Econ Mornings: June 2nd, 2025

Macro releases and commentary released the morning of June 2nd, 2025

(all times are in EST)

Mixed Global Manufacturing Signals

Released: June 02, 2025 00:00

Global manufacturing activity presented a mixed picture in May 2025, with regional performance diverging significantly. While the Eurozone and the US experienced encouraging improvements, the former reaching a 33-month high driven by France and Austria, and the latter posting its strongest reading since February, South Korea's manufacturing sector continues to struggle, showing only marginal gains alongside deepening declines in new orders and output. Despite generally improving sentiment across regions, fueled by hopes of easing trade tensions and policy stabilization, persistent raw material price inflation in the US and falling backlogs in the Eurozone suggest underlying demand concerns remain, alongside continued, albeit slowing, employment declines in several key economies.

Commodity Prices Show Volatile Rebound

Released: June 02, 2025 00:30 - Link

May's RBA Index of Commodity Prices demonstrated a volatile rebound, rising 0.4% MoM in SDR terms following a significant April decline, although spot price performance for bulk commodities showed a more substantial 0.8% MoM increase. Gains were broad-based across rural, non-rural, and base metals subindices; however, the index contracted -1.5% MoM when measured in AUD. Despite the May uptick, the index remains meaningfully lower YoY, with SDR-denominated values down -7.7%, primarily reflecting weaker iron ore and coking coal, while AUD-denominated values retreated a less dramatic -2.9% YoY.

UK House Prices Show Unexpected Resilience

Released: June 02, 2025 02:00 - Link

UK house prices demonstrated surprising resilience in May, rising 0.5% MoM and pushing YoY growth to 3.5%, exceeding expectations despite a weakening 3Mo3M change indicating moderating momentum. The average price advanced to £273,427, reflecting ongoing, albeit uneven, demand spurred by favorable underlying conditions, namely, low unemployment, rising real earnings, and anticipated monetary easing, though transaction volumes remain sensitive to policy shifts, as evidenced by the March spike related to stamp duty. Regional disparities persist, with rural areas significantly outperforming urban centers in price appreciation over the past five years, driven largely by older demographics, while younger buyers continue to prioritize urban locations.

Diverging Credit Trends in April Data

Released: June 02, 2025 04:30 - Link

April's macroeconomic data reveal a complex picture of diverging trends, with consumer credit expanding by £1.6 billion, fueled by a doubling of credit card borrowing and accelerating to 6.7% YoY, counterbalanced by a significant £13.7 billion decline in UK mortgage lending, the first net repayment since late 2023, and a stalling of total lending to individuals. While non-financial corporate lending remains robust, with both large and smaller firms showing signs of recovery and PNFCs exhibiting net repayments, household deposits increased alongside record ISA inflows, even as broader money supply measures, particularly M4 and M4Lex, decelerated from prior months, indicating a potential softening in credit expansion despite resilient corporate borrowing.

Private Sector Activity Outlook Declines

Released: June 02, 2025 04:30 - Link

The CBI's Growth Indicator reveals a concerning downward trend in private sector expectations, signaling the bleakest outlook for activity since late 2022. Businesses anticipate activity to contract through August, driven by broad-based declines across services, distribution, and manufacturing sectors, with consumer and business services facing particularly acute pressures. This anticipated contraction follows another period of falling activity through May, extending a concerning trend that suggests a significant slowdown in the broader economy.

Retail Sales Expected to Rebound in May

Released: June 02, 2025 08:30

Preliminary data from the Chicago Fed's CARTS nowcast suggest a strong rebound in May retail and food services sales (ex autos), projecting a 0.4% MoM increase and a 4.4% YoY gain, building upon April's 4.2% YoY growth. This latest estimate, bolstered by positive signals across all contributing factors including consumer sentiment and transaction volume, contrasts sharply with the significant overestimation of declines in April's initial nowcast. Notably, prices remain subdued with a 0.0% MoM and -0.1% YoY change, implying a real retail sales growth rate of 0.4% MoM.

Gasoline Prices Moderate

Released: June 02, 2025 09:00 - Link

Gasoline prices continued to moderate last week, with the national average falling to $3.093, a decline of 3.8 cents MoM and a substantial 41.0 cents YoY. This trend reflects the resolution of a refinery issue in the Great Lakes and anticipated increased supply on the West Coast, though inventories remain constrained entering the summer driving season. Diesel prices also decreased, settling at $3.465 per gallon. The difference between the national average and the median price, currently at 14 cents, suggests disparities in regional pricing dynamics and indicates potential for broader price relief contingent on consistent refinery performance.

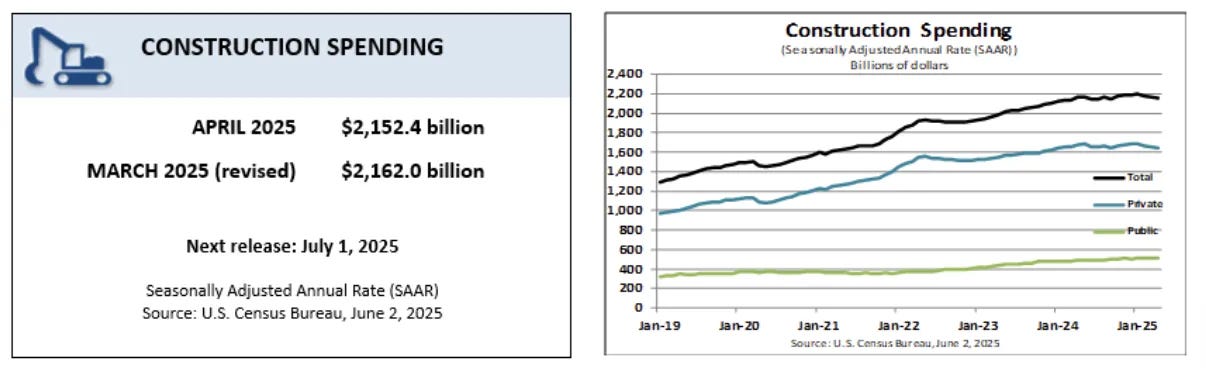

Construction Spending Declines

Released: June 02, 2025 10:00

April construction spending contracted across several categories, revealing a notable softening in economic activity. Total spending declined -0.4% MoM and -0.5% YoY, dragged down primarily by weakness in residential and private investment, with commercial spending exhibiting particular concern at -0.8% MoM and -3.6% YoY. While public spending provided a counterweight with a 0.4% MoM increase and robust 5.5% YoY growth, the overall trend indicates persistent headwinds for the construction sector, underscored by a continued slump in manufacturing spending and a broader deceleration in private sector investment.

Regional Economy Shows Mixed Signals

Released: June 02, 2025 10:00

In May 2025, the regional Mid-American PMI Business Conditions Index fell to 51.0 from 53.3 in April, signaling slower growth. Manufacturing employment remained below growth neutral, and over half of supply managers reported rising input costs due to actual or anticipated tariffs. About one-third of firms switched suppliers in response to tariff-related pressures, with some using tariffs as a pretext to raise prices. Regional exports of manufactured goods declined -1.4% YoY in Q1, and amid these signs of deceleration, economist Goss anticipates a Fed rate cut at the June 17–18 meeting.

Manufacturing Contraction Signals Economic Weakness

Released: June 02, 2025 10:00 - Link

May's ISM Manufacturing PMI data revealed a concerning acceleration of contraction within the sector, falling to 48.5 and signaling persistent weakness in demand as evidenced by a significant drop in new export orders and a worrying decline in the imports index, the lowest since the Global Financial Crisis. While production saw a modest increase and inventories decreased likely due to completed tariff stockpiling, ongoing struggles in overseas markets and retaliatory trade measures are weighing heavily on activity, putting upward pressure on input costs despite a slight easing of the Prices Index. Although the manufacturing sector's challenges are apparent, broader economic growth remains positive, marking its 61st consecutive month, suggesting resilience within other areas of the US economy.

Other data releases and commentary:

Spain Tourist Arrivals: April 2025, Released: 06/02/2025 03:00

Spain Tourist Expenditures: April 2025, Released: 06/02/2025 03:00

Highly Unusual Divergence in US-EU Inflation Outlook, Released: 06/02/2025 07:00

NBER Digest: June 2025, Released: 06/02/2025 09:15

Auto Market Weekly: Week of June 2nd, Released: 06/02/2025 10:00

JPMorgan Weekly Market Recap: Week of June 2nd, Released: 06/02/2025 07:00

Jet Fuel Price Monitor: Week of May 30th, Released: 06/02/2025 12:00