Econ Mornings: May 19th, 2025

Macro releases and commentary released the morning of May 19th, 2025

(all times are in EST)

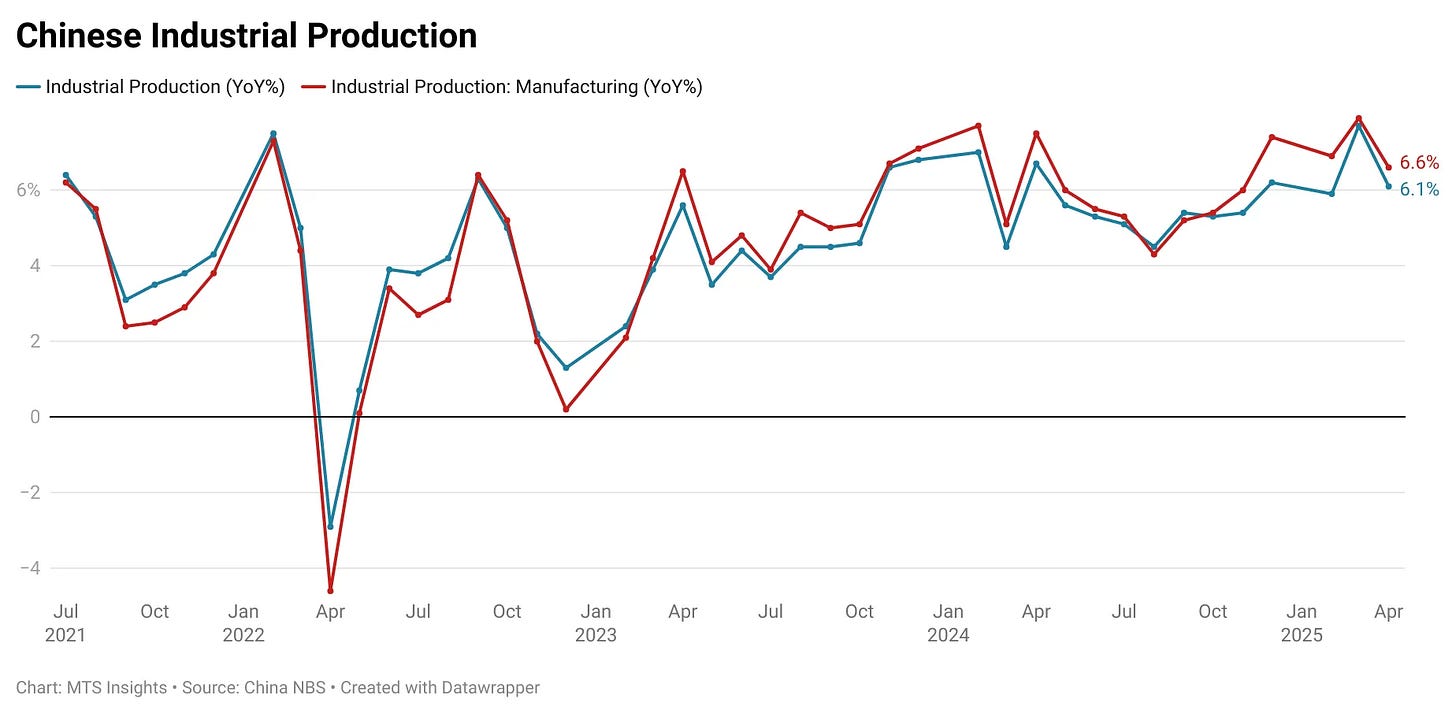

China's Industrial Production Shows Decelerating Growth

Released: May 18, 2025 21:00 - Link

March industrial production data revealed a mixed picture for the Chinese economy, with the 6.1% YoY increase exceeding forecasts but signaling a deceleration in momentum as monthly growth hit a year-long low. While overall growth remained positive, both state-owned and private sector firms experienced moderating expansion, and manufacturing activity cooled considerably. A significant drag on performance stemmed from a sharp MoM decline in export delivery value, alongside contractions in key high-tech sectors like mobile phones and microcomputer equipment, and a marked slowdown in integrated circuit production. Weakness in cement production, extending a concerning YTD trend, further underscores emerging vulnerabilities within the commodities and building materials segments.

China's Retail Sales Slowdown

Released: May 18, 2025 21:00 - Link

April's retail sales data reveal a concerning deceleration in China's recovery, with a 5.1% YoY increase falling short of forecasts and marking the weakest performance since June 2024. While gains in food and appliances, along with robust growth in office supplies, recreation, and daily necessities, offered partial offsets, the significant weakening of auto sales and a continued contraction in petroleum product sales, driven by low energy prices, highlight persistent headwinds. The divergence in performance across categories suggests a consumer base with uneven spending patterns, tempering optimism surrounding the broader economic outlook and warranting close monitoring of second-quarter trends.

China's Investment Growth Slows Amid Private Sector Weakness

Released: May 18, 2025 21:00 - Link

China's fixed asset investment gained 4.0% YoY in April, a modest deceleration from March and falling short of forecasts, reflecting a divergence in growth drivers. While public investment and key areas like industrial investment, particularly utilities, and agricultural investment propelled growth, private investment remained sluggish at just 0.2% YoY. The expansion was further complicated by a decline in foreign investment offset by increased activity from Hong Kong, Macao, and Taiwan firms, alongside uneven sectoral performance with the primary industry leading the way and the tertiary sector experiencing a slight contraction. Infrastructure investment showed strength, particularly in water-related projects, although construction and installation work lagged, hinting at potential challenges in project execution.

China's Real Estate Investment Contracts

Released: May 18, 2025 21:00 - Link

China's real estate sector continues to experience significant headwinds, as evidenced by April's data revealing a deepening contraction in investment, falling -10.3% YoY. This slowdown is widespread, impacting new construction, which saw area decline sharply, alongside reduced housing completions and muted sales across both residential and commercial segments. The weakening market conditions are also reflected in diminished developer funding sources, with notable declines in self-raised funds and personal mortgage loans, suggesting ongoing financial pressure on the industry.

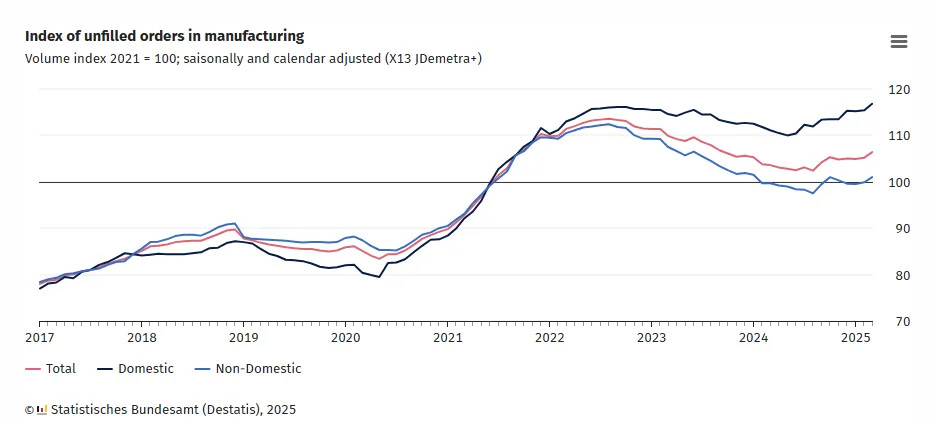

German Manufacturing Orders Rise in March

Released: May 19, 2025 02:00 - Link

Germany's manufacturing sector demonstrated resilience in March 2025, with the stock of orders rising 1.1% MoM and 2.8% YoY, supported by robust gains in automotive and capital goods orders, including substantial increases in order backlogs of 3.7% and 1.4% respectively. Both domestic and foreign order volumes contributed to the overall expansion, although consumer goods orders softened -1.2% MoM. The average order fulfillment time extended slightly to 7.8 months, reflecting particularly long lead times for capital goods producers at 10.6 months, while the consumer goods backlog shortened marginally to 3.6 months.

Spain's Trade Deficit Widens Amid Import Surge

Released: May 19, 2025 04:00 - Link

Spain's international trade position deteriorated significantly in March 2025, with the trade deficit widening to €5.48 billion, marking the largest for the month in over a decade. While exports showed robust growth, rising 6.7% MoM and 8.5% YoY, this was overwhelmed by a sharper increase in imports, up 11.9% MoM and 18.3% YoY. This recent surge follows a weak Q1 2025 where exports contracted -1.8% QoQ, despite rising non-energy imports 10.0% YoY and energy imports 5.3% YoY. Notably, the rapid increase in imports was driven by substantial gains in primary materials, up 45.7% YoY, and chemical products, rising 26.6% YoY, suggesting increased domestic demand and potential inflationary pressures.

UK Consumer Sentiment Improves on Rate Cut Expectations

Released: May 19, 2025 04:30 - Link

May's S&P Global UK Consumer Sentiment Index reflects a tentative shift in household outlook, driven primarily by an increased expectation of interest rate cuts, a substantial reversal from April, and a strengthening labor market underscored by gains in job security and income expectations. While sentiment edged higher to a two-month peak of 45.2, households remain guarded, as evidenced by the Debt Sentiment Index's stability and only modest improvements in cash availability and views on major purchases. Though both current and expected household finances saw modest gains, the index remains in negative territory, suggesting ongoing economic caution despite the emerging favorable signals.

Euro Area Inflation Remains Persistent

Released: May 19, 2025 05:00 - Link

April's finalized Euro area inflation data revealed a persistent inflationary environment, with headline inflation holding steady at 2.2% YoY and 0.6% MoM, despite offsetting revisions across food, energy, and services. Core inflation accelerated to 2.7% YoY, boosted by a 1.0% MoM increase, surpassing last year's pace, and driven by upward revisions to services inflation, now contributing 1.80 ppts to the headline rate. While energy prices continued to exert downward pressure, declining -3.6% YoY, the overall effect was neutralized by rising food prices, which increased 3.0% YoY, their highest annual rate since February 2024, and a stronger-than-initially estimated contribution from services.

Used Vehicle Market Shows Early Signs of Softening

Released: May 19, 2025 09:00 - Link

Preliminary data from the Manheim Used Vehicle Value Index reveal a softening market in early May 2025, with wholesale prices falling -1.1% MoM, though remaining 4.4% higher YoY. The current depreciation, exceeding the typical May decline of -0.3 percentage points, follows a period of strong appreciation in April and suggests a possible correction after sustained price increases. While the Three-Year-Old Index experienced less depreciation than the broader market, MMR Retention values indicate that actual market prices are trending below valuation models. Year-over-year performance varied considerably by segment, with luxury vehicles and SUVs leading gains, while compact cars saw a decline, and trucks underperformed the broader industry; however, all segments registered declines compared to April, particularly in the truck and compact car categories.

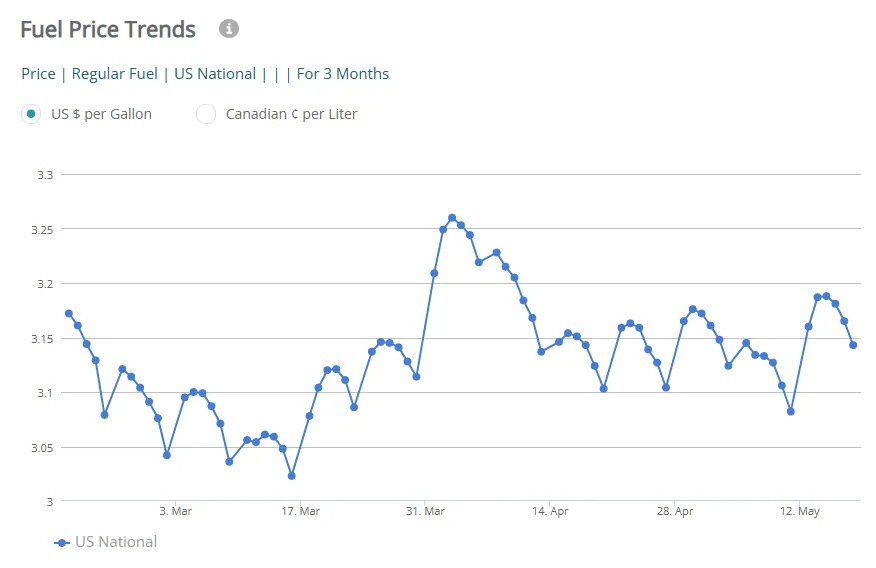

Gas Prices Rise, Signaling Inflationary Pressure

Released: May 19, 2025 09:00 - Link

Gas prices saw a noticeable uptick this week, with the national average rising 6.1 cents to $3.143, fueled by a broader trend of rising costs, evidenced by the 1.9 cent MoM increase. While current prices remain significantly lower YoY, reflecting ongoing supply-side adjustments, the rise in both gasoline and diesel (up 2.9 cents to $3.502) signals potential upward pressure on inflation. The discrepancy between the national average and the median price ($2.99, up 8 cents WoW) suggests regional variations in market dynamics, potentially indicating differences in inventory levels or local taxes impacting consumer costs.

E-Commerce Sales: Slowing Growth, Shifting Behavior

Released: May 19, 2025 10:00 - Link

First quarter 2025 US retail e-commerce sales demonstrated a complex picture, with a flat QoQ performance masking a still-healthy 6.1% YoY increase, a deceleration from the prior quarter's 8.5% pace. While nominal sales showed resilience year-over-year, unadjusted figures revealed a deeper -20.3% QoQ decline, exceeding the previous year's contraction. The share of e-commerce within total retail sales held steady at 16.2%, although the unadjusted measure rose 0.5 ppts YoY, suggesting a shift in underlying consumer behavior.

Economic Outlook Weakens Amid Tariff Concerns

Released: May 19, 2025 10:00

April's significant -1.0% MoM decline in the Leading Economic Index, the sharpest in over two years, alongside downward revisions to March's reading and weakening consumer sentiment and construction activity, signals a concerning shift in the economic outlook. While the Coincident Economic Index continues to show modest gains and the Lagging Index is exhibiting resilience with a recent upward trend, the Conference Board now anticipates a considerably slower 1.6% GDP expansion for 2025, a notable deceleration from last year's 2.8% growth, largely attributable to anticipated impacts from tariffs expected to be most pronounced in the third quarter.

Texas Banks Show Mixed Signals, Growing Concerns

Released: May 19, 2025 10:30 - Link

May's Dallas Fed Banking Conditions Survey reveals a complex picture for Texas banks, with subtle expansion in loan volume offset by a significant cooling of loan demand. A sharp decrease in nonperforming loans and continued downward pressure on loan pricing suggest easing credit conditions, although a rebound in credit standards and terms offers a mixed signal. Most concerning is the accelerating deterioration in bank outlook and general business activity, reaching levels not seen since the third quarter of last year, indicating growing apprehension about the economic landscape and potential headwinds for regional lenders.

Consumer Spending Shows Mixed Signals

Released: May 19, 2025 11:00

April's SCE Household Spending Survey reveals a nuanced picture of consumer behavior, with nominal spending growth YoY slowing modestly to 4.5%, primarily due to lower-income households. Despite this, expectations for overall and essential spending over the next twelve months have risen, suggesting persistent inflationary pressures, particularly among more educated and higher-income consumers. A notable shift in spending patterns is apparent, with fewer households reporting large purchases and a slight uptick in home repair outlays, coupled with a decrease in anticipated non-essential spending, a reading not seen since early 2020, potentially signaling increased sensitivity to price levels.

Other data releases and commentary:

Declining Foreign Participation in US Treasury 30-Year Auctions, Released: 05/19/2025 07:00

Trade truce, or just a pause? The fragile state of US-China relations, Released: 05/19/2025 07:00

Auto Market Weekly: Week of May 19th, Released: 05/19/2025 10:00

JPMorgan Weekly Market Recap: Week of May 19th, Released: 05/19/2025 07:00

Jet Fuel Price Monitor: Week of May 16th, Released: 05/19/2025 12:00