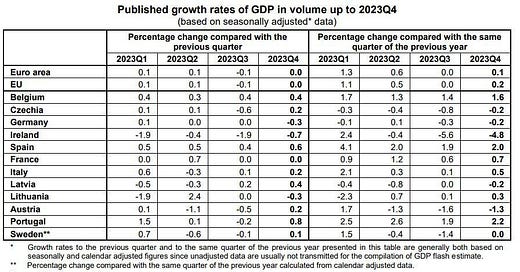

This morning we saw a slew of GDP data coming out of Europe, and it dominated the macro headlines. The region has seen weak activity for most of 2023, and in general, this trend continued into the final quarter.

Europe GDP Releases

In France, the fourth quarter of 2023 showed stagnant growth, marking the third quarter of no growth in the year. However, thanks to one strong quarter, GDP was up by a commendable 0.9% for the entire year. The quarterly dip can be attributed to a slight contraction in consumption by -0.1% and a more significant decline in Gross Fixed Capital Formation (GFCF) by -0.7% QoQ. Notably, a decrease in imports partially mitigated these negative contributions as well as a drop in inventories.

Moving to Germany, the largest economy in Europe, the country reported a decline of -0.3% QoQ in the fourth quarter, contributing to an overall contraction of -0.1% for the entire year. However, a revision in Q3 2023 GDP growth, up by 0.1 percentage points to 0.0%, technically prevents Germany from entering a recession. These figures underscore the challenges faced by the German economy that have come from tighter financial conditions and a weak manufacturing sector.

Italy, on the other hand, demonstrated some resilience with a 0.2% QoQ growth in Q4 2023, culminating in a robust 0.7% expansion for the whole year. Positive contributions from the industrial and services sectors played a pivotal role in this growth, effectively offsetting the impact of lower inventories. Italy’s economy also benefitted from higher net foreign trade in the fourth quarter.

Zooming out to the broader euro area, the aggregate GDP exhibited stagnation (0.0% QoQ) in Q4 2023, yet managed to register a 0.5% increase for the entire year. Noteworthy performances came from resilient Italy (0.2% QoQ) and Spain (0.6% QoQ), which beat consensus expectations, acting as growth engines, while Germany's -0.3% QoQ contraction posed a significant drag on the overall figures. Higher interest rates set by the ECB weighed heavily on economic activity in 2023, but European economies have surprised many by avoiding a recession.

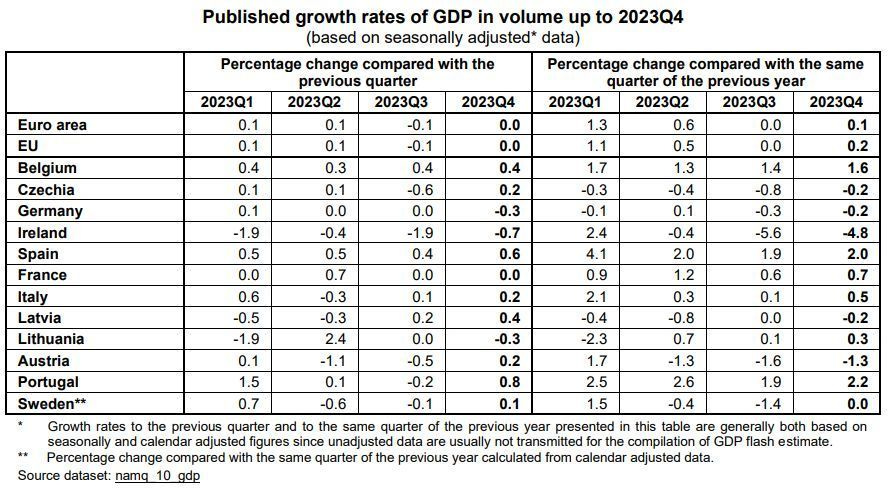

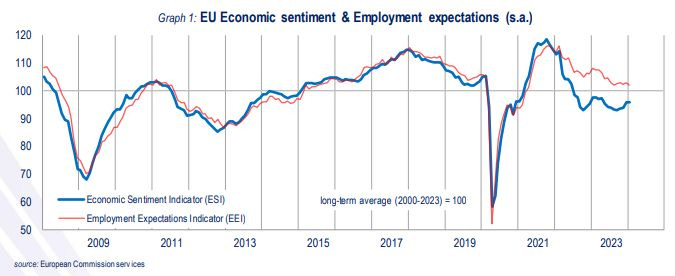

EU Economic Sentiment Survey

In addition to GDP data, we got an update on EU sentiment to start the new year. In January 2024, the European Union's Economic Sentiment Indicator showed a slight improvement, ticking up by 0.1 points to reach 95.9. However, juxtaposed against this uptick is a notable -0.7 percentage point decline in the Employment Expectations Indicator, signaling that the labor market is starting to loosen from its very tight state. Consumer sentiment was slightly weaker as it dipped by -0.2 percentage points to a reading of -16.2, though it remains comfortably above the lows experienced during peak inflation concerns. Business sentiment revealed marginal improvements in both services and the industrial sector, gaining 0.2 and 0.1 points, respectively. Services sentiment maintained a healthy level just below the 2023 highs.

Selling price expectations were stable across sectors of the economy except for services where they picked up substantially. The services sector saw a substantial surge of 1.1 points in selling price expectations, hitting 19.8—the highest reading since April 2023. Concurrently, employment expectations witnessed a broad decline which was the driving force of the decline in the EEI. The services sector was separate here as well as hiring expectations there were mostly unchanged.

Consumers, attuned to economic shifts, noted disinflation over the past year. Despite this, there is a stronger expectation of price growth in the coming year, reflected in the index reaching the highest level since September 2023. On the employment side, consumers sensed that labor markets were still tight and saw an improvement in hiring expectations, a contrast from the expectations on the business side

Japan’s Unemployment Rate Ticks Lower, Australia sees a Sharp Drop in Retail Sales, and UK Money Supply Decline Eases

On to more minor data releases out of Japan, Australia, and the UK:

Japan Employment

Despite a 0.5% YoY increase in the labor force over the past year, Japan continues to grapple with an exceptionally tight labor market. In December, the unemployment rate in the country fell -0.1 percentage points to 2.4%, marking a return to the lows observed in January 2023. This shift was primarily propelled by a -22,000 decrease in the labor force, resulting from a -12,000 drop in the number of employed individuals and an -8,000 reduction in the number of unemployed.

Australia Retail Sales

Australia witnessed a significant downturn in its retail sector, with sales plummeting by -2.7% MoM in December, marking the most substantial drop since August 2020. This decline surpassed analyst expectations, who had predicted a more modest -1.0% contraction. The impact was particularly pronounced in specific segments, as sales of household goods and department stores experienced staggering -8.5% and -8.1% MoM contractions, respectively. If not just monthly volatility, the decline in sales here could be showing that higher rates are finally catching up to consumers.

UK Money Supply

In the UK, the M4 money supply registered a year-over-year decline of -0.9%, indicating a slowdown in the overall money stock. However, M4 money supply saw an increase of 2.9% on a 3-month annualized basis, suggesting that financial conditions eased over the short term. Similarly, the household M4 money supply was up 0.9% year-over-year, but on a 3-month annualized basis, this measure accelerated, posting a 3.2% increase. Additionally, deposit rates saw a notable decline. The reported interest rate paid on deposits fell -27 basis points, settling at 4.8%.

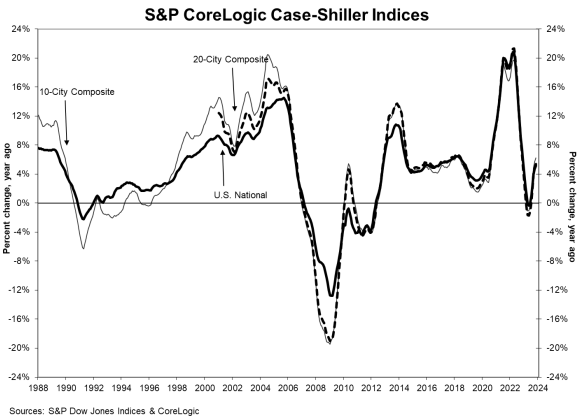

Mixed Reports on US Housing Prices in November

Two reports this morning provide insights into the dynamics of US home prices at the end of 2023. According to the S&P National Home Price Index, there was a slight dip of -0.2% MoM in November, but prices were up a robust 5.1% YoY, up from the 4.7% YoY growth observed in October. The 20-City Composite Index and the 10-City Composite Index also experienced minor declines of -0.2% MoM and -0.1% MoM, respectively. However, on a yearly basis, both indices showed positive trends, with the 20-City Composite Index growing by 5.4% YoY and the 10-City Composite Index increasing by 6.2% YoY.

In a parallel report, the Federal Housing Finance Agency (FHFA) House Price Index revealed a 0.3% MoM growth in November, contributing to a substantial 6.6% YoY increase. This YoY growth reflects an uptick from the 6.3% YoY observed in October. While the November figures showed a slight moderation compared to the same month in the previous year, with YoY growth at 6.6% versus 8.2% in October 2022, the overall positive trajectory is similar despite higher rates.

In the News

Saudi Arabia Directs Oil Output Cut Amid Shifting Dynamics

In a significant move, Saudi Aramco has received a directive from the Saudi government to reduce its planned maximum sustainable oil production capacity to 12 million barrels per day (bpd). This is the first time a directives have been issued since March 2020 when the Saudi Energy Ministry had previously requested Aramco to raise its capacity to 12 million bpd during a standoff with Russia. Analysts, including those at Morgan Stanley, speculate that the current move reflects a governmental anticipation that global demand for Saudi oil may not surge as strongly as previously predicted. SEB analyst Bjarne Schieldrop suggests that the decision could be driven by both cost-saving considerations and the recognition that the extra oil capacity may no longer be deemed necessary in the current global market context.

Qatari Ceasefire Talks Constructive, Israel Kills Three Palestinians in West Bank Hospital

In recent Middle East developments, talks between US, Qatari, Egyptian, and Israeli officials aimed at releasing hostages in Gaza have shown progress. The negotiations involve a proposed three-phase deal, including a 6-week ceasefire, the release of Palestinian prisoners, and further discussions on the release of Israeli soldiers. However, there's a demand from Hamas for the Israeli government to commit to ending the war as part of the deal. US Secretary of State Blinken has described the proposal as strong and compelling.

In another event, an Israeli operation in the West Bank involved disguised IDF members infiltrating a hospital and killing three Palestinians. Israel claims they were part of a "Hamas terrorist cell" hiding in the hospital, with one individual planning an imminent attack. Hamas confirmed one of the casualties as its member, while the Jenin Brigade stated that two were affiliated with Islamic Jihad.

Major Earnings

UPS ($UPS, shipping, mail) reported mixed earnings with a -7.4% YoY drop in average daily volume in the US, -8.3% YoY drop internationally, and an -11.4% YoY decline in supply chain solutions revenue. The operating margin of 11.2% missed the consensus estimate of 12.4%, leading to a reduction in full-year 2024 revenue expectations from $95.6B to a range of $92.0B to $94.0B (UPS 4Q 2023 Earnings).

General Motors ($GM, automaker) exceeded revenue expectations by about 8-9%, despite a -0.3% YoY revenue decline. The company observed a sharp -45.0% YoY decline in North American EBIT in Q4, but anticipates higher EBIT than consensus expectations in 2024. Headwinds in 2024 include lower industry pricing, ongoing pressures in China, and higher labor costs (GM Q4 2023 Earnings).

JetBlue ($JBLU, airline) slightly beat revenue expectations, with operating expenses growing 7.6% YoY while revenue increased 3.7% YoY. However, the company expects revenue to decline 5-9% in Q1 and remain flat for the full year of 2024 (JetBlue Q4 2023 Earnings).

Danaher ($DHR, medical/commercial products and services) reported a slight revenue beat but anticipates revenue decline in 2024. With 2023 revenue falling -11% YoY due to fading demand for COVID products, the company expects core revenue to fall high-single digits YoY in Q1 2024 and low-single digits YoY for FY2024 (Danaher Q4 2023 Earnings).

Pfizer ($PFE, biotech) missed Q4 revenue slightly, driven by reductions in revenue for COVID-19 products. Despite this, Pfizer expects operational revenue growth of 8% to 10% for full-year 2024 compared to 2023, with FY2024 guidance indicating revenues of $58.5 to $61.5 billion (Pfizer Q4 2023 Earnings).

Diageo ($DEO, consumer staples) reported a -1.4% decline in sales for the first half of FY24, attributed to FX and organic sales decline. While Latin America & Caribbean region sales fell -23%, excluding LAC, the group's organic net sales grew 2.5%. Diageo expects improvement in organic net sales growth in the second half of FY24 (Diageo H1 FY2024 Earnings).

For more macro and market commentary, check out my Reddit feed.