Econ Mornings: May 28th, 2025

Macro releases and commentary released the morning of May 28th, 2025

(all times are in EST)

Australian Construction Shows Mixed Q1 Performance

Released: May 27, 2025 21:30 - Link

Australia's construction sector demonstrated a nuanced performance in Q1 2025, with total work done unchanged QoQ at $74.43 billion, though still reflecting a positive 3.5% increase YoY. While residential construction fueled a 0.9% QoQ rise in building work and contributed significantly to the annual expansion, non-residential building activity softened, experiencing a slight decline both QoQ and YoY. Engineering work also retreated QoQ, albeit from a robust position, maintaining a healthy 4.5% YoY gain. The trend estimate suggests underlying momentum remains positive, pointing to a 0.7% QoQ rise, despite the quarterly standstill.

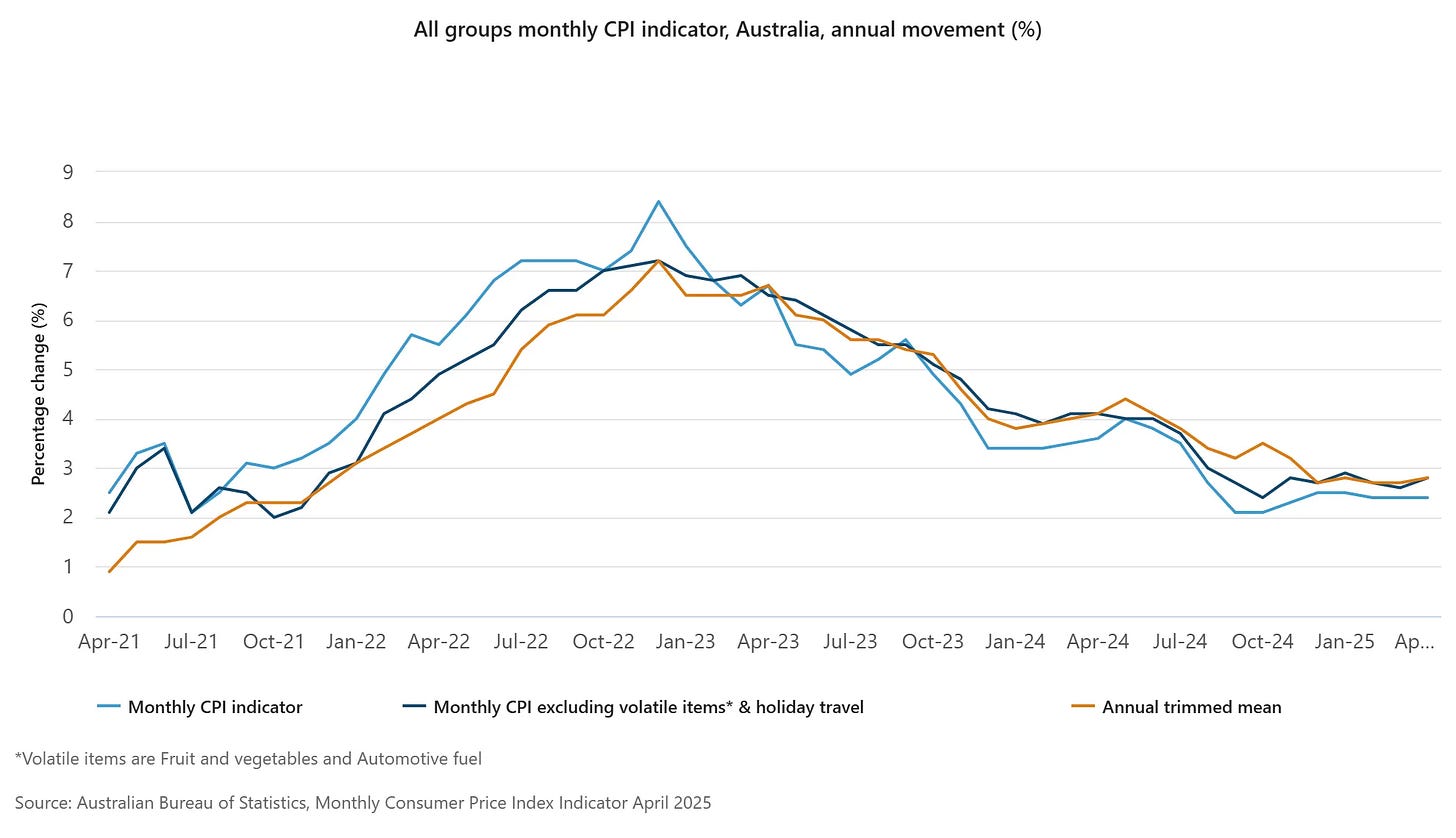

Persistent Inflation Pressures in Australia

Released: May 27, 2025 21:30 - Link

April's CPI data revealed persistent inflationary pressures in Australia, with headline inflation remaining at 2.4% YoY, slightly above anticipated declines. Core measures, including trimmed mean and excluding volatile items, accelerated to 2.8% and 2.6% YoY, respectively, masking some relief from easing food costs, particularly in non-alcoholic beverages. While transport costs contributed to downward pressure with automotive fuel prices continuing their decline, rising rents, gas, and a rebound in recreation and culture spending, notably holiday travel and accommodation, suggest underlying demand remains robust and complicates the policy outlook.

German Trade Prices Signal Disinflationary Trend

Released: May 28, 2025 02:00 - Link

Germany's trade prices displayed a disinflationary trend in April, as import prices fell significantly, driven primarily by a sharp drop in energy costs, particularly crude oil, hard coal, and mineral oil, partially offsetting earlier increases. While overall export prices remained positive YoY, the MoM decline in energy exports suggests waning external demand. Consumer goods continue to be a key driver of both import and export price movements, with notable inflation in food items contrasting with weakness in mineral oil products; this divergence highlights an evolving picture of German trade competitiveness amid fluctuating commodity markets.

France's Q1 Growth Masked by Inventory Build

Released: May 28, 2025 01:30 - Link

France's Q1 2025 GDP growth was finalized at a modest 0.1% QoQ, rebounding from a contraction in the prior quarter but largely fueled by a substantial inventory build of 1.0 ppt, masking underlying weakness. Domestic demand proved a headwind, with household consumption declining -0.2% QoQ, particularly hampered by a steep fall in transport equipment spending, while GFCF remained flat despite gains in IT/communications. A significant deterioration in net trade, with exports falling -1.8% and imports rising slightly, subtracted -0.8 ppt from overall growth. Despite a small increase in household purchasing power, a rising savings rate of 18.8% and declines in employment and hours per job suggest continued consumer caution, and falling value-added prices contributed to a slight compression of non-financial corporate profit margins to 31.8%, although the general government borrowing requirement improved to 5.6% of GDP.

Weak French Labor Market Persists

Released: May 28, 2025 02:45 - Link

France's labor market demonstrated continued weakness in Q1 2025, with private payroll employment decreasing by 28.7k and total employment falling 20.9k, underscoring concerns about underlying economic momentum. The -0.1% QoQ decline in total employment, slightly below consensus expectations, was driven by broad-based weakness across market services, particularly in other services, ICT, and wholesale/retail, alongside a ninth consecutive quarterly contraction in construction. While public sector employment offered partial offset with a 7.8k increase, the labor market's overall trajectory remains challenged by falling temporary and fixed-term contracts, coupled with declining employment across most age groups except for workers aged 55 and above.

French Household Goods Consumption Shows Modest Recovery

Released: May 28, 2025 02:45 - Link

April's household goods consumption in France demonstrated a modest recovery, rising 0.3% MoM following a substantial March contraction, although the result missed expectations. While food spending surged 2.1% MoM, bolstered by increased demand for agri-food products, gains were mixed across other categories; engineered goods and transport equipment saw increases, while energy consumption plummeted -3.6% MoM reflecting warmer weather. Despite the monthly uptick, broader trends reveal an ongoing weakness in the sector, with overall goods consumption still showing declines both QoQ and YoY, signaling persistent headwinds for French consumer spending.

French Producer Prices Decline

Released: May 28, 2025 02:45 - Link

France's producer price index experienced a notable contraction in April, falling sharply by 3.9% MoM and 1.3% YoY, primarily due to significant drops in electricity and petroleum prices both domestically and internationally. While food and beverage prices exhibited modest gains, the broader industrial PPI excluding energy decelerated, registering a 0.3% MoM decline and slowing to a 1.2% YoY increase. This downward pressure was further amplified by falling import prices, particularly for petroleum products and other manufactured goods, suggesting weakening demand and contributing to overall disinflationary pressures within the French economy.

French Trade Sales Show Signs of Stabilization

Released: May 28, 2025 02:45 - Link

French trade sales showed signs of stabilization in March, with a 0.4% MoM increase following a February downturn, supported by broad-based gains across retail, wholesale, and motor vehicle sectors. While overall trade volume remains down -0.8% YoY and Q1 trade volume declined -0.8%, the March rebound, particularly in specialized retail and agricultural raw materials, suggests underlying resilience. Motor vehicle sales, however, continue to lag, contributing to the annual decline, although early indications of a further 0.3% MoM rise in April retail sales offer a cautiously optimistic view of near-term consumer demand.

Germany's Labor Market Shows Weakening Trends According to Destatis

Released: May 28, 2025 03:55 - Link

Germany's labor market demonstrated a concerning divergence in April, with seasonally adjusted employment flat MoM at 45.8 million and down a marginal -0.1% YoY, while unadjusted figures showed a smaller, positive MoM gain overshadowed by a larger -61k YoY decline. Although the adjusted unemployment rate held at 3.6%, the unadjusted rate climbed to 3.8%, reflecting a substantial rise in the number of unemployed individuals, up 0.6 ppt YoY and exhibiting an 18.2% increase in the number of unemployed, suggesting underlying weakness in the broader economy despite the stability in the headline adjusted figures.

Weakening German Labor Market According to Bundesagentur für Arbeit

Released: May 28, 2025 03:55 - Link

The German labor market demonstrated considerable weakness in May, with unemployment increasing by 34k and totaling a YoY rise of 197k, despite the unemployment rate remaining steady at 6.3%. Declines in registered job vacancies and underemployment, coupled with a significant drop in the BA Job Index, suggest a softening demand for labor and reinforce concerns regarding the broader economic outlook. The increasing number of individuals receiving unemployment benefits, up 95k YoY, alongside the Bundesagentur für Arbeit's assessment of a lackluster spring revival and expectation of further unemployment increases this summer, points to an ongoing deterioration in labor market conditions.

ECB Survey Signals Diminishing Confidence

Released: May 28, 2025 04:00 - Link

The latest ECB Consumer Expectations Survey reveals a concerning shift in sentiment, as near-term inflation expectations edged higher to 3.1% YoY, signaling persistent price pressures despite efforts to curb them. This coincides with a decline in nominal income growth expectations and a notable divergence between income and spending forecasts, suggesting potential strain on household finances. Pessimism regarding the economic outlook is also evident, with lowered growth expectations and a rising unemployment rate expectation, coupled with heightened expectations for home price and mortgage rate increases. Furthermore, a significant proportion of households perceive and anticipate increased difficulty accessing credit, contributing to a broader picture of economic fragility and dampened confidence.

India's Industrial Production Accelerates

Released: May 28, 2025 05:30 - Link

April industrial production data reveal a surprising acceleration in India's industrial sector, rising 2.7% YoY, exceeding prior expectations despite a moderation from March's stronger 3.9% pace. The expansion was largely driven by robust manufacturing, particularly in machinery, motor vehicles, and electrical equipment, alongside a significant jump in capital goods production. Counterbalancing this positive trend were contractions in mining activity and a slowing in electricity generation. While consumer durables showed some strength, declining consumer non-durables and marginal shifts in primary goods were observed, suggesting uneven performance across various industrial segments.

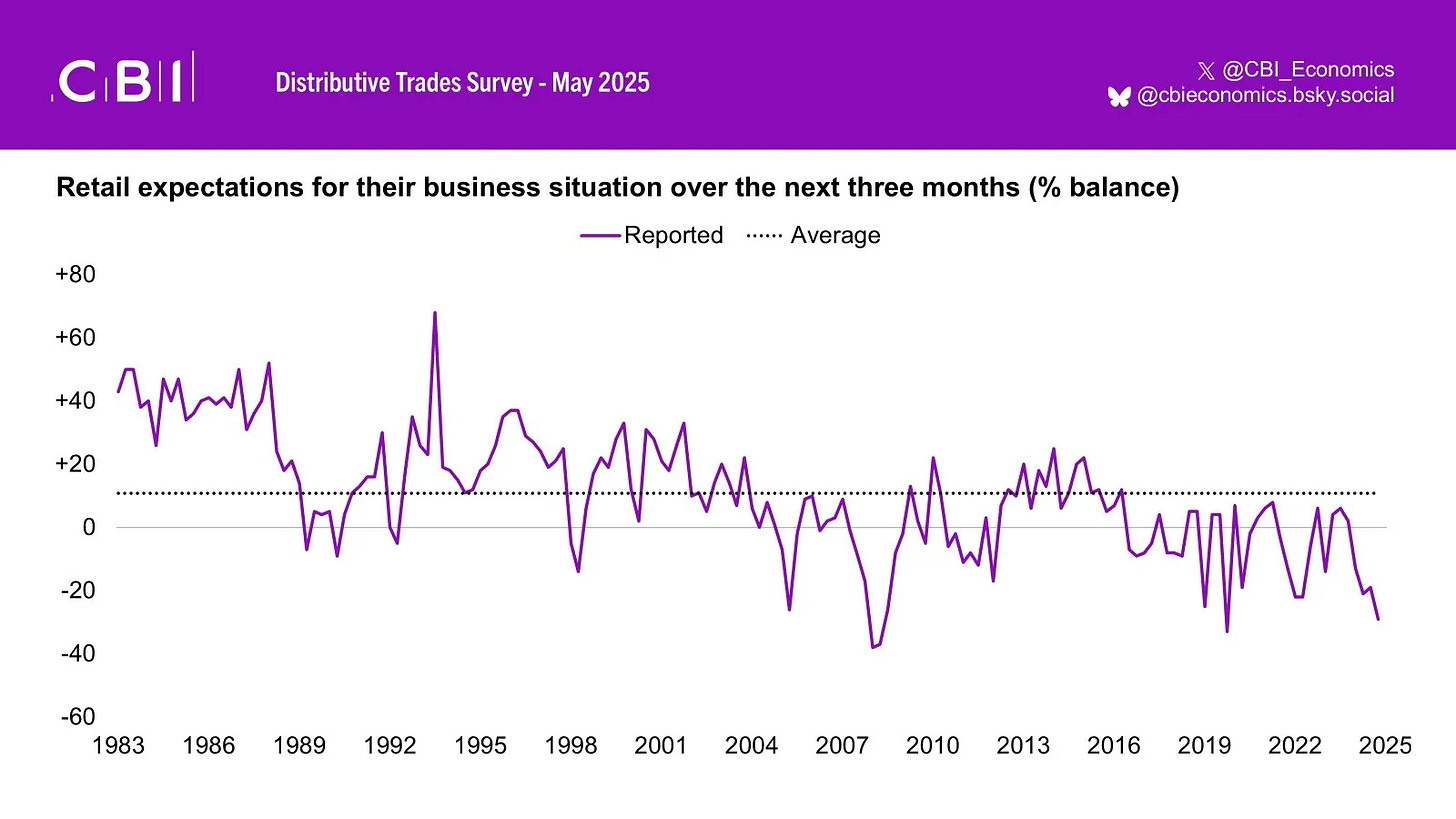

UK Retail Sector Declines Rapidly

Released: May 28, 2025 06:00 - Link

May's CBI Distributive Trades Survey reveals a concerning deterioration in the UK retail sector, marked by the most rapid decline in sentiment observed in five years. Overall sales volumes plummeted, with motor trades experiencing particularly severe contractions, while broader distribution sales mirrored the fastest drop since early 2021. Despite a welcome surge in online retail sales, retailers anticipate further weakness across employment, investment, and business conditions, alongside accelerating selling price inflation that, while still below historical averages, points towards persistent cost pressures.

Mortgage Applications Signal Refinance Slowdown

Released: May 28, 2025 07:00 - Link

Last week's decline in the MBA Mortgage Applications Index, falling -1.2% WoW, reflects the impact of rising interest rates, which climbed to a four-month high of 6.98% for the 30-year fixed. While the Purchase Index saw a positive 2.7% WoW gain and is up 5.2% YoY, this was largely countered by a substantial -7.1% WoW decrease in refinance activity, driven by both immediate and longer-term drops in application volume. This divergence suggests continued strength in the housing market's demand side, but diminished borrower appetite for refinancing given the prevailing rate environment.

Fifth District Manufacturing Shows Modest Improvement

Released: May 28, 2025 10:00 - Link

The Richmond Fed's May survey indicates a modest easing of contraction within the Fifth District's manufacturing sector, with the headline index rising from -13 to -9, driven by improvements in shipments, new orders, and employment. Despite this, local business conditions remain challenged, although optimism regarding future activity has noticeably strengthened. A quicker turnaround in vendor lead times and minimal movement in prices paid, coupled with a slight uptick in prices received, suggests persistent inflationary pressures, albeit with easing expectations for both input and output price increases moving forward.

Regional Services Slowdown Signals Labor Market Fragility

Released: May 28, 2025 10:00 - Link

The Richmond Fed's May survey reveals a concerning slowdown in regional services, as evidenced by a sharper revenue contraction despite a modest uptick in demand. While local conditions and future expectations show signs of stabilization, the significant drop in the employment index, coupled with rising wage pressures, where the Wages index climbed to 20, suggests a potential fragility in the labor market. The stabilization of Prices Paid at 4.97% alongside a slight decrease in Prices Received, alongside anticipated acceleration in both over the coming year, warrants close monitoring for inflationary pressures despite the overall contractionary environment.

Texas Service Sector Shows Mixed Signals

Released: May 28, 2025 10:30 - Link

Texas's service sector experienced a mixed May, with overall revenue contracting modestly alongside a significant downturn in retail conditions, the latter registering the poorest performance since April 2020, driven by collapsing companywide sales and inventory drawdowns. While the General Business Activity index improved in the broader service sector and uncertainty diminished, retail activity suffered pronounced declines, evidenced by deteriorating employment, plummeting sales, and decreased wages. Across both sectors, input and selling price pressures eased considerably, but sustained weakness in retail, reflected in negative business activity readings and a cautious future outlook, warrants close monitoring of the state's economic trajectory.

Household Finances: Stability and Shifting Sentiment

Released: May 28, 2025 11:30 - Link

Household financial well-being in 2024 remained relatively stable compared to 2023, with 73% of adults reporting being “doing okay” or “living comfortably,” though this figure is notably lower than the 2021 peak. Persistent inflation remains the primary worry for households, while concerns about housing costs have risen considerably. Critically, the divergence between perceived personal financial health and broader economic conditions narrowed considerably throughout 2024, suggesting a potentially shifting sentiment regarding the overall trajectory of the US economy.

Other data releases and commentary:

France Services PPI: Q1 2025, Released: 05/28/2025 02:45

France Manufacturing Sales: March 2025, Released: 05/28/2025 02:45

France Services Output: March 2025, Released: 05/28/2025 02:45

Data Center Construction Contributing One Percentage Point to GDP Growth, Released: 05/28/2025 07:00

Atlanta Fed Survey of Business Uncertainty: May 2025, Released: 05/28/2025 11:00

AAR Weekly Rail Traffic: Week of May 24th, Released: 05/28/2025 12:00

FOMC Minutes: May 2025 Meeting, Released: 05/28/2025 14:00