Econ Mornings: May 8th, 2025

Macro releases and commentary released the morning of May 8th, 2025

(all times are in EST)

Bank of Japan Maintains Accommodative Monetary Policy

Released: May 07, 2025 18:50 - Link

The Bank of Japan reaffirmed its commitment to maintaining the overnight call rate near 0.5%, continuing its accommodative stance despite a moderate recovery in the Japanese economy and persistent inflation, currently running 3.0-3.5% YoY driven by wage growth and rising import costs. While corporate profits and capital expenditure remain positive, supported by favorable funding conditions, concerns linger regarding the impact of impending U.S. tariff policies and a slowing Chinese economy, fueling mixed views on the timing of any potential future interest rate adjustments. JGB purchases continue their planned reduction, and although bond market functioning has improved, the BoJ acknowledges vulnerabilities for smaller firms facing increased borrowing expenses, and expresses heightened caution surrounding broader global economic and geopolitical uncertainties.

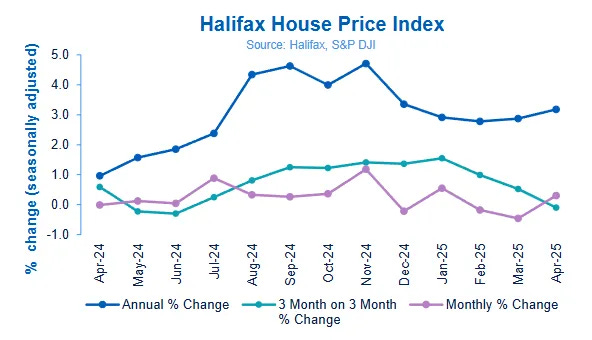

Housing Market Normalizes After Stamp Duty Boost

Released: May 08, 2025 02:00 - Link

April's Halifax House Price Index revealed a surprising 0.3% MoM increase, reversing March's downturn and surpassing anticipated declines, though this uptick appears to be a temporary adjustment following the initial flurry of activity spurred by stamp duty changes. While the market demonstrated resilience with prices remaining remarkably stable over the past six months, a slight -0.1% QoQ decline alongside a 3.2% YoY increase signals continued, albeit muted, price pressures. Halifax's assessment underscores that the tax changes primarily influenced transaction volumes rather than generating substantial upward pressure on property values, suggesting a normalization of the housing market is underway.

German Industrial Production Rebounds in March

Released: May 08, 2025 02:00 - Link

German industrial production demonstrated surprising strength in March, surging 3.0% MoM, significantly outpacing expectations and reversing February's sharp contraction. While annual figures remain in negative territory with a -0.2% YoY decline, the 3Mo3M comparison reveals a robust 1.4% increase for Q1 2025, marking the best quarterly performance in over two years. Gains were broad-based, fueled by substantial expansions in automotive, pharmaceuticals, and machinery, alongside notable increases in consumer and capital goods. Despite a MoM decline in energy production, excluding these sectors and construction, production rose even further, suggesting underlying demand momentum. The rebound, though uneven across sectors, offers some indication of a potential stabilization in Germany's industrial landscape.

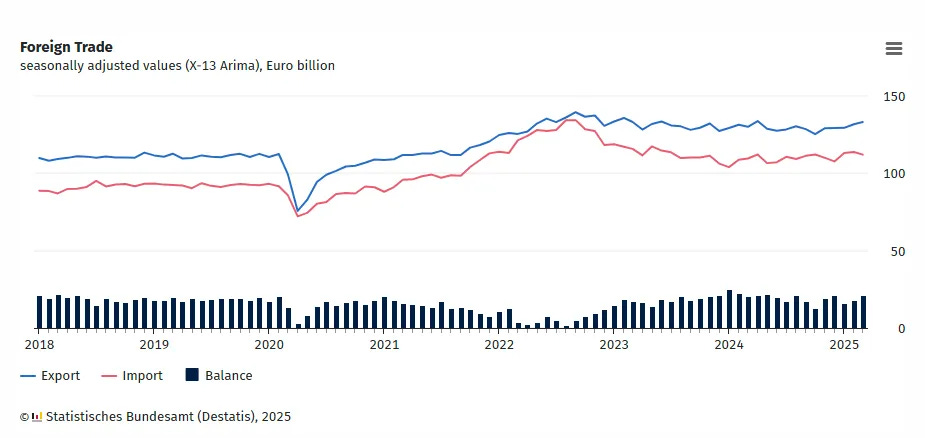

German Trade Balance Strengthens Amidst Shifting Global Trade

Released: May 08, 2025 02:00 - Link

Germany's trade balance strengthened considerably in March, reaching €21.1 billion, bolstered by robust export performance and a contraction in imports. Export growth, totaling 1.1% MoM and 2.3% YoY, was driven by increased trade within the EU and notably, a continued surge in shipments to the US, likely reflecting anticipatory behavior ahead of planned tariff implementations. While exports to China also saw a significant increase, alongside rising imports from the nation, the overall picture suggests a resilient German economy navigating evolving global trade dynamics and mitigating potential disruptions through proactive adjustments.

Spain's Industrial Output Rebounds in March

Released: May 08, 2025 03:00 - Link

Spain's industrial sector demonstrated a significant rebound in March, with production rising 0.9% MoM and 1.0% YoY, a stark contrast to the -1.9% YoY decline recorded in February, further amplified by an unadjusted YoY growth rate of 8.5%. The recovery was largely driven by a robust 6.8% YoY increase in energy output, while intermediate goods also contributed positively. Despite broad-based MoM gains across sectors, consumer goods experienced a notable contraction of -1.7% YoY, particularly within non-durables which fell -1.2% YoY, suggesting persistent weakness in consumer demand. Capital goods exhibited marginal growth, only 0.1% YoY, hinting at a hesitant investment climate.

Easing Inflation and Wage Pressures

Released: May 08, 2025 04:30 - Link

April's Decision Maker Panel survey reveals a cautiously optimistic macroeconomic outlook, with firms reporting decelerating output price inflation and cooling year-ahead price expectations, alongside a noticeable easing in wage pressures, reflected in both actual growth and anticipated increases, with single-month wage growth expectations hitting a fresh low. While CPI inflation expectations remain anchored, the ongoing impact of US tariffs appears limited for most firms, despite increased uncertainty surrounding the trade environment following a recent pause, suggesting a more nuanced response than initially feared.

Bank of England Eases Rates Amid Economic Uncertainty

Released: May 08, 2025 07:00 - Link

The Bank of England initiated a gradual policy easing cycle with a 25 bps rate cut to 4.25% at its May meeting, reflecting a delicate balance between persistent disinflation and softening domestic demand amidst heightened global trade uncertainty. While the decision was reached by a narrow 5-4 vote, the updated Monetary Policy Report revealed upward revisions to near-term inflation forecasts, alongside projections of significant medium-term disinflation and stronger-than-expected GDP growth that now anticipates a smoother growth path over the next few quarters. Despite acknowledging transitory inflationary pressures and a period of excess economic slack, the Bank emphasized a data-dependent approach and refrained from committing to a pre-set course for future policy, signaling that monetary policy will remain restrictive until inflation risks sustainably subside.

Labor Market Shows Resilience Amid Mixed Signals

Released: May 08, 2025 08:30

The latest unemployment insurance data reveal continued labor market resilience, with initial claims declining 13k to 228k, alongside a significant drop in continued claims to 1.879 million and a corresponding decrease in the insured unemployment rate. While not seasonally adjusted claims also showed a welcome decline YoY, elevated federal employee claims, still notably above levels from a year prior, and a substantial spike in New York attributable to widespread industry layoffs briefly offset these positive signals in the headline figure.

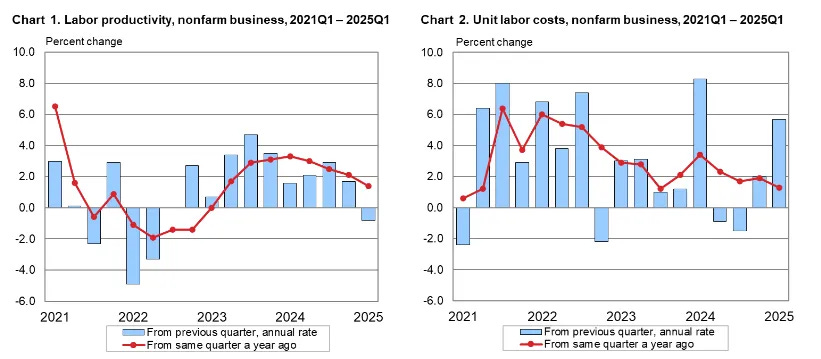

US Labor Productivity Slows in Q1 2025

Released: May 08, 2025 08:30

Preliminary data reveal a concerning slowdown in US labor productivity during Q1 2025, falling -0.8% QoQ after a period of growth, driven by a contraction in total output alongside rising hours worked. Although annual productivity remains positive, up 1.4% YoY, the sharp increase in hourly compensation, 4.8% QoQ, spurred a significant surge in unit labor costs, reaching 5.7% annualized, the largest jump since Q1 2024, and potentially signaling inflationary pressures. The divergence in performance, with robust manufacturing productivity growth of 4.5% offsetting weakness in other sectors, suggests the unevenness in the current economic environment, as evidenced by comparatively moderate manufacturing unit labor cost increases of 1.6% annualized.

Container Rates Decline Amid Softening Demand

Released: May 08, 2025 09:45

The Drewry World Container Index continued its downward trend, falling 1% WoW to $2,076, marking four consecutive weeks of decline as softening demand from China impacts global shipping. While rates exhibited route-specific divergence, with significant drops on routes like Shanghai-Rotterdam and Shanghai-Genoa, increases were observed on Shanghai-LA and Shanghai-NY, potentially reflecting adjustments to carrier capacity. Drewry anticipates a moderation in rate fluctuations next week, aligning with the repositioning of vessel deployments to account for decreased cargo bookings originating from China.

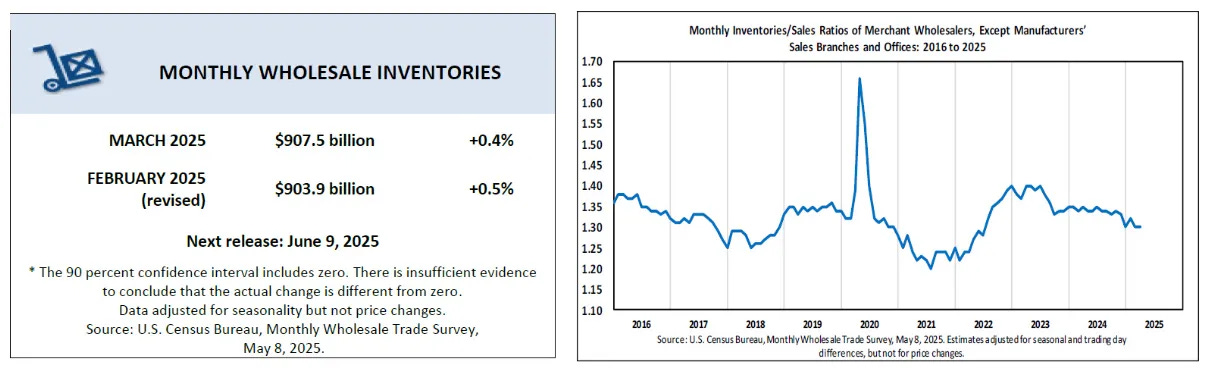

Wholesale Inventories Show Modest March Gain

Released: May 08, 2025 10:00

March wholesale inventories rose a modest 0.4% MoM, slightly below expectations but following a stronger-than-initially-reported February gain, primarily driven by increases in auto and machinery stocks. While nondurable inventories saw a smaller 0.1% rise, gains in pharmaceuticals were counteracted by declines in farm products and apparel. The overall inventory-to-sales ratio held steady at 1.30x, reflecting a broader trend of improved inventory management as the ratio has decreased YoY, notably with durable goods inventories exhibiting a more substantial reduction.

Natural Gas Storage Shows Moderating Deficit

Released: May 08, 2025 10:30

The latest natural gas storage report revealed a 104 Bcf build last week, aligning with consensus forecasts and moderating the previous week's downward YoY inventory comparison. While still reflecting a deficit compared to prior years, storage levels now sit only marginally above the five-year average, signaling a shift from the more substantial shortfall observed recently. The improved positioning relative to the five-year average and the slowing pace of YoY inventory decline suggest a lessening degree of tightness in the natural gas market.

NY Fed Survey Shows Declining Consumer Sentiment

Released: May 08, 2025 11:00 - Link

April's NY Fed Survey of Consumer Expectations reveals a concerning shift in household sentiment, characterized by rising three-year inflation expectations to 3.2% alongside a decline in longer-term expectations, and a notable weakening of labor market optimism, evidenced by falling job-finding and expected earnings growth, all while perceptions of both current and future household financial well-being worsened. Consumers anticipate increased costs for housing, education, and healthcare, even as food price expectations modestly decreased. The rise in the probability of missed debt payments, coupled with increased stock price optimism, suggests a bifurcated outlook potentially reflecting a belief in market recovery despite persistent economic anxieties.

Gas Prices Decline Amid Increased Supply

Released: May 08, 2025 12:00 - Link

Gas prices retreated last week, with the AAA national average declining 3.4 cents to $3.152, reflecting a broader trend of softening demand between seasonal travel periods. The current average is notably lower than both last month's $3.246 and last year's $3.640, with a significant YoY drop of 9.4 cents and 48.8 cents respectively. Anticipated increases in oil production from OPEC+ starting in June promise to further bolster supply and likely exert downward pressure on crude prices, suggesting continued affordability for consumers throughout the summer driving season.

Other data releases and commentary:

Trade War Has Much Bigger Negative Impact on the US, Released: 05/08/2025 07:00

BoE Weekly Report: 5/7/2025, Released: 05/08/2025 08:00

NOAA National Climate Report: April 2025, Released: 05/08/2025 11:00