Econ Mornings: June 24th, 2025

Macro releases and commentary released the morning of June 24th, 2025

(all times are in EST)

Japan Inflation Shows Mixed Signals

Released: June 24, 2025 00:00

May's inflation data for Japan reveals a mixed picture of persistent price pressures. While the trimmed mean CPI edged higher to 2.5% YoY, marking the strongest reading since early 2024, weighted median inflation remained steady at 1.7% YoY, also the highest level seen in that timeframe. A slight easing of mode CPI inflation to 1.6% YoY contrasts with the broad upward trend in prices, evidenced by the notable increase in the proportion of CPI index items experiencing price increases, reaching 81.6%, a level not observed since February 2024, suggesting continued cost-push effects are impacting the economy.

Spain's Services Sector Shows Mixed Performance

Released: June 24, 2025 03:00 - Link

Spain's services sector experienced a deceleration in turnover growth during April, with a slight MoM decline offset by a stronger YoY expansion of 2.7%, contrasting with the momentum observed in March. While trade activity, particularly wholesale trade (excluding motor vehicles) and motor vehicle trade, contributed positively with robust MoM growth, weakness emerged in transportation and storage, real estate, and accommodation & food services, the latter reflecting a concerning second consecutive monthly contraction. The mixed performance, with professional services also showing marginal MoM weakness, suggests a divergence in underlying demand and highlights potential headwinds for overall economic expansion.

German Business Climate Improves

Released: June 24, 2025 04:00 - Link

Germany's ifo Business Climate Index advanced to 88.4 in June, surpassing consensus and marking its strongest reading in ten months, primarily fueled by a significant increase in future-looking sentiment. While current conditions saw only a minor lift, the services sector demonstrated a pronounced recovery, and construction sentiment reached its highest level since early 2023, signaling a possible shift in momentum. However, manufacturing remains challenged by subdued demand and backlog issues, and trade sentiment, while improving, continues to be uneven, with retail performance lagging wholesale gains.

UK Manufacturing Weakens Amid Persistent Headwinds

Released: June 24, 2025 06:00 - Link

The CBI's latest Industrial Trends Survey reveals persistent weakness in the UK manufacturing sector, with output volumes continuing to contract and order books deteriorating further, notably underperforming expectations. While anticipated declines in the next quarter offer a glimmer of hope, the broad-based contraction across most sub-sectors, coupled with easing but still elevated selling price expectations and diminished stock adequacy, suggests ongoing headwinds for manufacturers. The stabilization of export order books offers a marginal positive, but the overall picture points to a challenging environment characterized by subdued demand and lingering inflationary pressures.

Canadian Manufacturing Sales Decline

Released: June 24, 2025 08:30 - Link

Canadian manufacturing activity appears to be softening, as indicated by an advance estimate of -1.3% MoM sales for May, marking a concerning fourth consecutive monthly contraction. The broad-based weakness, notably impacting petroleum and coal products, transportation equipment, and food products, suggests persistent headwinds within the sector. While the 69.7% weighted response rate introduces some degree of uncertainty, the magnitude of the decline warrants close monitoring for a potential broader slowdown in industrial production and associated impacts on GDP growth.

US Current Account Deficit Widens in Q1 2025

Released: June 24, 2025 08:30 - Link

The US current account deficit substantially expanded in Q1 2025, reaching $450.2 billion, or 6.0% of GDP, largely reflecting a significant increase in goods imports outpacing goods export growth. While goods exports saw a rise, imports surged even further, overshadowing declines in services exports and improvements in net secondary income. This widening deficit was also compounded by a $7.6 billion net deficit in primary income, alongside a considerable $299.5 billion in net U.S. borrowing, indicated by a substantial rise in foreign liabilities exceeding increases in U.S. assets abroad.

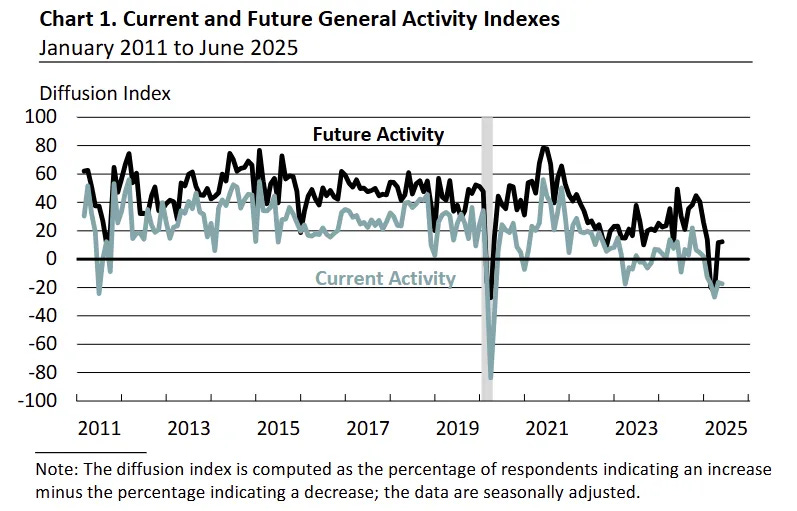

Philadelphia Fed Survey Reflects Service Sector Weakness

Released: June 24, 2025 08:30 - Link

June's Philadelphia Fed Nonmanufacturing Survey signals persistent headwinds for regional service sector activity, as the General Activity Index edged lower despite a modest uptick in the broader regional reading. While firms reported a welcome rise in Sales/Revenues, a concerning decline in New Orders and a significant drop in full-time employment suggest underlying fragility. Rising expectations for higher Q2 sales offer a glimmer of optimism, but pervasive uncertainty and ongoing supply chain issues continue to hamper expansion, compounded by subdued pricing power and uneven capital expenditure patterns, with equipment/software investment showing more strength than physical plant.

Canadian Inflation Shows Mixed Signals

Released: June 24, 2025 08:30 - Link

May's CPI data reveal a complex picture for the Canadian economy, with the headline inflation rate holding steady at 1.7% YoY despite a 0.6% MoM increase, largely influenced by ongoing declines in energy prices, particularly gasoline which is down significantly YoY due to base effects and policy changes. While core inflation measures excluding energy and food remain elevated, hovering around 2.6% - 2.7% YoY, the moderation in rent growth and mortgage interest costs, alongside easing price pressures in goods, especially non-durable goods, suggest a gradual easing of inflationary pressures, although increases in new vehicle prices and food costs, along with persistent strength in services inflation at 3.2% YoY, warrant continued monitoring.

Housing Market Moderation in April

Released: June 24, 2025 09:00 - Link

April's FHFA House Price Index data reveals a moderating housing market, with the national index experiencing a -0.4% MoM decline, the steepest monthly drop since July 2022, while still registering a 3.0% YoY increase, the lowest such figure in nearly a year. Regional performance was uneven; significant MoM price drops were concentrated in the West South Central and South Atlantic divisions, offset by gains in the Middle Atlantic, which also led YoY growth alongside the East North Central and New England. The Pacific division continues to lag, demonstrating the divergence in housing market conditions across the nation.

U.S. Home Price Appreciation Moderates

Released: June 24, 2025 09:00 - Link

April 2025 data from the S&P CoreLogic Case-Shiller National Home Price Index revealed a continued moderation in U.S. home price appreciation, with a -0.4% MoM decline and a slowing 2.7% YoY gain, the weakest annual increase since mid-2023, as both the 10-City and 20-City composites posted similar downward revisions in YoY growth. Regional performance varied significantly, with strong gains in New York, Chicago, and Detroit contrasting with declines in Tampa and Dallas, despite widespread NSA MoM increases across major metros. These trends suggest a market increasingly influenced by affordability challenges stemming from elevated mid-6% mortgage rates and persistent, albeit constrained, housing supply, leading to a more geographically fragmented outlook.

Chicago Fed Report Shows Softening Economic Conditions

Released: June 24, 2025 10:00

The June Chicago Fed Survey reveals a softening in economic conditions, with the overall Activity Index dropping to -3, despite a surprising recovery in manufacturing activity. While production in the manufacturing sector strengthened, the nonmanufacturing sector experienced a significant pullback, contributing to a generally pessimistic outlook as over half of respondents anticipate a contraction in activity over the coming year. Labor market indicators signal a continued slowdown, evidenced by declining hiring pace and negative indexes, while capital spending expectations remain subdued. Encouragingly, cost pressures have eased, but the pervasive sense of caution suggests that economic growth is likely to remain fragile in the near term.

Fifth District Service Sector Shows Signs of Stabilization

Released: June 24, 2025 10:00 - Link

The Richmond Fed's June Services Survey indicates a tentative stabilization in Fifth District service sector activity, with revenue contraction easing and demand showing modest improvement. While local business conditions remain weak, expectations are brightening, accompanied by a pickup in employment and notably optimistic future hiring plans. Wage pressures persist, although current readings edged lower; however, firms anticipate continued strong wage growth. Both input and output price metrics increased MoM, reflecting ongoing inflationary pressures, and while expectations remain elevated, they have not accelerated, suggesting potential for price stabilization in the coming months.

Fifth District Manufacturing Sector Contraction Slows

Released: June 24, 2025 10:00 - Link

The Richmond Fed's June survey suggests the Fifth District manufacturing sector continues to experience contraction, albeit at a moderated rate, with the headline index rising to -7. While shipments and new orders saw modest gains MoM, backlogs remain depressed, and employment edged lower, pointing to ongoing weakness in local business conditions. A concerning development is the rise in vendor lead times and a significant jump in raw materials inventories, signaling potential supply chain adjustments and inventory management challenges. Inflationary pressures are evident through rising Prices Paid and Received, alongside a divergence in future price expectations; specifically, expectations for Prices Received rose substantially, potentially reflecting increased pricing power for manufacturers.

Consumer Confidence Declines Amidst Economic Concerns

Released: June 24, 2025 10:00 - Link

June's Conference Board Consumer Confidence Index registered a significant decline, retreating to 93.0 after May's gains and signaling potential headwinds for consumer spending. The drop was broad-based, with both present conditions and future expectations indices experiencing notable contractions, keeping expectations well below levels historically indicative of economic stability. While inflation expectations moderated slightly, consumer sentiment regarding interest rates remains elevated, fueling anxieties despite plans for durable goods purchases holding firm. The concurrent softening of home and service purchase intentions, alongside a cautious outlook on stock prices, suggests a growing apprehension among households despite improved inflation perceptions.

Trade Tensions Shift: Middle East Eases, US Tariffs Loom

Released: June 24, 2025 12:00

The immediate threat to global trade posed by escalating tensions in the Middle East appears to be receding following a ceasefire agreement, averting anticipated disruptions to energy markets and logistics infrastructure like the Strait of Hormuz and key ports. However, attention is now returning to the unresolved US trade war, with several countries facing potential tariff hikes by July 29th unless agreements are reached, and progress remaining limited with major trading partners. While a China trade deal involving a 30% baseline tariff appears imminent, the broader trade landscape remains complex with varied tariff applications and a potential cooling of the initial demand surge following the recent China-US deescalation. This confluence of factors is contributing to a softening of container spot rates across major lanes, with Transpacific rates experiencing a significant decline despite increased carrier capacity and a looming peak season, while air cargo rates remain relatively stable overall.

Cooling Goods Economy Signals Freight Demand Weakness

Released: June 24, 2025 12:00 - Link

May's ATA Truck Tonnage Index, registering 113.8 after a downward revision of prior gains, signals a cooling in the goods economy, confirmed by the first YoY decline seen this year and meager 0.1% year-to-date tonnage growth. While the unadjusted index showed a surprising 2.9% MoM uptick, the broader trend reflects persistent volatility, specifically attributed to construction headwinds, uneven manufacturing output, and a consumer base exhibiting restraint, collectively dampening overall freight demand.

Housing Market Cools in May 2025

Released: June 24, 2025 12:00 - Link

The Redfin Home Price Index revealed a softening housing market in May 2025, with prices declining 0.1% MoM, a rare occurrence over the last ten years, and YoY growth decelerating to 3.6%, the slowest pace since July 2023. While some areas like Nassau County and San Diego saw modest MoM increases, broad-based weakness emerged, with declines prominent across 32 of the 50 largest metros, particularly in Charlotte, San Francisco, and Seattle. The cooling demand is further evidenced by a drop in the proportion of sales exceeding asking prices and a rise in inventory, signaling a potential shift away from the robust appreciation seen earlier in the recent cycle, despite pockets of strong gains in metros like New York and Nassau County.

Other data releases and commentary:

New White Paper - Mid-Year Outlook: At the Crossroads of Stagflation, Released: 06/24/2025 07:00

Semiannual Monetary Policy Report to the Congress: June 2024, House Testimony, Released: 06/24/2025 10:00

Cox Automotive Auto Market Report: June 24th, Released: 06/24/2025 10:00