Econ Mornings: May 21st, 2025

Macro releases and commentary released the morning of May 21st, 2025

(all times are in EST)

Japanese Manufacturing Sentiment Declines

Released: May 20, 2025 18:00 - Link

April's Reuters Tankan survey revealed a softening in Japanese manufacturing sentiment, with the index declining 1 point to 8, reflecting persistent concerns surrounding trade tariffs and their impact on export-oriented sectors like automotive and machinery. While the non-manufacturing index remained stable at 30, near-term expectations point to further deterioration across transport and metal products, driven by ongoing tariff anxieties, rising inflation, and decelerating growth in China. Elevated labor and raw material costs are compounding the challenges, although inbound tourism offered a small measure of support for some businesses.

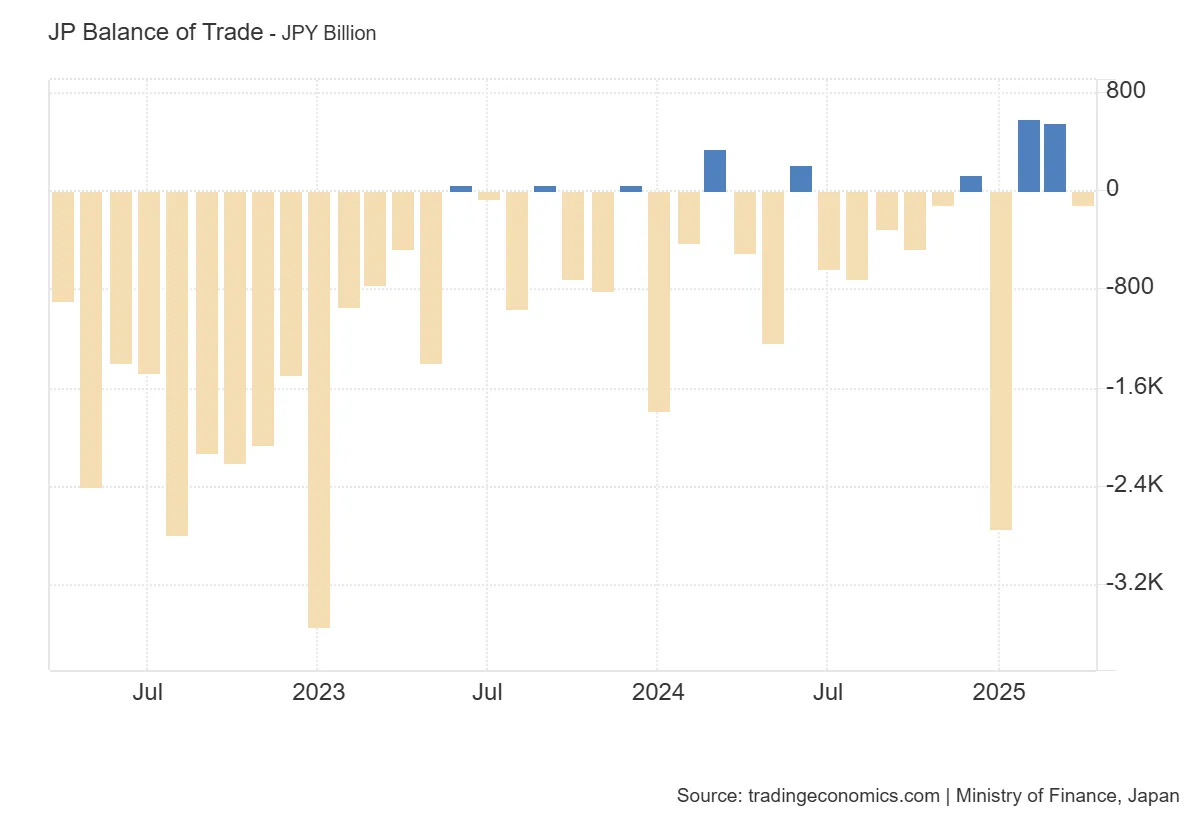

Japan's Trade Balance Swings to Deficit

Released: May 20, 2025 18:50 - Link

April's trade data revealed a substantial deterioration in Japan's trade balance, shifting from a significant surplus to a deficit of ¥115.8 billion amid weaker-than-expected performance. While export values edged up 2.0% YoY, the monthly decline of 7.0% MoM, coupled with import resilience, only falling 0.3% MoM and 2.2% YoY, drove the unexpected shift. Export weakness was partly attributable to a 5.6% MoM drop in shipments to the US, offsetting gains of 6.0% YoY to Asia, particularly strong increases to Hong Kong and Taiwan. The divergence between export and import trends suggests evolving global demand patterns and poses a potential headwind for Japan's economic recovery.

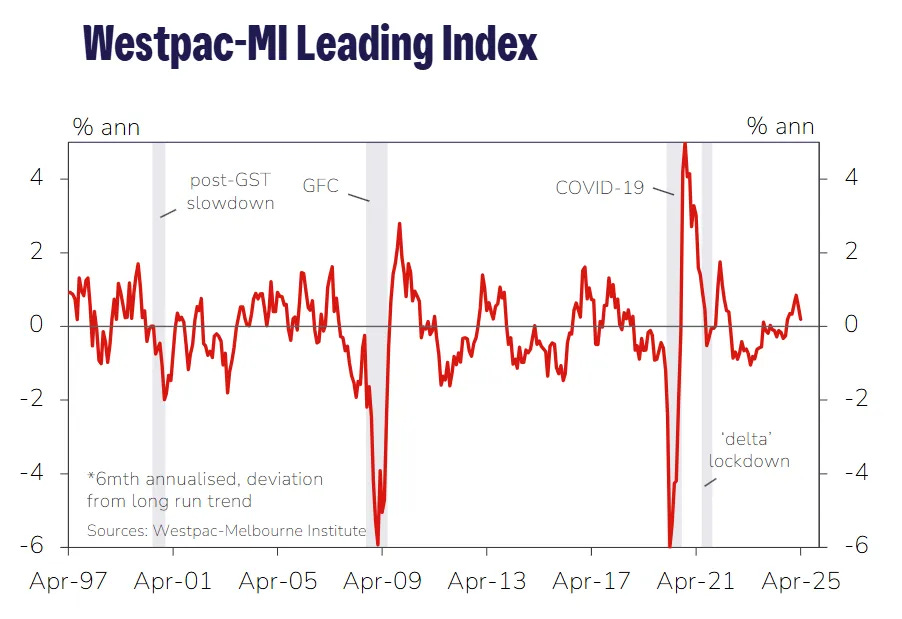

Slowing Momentum Signals Economic Deceleration

Released: May 20, 2025 19:00 - Link

The Westpac-Melbourne Institute Leading Index's six-month annualised growth rate decelerated to a concerning 0.2% in April, reflecting a diminishing pace of economic momentum driven by weakening consumer sentiment, equity markets, and rising unemployment expectations, alongside declines in dwelling approvals and hours worked. While commodity prices, US industrial production, and the yield spread provided marginal support, these factors are showing signs of slowing. Consequently, Westpac anticipates a 1.9% YoY GDP growth by the close of 2025, with the Reserve Bank of Australia likely to maintain its current monetary policy stance pending further inflation data.

UK Inflation Surges in April

Released: May 21, 2025 02:00 - Link

UK inflation unexpectedly surged in April, with the headline CPI index rising 1.2% MoM and reaching 3.5% YoY, driven primarily by soaring household utility bills and holiday travel costs, particularly airfares related to Easter timing and a regulatory price cap increase. Core inflation also accelerated, posting a 1.4% MoM and 3.8% YoY increase, demonstrating persistent underlying price momentum despite softer goods inflation. While goods prices remain relatively subdued, services inflation continues to run hot, reflecting strong consumer finances and wage pressures within the service sector, which puts the Bank of England's recent interest rate cut into question and forces a reassessment of the inflation outlook.

Mortgage Applications Decline Amid Rising Rates

Released: May 21, 2025 07:00 - Link

Last week's MBA Mortgage Applications Composite Index experienced a notable decline, reflecting the impact of rising interest rates. Both purchase and refinance activity weakened, with the Purchase Index down -5.2% WoW and the Refinance Index falling -5.1% WoW. While total applications remain elevated compared to levels four weeks prior, purchase applications up 4.4% and refinance up 1.3%, the latest data signals a softening trend as the 30-year fixed rate climbed 6 bps to 6.92% and the 15-year rate increased 9 bps to 6.21%, contributing to the -5.7% WoW drop in purchase applications and a -5.0% WoW decline in refinance activity.

Canadian New Home Prices Decline

Released: May 21, 2025 08:30 - Link

April's new housing price index data revealed a concerning trend in Canada's residential construction sector, with a steeper-than-anticipated decline of 0.4% MoM, contrasting with market expectations of a more modest 0.1% rise. This result, coupled with the broader YoY figure now registering a decrease of 0.6%, a notable shift from the previous 0.1% increase and the lowest reading since January 2024, suggests that the upward pressure on new home prices has faded considerably, potentially signaling a softening in demand or rising construction costs impacting builder margins.

Unexpected U.S. Crude Oil Inventory Build

Released: May 21, 2025 10:30

Last week's Petroleum Status Report revealed a surprising build in U.S. crude oil inventories, contrasting with anticipated draws, although overall inventories remain notably below both year-ago and historical averages. While refinery activity and utilization rates showed some improvement, reflected in a modest rise in the 4-week average, total products supplied over the last month weakened, particularly for distillates, offsetting gains in jet fuel demand. Increased crude imports contributed to the inventory build, while the 4-week average for crude imports continues to trend lower YoY, suggesting some softening in external demand pressures.

Persistent Inflation Expectations Remain

Released: May 21, 2025 11:00 - Link

Business inflation expectations eased modestly to 2.5% in May, according to the Atlanta Fed, despite a slight recovery in sales, as firms reported profit margins dwindling to their weakest point since late 2023. While YoY unit cost growth accelerated to 2.3%, firms signaled continued pricing pressure, with the median firm anticipating a 4.0% price increase over the next 12 months, the most significant expectation since late 2022, suggesting persistent cost challenges and a potential for ongoing inflationary pressures within the economy.

U.S. M&A Declines in April

Released: May 21, 2025 12:00 - Link

April witnessed a contraction in U.S. M&A activity, with deal announcements falling -1.6% MoM and aggregate spending declining notably, suggesting a cautious investment climate. While a few sectors, including Technology Services, Health Technology, Miscellaneous, and Consumer Non-Durables, demonstrated increased activity over the past three months, a broader trend revealed weakness, particularly in Finance, Commercial Services, Consumer Services, Distribution Services, and Industrial Services, which experienced substantial declines in deal volume YoY.

Other data releases and commentary:

Spain Services Sector Activity Indicators: March 2025, Released: 05/21/2025 04:00

Spain Industrial Turnover Indices: March 2025, Released: 05/21/2025 04:00

Significant Headwinds to Consumer Spending, Released: 05/21/2025 07:00

AAR Weekly Rail Traffic: Week of May 17th, Released: 05/21/2025 12:00