Econ Mornings: June 26th, 2025

Macro releases and commentary released the morning of June 26th, 2025

(all times are in EST)

Japanese Investors Favor Foreign Debt

Released: June 25, 2025 19:50

Japanese investors continued to reshape their international portfolio positioning last week, registering a substantial ¥615.5 billion net purchase of foreign long-term debt securities while maintaining a sixth consecutive week as net sellers of foreign equities, albeit at a diminishing -¥88.2 billion. Conversely, foreign investors demonstrated considerable selling pressure on Japanese assets, offloading ¥524.3 billion in equities and ¥368.8 billion in long-term debt, although a noteworthy ¥1,496.9 billion was allocated to Japanese short-term debt, marking a second week of robust inflows.

German Consumer Sentiment Wavering Amid Rising Savings

Released: June 26, 2025 02:00 - Link

Germany's consumer climate is signaling a potential shift in sentiment, with the GfK indicator projected to decline to -20.3 in July 2025, interrupting a recent positive trend. While income expectations and economic outlooks, the latter seeing the largest jump since early 2022, benefited from wage growth, pension increases, and anticipated fiscal support, a significant rise in savings willingness to 13.9 reflects ongoing anxieties. This rise in precautionary savings, coupled with persistently weak buying inclination, suggests that while expectations regarding the broader economy are improving, consumers remain hesitant to commit to significant purchases despite a revised, slightly lower, June reading of -20.0.

Weakening UK Consumer Spending

Released: June 26, 2025 06:00 - Link

UK consumer spending continues to weaken considerably, as evidenced by the CBI Distributive Trades Survey for June, which reported a steep contraction in retail sales volumes and a net balance of -46%, marking nine consecutive months of decline. Deteriorating order volumes, falling to -51% YoY, signal ongoing demand weakness, while elevated stock levels, currently at +26%, suggest retailers are adjusting to a challenging environment. Despite a slight anticipated uptick in online sales growth to +8% MoM, overall total distribution sales remain deeply in the red, forecasting a -42% decline YoY for July, alongside ongoing contractions in the motor trade, indicating a broad-based slowdown in consumer activity and potentially foreshadowing further economic headwinds.

Q1 2025 GDP Growth Revised Downward

Released: June 26, 2025 08:30 - Link

The third and final estimate of US GDP growth for the first quarter of 2025 revealed a more substantial contraction than previously thought, with real GDP growth revised down to -0.5% from the prior estimate of -0.2%. This significant downward revision was primarily driven by a substantial weakening in personal consumption expenditures, particularly in services spending, which contributed only 0.31 ppts to growth, a level not seen since the pandemic. While private domestic investment remained positive, residential investment contracted more sharply than initially reported, and the contribution from net exports was also revised lower. The concerning decline in consumer spending, reflected in a downward revision of the Fed-preferred measure of private domestic final purchases to just 1.9%, suggests a concerning shift in consumer sentiment and financial health, potentially complicating the Federal Reserve's efforts to balance inflation risks and employment prospects.

US Manufacturing Rebounds Strongly

Released: June 26, 2025 08:30

May's preliminary data reveals a robust rebound in US manufacturing, with durable goods new orders jumping a substantial 16.4% MoM to $343.6 billion, reversing April's significant downward revision. The surge was largely attributable to a dramatic increase in transportation equipment orders, particularly in nondefense aircraft and parts, though ex-transport orders also showed modest gains across computers & electronics, fabricated metals, and electrical equipment. While shipments experienced only marginal growth, the strength in new orders, especially concerning capital goods and aircraft, suggests renewed business investment and a potentially positive signal for broader economic momentum following a softer start to the second quarter.

Mixed Signals Indicate Uneven Economic Trajectory

Released: June 26, 2025 08:30

May's advance data revealed a complex macroeconomic picture for the United States, primarily driven by a significantly larger-than-anticipated goods trade deficit stemming from a rebound in imports following April's unusual contraction. While goods exports experienced a MoM decline, they remain robust on a YoY basis, contrasting with stagnant import activity. Reduced wholesale inventories, particularly durable goods, suggest easing supply chain pressures, while retail inventory builds, spurred by auto stock replenishment and broader gains, point to continued consumer demand. These mixed signals indicate a cautiously optimistic, yet uneven, economic trajectory as we progress through the second half of 2025.

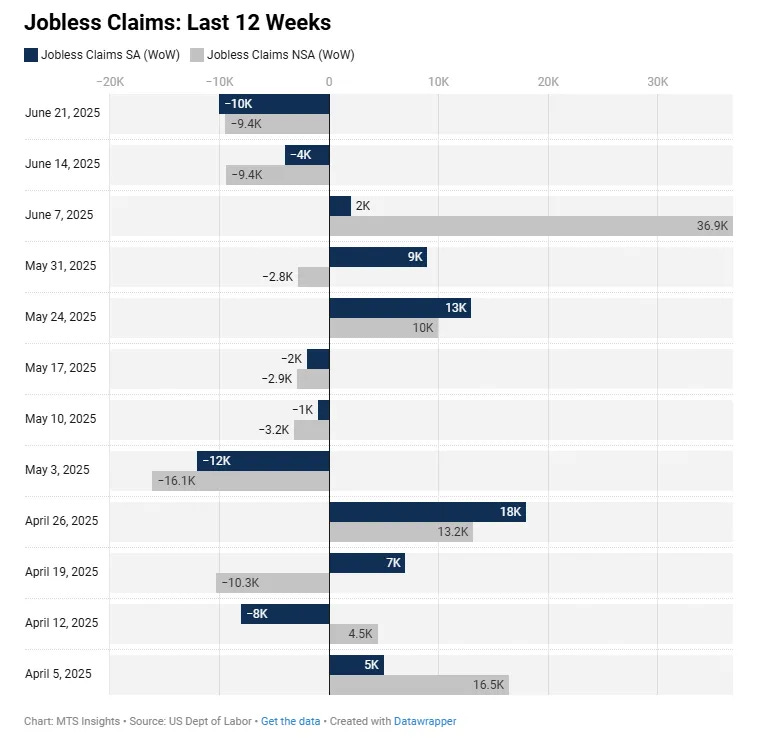

Mixed Signals in Labor Market

Released: June 26, 2025 08:30

The labor market showed mixed signals last week, with initial jobless claims declining 10k to 236k, though unadjusted claims remain elevated YoY. While the decrease offered a touch of optimism, the significant rise of 37k in continued claims, reaching the highest level since November 2021, alongside the persistent elevated level of federal employee claims, suggests underlying weakness in labor demand and potential difficulties for some workers finding sustained employment. Pennsylvania's ongoing elevated claims also warrant monitoring as a possible indicator of localized economic strain.

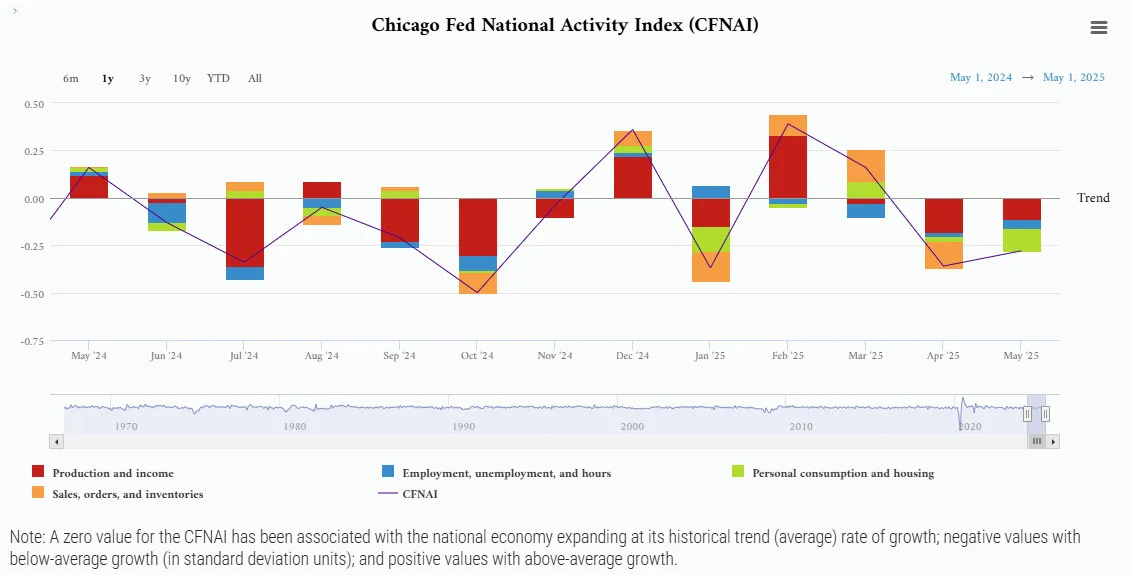

Mixed Signals Indicate Below-Trend Activity

Released: June 26, 2025 08:30

May's CFNAI reading of -0.28 signals continued below-trend economic activity, despite a modest MoM uptick, with the CFNAI-MA3 experiencing a notable decline to -0.16. A weaker Diffusion Index of -0.24 points to pervasive softness, although production-related indicators showed some improvement, partially offset by a deterioration in employment and a significant downturn in personal consumption and housing. Sales, orders, and inventories offered little support, highlighting a nuanced picture of ongoing economic headwinds.

Canadian Wholesale Sales Decline in May

Released: June 26, 2025 08:30 - Link

Preliminary data reveal that Canadian wholesale sales, stripping out volatile energy and agricultural commodities, edged down 0.4% MoM in May, marking the second consecutive monthly contraction. This pullback was primarily driven by reduced activity in the machinery, equipment, and supplies sector. The estimate's reliability is somewhat tempered by a lower-than-typical weighted response rate of 63.4%, compared to an average of 82.1% over the prior year, suggesting potential revisions as more complete data become available.

Container Spot Rates Decline Amid Softening Demand

Released: June 26, 2025 09:45

Container spot rates experienced a sharp -9% WoW decline to $2,983, driven primarily by softening US import volumes and evidenced by a -20% WoW plunge on the Shanghai-Los Angeles route, despite recent gains. While certain routes like Shanghai-New York and Shanghai-Rotterdam showed resilience, with rates still elevated compared to early May and the prior year, overall trends suggest a deteriorating supply-demand balance expected to further depress spot rates in the second half of 2025. Uncertainty surrounding potential shifts in trade policy and vessel capacity adjustments will likely contribute to ongoing volatility in the coming months.

Pending Home Sales Show Unexpected Gains

Released: June 26, 2025 10:00 - Link

May 2025 pending home sales demonstrated surprising resilience, rising 1.8% MoM and 1.1% YoY, fueled by continued employment and wage growth despite persistent affordability challenges stemming from fluctuating mortgage rates. Regional performance was uneven; the West and Northeast experienced MoM gains alongside negative annual comparisons, while the Midwest and South showed positive trends in both monthly and yearly figures. The South's continued strength is attributable to improved inventory levels and job creation, contrasting with the Northeast where constrained supply is contributing to bidding wars and prices exceeding listed values.

Natural Gas Storage Shows Tightening Trend

Released: June 26, 2025 10:30

The latest natural gas storage report revealed a 96 Bcf injection, modestly surpassing consensus forecasts and contributing to inventories now totaling 2,898 Bcf. While the build supports a somewhat less constrained supply picture, the year-over-year deficit narrowed this week to -6.3%, signaling ongoing underlying tightness. This improvement, alongside a rising differential against the five-year average, now at +6.6%, suggests continued upward pressure on prices despite the larger-than-expected injection, potentially influencing broader energy market dynamics.

Tenth District Manufacturing Shows Fragile Recovery

Released: June 26, 2025 11:00 - Link

The Kansas City Fed's June manufacturing survey reveals a mixed picture of continued contraction within the Tenth District, despite a modest uptick in the composite index to -2. While production and shipments showed notable gains MoM, softening external demand, reflected in a steep decline in new export orders, and diminishing backlog of orders suggest underlying demand remains fragile. Persistent labor market weakness, alongside escalating prices paid for raw materials and prices received for finished products, highlights cost pressures building within the sector. Though firms' outlooks show some optimism, uncertainty persists, prompting a significant portion to temporarily suspend capital investment, signaling a cautious approach to future growth.

Gas Prices Rise Slightly Amid Geopolitical Concerns

Released: June 26, 2025 12:00 - Link

Last week's AAA average gas price edged up to $3.220, a modest MoM increase of 4.1 cents, though still significantly below the YoY price of $3.494. Initial volatility in the petroleum futures market following weekend U.S. airstrikes briefly pushed oil to $78/bbl before prices stabilized. While the immediate impact from geopolitical tensions appears to have subsided, the anticipated surge in travel demand for the upcoming Independence Day holiday poses a potential upside risk for prices in the short term.

Other data releases and commentary:

Outlook for PE, Released: 06/26/2025 07:00

U.S. Q1 GDP, Third Estimate: Major Revisions To Consumption In The Final Look At First Quarter Growth, Released 06/26/2025 12:00