Econ Mornings: May 23rd, 2025

Macro releases and commentary released the morning of May 23rd, 2025

(all times are in EST)

UK Consumer Confidence Improves

Released: May 22, 2025 19:00 - Link

May's GfK UK Consumer Confidence Index registered a notable increase, defying expectations and signaling a potential shift in household sentiment. While expectations for the broader economy remain subdued, particularly when viewed against last year's performance, improvements across all sub-components, notably a first positive outlook on personal finances in over a year and the strongest Major Purchase Index since late 2024, suggest that consumers are cautiously more optimistic. The slight decline in the Savings Index, coupled with continued positive readings, indicates a willingness among households to prioritize spending rather than solely focusing on bolstering savings, a development that could offer support to economic activity.

Japan Inflation Remains Elevated

Released: May 22, 2025 19:30

Japan's headline consumer price index edged up 0.4% MoM and remained at 3.6% YoY in April, despite a decline in food prices, largely influenced by a significant rise in energy costs and broad-based price pressures. Excluding fresh food, inflation accelerated to 3.5% YoY, the strongest reading since January 2023, propelled by a substantial monthly jump in household durable goods and noticeable increases across categories like clothing, footwear, and recreation, suggesting a widening scope of inflationary pressures that may complicate the Bank of Japan's policy outlook.

UK Retail Sales Show Unexpected Strength

Released: May 23, 2025 02:00 - Link

April's UK retail sales data revealed a surprisingly robust performance, with volumes climbing 1.2% MoM and 5.0% YoY, surpassing expectations and marking the fourth successive monthly rise to the highest level in nearly two years. While food store sales experienced a notable 3.9% MoM surge driven by weather conditions, non-food retailers saw a slight 0.7% MoM decline, partially dampened by weakness in clothing despite gains in other segments. The three-month moving average saw an encouraging 1.8% QoQ increase, although online spending values dipped 0.3% MoM despite a strong 6.1% YoY gain, contributing to a slight reduction in online sales' share of the total retail market and overall total retail spend rising 0.7% MoM.

Spain's Business Turnover Shows Mixed Trends

Released: May 23, 2025 02:00 - Link

Spain's Business Turnover Index demonstrated a mixed picture in March 2025, registering a negligible 0.0% MoM change while still exhibiting a robust 5.5% YoY increase, a deceleration from February's 6.7% figure. Disparities across sectors were notable, with electricity and water supply turnover leading growth at 37.2% YoY and 7.4% MoM, contrasted by the extractive and manufacturing industries which saw minimal YoY growth of just 0.4% and a -1.0% MoM decline. The wider picture of strength is partially influenced by base effects, as evidenced by the unadjusted BTI's 8.9% YoY rise despite the flat monthly reading, suggesting a gradual cooling in overall business activity.

French Consumer Sentiment Declines

Released: May 23, 2025 02:45 - Link

French consumer sentiment weakened considerably in May 2025, as evidenced by a 3-point decline in the consumer confidence index to 88, significantly below its historical average. The pronounced drop reflects increasing concerns regarding personal finances and major purchases, exacerbated by a sharp deterioration in expectations for the future standard of living, reaching a level unseen since early 2023, and a surge in anxieties about unemployment. Despite modest declines in perceived saving capacity, heightened worries about job security and a rebound in perceived past inflation, coupled with only a marginal easing of future inflation expectations, suggest a growing sense of economic fragility among French households.

Spain's Services Sector Shows Strong Growth

Released: May 23, 2025 03:00 - Link

Spain's services sector demonstrated robust momentum in March 2025, with the Production Index climbing 0.7% MoM and a noteworthy 5.1% YoY, building on prior gains. The unadjusted YoY figure, at 6.6%, highlights the underlying strength, particularly within the trade sector which saw exceptionally strong performance. While other services showed solid, albeit more moderate, gains, the acceleration in monthly growth, a 1.3 pt increase, signals a broadening recovery and suggests upward revisions to near-term economic forecasts are warranted.

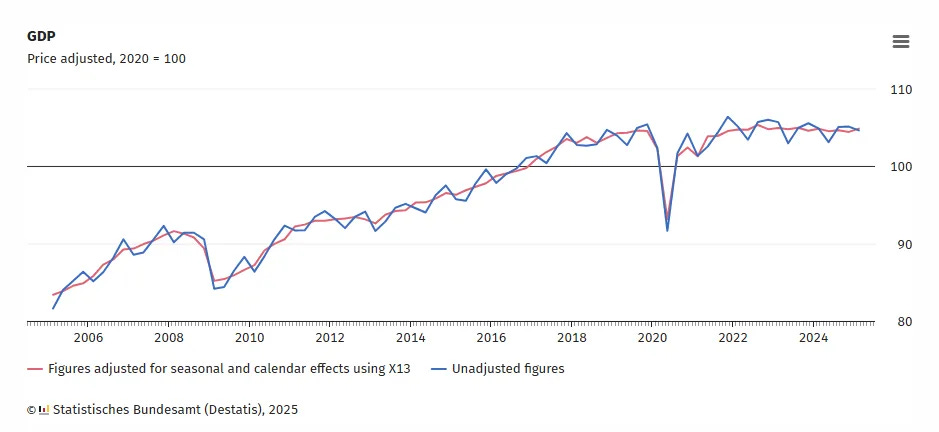

German GDP Growth Stronger Than Initially Estimated

Released: May 23, 2025 04:00 - Link

Germany's finalized GDP data for Q1 2025 reveal a stronger-than-previously-anticipated expansion, revised to 0.4% QoQ and 0.0% YoY, marking the best quarterly performance since Q2 2022. This upward revision, attributed to unexpectedly robust activity in March, was driven by a 3.2% QoQ rise in exports and gains in manufacturing, trade, and information services, partially offset by a 3.2% QoQ decline in gross capital formation stemming from inventory changes. While final consumption increased, boosted by household spending, positive productivity growth of 0.4% QoQ per employee and 0.5% QoQ per hour worked provides limited offset to the continuing negative annual productivity trends.

China's FDI Continues to Decline

Released: May 23, 2025 05:00 - Link

Foreign direct investment into China continued its downward trend in April, with year-to-date flows declining -10.9% YoY, a modest worsening from the -10.8% YoY decline recorded in March. This persistent contraction in FDI signals ongoing challenges for the Chinese economy, potentially reflecting concerns about geopolitical factors, domestic growth prospects, and the evolving regulatory landscape impacting investor sentiment.

G20 Trade Shows Mixed Performance

Released: May 23, 2025 06:00 - Link

First-quarter 2025 G20 merchandise trade demonstrated positive momentum, with exports rising 2.0% QoQ and imports accelerating by 3.1% QoQ, suggesting a continued expansion in global demand. However, early data on services trade reveals a more uneven performance; exports edged down -0.7% QoQ while imports grew 1.0% QoQ, potentially signaling shifting patterns in service consumption and provision within the G20 economies.

March Canadian Retail Sales Show Unexpected Gains

Released: May 23, 2025 08:30 - Link

March retail sales demonstrated surprising resilience, advancing 0.8% MoM to $69.8 billion, largely propelled by a significant surge in motor vehicle and parts dealer activity. While core retail sales showed more moderate growth of 0.2% MoM, with building materials and apparel notably strong, general merchandise sales declined. Volume sales outpaced nominal gains, suggesting price pressures remain contained, evidenced by a 1.6% YoY decrease in gasoline prices. Despite the overall positive performance, e-commerce sales experienced a contraction, now representing a smaller portion of total sales, and provincial performance was mixed, with Quebec leading gains and Manitoba experiencing a decline. Looking ahead, the preliminary indication is that retail sales will continue on an upward trajectory, rising another 0.5% MoM in April.

US New Home Sales Show Unexpected Growth

Released: May 23, 2025 10:00

April's surprisingly robust increase in US new home sales, climbing 10.9% MoM and 3.3% YoY to a SAAR of 743k, suggests continued resilience in the housing market despite a -1.2% YTD decline. While inventory remains elevated, indicated by a months' supply of 8.1x, the sharp MoM jump in sales points to strengthening demand, likely driven by lower mortgage rates and shifting buyer preferences. Price movements were mixed; the median sales price edged higher MoM but remains below last year's level, while average sales prices saw modest gains both MoM and YoY, signaling a potential divergence in buyer demographics and product mix.

Tenth District Service Sector Shows Increased Activity

Released: May 23, 2025 11:00 - Link

The Kansas City Fed's May Services Survey reveals a notable uptick in Tenth District service-sector activity, evidenced by an 8-point rise in the composite index to 11, fueled by a substantial surge in revenue and sales. While input price pressures have eased slightly MoM, rising selling prices and increased pricing volatility, driven by ongoing tariff and supply chain complexities, suggest persistent inflationary pressures. Despite robust hiring momentum and a rebound in capital expenditures, credit conditions remain constrained, and although firms generally maintain optimistic expectations for the year, a significant portion are adjusting prices more frequently, indicating sensitivity to shifting economic conditions.

Housing Boosts Q2 2025 GDP Nowcast

Released: May 23, 2025 11:45

The New York Fed's nowcast for Q2 2025 GDP growth edged up to 2.43%, reflecting a modestly improved outlook for the current quarter. This small revision was almost entirely driven by a surprisingly robust increase in single-family home sales, which contributed 7 bps to the upward adjustment. The absence of significant movements in other macroeconomic indicators suggests a quiet week for broader economic signals, placing particular emphasis on the housing market's recent performance as a key determinant of near-term growth.

Other data releases and commentary:

Minimizing residual CO2 emissions in 2050, Released: 05/23/2025 06:00

AI Bubble Fueled by Zero Interest Rates, Released: 05/23/2025 07:00

Skate to where the puck is going to be, Released: 05/23/2025 12:00