Econ Mornings: May 16th, 2025

Macro releases and commentary released the morning of May 16th, 2025

(all times are in EST)

Japan's Economy Contracts Amid Export Weakness

Released: May 15, 2025 19:50 - Link

Japan's economy unexpectedly contracted -0.2% QoQ in Q1 2025, reversing the prior quarter's 0.6% expansion despite robust domestic demand, which rose 0.6% and was primarily driven by a 0.9% increase in private demand fueled by strong investment. While private demand added 0.7 ppts to GDP, a significant -0.8 ppts drag from net exports, owing to a 2.9% increase in imports and a -0.6% decline in exports, resulted in the overall contraction. Concurrently, final sales of domestic product and gross domestic income both weakened, and inflationary pressures mounted, as evidenced by a 0.9% QoQ and 3.3% YoY rise in the GDP deflator, the highest reading in nearly eighteen months.

Japan's Economic Momentum Softens

Released: May 15, 2025 23:30 - Link

March data from the Survey of Commerce reveal a softening in Japan's economic momentum, as retail sales growth slowed to 3.0% YoY despite a preliminary estimate of 3.1%, with wholesale sales also experiencing a downward revision to 3.4% YoY and total commercial sales at 3.3% YoY. While furniture & household goods and an unspecified “other” category exhibited robust monthly increases of +6.2% and +3.8% respectively, a substantial -5.0% MoM drop in general merchandise sales, following a -4.9% MoM decline in February, suggests persistent weakness in consumer spending and warrants close monitoring of future data releases.

Japan Industrial Output Shows Unexpected Gains

Released: May 16, 2025 00:30 - Link

March industrial output in Japan showed surprising resilience, posting a 0.2% MoM and 1.0% YoY gain following substantial upward revisions to earlier data. While shipments experienced a contraction of 1.8% MoM and 0.3% YoY, the decline was less severe than initially reported. Rising inventories, up 1.2% MoM and down 0.7% YoY, contributed to a notable 4.4% MoM and 0.6% YoY increase in the inventory-sales ratio, suggesting a potential shift in supply chain dynamics. Despite a sharp -2.4% MoM dip in capacity utilization, the largest since last August, overall Q1 2025 utilization still managed a 2.3% QoQ improvement thanks to a favorable start to the quarter.

French Business Creation Rebounds in April

Released: May 16, 2025 02:45 - Link

French business creation demonstrated a robust recovery in April 2025, with total births rising 4.6% MoM, spurred by broad-based gains across both micro-entrepreneur and conventional business structures after recent weakness. This rebound was particularly pronounced in the transportation and storage sector, which saw a significant 20.5% MoM increase, while household services experienced a slight decline. Despite the encouraging April performance, the overall pace of business creation remains modest, registering only a 1.4% increase YoY over the last twelve months, suggesting a tempered but persistent underlying trend.

Italy’s Trade Performance Shows Slowing Momentum

Released: May 16, 2025 04:00 - Link

Italy's international trade performance in March 2025 reveals a mixed picture of slowing momentum. While yearly export and import values remain positive, demonstrating underlying economic growth, monthly figures point to a deceleration, with export prices dipping and import prices slightly rising. The divergence in trade flows is notable, as exports to the EU experienced a significant MoM decline offset by gains in non-EU markets, while import trends mirrored this pattern. Although Q1 2025 showed increases in both exports and imports QoQ, the broader context of slowing MoM figures and rising import prices suggests potential headwinds for Italy's external sector.

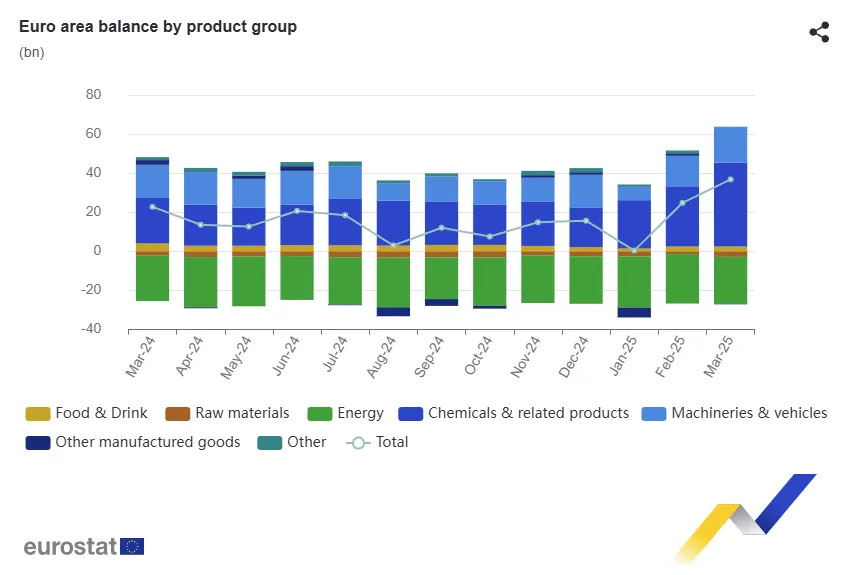

Euro Area Trade Surges to Highest Level in Decade

Released: May 16, 2025 05:00 - Link

The euro area experienced a significant boost to its international trade position in March, with the trade balance expanding to €36.8 billion, the strongest in over a decade. This improvement stemmed from robust export growth, rising 2.9% MoM and 13.6% YoY, outpacing import growth of 1.0% MoM and 8.8% YoY. Underlying this trend were notable increases in surpluses within the chemicals sector, reaching €42.8 billion with substantial gains both MoM and YoY, alongside a €2.7 billion monthly rise in the machinery & vehicles trade surplus. The data suggests strengthening external demand for euro area manufactured goods and hints at broader economic momentum within the region.

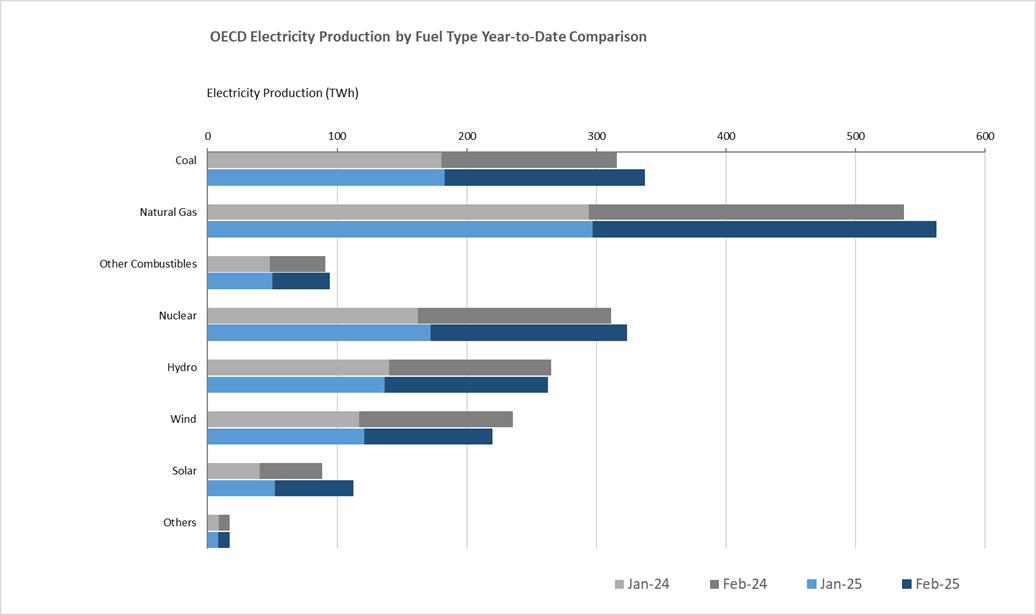

OECD Electricity Generation: Fossil Fuels Dominant, Renewables Decline

Released: May 16, 2025 05:00

February 2025 OECD electricity generation totaled 904.8 TWh, a 4.0% increase YoY, with fossil fuels accounting for nearly half of the total, driven by significant gains in coal and natural gas production across the Americas and Europe. While solar generation showed strong growth, a substantial decrease in wind power, particularly in OECD Europe, resulted in a 2.1% YoY decline in renewable electricity output. Nuclear power generation experienced a modest increase, led by gains in Asia Oceania, though the Americas saw a contraction.

Italy’s Inflation Cools, Core Prices Remain Elevated

Released: May 16, 2025 05:00 - Link

April's finalized CPI data revealed a modest increase of 0.1% MoM and 1.9% YoY for Italy, a downward revision from prior estimates largely driven by weaker-than-anticipated goods inflation, particularly in energy and industrial goods. While headline inflation cooled, underlying price pressures remain elevated, as evidenced by core CPI climbing 0.8% MoM and 2.1% YoY, and CPI excluding energy rising 2.2% YoY, both showing an acceleration compared to the prior period. The broader HICP measure also reflects this softening, registering 0.4% MoM and 2.0% YoY, once again revised lower from the initial release.

Trade Prices Rise Amid Tariff Concerns

Released: May 16, 2025 08:30

April's trade price indexes surprised to the upside, reflecting increased import and export prices that diverged from anticipated declines. The outperformance was largely driven by durable goods segments, as businesses proactively built inventories in anticipation of heightened tariff rates and potential retaliatory measures. While a significant decrease in energy import prices partially offset the gains, nonfuel import prices rose 0.4% MoM, the largest increase since a year ago, with notable strength in industrial supplies and finished metals, likely influenced by tariff-related increases with Canada. Export prices also exceeded expectations, boosted by durable goods and a similar, tariff-influenced dynamic in industrial supplies, suggesting widespread attempts to preemptively adjust to evolving trade policy.

US Housing Market Shows Mixed Signals

Released: May 16, 2025 08:30

April's new residential construction data presents a mixed picture for the US housing market. While overall housing starts edged higher, the decline in single-family starts, now at their lowest annualized rate since July 2024, and a significant drop in building permits signal persistent headwinds for that segment. Multifamily construction surged, achieving the highest annualized rate in nearly five months, offering a partial offset. However, declining housing completions and a decrease in homes under construction suggest a weakening pipeline and a likely contraction in housing supply entering Q2, potentially impacting broader economic activity.

Regional Economic Outlook Remains Pessimistic

Released: May 16, 2025 08:30 - Link

Services firms in the New York Fed region continue to signal significant economic headwinds, as evidenced by the May survey data. While the headline Business Activity index improved, the underlying Business Climate index remains deeply pessimistic, with a large majority of respondents characterizing conditions as worse than normal. Declining capital spending, the lowest since early 2021, and a mildly negative shift in employment expectations, alongside falling prices received, paint a concerning picture. Critically, the stubbornly negative future business activity index, unchanged from its April 2020 lows and coupled with minimal expectations for improvement, suggests a sustained contraction is anticipated, potentially reinforcing current easing measures and impacting broader regional economic performance.

Consumer Sentiment Declines Amid Inflation Concerns

Released: May 16, 2025 10:00

Preliminary May data from the UMich Index of Consumer Sentiment reveal a concerning downturn, falling to 50.8, a significant drop both MoM and YoY, and below consensus forecasts, signaling heightened anxieties about the economic outlook. Declines in both current conditions and expectations were broad-based, fueled primarily by anxieties surrounding weakening income levels and a near 10% slide in perceptions of personal finances. Crucially, inflation expectations are trending higher across the political spectrum, with year-ahead expectations jumping to 7.3% and long-run expectations rising to 4.6%, potentially tempering consumer spending and complicating monetary policy considerations, while the impact of recently announced tariff adjustments remains to be seen in the final release.

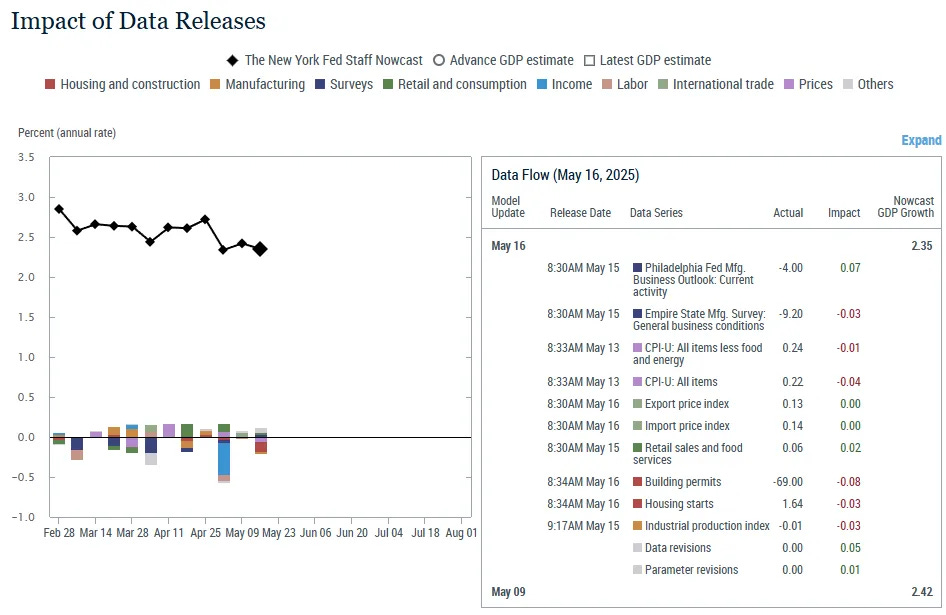

Q2 2025 GDP Growth Forecast Edges Lower

Released: May 16, 2025 11:45

The New York Fed's nowcast for Q2 2025 GDP growth edged down to 2.35%, reflecting a mixed bag of incoming data. While retail sales and upward revisions offered some support, downward pressure stemmed primarily from weaker housing starts, building permits, industrial production, and the Empire State Manufacturing survey, alongside concerning core and headline CPI inflation readings. The Philadelphia Fed Manufacturing survey provided a modest offset, but overall the shift suggests a softening in the growth trajectory, warranting close monitoring of upcoming indicators.

Other data releases and commentary:

IATA Quarterly Air Transport Chartbook: Q1 2025, Released: 05/16/2025 06:00

Growth in Vietnam’s Air Passenger Market, Released: 05/16/2025 06:00

The Fiscal Situation in France and Germany Is Deteriorating, Released: 05/16/2025 07:00

Services, baby, services, Released: 05/16/2025 12:00