Econ Mornings: May 29th, 2025

Macro releases and commentary released the morning of May 29th, 2025

(all times are in EST)

UK Vehicle Production Declines Significantly

Released: May 28, 2025 19:00 - Link

April 2025 witnessed a concerning contraction in UK vehicle production, falling -15.8% YoY to the lowest level in over seven decades, reflecting broad-based weakness across both car and commercial vehicle segments. While exports to China and Turkey offered some offset, overall export volumes declined, particularly to the EU and US, alongside a notable -68.6% plunge in commercial vehicle output tied to plant closures and normalizing demand for heavy goods vehicles. Year-to-date figures reveal a cumulative -8.3% decrease in total output, prompting calls from the SMMT for supportive industrial policies to navigate evolving global trade patterns and bolster the nation's manufacturing base.

Australian Capital Expenditure Declines Slightly

Released: May 28, 2025 19:30 - Link

Private new capital expenditure in Australia contracted modestly in Q1 2025, with a -0.1% QoQ decline and a -0.5% YoY decrease, as investment in equipment, plant, and machinery suffered a notable downturn. This weakness offset growth in buildings and structures spending, and was tempered by a 1.9% QoQ increase in mining sector investment alongside a -0.9% QoQ decline in non-mining investment. Despite the current quarter's underperformance, the overall outlook appears somewhat brighter, with the 2025-26 capex estimate revised upwards by 5.6% to $155.9 billion, suggesting an expectation of renewed momentum later in the fiscal year.

Japanese Investor Activity Shifts Amidst Market Rebalancing

Released: May 28, 2025 19:50

Japanese investor activity demonstrated a notable shift during the week ending May 24th, with a substantial pullback in overseas bond purchases, declining sharply from recent trends to just ¥92.0 billion. This moderation coincided with a second consecutive week of net selling in foreign equities, amounting to ¥524.7 billion, while domestic investment saw positive flows into Japanese equities of ¥309.3 billion, offset by outflows from Japanese long-term debt of -¥334.4 billion, suggesting a rebalancing of portfolio exposure amidst evolving market conditions.

Japanese Machine Tool Orders Decline

Released: May 29, 2025 01:00 - Link

Japanese machine tool orders contracted sharply in April, declining 13.8% MoM, although the sector still registered a positive 7.7% YoY increase driven primarily by robust foreign demand. While overseas orders demonstrated resilience, domestic demand experienced significant weakness, particularly in motor vehicles and iron/non-ferrous metals, contributing to a 30.2% MoM drop. Despite the broader decline in orders and a substantial 42.0% MoM decrease in sales, NC machinery sales performed well, advancing 31.5% YoY. The stabilization of order backlogs at a still-reduced level of -10.9% YoY suggests potential production bottlenecks and emerging concerns about future order flow.

Japan Consumer Confidence Shows Slight Improvement

Released: May 29, 2025 01:00

Japan's Consumer Confidence Index improved modestly in May 2025, climbing 1.6 points to 32.8, spurred by a significant gain in livelihood sentiment and improvements in perceptions of employment and income, although the overall level remains subdued. While households showed slightly increased optimism regarding their financial situations and job security, willingness to purchase durable goods saw a marginal increase. Critically, inflation expectations persist as a key constraint, with a substantial majority anticipating continued price increases, indicating that a sustained recovery in consumer spending may be contingent on easing inflationary pressures.

Spain's Retail Sales: Expansion Amid E-Commerce Decline

Released: May 29, 2025 03:00 - Link

April retail sales data for Spain reveal a mixed picture of continued expansion tempered by emerging headwinds. Overall sales increased 0.7% MoM and 4.0% YoY, fueled by broad-based gains in both food and non-food product categories, with particularly robust performance at service stations. However, this positive momentum was offset by a notable -1.6% MoM decline in e-commerce, a worrying sign for the sector's future trajectory. Concurrent with these sales figures, retail employment continued its upward climb, rising 0.5% MoM and 1.2% YoY, suggesting underlying labor market strength despite the softening online sales environment.

Italy's Economy Shows Signs of Rebound

Released: May 29, 2025 04:00 - Link

Italy's macroeconomic health showed signs of renewed optimism in May, as both consumer and business confidence indicators posted gains after a disappointing April. Consumer confidence jumped 3.8 points, fueled by broad-based improvements including a significant rise in perceptions of the economic climate, while business confidence edged higher to 93.1, primarily driven by a notable surge in market services sentiment and robust retail trade assessments. Despite the generally positive trend, construction sentiment weakened slightly, reflecting concerns about labor availability, suggesting potential headwinds for that sector moving forward.

UK Services Sector Faces Downturn

Released: May 29, 2025 04:30 - Link

The UK services sector is experiencing a pronounced downturn, evidenced by deteriorating business confidence, declining volumes across both business and consumer segments, and escalating cost pressures outpacing selling price increases. Profitability remains severely negative, with anticipated further declines in the coming months, alongside contractions in headcount and reductions in investment intentions spanning IT, vehicles, and property. Weakening demand, coupled with heightened uncertainty, is significantly impacting the sector's outlook, suggesting a continued period of subdued activity and potential risks to broader economic stability.

Labor Market Shows Signs of Softening

Released: May 29, 2025 08:30

The labor market showed signs of modest softening last week, with initial jobless claims rising 14k to 240k, alongside a 26k increase in continued claims to 1.919 million, pushing the insured unemployment rate up to 1.3%. While not seasonally adjusted figures remain below last year's levels, the uptick in claims, particularly within the UCFE category and driven by specific sectoral layoffs in Illinois, suggests a potential cooling in demand for labor and warrants closer monitoring in the coming weeks.

US Q1 2025 GDP Growth Revised Up

Released: May 29, 2025 08:30 - Link

The second look at Q1 2025 US GDP reveals a contraction of -0.2%, a slight improvement from the initial reading, but underscored by substantial downward revisions to real final sales and household consumption, specifically a 0.7 ppts drop in services consumption. While gross private domestic investment saw a welcome boost, the drag from weaker personal consumption and a significant decline in gross domestic income, coupled with a notable fall in corporate profits following a strong Q4, paints a concerning picture of slowing economic momentum. This deceleration is further reflected in eased inflation pressures, with both the GDP price index and core PCE price index seeing modest downward revisions, although gains in inventory contribution partially cushioned the overall contraction.

Container Rates Rise Amid Trade Uncertainty

Released: May 29, 2025 09:45

The Drewry World Container Index surged 10% WoW to $2,508, marking a third consecutive week of rising spot rates, primarily driven by substantial increases on key China-US trade lanes with the Shanghai-LA route experiencing a significant 17% WoW jump and the Shanghai-NY route up 14% WoW. This upward pressure is now intertwined with considerable uncertainty surrounding the legal challenges to existing tariffs and the pending implementation of US penalties targeting Chinese shipping, both of which pose potential disruptions to trade flows and could dictate the subsequent volatility and timing of rate adjustments.

Housing Sales Decline Amid High Mortgage Rates

Released: May 29, 2025 10:00 - Link

April pending home sales data revealed a concerning downward trend, with the Pending Home Sales Index falling to 71.3 and overall sales dropping 6.3% MoM and 2.5% YoY, the most significant decline in a year. Broad weakness permeated all four US regions, most notably in the West, which saw a sharp 8.9% MoM decrease, while the South also experienced a substantial MoM contraction of 7.7%. Though inventory levels are increasing, persistently high mortgage rates continue to suppress buyer demand and contribute to the softening housing market.

Natural Gas Storage Shows Moderating Drawdown

Released: May 29, 2025 10:30

Last week's natural gas storage report revealed a build of 120 Bcf, aligning with forecasts and suggesting a moderation of the tightening seen earlier in the season. While inventories remain below last year's levels, the year-over-year deficit narrowed to -12.3%, a welcome shift from the steeper drawdown observed previously. Crucially, storage is now exceeding the five-year average by a more substantial 3.9%, indicating a healthier buffer heading into the summer months and potentially mitigating upward pressure on prices.

Gas Prices Remain Tame to Start the Summer

Released: May 29, 2025 12:00 - Link

Last week's AAA national average gas price retreated to $3.166, marking a decline of 2.9 cents, though remaining 0.6 cents higher MoM and significantly below last year's price, down 40.8 cents YoY. While current prices suggest continued affordability relative to the previous summer, the upcoming Atlantic hurricane season poses a tangible risk. NOAA's forecast of a 60% probability of an above-normal season introduces considerable uncertainty, as Gulf Coast disruptions could temporarily impact refining capacity and fuel distribution, potentially leading to price increases.

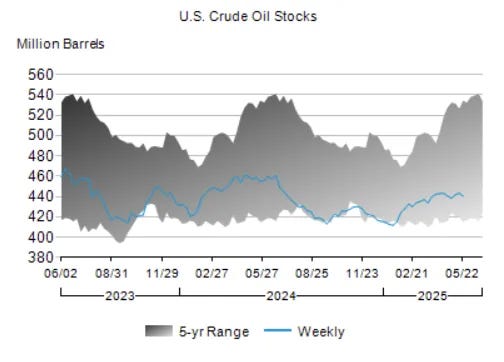

Inventory Draws Signal Softening Demand

Released: May 29, 2025 12:00

The latest petroleum data reveal a complex picture of softening demand alongside significant inventory draws. U.S. crude oil inventories are substantially below historical averages, declining both QoQ and YoY, mirroring similar movements in gasoline and distillate stocks which are deeply underwater seasonally. While net imports are up slightly on a four-week average, refinery throughput has decreased, contributing to lower crude oil utilization rates. Overall product demand is showing weakness, particularly in gasoline and distillate categories, although jet fuel consumption has bucked the trend. These dynamics are translating to lower prices for both crude and refined products, evidenced by the sharp decline in WTI and dips in retail gasoline and diesel prices, all relative to year-ago levels.

Other data releases and commentary:

Italy Industry and Services Turnover: March 2025, Released: 05/29/2025 05:00

Air Cargo Market Analysis: April 2025, Released: 05/29/2025 06:30

More Than 80% of Active Managers in Public Markets Underperform Their Index, Released: 05/29/2025 07:00

Air Passenger Market Analysis: April 2025, Released: 05/29/2025 09:30