM and 5.8% YoY fall in imports significantly eased the deficit. Despite this encouraging monthly picture, year-to-date figures indicate a continued, albeit moderating, expansion of both exports and imports, with a 0.8% and 5.1% rise, respectively, reflecting ongoing global demand. Marked declines in both energy exports and imports contributed substantially to the overall trade picture, suggesting a shift in global energy markets is impacting Spain's balance of payments.

UK Consumer Sentiment Declines Amid Inflation Concerns

Released: June 23, 2025 04:30 - Link

UK consumer sentiment cooled in June, slipping to 45.0 as persistent inflation and anxieties surrounding job security continued to dampen household confidence. The decline was underscored by a drop in the Spending Sentiment Index and cash availability, alongside weakening job security and overall labour market sentiment. While the Household Finance Index registered a modest gain, the best in six months, anticipated future finances softened, and a rise in credit demand contrasts with a concerning decline in the Debt Sentiment Index. Despite slight improvements in the Savings Index, the continued drawdowns signal ongoing financial strain on UK households.

Rising Gasoline Prices Driven by Geopolitical Tensions

Released: June 23, 2025 09:00 - Link

Gasoline prices rose sharply last week, with the national average increasing 9.7 cents MoM to $3.18, driven by escalating geopolitical tensions between Israel and Iran and subsequent U.S. military actions. While the national average remains unchanged MoM and is still significantly lower YoY (-23.3 cents), both gasoline and diesel prices, which saw a substantial 16.1 cent weekly jump to $3.649, are trending upward, exhibiting the most rapid ascent since last summer. Motorists should prepare for a continued and steady price climb over the coming week, potentially adding another 7 to 15 cents to the national average and 10 to 20 cents to diesel, contingent on evolving international events.

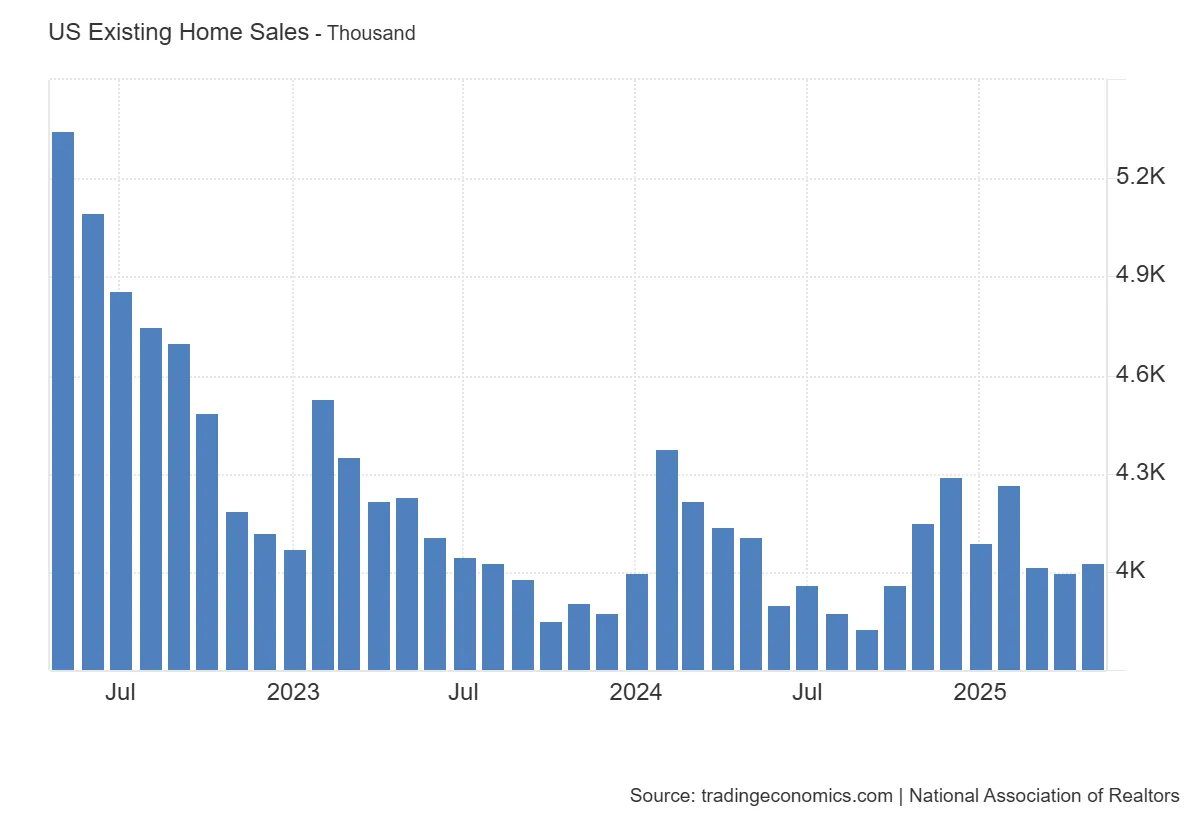

Existing Home Sales Show Modest Gains Amid Inventory Increase

Released: June 23, 2025 10:00 - Link

US existing home sales demonstrated resilience in May, edging up 0.8% MoM despite a concerning 0.7% YoY decline, as elevated mortgage rates continued to constrain market activity. While sales volume reached a SAAR of 4.03 million units, inventory expanded significantly, rising 6.2% MoM and 20.3% YoY to 1.54 million units, suggesting a shift toward a more balanced market. The median home price reached a record $422,800, exhibiting continued upward pressure, though single-family sales outperformed condo/co-op sales, and regional performance was mixed with a pronounced decline in the West. A reduction in first-time buyer participation to 30% and a rise in cash sales to 27% of transactions point to evolving purchasing dynamics.

Texas Agriculture: Cautious Optimism Amidst Challenges

Released: June 23, 2025 10:30 - Link

The Dallas Fed's Q2 2025 Agricultural Survey reveals a cautiously optimistic, albeit still challenging, environment for Eleventh District farmers. While recent precipitation eased drought stress, persistently low commodity prices and existing debt burdens continue to weigh on financial health, reflected in declining loan demand and falling repayment rates, though the latter is moderating. Increased fund availability and lower interest rates, with real estate loan rates now under 8%, offer some respite, contributing to a faster pace of loan renewals and extensions. Despite ongoing headwinds, land values for irrigated and ranchland stabilized, while dryland values remain elevated YoY, and real cash rents increased across all land types, suggesting a continued sensitivity to underlying demand and production costs.

U.S. M&A Activity Declines in May

Released: June 23, 2025 12:00 - Link

May witnessed a contraction in U.S. M&A deal announcements, falling 7.9% MoM to 969, despite a notable 40.3% QoQ increase in total spending. While deal activity dipped across most sectors when viewed against the prior year's three-month period, several, including Technology Services, Transportation, and Electronic Technology, bucked the trend with increased announcements. Conversely, sectors like Finance, Consumer Services, and Health Services experienced substantial declines in deal volume, suggesting a shift in investment priorities and potentially reflecting ongoing concerns around interest rates and broader economic uncertainty.

Other data releases and commentary:

Geopolitical rifts drive defense theme, Released: 06/23/2025 07:00

Israel-Iran and economic risk in a world of radical uncertainty, Released: 06/23/2025 07:00

Productivity Gains Are Coming, Released: 06/23/2025 07:00

Auto Market Weekly: Week of June 23rd, Released: 06/23/2025 10:00

JPMorgan Weekly Market Recap: Week of June 23rd, Released: 06/23/2025 07:00

TransUnion Credit Industry Snapshot: May 2025, Released: 06/23/2025 10:00

Jet Fuel Price Monitor: Week of June 20th, Released: 06/23/2025 12:00