Econ Mornings: May 27th, 2025

Macro releases and commentary released the morning of May 27th, 2025

(all times are in EST)

Japanese Services Inflation Shows Mixed Signals

Released: May 26, 2025 18:50 - Link

April's Services Producer Price Index data reveals a mixed picture for the Japanese economy. While the headline SPPI rose 0.5% MoM and 3.1% YoY, a moderation from the prior month's pace, the exclusion of international transportation shows persistent inflationary pressures within the domestic services sector, rising 0.6% MoM and 3.3% YoY. The notable surge in hotel prices, alongside a strong increase in core service sectors experiencing high labor costs, up 1.3% MoM and 3.5% YoY, suggests that demand-driven inflation remains a factor. However, a substantial decline in advertising services, particularly within online and print media, and significant drops in international transportation prices partially offset these gains, indicating a degree of sectoral weakness.

China Industrial Profits Show Mixed Signals

Released: May 26, 2025 20:30 - Link

China's industrial sector demonstrated resilience in Jan-Apr 2025, with profits climbing 1.4% YoY to ¥2.12 trillion, fueled primarily by robust gains in manufacturing and specific sectors like agricultural food processing and electrical machinery. However, this positive headline masks underlying weaknesses, particularly within the mining sector, where profits plummeted 26.8% YoY due to commodity price pressures. While private enterprise profits improved, state-owned enterprises experienced a decline, and rising costs, outpacing operating income growth, compressed profit margins to 4.87%. Concerningly, inventory turnover days increased and accounts receivable collection periods lengthened, suggesting potential headwinds related to working capital management that require close monitoring.

Japan's Inflation Trends Upward

Released: May 27, 2025 00:00

Japan's underlying inflation metrics continued their upward trend in April, signaling persistent price pressures within the economy. Trimmed mean CPI inflation reached 2.4% YoY, while weighted median and mode CPI inflation climbed to 1.7% and 1.8% YoY, respectively, all marking their highest levels since January 2024. The broad-based nature of this inflation is further underscored by the significant increase in the share of items experiencing price increases, reaching 80.3% and representing the second-highest proportion observed over the past year.

EU Auto Sales: Electrification Drives Growth Amidst Overall Decline

Released: May 27, 2025 00:30 - Link

April's ACEA data reveals a complex automotive landscape across the EU, where a modest 1.3% YoY rise in new car registrations masks an underlying -1.2% decline YTD. While overall sales remain subdued, electrification continues to advance, particularly for BEVs, which saw robust 26.4% YTD growth fueled by significant gains in Germany, Belgium, and the Netherlands, though offset by weakness in France. Hybrid-electric vehicles are also experiencing substantial growth, bolstered by particularly strong performance in France and Spain, while traditional internal combustion engine vehicles face persistent headwinds, with petrol registrations down -20.6% and diesel sales plummeting -26.4% YTD, reflecting a significant shift in consumer preference and regulatory pressures.

German Consumer Sentiment Improves Slightly

Released: May 27, 2025 02:00 - Link

Germany's consumer climate is showing signs of tentative improvement, with the GfK Indicator set to rise to -19.9 in June, although the reading remains subdued. The shift is primarily driven by rising income expectations, bolstered by wage gains and decelerating inflation, and a notable uptick in economic expectations, both at their highest levels in several months. However, consumers are tempering optimism; willingness to buy remains constrained, and a continued emphasis on savings reflects ongoing anxieties surrounding the trade environment and labor market dynamics.

French Inflation Eased in May

Released: May 27, 2025 02:45 - Link

France's preliminary May 2025 CPI data reveal a surprising easing of inflationary pressures, with the headline index declining -0.1% MoM and the YoY rate falling to 0.7%, well below consensus. This deceleration was largely driven by continued declines in energy prices, particularly petroleum and gas, alongside a moderation in services inflation, specifically in transport and communication. While food inflation ticked higher to 1.3% YoY, the easing of fresh food price increases partially offset this, and manufactured goods prices remained subdued. The broader HICP followed a similar trend, falling -0.2% MoM and decelerating to 0.6% YoY, suggesting a broader disinflationary trend in the French economy.

Euro Area Sentiment Improves, Inflation Expectations Ease

Released: May 27, 2025 05:00 - Link

May's data reveal a strengthening, albeit uneven, macroeconomic picture for the euro area, as the Economic Sentiment Indicator surpassed expectations at 94.8, fueled by a rebound in employment expectations and a notable improvement in consumer confidence driven by eased concerns about the economic outlook and purchase intentions. While retail trade confidence rose considerably, future business expectations tempered this optimism, and industry and services confidence remained largely unchanged. Importantly, declining selling price and consumer price expectations, alongside a substantial drop in the Economic Uncertainty Indicator, suggest easing inflationary pressures and reduced anxiety among businesses and households, signaling a potentially more favorable environment for future growth.

Canadian Business Confidence Declines Amid Cost Pressures and Trade Concerns

Released: May 27, 2025 08:00 - Link

Canadian business confidence weakened considerably in Q2 2025, registering the lowest level since early 2024, reflecting persistent cost pressures and emerging trade-related anxieties. Elevated cost-related hurdles, particularly concerning raw material prices which increased YoY, alongside labour-related challenges requiring increased management hours, are significantly impeding growth. Expectations for sales growth over the next 3 months have diminished, while a substantial proportion of businesses plan price increases to offset these burdens; this is further complicated by anticipations of substantial impacts from both U.S. tariffs and Canadian counter-tariffs, compelling a focus on cost reduction across the business sector.

Canada’s Wholesale Sales Decline in April

Released: May 27, 2025 08:30 - Link

April's preliminary wholesale sales data reveal a concerning -0.9% MoM contraction, marking the initial downturn in this key indicator since August 2024. The decrease is primarily attributable to weaker performance within the motor vehicle and related components subsector. While the preliminary nature of the estimate is important to acknowledge, the figures warrant close monitoring, especially considering the lower-than-average weighted response rate of 55.0% compared to the 12-month average of 82.3%, which introduces a degree of uncertainty around the overall magnitude of the contraction.

Durable Goods Orders Signal Manufacturing Slowdown

Released: May 27, 2025 08:30

April's preliminary data revealed a sharper-than-anticipated decline of 6.3% MoM in US durable goods new orders, though this exceeded expectations and remained positive on a 4.2% YoY basis. While transportation equipment orders plummeted 17.1% MoM, driven by significant drops in motor vehicles and nondefense aircraft, ex-transport orders showed surprising resilience with a slight gain of 0.2% MoM, underpinned by strength in machinery, fabricated metal products, and electronics. The concerning drop of 1.3% MoM in nondefense capital goods (ex-aircraft) and the continued weakness in shipments, down 0.4% YoY, suggest potential headwinds for future manufacturing activity, though increasing inventories and a slight uptick in monthly shipments offer a modicum of offset.

Housing Market Shows Signs of Cooling

Released: May 27, 2025 09:00 - Link

March's FHFA House Price Index data revealed a softening housing market, with a -0.1% MoM decline marking the first monthly contraction since January 2024 and falling short of anticipated gains. While the YoY increase remains positive at 3.7%, it represents a deceleration from February's reading and the broader Q1 2025 performance, which saw a muted 0.7% QoQ and 4.0% YoY growth, the lowest quarterly rate since Q4 2022. Regional performance was mixed, with notable weakness in the East North Central and Mountain regions, contrasting with stronger gains in the Middle Atlantic and East South Central divisions.

Home Price Appreciation Moderates

Released: May 27, 2025 09:00 - Link

The latest S&P Case-Shiller Home Price Index data reveal a moderation in U.S. home price appreciation, with the National Index declining -0.3% MoM while still registering a 3.4% YoY increase, a slowdown from the previous month's 4.0% gain. Both the 20-City and 10-City composites also showed reduced YoY growth, falling below anticipated levels, though non-seasonally adjusted monthly figures paint a slightly more optimistic picture. Regional performance varied considerably, with New York, Chicago, and Cleveland exhibiting strong YoY gains, offset by a -2.2% decline in Tampa, and suggesting localized impacts despite ongoing support from constrained housing supply and elevated mortgage rates.

Easing Gasoline Prices Expected to Stabilize

Released: May 27, 2025 09:00 - Link

Gasoline prices softened slightly this week, with the national average falling to $3.131, though remaining elevated 3.1 cents MoM and significantly lower YoY. Diesel prices also decreased, settling at $3.476. Despite a milder-than-expected decline leading into the Memorial Day holiday, current prices represent some of the most accessible levels since 2021, particularly when considering inflation. Looking ahead, expectations point toward a period of relative price stability as refinery maintenance concludes, with forecasts limiting movement between $3.00 and $3.30 per gallon. Potential disruptions from the upcoming hurricane season and OPEC+ production decisions will continue to warrant close observation.

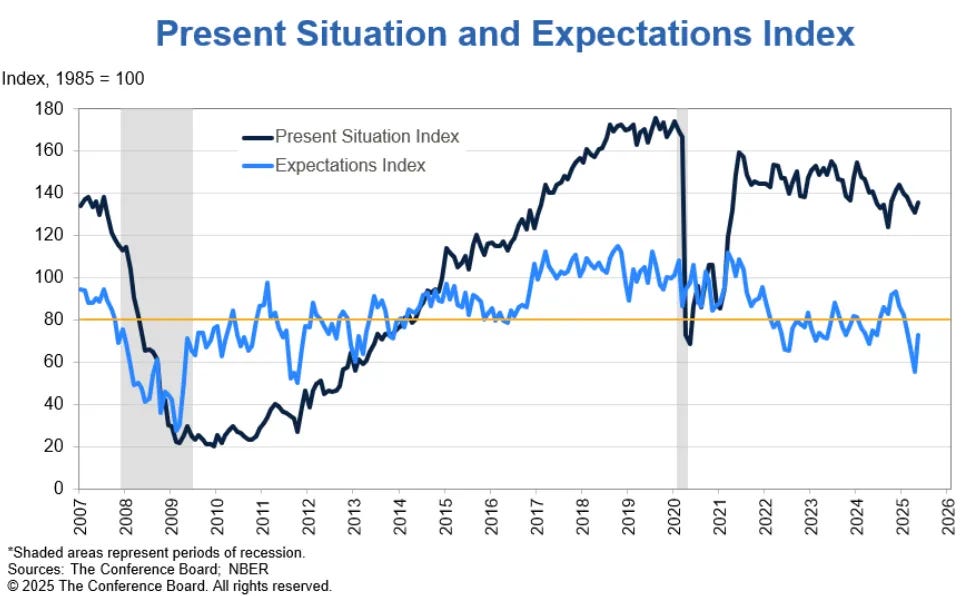

Consumer Confidence Rebounds on Optimism

Released: May 27, 2025 10:00 - Link

May's Consumer Confidence Index saw a significant rebound to 98.0, fueled by a substantial 17.4-point jump in the Expectations Index and a solid 4.8-point increase in the Present Situation Index, both exceeding forecasts. A notable shift in consumer sentiment reflects a more optimistic outlook on stock market performance, alongside easing inflation expectations and reduced recession anxieties. Improved spending intentions across key categories, notably supported by the recent easing of US-China tariffs, suggest a potential bolstering of near-term consumer activity despite ongoing affordability concerns.

US Auto Sales: May Slowdown Expected

Released: May 27, 2025 10:00 - Link

Cox Automotive's May 2025 US auto sales forecast indicates a likely seasonal deceleration following a robust April, with a sales pace of 16.0 million units, representing a modest increase YoY and a pullback from the prior month. Volume is anticipated at 1.50 million units, demonstrating a 3.2% rise YoY and a 2.5% gain from April, but the firm expects May to mark the final period benefitting from pull-ahead sales, signaling a broader softening in sales momentum throughout the remainder of the year.

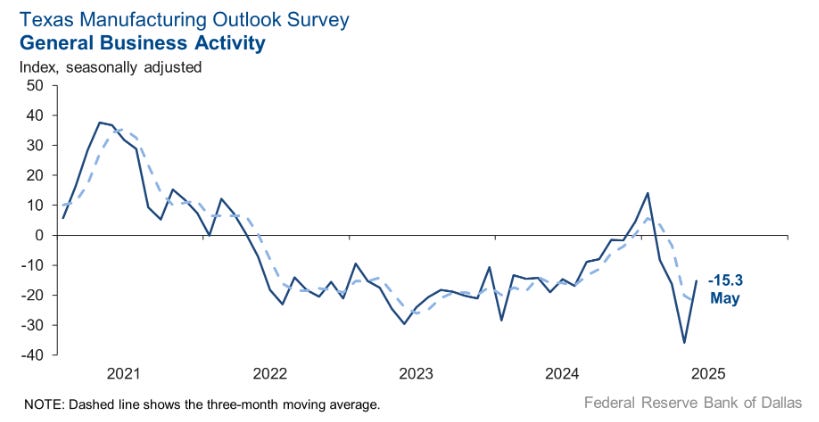

Texas Manufacturing Shows Moderated Contraction

Released: May 27, 2025 10:30 - Link

Texas manufacturers reported a moderated contraction in May, as evidenced by a significant jump in the General Business Activity Index, though production itself remained largely unchanged. While improved sentiment, reflected in rising Company Outlook and reduced uncertainty, and a rebound in new orders offer a glimmer of optimism, persistent inflationary pressures, with Prices Paid and Prices Received remaining high despite a slight easing in raw material costs, continue to constrain activity. Firms are cautiously optimistic about future conditions, with forward-looking indexes showing notable gains, yet lingering trade barriers, as highlighted by anecdotal commentary, continue to negatively impact profitability and overall sales volume.

Consumer Sentiment Reflects Fiscal Uncertainty

Released: May 27, 2025 11:00

April's SCE Public Policy Survey reveals a notable shift in consumer sentiment reflecting heightened anxieties surrounding government programs and potential fiscal adjustments. Expectations for cuts across a range of federal benefits, including housing assistance, student aid, and Social Security, reached record highs, alongside increased worries about reductions in Medicare. While anticipated declines in certain taxes experienced a minor pullback, they remain near historical peaks, contributing to a broader feeling of fiscal uncertainty. Critically, the perceived probability of an expansion in Medicare has diminished significantly QoQ, suggesting a diminished expectation of further government support within the healthcare system.

Container Volume Rebound and Supply Chain Volatility

Released: May 27, 2025 12:00 - Link

Transpacific container volumes are experiencing a rapid rebound following April's trade war-induced slump, driven by a combination of pent-up demand from previously paused shipments, accelerated holiday order fulfillment ahead of the August pause expiration, and a substantial backlog of manufactured goods in China. While the initial deescalation spurred this resurgence, lingering trade war anxieties persist among small and medium-sized businesses, and the administration's recent tariff announcements, targeting smartphones and potentially escalating reciprocal tariffs with the EU, continue to inject volatility into the global supply chain. This sudden surge in demand, exacerbated by port congestion and logistical constraints from repositioning vessels, has led to significant upward pressure on container rates, with FBX rates climbing sharply last week and further increases anticipated, while declining de minimis rules and the resulting decrease in Chinese exports are negatively impacting air cargo rates on the China-US lane.

Other data releases and commentary:

Number of Days Working From Home per Week, Released: 05/27/2025 07:00

Cox Automotive Auto Market Report: May 27th, Released: 05/27/2025 10:00

Auto Market Weekly: Week of May 26th, Released: 05/27/2025 10:00