Euro Area Inflation Eases, US Data Show Looser Labor Market

Macro and market developments in 2/1/2024

Central banks across the globe breathed a sigh of relief and bond traders pushed yields lower as macro data this morning in the US and Europe was largely dovish.

Euro Area: PMI Signals Weaker Contraction, Prices Fall to Start the Year

The Eurozone Manufacturing PMI reached a 10-month high at 46.6 in January as the contraction in manufacturing activity in Europe continues to moderate. The output and new order contractions were reported as the weakest since April 2023. Interestingly, the longer shipping times caused by conflicts in the Red Sea have not contributed to inflationary pressures. Instead, deflation in input and output prices “gathered momentum”.

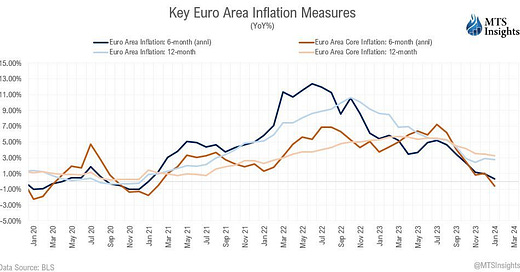

Euro area inflation showed a decline of -0.4% MoM, with a YoY increase of 2.8% in January, down from 2.9% in December. Core inflation saw a stronger decline on the month, registering a -0.9% MoM decrease and settling at 3.3% YoY (December rate at 3.4% YoY). The 6-month annualized core inflation rate reached -0.55%, the lowest since January 2021. This contrasts notably with the US core PCE inflation 6-month annualized rate of 1.86%, indicating a potentially more dovish stance for the European Central Bank compared to the Federal Reserve.

UK: Bank of England Pauses

The Bank of England's Monetary Policy Committee (MPC) voted by a majority of 6–3 to maintain the Bank Rate at 5.25% during its meeting ending on January 31, 2024. Two members favored an increase by 0.25 percentage points to 5.5%, while one member suggested a reduction by 0.25 percentage points to 5%.

The Committee's updated projections for activity and inflation consider a market-implied path for Bank Rate declining to around 3.25% by the end of the forecast period. Despite recent weakness, GDP growth in the UK is expected to gradually pick up. The labor market has eased but remains tight. CPI inflation is projected to fall temporarily to the 2% target in 2024 Q2 before increasing again in Q3 and Q4. Risks to the modal CPI inflation projection are skewed to the upside due to geopolitical factors.

The MPC maintains a restrictive stance on monetary policy to ensure inflation returns to the 2% target sustainably in the medium term, emphasizing the need for a prolonged period of restrictive measures until inflation risks dissipate. In the end, the Bank of England reasserts its intention to remain data-dependent.

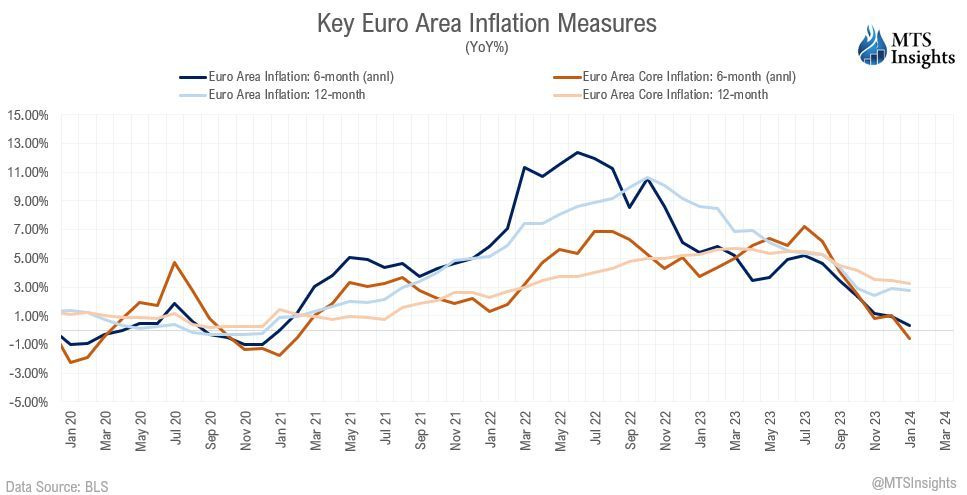

US: Several Signals Point to Looser Labor Market

Jobless claims in the US increased by 9,000 to 224,000 last week. Initial claims weren’t the focus as the aggregated figures stuck out. The insured unemployment rate grew by 0.1 ppts to 1.3%, and the total number of continued claims jumped by 70,000 to 1.90 million. The most compelling increase so far is the rise in the not seasonally adjusted insured unemployment total which is up from 1.91 million a year ago to 2.19 million now.

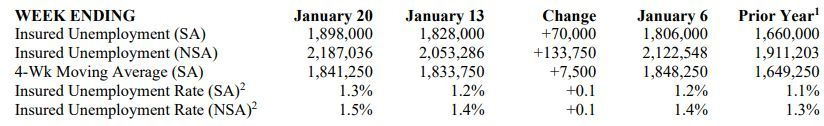

Out of the BLS, strong labor productivity data is helping to ease the rise in worker compensation. US labor productivity exhibited growth of 3.2% QoQ (annualized) and 2.7% YoY in Q4 2023. Hourly compensation increasing by 3.7% QoQ (annualized) was slightly faster than productivity but not by much. As a result, unit labor costs grew 0.5% QoQ (annualized) and were up 2.3% YoY. Manufacturing unit labor costs saw a slightly different trend, rising sharply by 5.5% in 2023, the fastest rate since the pandemic.

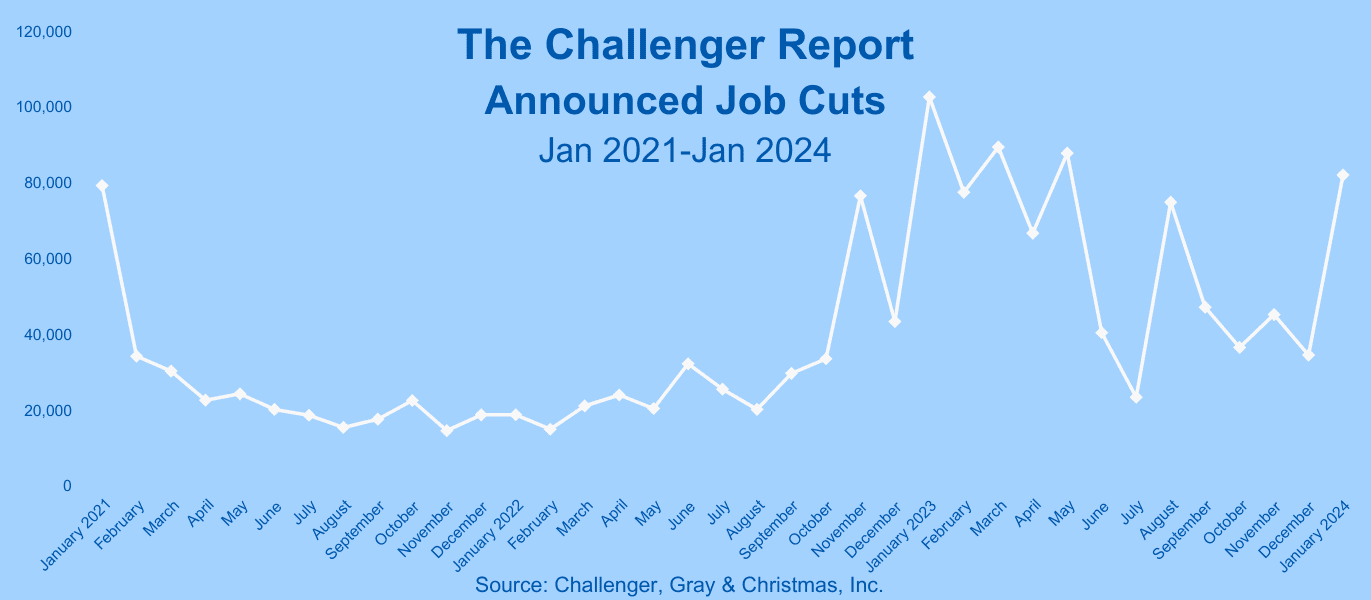

The Challenger job cuts report for January 2024 highlights increasingly significant challenges in the job market, with 82,307 cuts announced, the highest for January since 2009. Hiring announcements were 5,376, setting a record for the lowest January on record. Financial companies and the tech sector saw the highest number of cuts with tech layoffs at the highest since May 2023.

Italy: Energy Deflation Pauses

Italy's Consumer Price Index (CPI) showed a growth of 0.3% MoM and 0.8% YoY in January, up from 0.6% YoY in December. Energy inflation notably increased to 0.3% MoM, rebounding from -4.2% MoM in the previous month. Outside of that decline, there was still some disinflation. Core inflation experienced a slight decline to 2.8% YoY in January from 3.1% in December.

Australia: Import Prices Back on the Rise

Australian import prices showed growth in Q4 2023, rising by 1.1% QoQ, the most significant increase since Q4 2022. Notably, road vehicles experienced the largest increase at +2.7% QoQ, while petroleum continued to see a sharp decline at -14.0% YoY.

S&P Global Manufacturing PMIs: January 2024

Asia Pacific

India: 56.5 (Dec 54.9)

Russia: 52.4 (Dec 54.6)

South Korea: 51.2 (Dec 49.9)

China: 50.8 (Dec 50.8)

ASEAN: 50.3 (Dec 49.7)

Australia: 50.1 (Dec 47.6)

Taiwan: 48.8 (Dec 47.1)

Japan: 48.0 (Dec 47.9)

Europe

Ireland: 49.5 (Dec 48.9)

Spain: 49.2 (Dec 46.2)

Netherlands: 48.9 (Dec 44.8)

Italy: 48.5 (Dec 45.3)

Poland: 47.1 (Dec 47.4)

UK: 47.0 (Dec 46.2)

Eurozone: 46.6 (Dec 44.4)

Germany: 45.5 (Dec 43.3)

France: 43.1 (Dec 42.1)

Czech Rep: 43.0 (Dec 41.8)

In the News

US Passes Child Tax Credit Enhancement and Business Tax Relief

The House passed a $79 billion bipartisan tax cut package aiming to enhance the child tax credit for lower-income families and boost tax breaks for businesses. The bill, although facing uncertain prospects in the Senate, marks a significant achievement for the House, passing with a vote of 357-70. Key provisions include an earlier deadline for claiming the employee retention tax credit, immediate deductions for business equipment and R&D expenses, and increased flexibility in deductible borrowing for businesses. Democrats wanted a bigger tax credit ($3,600 annually for children under age 6 and $3,000 for children ages 6 to 17) but that was too much for Republicans to agree on.

US Assigns Blame for Attack that killed US Soldiers and Continues Patrol in Red Sea

In response to the attack that killed U.S. soldiers in Jordan, the U.S. formally assigned blame to the Islamic Resistance in Iraq, planning a multi-phase counterattack. National Security Council spokesperson John Kirby said as the US was preparing to respond to the attack, there would be multiple phases of a counterattack. Additionally, U.S. forces conducted a military strike against Houthi drones and a ground control station, claiming it as self-defense against imminent threats to merchant vessels and U.S. Navy ships.

European Farmers Protest Green Policy and Cheap Imports during EU Summit in Brussels

Farmers from Italy, Spain, and other European countries threw eggs and stones at the European Parliament in Brussels, demanding more support from EU leaders to respond to the issues impacting the agricultural sector. Similar to the unrest France, the protests reflect discontent with green regulations and cheap imports. The protests highlight the growing influence of far-right politicians expected to make gains in the upcoming June elections. However, the farmers' concerns appear to take a back seat amid ongoing discussions about aid for Ukraine.

Major Earnings

Royal Caribbean (RCL - Travel/Tourism) - Anticipates a robust 2024, expressing strong confidence in demand and pricing. The company reports record booking levels in rate and volume, with consumer spending onboard and pre-cruise purchases surpassing previous years. Booking strength extends across key itineraries, reflecting a broad-based positive trend. Forecasts an adjusted profit of $9.50-$9.70 per share for 2024, marking a substantial 40% YoY increase, exceeding the Street consensus of $9.18.

Tractor Supply (TSCO - Farming Supplies) - Records a comparable store sales decline of -4.2%, attributed to softness in cold weather products, discretionary categories, and big-ticket items, partially offset by strength in year-round consumable, usable, and edible categories. Forecasts comparable store sales of 1-1.5% for the full year 2024, anticipating a rebound in specific product categories.

Honeywell (HON - Industrial, Aerospace) - Achieves a moderate 4% increase in sales for 2023, with notable performance in the aerospace segment (15% growth). The building technologies segment reports a 2% sales increase for 2023. Backlog remains at a record level, reaching $31.8 billion by the end of the year. Issues 2024 guidance with sales expected in the range of $38.1 billion to $38.9 billion, indicating year-over-year organic growth of 4% to 6%. The company maintains a positive outlook for the aerospace and building technologies segments.

For more macro and market commentary, check out my Reddit feed.