Employment and Wage Data in Focus Before Fed Announcement

Macro and market developments for 1/31/2024

Macro updates poured in from around the world on a busy morning for economy observers. Data in focus is analyzed in the context of a Federal Reserve announcement later today. In the US, the most important updates were in wage data while a smattering of employment, inflation, and activity data was released abroad.

US: Employment Dynamics and Cost Index Insights

The latest ADP Employment Report for January showcased a gain of 107,000 jobs in the US which was below the 145,000 expected by analysts. The service sector led the way with an addition of 77,000 jobs, complemented by the goods sector contributing 30,000. The leisure and hospitality sector remained the leading industry in US job growth. Notably, the construction sector saw a relatively strong growth of 22,000. While monthly volatility is a thing, continued hiring in this sector can be a signal of broader strength in the economy.

On the wage growth front, ADP’s report showed that annual pay growth for job changers experienced a substantial easing, dropping from 8.0% YoY in December to 7.2% YoY in January. Meanwhile, pay growth for job stayers showed a more modest decline from 5.4% YoY to 5.2% YoY. The falling job changer wage growth is consistent with the JOLTS quits rate falling over the last few months.

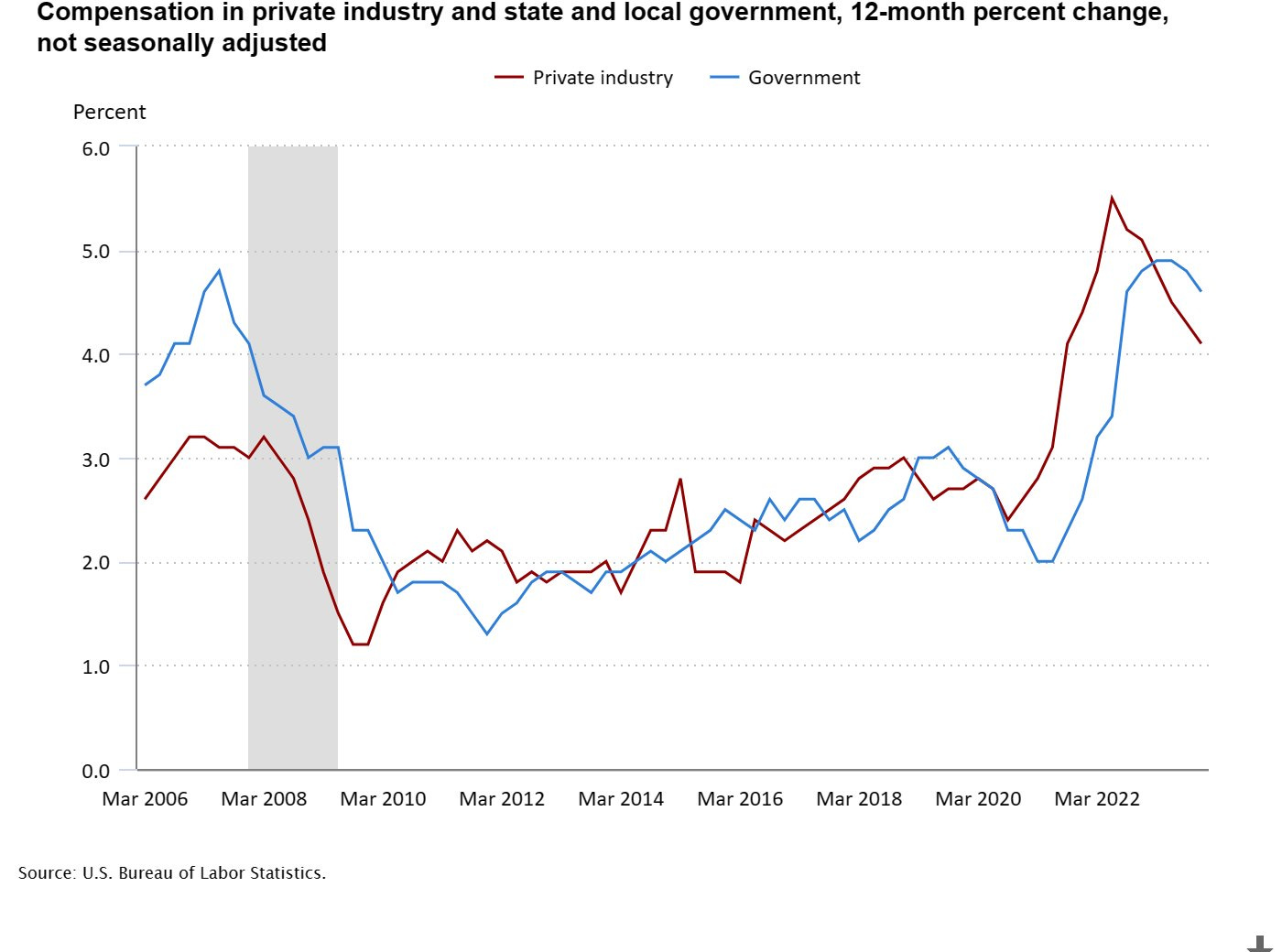

We also got an update on wage data out of the BLS through the ECI release. The Employment Cost Index (ECI) for Q4 2023 reported growth of 0.9% QoQ and 4.2% YoY, signaling a slight moderation from the 4.3% YoY in Q3 2023. Private wage and salary costs mirrored this trend, growing 0.9% QoQ and 4.3% YoY, showing a slightly stronger deceleration of -0.2 ppts from the Q3 rate of 4.5% YoY. Disinflation in wages is continuing at the snail’s pace it has been at for the last 6 months. As a result, the Fed should not try and rush to rate cuts as strong wage growth remains an upside risk on inflation.

Japan: Mixed Signals in Economic Indicators

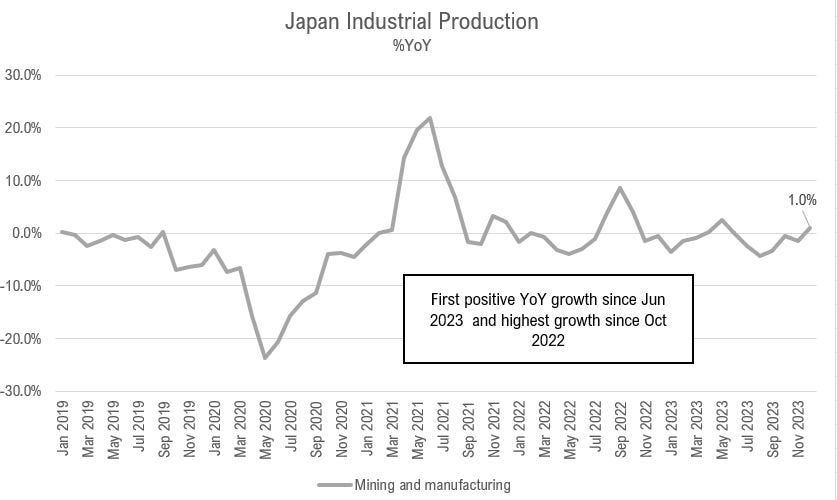

Japan's industrial production continued to reflect that of a moderately strong economy, growing by 1.8% MoM in December, marked by increased shipments and reduced inventories. The 1.0% YoY growth was the highest since October 2022. Strong sectors included general-purpose & business-oriented machinery, chemicals, and production machinery. However, the current forecast anticipates a substantial drop of -7.2% MoM, introducing an element of caution in the outlook.

On a more negative note, Japanese retail sales experienced a setback, declining -2.9% MoM in December, with commercial sales only up by 0.4% YoY, the weakest since June 2023. On a YoY basis, retail sales growth was down to 2.1% YoY, from 5.4% YoY in November. Despite this, the full-year retail sales growth for 2023 stood at 5.6%.

Nevertheless, Japan's Consumer Confidence Index showed that consumers are still feeling good. The index grew to 38.0 in January, the highest since 2021. The positive momentum extended to indices tracking employment and the willingness to buy durables, growing by 1.0 and 1.4 points, respectively.

Australia: Inflationary Pressures Ease

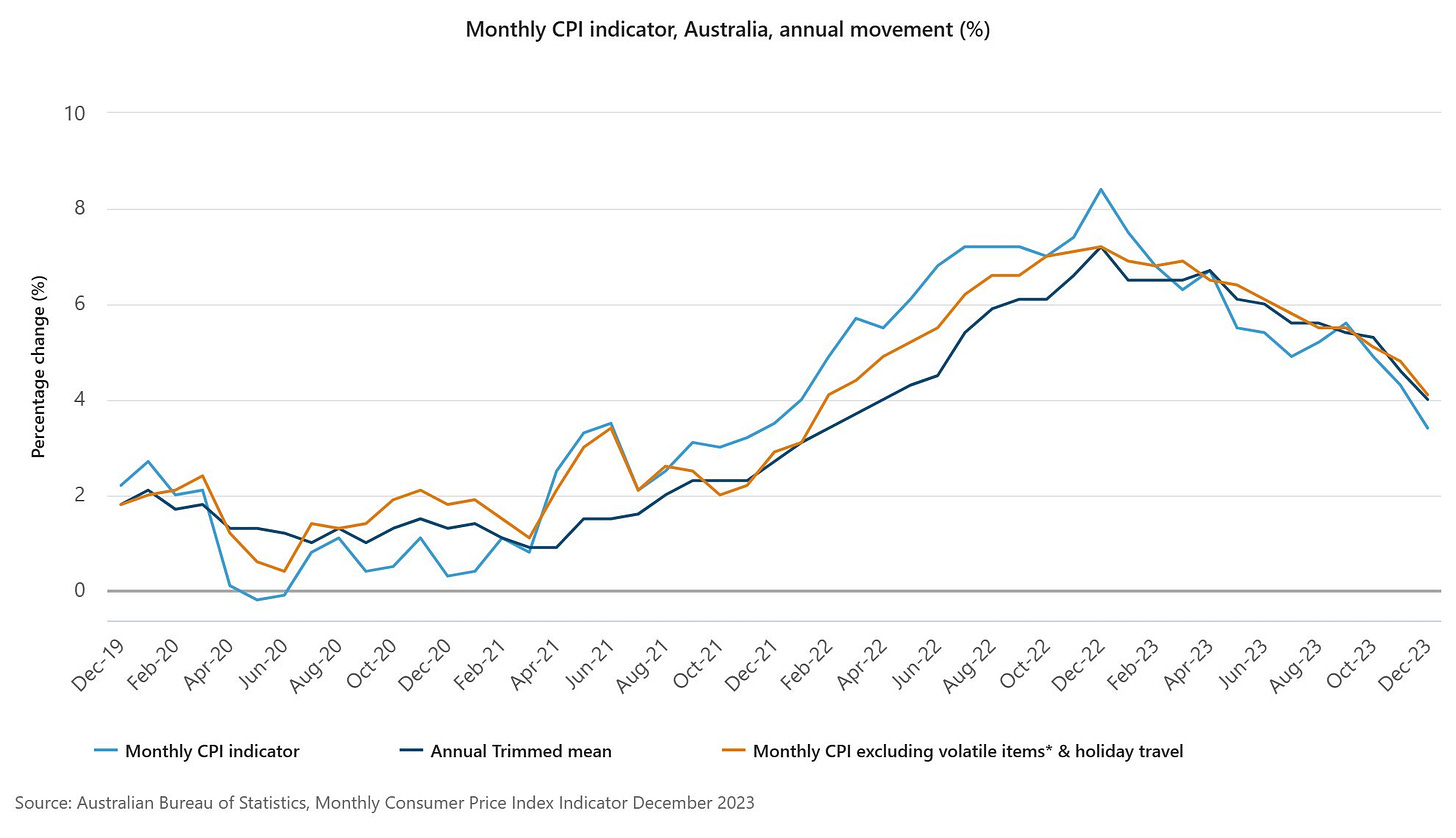

Australia witnessed a slowdown in inflationary pressures as the Consumer Price Index (CPI) grew by 3.4% YoY in December, down from 4.3% in November. Core CPI also dipped to 4.1% YoY, driven by easing in electricity and recreation inflation. These figures marked the lowest rates since February 2022 and November 2021, respectively. Easing in electricity & recreation inflation were the drivers of the falling headline rate.

China: PMI Challenges and Market Downturn

China's CFLP Manufacturing Purchasing Managers' Index (PMI) grew marginally to 49.2 in January. While the production index saw improvement, reaching 51.3, new orders struggled at 49.0, indicating contraction. The Employment index (at 47.6) pointed to a decline in hiring that was worse than at any point in 2023. The CFLP Non-manufacturing PMI fared better as it improved 0.3 pts to 50.7. Similar to manufacturing, there was a slight growth in Business Activity (50.7) despite a contraction in New Orders (47.6). The real weakness was in the Export Orders index which tanked to 45.2, worse than any 2023 reading.

Following the release of PMI data, China's CSI 300 Index hit a 5-year low, erasing gains from the previous week's financial easing news. The index is down -6.3% for the month. Homin Lee, senior macro strategist at Lombard Odier notes that investor pessimism "is unlikely to change for the foreseeable future."

Germany: Weak Sales but Favorable Employment, Inflation

The German economy continues to report numbers that show its extreme frailty. Retail sales especially faced challenges, declining -1.6% MoM and -1.7% YoY in December, with a drop of -2.8% MoM in food sales and -1.6% MoM in non-food sales. The overall sales performance for the full year of 2023 reflected a sharp decline of -3.3%.

In contrast to other German economic indicators, employment figures are still very strong. German employment showed slight growth, both on a monthly (0.1%) and yearly (0.4%) basis in December. The unemployment rate remained stable at 3.1% as tight labor conditions have persisted over the last year. This seems to be the only good German data point.

Unless you are the ECB looking at Germany’s latest inflation data. In January, Germany experienced moderated inflation, with the Consumer Price Index (CPI) growing by 0.2% MoM and 2.9% YoY, the lowest since June 2021. This represents a slight slowdown from December, with services inflation, however, accelerating to 3.4%. Additionally, it is a large downside surprise to the 3.3% YoY consensus expectation.

France: Inflation Moderation Signals Economic Adjustments

In France, the inflationary landscape displayed signs of moderation as prices eased by 0.2% MoM, resulting in an annual rate of 3.1% YoY in January. This decline from the 3.7% YoY figure in December was attributed to easing trends in food, energy, and goods inflation. Notably, services inflation showed a slight firming, rising by 0.1 percentage points to 3.2% YoY in the last month and 0.6 ppts in the last year. Unlike Germany, the 3.1% YoY rate was a slight beat of the expectations of 2.9% YoY.

UK: Nationwide House Prices Show Resilience in January

The UK Nationwide House Price Index started 2024 strong, with home prices growing by 0.7% MoM in January. On a three-month basis, the index grew by 1.1%, marking the strongest performance since July 2022. Despite the monthly and quarterly upticks, a slight decline of -0.2% YoY persists but will very likely turn positive next month.

Canada: GDP Growth Fueled by Goods Industry

In Canada, GDP experienced a 0.2% MoM growth in November, propelled by the goods industry, which saw its strongest expansion since January 2023 at 0.6% MoM. Despite facing challenges from public sector strikes in Quebec, the services sector managed to contribute with a modest 0.1% MoM growth, underscoring a balanced but resilient economic landscape.

In the News

Apple: Navigating Challenges in iPhone Shipments

Apple faces headwinds in its iPhone shipments as indicated by TF International Securities' latest supply chain survey, revealing a reduction to about 200 million units in 2024 or a 15% year-over-year decline. Weekly shipments in China have plummeted by 30% to 40% YoY recently, raising concerns about double-digit falls in iPhone volumes for the Chinese market. Jefferies expects iPhone's volume in China could fall by double digits this year. In contrast, Samsung has increased shipments of the Galaxy S24 series by 5% to 10% in 2024. The dip in Apple's prospects prompts questions about whether it is grappling with increased competition or encountering broader economic challenges.

French Farmers Protest: Rising Costs and Climate Policies

French farmers are taking to the streets, protesting and blocking traffic due to escalating operating costs and climate change policies. These challenges have made it difficult for farmers to compete with their foreign counterparts since the Russia-Ukraine war started and inflation became a major economic concern. While the government may initially take a soft approach, the stakes could escalate, especially with the upcoming Paris Olympics in the summer, adding pressure for resolution and potential policy changes.

Citadel CEO Ken Griffin's Economic Insights

Citadel CEO Ken Griffin shared insights on the economy, emphasizing the potential catastrophic impact of a rupture between Taiwan and China, particularly on the semiconductor supply crucial for U.S. industries. Additionally, Griffin noted the dissipation of September and October inflationary factors, projecting inflation in the low twos for the year, a slight uptick in unemployment, and potential rate cuts in the summer. Griffin expressed concern about the "reckless level of federal spending," creating a unique economic backdrop with short-term euphoria but the risk of a future hangover.

Oil Market: Geopolitical Dynamics and Demand Concerns

In the oil market, geopolitical tensions in the Middle East are viewed as "unlikely" to escalate, with countries aiming to avoid confrontation. However, drone attacks in Russia could pose a potential threat to oil product balances. Concerns about China's real estate crisis have sparked apprehensions about future oil demand. Additionally, the U.S. has reinstated sanctions on Venezuela, marking a significant move after the country's president blocked opposition from participating in elections.

Earnings

Starbucks ($SBUX, Consumer Discretionary) - FY24 revenue growth outlook lowered to +7% to +10% compared to the prior range of +10% to +12%. Full-year 2024 global and U.S. comparable sales growth expected to be up 4% to 6%, revised from +5% to +7%. Middle East conflict and the China macro backdrop identified as headwinds.

Mondelez ($MDLZ, Consumer Defensive/Staple) - Reported slower-than-expected sales and provided cautious guidance for 2024. Organic net revenue growth expected to be in the range of 3-5% for 2024, citing greater volatility due to geopolitical uncertainty. When CEO was asked about state of American consumer:

From a mindset perspective, from a confidence perspective in North America, probably the best in the last 2.5 years. So what they're doing is still reflecting sort of the tension they're under, but they are expecting the economy to improve and that better times are ahead for them.

For more macro and market commentary, check out my Reddit feed.