Econ Mornings: June 27th, 2025

Macro releases and commentary released the morning of June 27th, 2025

(all times are in EST)

UK Vehicle Production Plummets

Released: June 26, 2025 19:00 - Link

May vehicle production in the UK experienced a severe contraction, falling -32.8% YoY to the lowest level since 1949, as a combination of tariffs, industry restructuring, and plant closures significantly impacted both car and commercial vehicle output. Car production declined -31.5%, driven by steep drops in exports, particularly to the US, and a sharp decrease in domestic sales, while commercial vehicle manufacturing plummeted -53.6% due to plant closures and a diminished export share. With year-to-date production down -12.9%, industry representatives are urgently advocating for the swift implementation of the UK's new Industrial Strategy to address competitiveness, energy costs, and trade access issues.

Japan's Labor Market Remains Strong

Released: June 26, 2025 19:30

Japan's labor market demonstrated continued strength in May, with the unemployment rate holding steady at 2.5% despite a robust 330k increase in total employment and a 40k MoM decline in unemployment. The acceleration of labor force participation among prime-age workers, following a significant rise in April, is driving this positive trend, contributing to a notable 0.4 ppts MoM and 1.1 ppts YoY increase in the prime-age employment rate, signaling a sustained and encouraging shift in labor market dynamics.

Japan's Retail Sales Moderate

Released: June 26, 2025 19:50 - Link

May retail sales data revealed a concerning moderation in Japan's economic momentum, with a -0.2% MoM decline and a softened 2.2% YoY increase, falling short of expectations. While total commercial and wholesale sales demonstrated slight monthly gains, both posted annual declines marking the first since March 2024, suggesting weakening consumer demand and business investment. The particularly sharp deterioration in general merchandise sales, now down -14.9% YoY, alongside a deceleration in machinery & equipment sales growth to 1.4% YoY, paints a picture of sustained pressure on domestic spending and potential headwinds for the broader economy.

China Industrial Profits Decline

Released: June 26, 2025 20:30 - Link

China's industrial profit performance through May 2025 reveals a concerning slowdown, with overall profits declining -1.1% YoY to ¥2.72 trillion despite positive contributions from manufacturing, which rose +5.4% YoY. This decline, particularly stark in May's -9.1% YoY drop, was largely driven by significant contractions in mining (-29.0%) and offset only partially by gains in power/utilities (+3.7%). While private enterprises demonstrated resilience with a +3.4% YoY increase in profits, state-owned enterprises struggled (-7.4%) and foreign-funded firms saw only marginal growth (+0.3%). Rising inventories (+3.5%) and a lengthening average collection period (70.5 days, +4.1 days YoY), coupled with outpacing cost increases (+3.0% YoY) which compressed profit margins to 4.97% (-0.19 pp YoY) suggest ongoing challenges for China's industrial sector.

French Trade Sales Show Modest Gains

Released: June 27, 2025 02:45 - Link

April's French trade sales demonstrated modest positive momentum, with the headline volume increasing 0.7% MoM, driven primarily by gains in wholesale and retail sectors, though a concerning -0.5% YoY decline across the February-April period suggests underlying weakness. Wholesale activity saw notable strength in food, beverages, and agricultural raw materials, partially offset by contractions in "other machinery & equipment," while retail trade experienced broad-based gains across both specialised and non-specialised stores. Despite a flat performance in motor vehicles and motorcycles, preliminary indications of a -0.2% MoM decline in May retail trade warrant close monitoring, even as the broader Mar-May period registers a strong 2.7% YoY expansion.

French Consumer Spending Shows Mixed Signals

Released: June 27, 2025 02:45 - Link

French household goods consumption showed unexpected resilience in May, rising 0.2% MoM despite a deceleration from April's 0.5% gain, largely propelled by a significant rebound in energy demand, particularly electricity and gas, that countered weakness in food and durable goods categories. While total consumption remains in negative territory, exhibiting a -0.5% YoY and -0.9% QoQ decline, the monthly figures suggest a complex picture; food spending retreated after a strong prior month, durable goods consumption continued its downward trend, and textile/clothing spending remained soft, indicating underlying consumer caution persists alongside opportunistic energy purchases.

French Producer Prices Show Disinflationary Trends

Released: June 27, 2025 02:45 - Link

France's Producer Price Index registered further disinflationary pressures in May, declining -0.8% MoM and -0.7% YoY, reflecting widespread weakness across domestic, export, and import channels. While the rate of monthly contraction eased from the prior period, underlying industrial price stability is evident in the near-flat performance of PPI ex-energy, which ticked down to 0.9% YoY. Domestic price declines were tempered by easing electricity and petroleum costs, while foreign markets saw pronounced drops in plastics, petroleum, and equipment. Significant downward pressure continued from import prices, particularly refined petroleum, though food and beverage prices presented a countervailing, albeit limited, upward trend across all markets.

French CPI Shows Unexpected Upward Pressure

Released: June 27, 2025 02:45 - Link

France's preliminary June CPI data revealed a surprising uptick in price pressures, with the headline CPI rising 0.3% MoM and pushing the YoY rate to 0.9%, exceeding consensus expectations. This acceleration was largely attributable to a significant rebound in services inflation, now at 2.4% YoY, particularly within accommodation, transport, and healthcare, while the moderation in the decline of energy prices also contributed. Although food inflation edged slightly higher and fresh food decelerated, manufactured goods remained deflationary at -0.2% YoY, suggesting the broader inflationary trend warrants close monitoring as the HICP also showed a similar, albeit more moderate, upward trajectory, rising 0.4% MoM and 0.8% YoY.

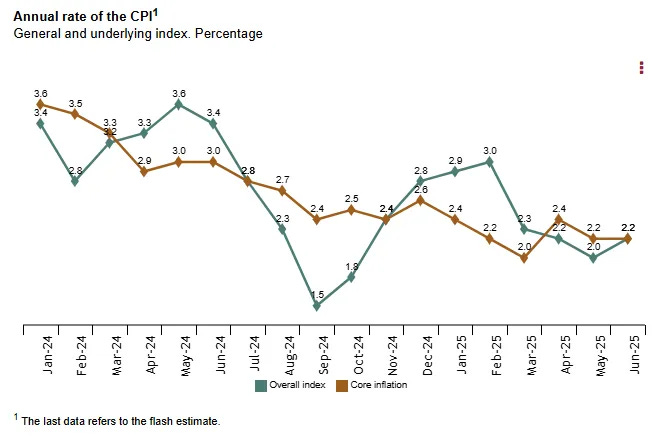

Spanish Inflation Accelerates

Released: June 27, 2025 03:00 - Link

Spain's preliminary June CPI data revealed an uptick in inflationary pressures, with headline inflation rising 0.6% MoM and 2.2% YoY, mirroring the core rate and exceeding May's 2.0% YoY figure. This acceleration, evident in both headline and HICP measures, is largely attributable to rising fuel costs and intensifying food price inflation compared to a deflationary base a year prior. Should these figures hold, Spain will have seen its first resurgence in headline CPI since February, signaling a potential shift in the nation's inflation trajectory.

Spain's Retail Sector Shows Continued Growth

Released: June 27, 2025 03:00 - Link

Spain's retail sector demonstrated resilience in May, with sales increasing 0.2% MoM and a robust 4.8% YoY, building on previous gains and outpacing April's growth. While food sales saw a slight monthly decline, non-food product sales and e-commerce led the advance, alongside a positive contribution from service stations. The broader upward momentum is further substantiated by a 1.4% YoY rise in retail employment and a notably stronger unadjusted retail index, signaling sustained consumer spending and a positive outlook for the sector.

Italian Economy Shows Mixed Signals

Released: June 27, 2025 04:00 - Link

June data reveals a mixed picture for the Italian economy, with consumer sentiment slipping slightly MoM due to weakening personal and current conditions, even as expectations for the broader economic climate rose. Business confidence, however, strengthened for the second consecutive month, largely propelled by a more positive outlook in market services and construction, although retail trade sentiment remains constrained by cautious expectations. While improvements in current sales and labor expectations within certain sectors offer some encouragement, the divergence in sentiment across industries suggests continued fragility and uneven recovery within the Italian economy.

Euro Area Sentiment Softens

Released: June 27, 2025 05:00 - Link

June's economic sentiment data for the euro area reveals a softening outlook, as the Economic Sentiment Indicator dropped to 94.0, reflecting broad-based pessimism despite a marginal improvement in employment expectations. Manufacturing confidence deteriorated significantly, weighed down by weaker order books and production prospects, while retail trade also demonstrated vulnerability. Although services showed slight resilience, consumer sentiment remains subdued and retail inflation expectations persist. A notable development is the decline in the Economic Uncertainty Indicator, suggesting diminished perceived risks despite the generally cautious macroeconomic tone.

Spain's Industrial Sector Cools Amid Rising Inflation

Released: June 27, 2025 06:00

Spain's industrial sector is signaling a cooling trend, as evidenced by a significant decline in the June 2025 ICI, reflecting weakening demand and cautious outlooks. Order book balances deteriorated notably MoM, while production expectations continue to point toward contraction, compounded by ongoing inventory depletion. Though employment expectations remain stable, accelerating price expectations, reaching an 8.1 and a three-month high, suggest rising inflationary pressures that may further dampen business sentiment and constrain economic activity in the coming quarters.

Canadian GDP Contracts in April

Released: June 27, 2025 08:30 - Link

Canada's economy contracted for the first time in months, experiencing a -0.1% MoM decline in real GDP during April, a reversal from March's modest expansion. The downturn was largely driven by substantial contractions in manufacturing and wholesale trade, particularly in transportation equipment, petroleum products, and motor vehicles, overshadowing gains in finance and insurance tied to equity market volatility, and boosted activity in the public sector stemming from the federal election and consumer-facing sectors like arts and recreation. Looking ahead, initial projections suggest continued weakness in May, with another -0.1% MoM decline expected as mining, public administration, and retail trade falter, although real estate and leasing may provide some offset.

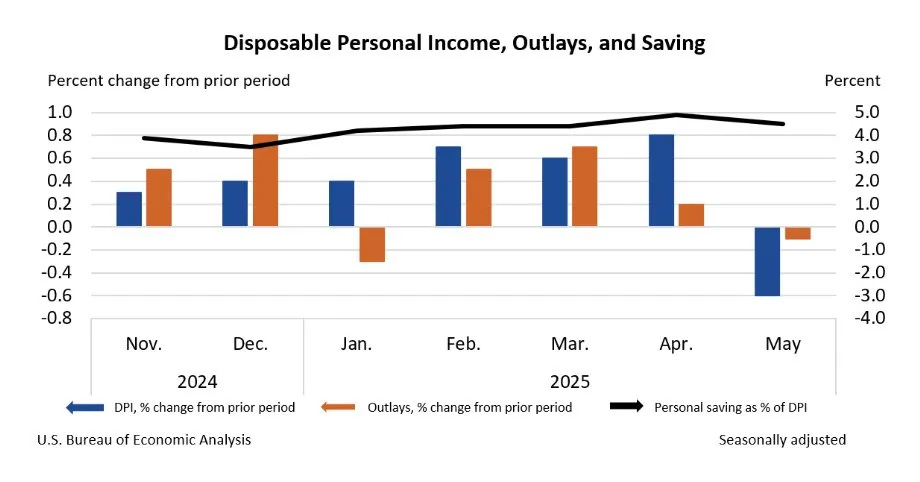

Soft Income and Consumption Signal Economic Slowdown

Released: June 27, 2025 08:30 - Link

May's personal income and outlays report revealed a concerning slowdown in economic activity, as both income and consumption fell short of expectations, adding to anxieties stemming from the recent downward revision to Q1 GDP. A significant drop in personal income, driven largely by volatility in government transfers and proprietors' income, was mirrored by a weaker-than-expected decline in personal consumption expenditures, particularly in durable goods spending. Despite the soft income and consumption data, core PCE inflation edged slightly higher, registering 0.2% MoM and 2.7% YoY, reinforcing the Federal Reserve's cautious approach and potentially limiting the scope for near-term monetary easing, although recent inflation trends suggest a renewed case for policy accommodation may be developing.

Consumer Sentiment Improves on Inflation Expectations

Released: June 27, 2025 10:00

June's final University of Michigan Index of Consumer Sentiment registered 60.7, signaling a welcome reprieve from a recent downturn with a significant +16.3% MoM increase, although still lagging behind year-ago levels by -11.0%. The improvement was driven by a substantial rise in expectations, fueled by easing inflation concerns, particularly evident in the sharp decline in both year-ahead and long-run inflation expectations, now at their lowest levels since February 2025, even as current conditions remain somewhat subdued. Despite this encouraging uptick, sentiment remains considerably below its post-election peak, suggesting ongoing anxieties surrounding price pressures and trade policy continue to influence consumer confidence.

Tenth District Services Activity Declines

Released: June 27, 2025 11:00 - Link

The Kansas City Fed's June survey reveals a notable softening in Tenth District services activity, with the composite index falling significantly MoM. Revenue and sales experienced a sharp decline, mirrored by moderation in employment and hours worked, alongside a considerable drop in capital expenditures, suggesting waning business confidence. While input and selling prices continue to register historically high levels, the latter is showing signs of easing, with expectations retracing gains seen earlier in the year. Despite the slowdown, most firms have refrained from substantial adjustments to staffing or investment strategies, and limited exposure to international trade and ongoing uncertainty appears to be influencing investment decisions.

GDP Nowcast Signals Economic Slowdown

Released: June 27, 2025 11:45

The New York Fed's latest GDP Nowcast indicates slowing economic momentum, revised downwards to 1.72% as of June 27th, primarily due to a significant contraction in consumer spending and income. A notable decline in real personal consumption expenditures and real disposable personal income, both MoM, exerted the largest downward pressure on the forecast, while data revisions reflecting weaker Q1 performance also contributed. Although a rise in manufacturers' new durable goods orders provided a minor boost, this was insufficient to counteract the impact of falling home sales and overall softness in consumption, signaling potential headwinds for the second quarter.

Service Sector Weakness Signals Economic Disinflation

Released: June 27, 2025 12:00

June's MTSI Services PMI Composite Index revealed a concerning downturn, dropping to -1.19 from May's -0.90, signaling persistent weakness in the service sector. The decline was driven by deteriorating revenue and new orders, with the latter showing a significant deviation from its historical average. While initial employment readings suggested minimal change, updated data indicates a more substantial contraction, and a divergence between Prices Paid and Prices Received suggests diminishing pricing power for service firms, potentially reflecting broader disinflationary pressures within the economy.

Manufacturing Sector Contracts Amid Moderating Inflation

Released: June 27, 2025 12:00

June's MTSI Manufacturing PMI Composite Index declined to -1.00, signaling continued contraction within the sector, as the initial optimism from May's New Orders rebound faded. While employment readings experienced a temporary lift in May, recent data demonstrates renewed weakness, mirroring a broader softening in demand. Encouragingly, inflation, as measured by both input and output prices, appears to be moderating after reaching a peak in April, suggesting easing pressures within the manufacturing economy throughout Q2 2025.

Other data releases and commentary:

France Services Output: April 2025, Released: 06/27/2025 02:45

Italy PPI: May 2025, Released: 06/27/2025 05:00

Italy Industry and Services Turnover: April 2025, Released: 06/27/2025 05:00

Who is buying Treasuries, Mortgages, Credit, and Munis?, Released: 06/27/2025 06:00

War in the Middle East and Jet Fuel Supply, Released: 06/27/2025 06:00

Outlook for Real Assets, Released: 06/27/2025 07:00

Questioning the narrative, Released: 06/27/2025 12:00

U.S. Q1 GDP, Third Estimate: Major Revisions To Consumption In The Final Look At First Quarter Growth, Released: 06/27/2025 12:00