Econ Mornings: May 13th, 2025

Macro releases and commentary released the morning of May 13th, 2025

(all times are in EST)

Strong Retail Sales Signal Economic Expansion

Released: May 12, 2025 19:00 - Link

April's BRC retail sales data revealed a surprisingly robust expansion, with total sales jumping 6.8% YoY, significantly outpacing expectations and marking the strongest annual increase since early 2022. While a combined March/April review, adjusted for Easter timing, showed a still-positive 4.3% YoY increase, both food and non-food categories demonstrated considerable strength, with food sales rising 8.2% and non-food sales 6.1%. Notably, both in-store and online non-food sales contributed positively, though the online penetration rate edged slightly lower to 36.4%, suggesting a possible shift in consumer shopping preferences.

Softening Business Conditions Signal Economic Headwinds

Released: May 12, 2025 21:30 - Link

April's NAB Business Survey revealed a softening macroeconomic landscape, with business conditions retreating to 2, driven primarily by a notable decline in profitability and capacity utilisation, now at levels not seen since mid-2021. While business confidence edged up, it remains below historical norms, and the survey's indicators suggest emerging headwinds. Falling forward orders and a substantial pullback in capital expenditure point toward moderating investment intentions, compounded by rising purchase costs and accelerating retail and final product price growth. Industry-specific performance was mixed, with manufacturing, wholesale, and finance showing resilience, potentially influenced by the recent tariff announcements and indicative of an evolving business sentiment.

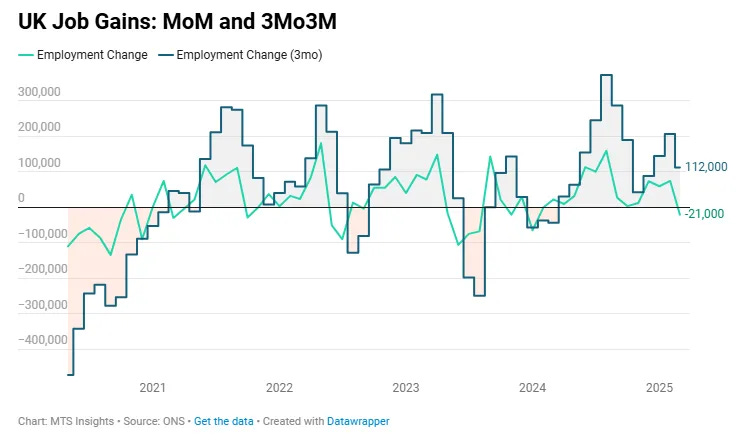

UK Labor Market Cools in Q1 2025

Released: May 13, 2025 02:00 - Link

The UK labor market displayed signs of cooling in Q1 2025, with job creation slowing to 112k, alongside a modest uptick in the unemployment rate to 4.5% driven by a decline in the inactivity rate. While redundancies remain low, job vacancies continue to trend downward, falling -14.7% YoY to 761k, and the ratio of unemployed to vacancies has increased. Pay growth remains elevated, with total pay up 5.5% YoY, although regular pay decelerated to 5.6% YoY, suggesting moderating wage pressures. Early indications of payroll employment in April reveal a continued contraction, though the magnitude appears to be lessening, and median monthly pay continues its upward trajectory at 6.4% YoY.

German Economic Sentiment Improves, Current Assessment Remains Negative

Released: May 13, 2025 05:00 - Link

Germany's economic sentiment, as measured by the ZEW indicator, experienced a substantial MoM surge to 25.2, significantly outpacing expectations and reflecting a renewed sense of optimism driven by recent policy changes, easing trade tensions, and stabilizing inflation. Despite this encouraging shift in sentiment, the assessment of the current economic situation remains deeply negative, registering the lowest reading across surveyed nations and contrasting with recoveries in both the Eurozone and US sentiment. While expectations for inflation and interest rates eased and equity market optimism grew, the divergence between sentiment and the perceived present conditions suggests underlying fragility persists within the German economy.

India’s Inflation Remains Subdued

Released: May 13, 2025 05:30 - Link

India's consumer price inflation ticked higher with a 0.31% MoM increase in March, yet remained subdued at 3.16% YoY, the lowest reading since July 2019 and below consensus forecasts. While marking the first monthly gain in six months, the broader trend continues to reflect easing inflationary pressures, particularly within the food segment where prices fell -0.15% MoM and are up only 1.78% YoY, a stark contrast to the double-digit increases seen last fall. Deflationary forces in vegetables and meat & fish are primary contributors, although health and personal care items experienced notable increases; however, their limited weighting minimizes the overall impact.

Small Business Sentiment Declines Amid Economic Headwinds

Released: May 13, 2025 06:00 - Link

Small business sentiment deteriorated in April, with the NFIB Optimism Index falling to 95.8 amid a concerning slide in expectations for future business conditions, now at their lowest level since the 2024 election. While Actual Earnings and Actual Sales showed modest gains, softening wage growth signals, particularly evident in the Compensation Plans index, combined with declining job openings and consistently high borrowing costs, remaining at 8.9%, suggest persistent headwinds for the small business sector despite recent improvements in some hard data metrics.

OECD Household Income Shows Modest Q4 Gains

Released: May 13, 2025 06:00 - Link

OECD household income demonstrated modest improvement in Q4 2024, with real income per capita rising 0.5% QoQ, building on a weaker 0.2% gain in the prior quarter. While overall income growth for the year reached 1.8%, a slight uptick from 1.7% in 2023, performance varied considerably across member states; G7 nations registered a 0.2% QoQ increase and a more substantial 1.7% YoY climb, but were tempered by contractions in Germany and Italy. This unevenness occurred alongside broader economic expansion, with GDP per capita rising 0.4% QoQ across the OECD and 0.3% QoQ in the G7.

Global Supply Chains Show Mixed Signals

Released: May 13, 2025 08:00 - Link

April's GEP Global Supply Chain Volatility Index edged upward to -0.39, reflecting a complex landscape of softening demand and mounting unused capacity across major economies. While overall purchasing activity weakened, particularly in Asia, where export demand faltered and factory output slowed notably in China, Taiwan, and South Korea, North America experienced reduced purchases and increased inventory builds linked to escalating trade risks. Europe demonstrated a degree of stabilization with diminishing spare capacity driven by growth in Germany and France, contrasting with the U.K.'s significant contraction in supplier activity.

Easing Inflation Signals Potential Rate Cuts

Released: May 13, 2025 08:30

The April CPI report reinforced the narrative of easing inflation, with headline inflation rising a modest 0.2% MoM and 2.3% YoY, both below expectations and reflecting the lowest annual rate since February 2021. Core inflation also remained subdued, increasing 0.3% MoM and holding the annual rate at 2.8% YoY, supported by continued weakness in goods prices and a moderating pace in services. While energy prices saw a partial rebound, broader consumer energy costs remain low thanks to weaker commodity prices, and concerning trends in international travel are reflected in falling airline fares. These results, alongside a special aggregate measure excluding volatile components like housing and used vehicles, now pointing to annual rates significantly below the Federal Reserve's 2% target, are strengthening the case for monetary policy easing and aligning with the market's view that rate cuts are increasingly likely.

Cautious Investor Sentiment Amidst Economic Concerns

Released: May 13, 2025 10:00 - Link

May's Investment Manager Index reflects persistent macroeconomic anxieties, evidenced by a modest uptick in the Risk Appetite Index to -19%, still indicative of a risk-off posture. Investor sentiment is largely driven by concerns surrounding the US political and economic outlook, valuations, and fiscal policy, compounded by broader global uncertainties and deteriorating equity fundamentals as earnings expectations have been sharply revised downward, the most significant adjustment since late 2022. While defensive sectors continue to attract capital, a surprising rebound in tech interest contrasts with the lowest energy sentiment recorded in over four years, suggesting a shift in perceived value and potential opportunities despite pervasive caution.

Household Debt and Student Loan Delinquencies Rise

Released: May 13, 2025 11:00 - Link

Household debt climbed $167 billion, or 0.9% QoQ, to $18.20 trillion in Q1 2025, fueled primarily by a $199 billion rise in mortgage balances offset by a decline in other non-mortgage debt. The emergence of previously unreported student loan payment delinquencies, stemming from the resumption of payments following a protracted pause, significantly elevated the reported 90+ day delinquency rate for student loans to 7.74%, a sharp contrast to the less than 1% observed in the prior quarter. While total household debt in serious delinquency rose to 2.45%, reflecting broader economic pressures, delinquency rates for auto, credit card, and other debt categories all decreased during the quarter, suggesting a varied picture of household financial health.

Tariff Deescalation Impacts Freight Markets

Released: May 13, 2025 12:00 - Link

The recent US-China tariff deescalation, while reducing reciprocal duties to a baseline of 30% on all goods, introduces a complex interplay of forces likely to impact both ocean and air freight markets. Though the reduction spurred a temporary drop in China-US ocean volumes, a combination of pent-up demand, inventory replenishment needs, and pre-emptive frontloading by shippers, mirroring behavior seen even under lower tariff levels, suggests a near-term rebound in demand and potential capacity constraints, as carriers previously reduced capacity through blank sailings. While this early peak season activity could trigger spot rate increases, fleet growth and heightened competition among carriers may temper the magnitude of rate hikes relative to last year. The suspension of de minimis exemptions for Chinese goods is already impacting e-commerce flows, but the broader effect on air cargo remains muted due to reliance on chartered flights, though the eventual reintroduction of freed-up freighter capacity may ease pressure on spot rates.

Other data releases and commentary:

BoJ Summary of Opinions: May 2025, Released: 05/12/2025 18:50

Australia Building Permits: March 2025 (Final), Released: 05/12/2025 21:30

It Takes Time to Rebuild Trust, Released: 05/13/2025 07:00

Cox Automotive Auto Market Report: May 13th, Released: 05/13/2025 10:00