European Industrial Production Crashes Back to 2022 Lows

Economic news and commentary for May 15, 2023

Euro Area Industrial Production

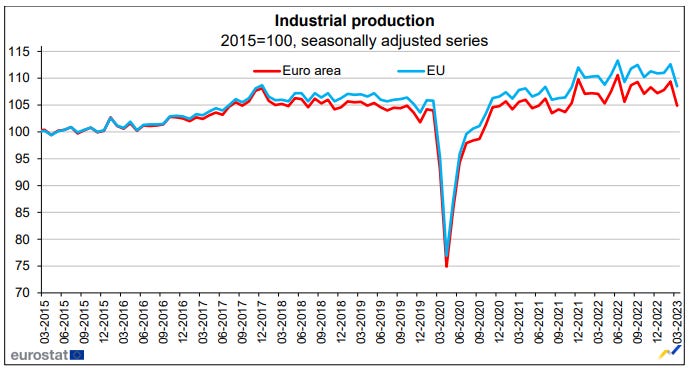

The European industrial sector continues to struggle after another month extends the trend of choppy data. Euro area industrial production fell -4.1% MoM and -1.4% YoY in March. This followed and reversed a gain of 1.5% MoM in February. The index of production has fallen back down to the lows of 2022 but hasn’t crashed like it would in a major recession. The cause of the decline in March was a sharp drop in capital goods production, down -15.4% MoM and -2.1% YoY. The declines in other categories were smaller but still significant. Intermediate goods (-1.8% MoM), energy (-0.9% MoM), and non-durables (-0.8% MoM) production all fell around -1 to -2% MoM. The only increase observed was in durable consumer goods, up 2.8% MoM.

With another sharp decline in industrial production, the trend of no trend continues for another month. For the most part, the industrial sector is proving to be fragile in the current context of higher interest rates and still high inflation. Major declines in Germany, France, and other large economies contribute to this weakness. In March specifically, an outsized contraction in Ireland caused the data to fall at the robust -4.1% MoM. Sluggish demand for intermediate goods (-4.7% YoY) and capital goods (-2.1% YoY) production is causing more clear downward trends in those industries while shortages of food and other necessities are providing support for non-durable goods production, up 6.8% YoY. Overall, we should expect momentum to continue to fall out of industrial activity in Q2 as the feeble growth of Q1 gives way to increased capital costs and planned inventory drawdowns.

Still to come…

8:30 pm (EST) - Australia Westpac Index of Consumer Sentiment

9:30 pm - RBA Meeting Minutes

10:00 pm - China Fixed Asset Investment, Industrial Production, and Retail Sales

Morning Reading List

Other Data Releases Today

India's wholesale price Inflation turned negative. The index was down -0.9% YoY in April, down from 1.3% YoY in March. Commodities (1.6% YoY) and fuel & power (0.9% YoY) both grew while manufactured product prices fell -2.4% YoY.

German wholesale prices fell -0.4% MoM and -0.5% YoY in April. This is the first annual decline in wholesale prices since December 2020. The decline was mostly a result of a contraction in mineral oil product prices(-15.7% YoY).

Canada housing starts jumped 22% MoM to 261,559 in April. The SAAR of total urban starts increased by 26% MoM, and multi-unit urban starts increased by 33% MoM. Single-detached urban starts decreased by -2% MoM.

The Empire State Manufacturing Survey Business Conditions index crashed -42.6 pts to -31.8 as almost half of the respondents reported deteriorating conditions. The New Orders index crashed -53.1 pts to -28.0, and the Shipments index dropped -40.2 pts to -16.4. Despite the decline in demand, the Prices Paid index increased 1.9 pts to 34.9, and the Prices Received index was mostly unchanged at 23.6.

US

Consumer Sentiment Slumps in Early May (Wells Fargo) - Consumers continue to signal they are downbeat about the economy, and that they expect inflation to remain higher for longer. The consumer sentiment index dropped to a six-month low and medium-to-long term inflation expectations notched a 12-year high.

Interest Rate Risk, Bank Runs and Silicon Valley Bank (St Louis Fed) - When commercial banks borrow—from depositors and other sources—over the short term and lend for long periods, it creates the risk that rising interest rates will reduce the value of their long-term assets. Bad news or a large drop in asset values may worry depositors and trigger a bank run, which could put a bank out of business if it cannot quickly liquidate assets to meet demands for withdrawals.

U.S. Debt Limit: Once More to the Brink (BMO) - It’s called ‘X-Date’. The day when Treasury’s extraordinary measures run out and its cash balance runs dry. It’s the moment when the U.S. government is no longer able to honour all financial obligations when they come due. It’s the point when America will eventually default on its debt, and it’s now expected to arrive in early June after Treasury Secretary Yellen’s notification to Congress on May 1—weeks before the previous projections and market expectations.

(Don’t) Take It to the Limit (BMO) - In a generally quiet week for the economy, when even the U.S. CPI was largely as expected and caused few ripples, markets began casting a warier eye on the debt ceiling tussle. Bloomberg recently called it the crisis no one wants to talk about, but there is now no choice, with the ceiling about to bite within weeks.

Debt Ceiling: High Risk, Low Reward (Northern Trust) - Since its creation, the ceiling has been raised or suspended over a hundred times, usually with no controversy. But under divided government, the limit has been used for objectives far from its intended purpose. Far from its intention to be a remedy, the limit has unintended consequences that carry tremendous risks to institutional and market stability.

Lending Standards Tighten for Residential and Commercial Real Estate Loans in Q1 2023 (NAHB) - According to the Federal Reserve Board’s April 2023 Senior Loan Officer Opinion Survey (SLOOS)—conducted for bank lending activity over the first quarter of 2023—banks reported that lending standards tightened for most residential real estate (RRE) and commercial real estate (CRE) loan categories. Demand for RRE and CRE loans weakened across all categories over the quarter. No banks expected their lending standards for most loans to ease over the remainder of 2023 and one-third expected more tightening.

U.S. Inflation: Painstaking Progress (BMO) - The April CPI report drew more than the usual amount of attention as it captured the first full year of aggressive monetary tightening and the first month of regional bank stress. The report largely met expectations of some further easing in headline and core inflation to 4.9% and 5.5%, respectively. Markets took some comfort from hints of cooling in the over-heated services sector.

Inroads Slowly Being Made on the Inflation Fight (Wells Fargo) - Inflation remains uncomfortably high in the U.S. In April, the CPI rose 0.4% on both a headline and core basis, keeping the core running at a 5.1% three-month annualized rate. However, details pointed to price growth easing ahead, while the Producer Price Index and NFIB small business survey also suggested more meaningful disinflation is on its way. Consumers aren't so sure.

Macro & Markets: Cut it out! (Nordea) - Rate cut speculation has been all over the place lately. While there are clear downward risks that could make central banks reverse course more rapidly, we find compelling arguments in favour of keeping rates high for longer than just a few months.

Texas economic expansion slows; business outlooks weaken (Dallas Fed) - The Texas economy’s modest expansion appears to be slowing despite having some pockets of strength. Manufacturing has stagnated, the labor market has shown signs of cooling, commercial real estate activity has weakened, and banking conditions have continued to deteriorate along with outlooks. However, the service sector has seen continued growth in recent months, job gains remain robust, wage pressures haven't yet abated and the housing market has begun to stabilize.

Trade and Globalization since the 1980s (St Louis Fed) - Recent events, such as pandemic-related international supply chain issues, have put a spotlight on global trade. Yet, economists have studied trade for a long time, as it is one of the many important factors driving long-run economic growth.

Europe

The impact of Brexit on UK trade and labour markets (ECB) - It has been almost two and a half years since the United Kingdom signed its post-Brexit trade deal with the European Union (EU), which was expected to have multifaceted impacts on the UK economy. While it will take some time for all the effects to emerge, this article focuses on recent developments in UK trade and labour markets, where the impacts of Brexit have been widely discussed.

UK - Stagnant GDP and sticky inflation to keep rates higher for longer (ABN AMRO) - GDP eked out 0.1% q/q growth in Q1, following 0.1% growth in Q4. In level terms, the UK is the only major advanced economy with GDP still below its pre-pandemic level, with output languishing some 6 percentage points below the pre-pandemic trend.

Türkiye | Post-quake recovery in activity (BBVA) - Industrial production (IP) rapidly recovered in March increasing by 5.5% m/m (1.8% m/m cons.), mostly wiping out the impact from the earthquakes. Recent better than forecasted momentum and potential continuation of populist policies after elections put upside risk on our 2023 growth forecast of 3%.

Weekly Focus - Inflation battle not done as BoE follows suit (Danske Bank) - In the absence of any bad news from the US banking sector, markets started the week off in a calm manner with yields edging higher. The US CPI print was markets' key focus point this week, and it printed very close to consensus, with core CPI unchanged at 0.4% mom, still way too high.

Poland: CPI inflation slowdown confirmed, but core remains elevated (ING) - CPI slowed in April, but service price growth remains high and core inflation is persistent. Newly-announced election calendar spending (1% of GDP) also suggests continued inflationary pressure and no rate cuts in 2023.

Australia

NAB Monetary Policy Update – 15 May 2023 (NAB) - After a sequence of surprises from the RBA in recent months, we are reverting to our baseline expectation from February that the cash rate will rise to a peak of at least 4.1% – which we pencil in for July, though we see some risk the RBA could wait till August.

Canada

BoC Senior Loan Officer Survey (2023 Q1) — Feeling the Squeeze (BMO) - The Bank of Canada's Senior Loan Officer Survey showed lending conditions tightening almost across the board in Q1. That shouldn't come as a shock given ongoing rate hikes through 2022 and January's potentially final hike.

Africa

African Currencies Are Under Pressure Amid Higher-for-Longer US Interest Rates (IMF) - Weaker currencies make the fight to curb inflation harder given the region’s dependence on imports.

Monetary Policy

Tightening Club: The Next Chapter (BMO) - Central bank actions are truly all over the map these days. Sure, they are all still gunning for 2% inflation, but the major policymakers are employing different methods to get there. Look at what has happened over the past few weeks.

After you, Chairman Powell (CIBC) - Although it’s still an open issue, the Fed seems ready to put away its rate hiking pen, if not as decisively as financial markets seem to assume. The latest CPI data weren’t really worthy of the roughly 10 basis point rally they engendered in two year Treasuries, a rally validated only if the Fed cuts before the end of this year. The hoopla rested on only one below target seasonally adjusted monthly gain for one specific subgroup of the overall

CPI index.

Commodities

Commodity Weekly: Patiently bullish on gold and copper as crude consolidates (Saxo Bank) - The commodity sector trades down around 2.5% on the month, on track for its sixth monthly loss, with current weakness being driven by energy and industrial metals in response to continued concerns about the global economic outlook and specifically the pace of the recovery in China which has proven to be less commodity intensive than previous government supported growth sprints.

Tourism

Global Tourism: An Incomplete Recovery (Northern Trust) - Few industries were spared from the impact of the pandemic in the past three years, and even fewer were hit as hard as the tourism sector. But optimism has finally returned to this vital area of the economy. International travel is well on its way to recovering to pre-pandemic levels.

Markets

Is the Resilience of Risk Assets at Risk? (BMO) - The S&P 500 is up a solid 7% this year, despite concerns about the economy, debt ceiling, and ongoing stress in the bank sector. That is impressive resilience given all of the challenges thrown at the market, and there are a number of reasons why stocks and risk assets more broadly have held in from a macro perspective. Here’s a look at some of those reasons, and some issues to consider as we go through the rest of the year.

Research

Winners and losers from recent asset price changes (Federal Reserve) - Asset prices and interest rates have changed dramatically and unexpectedly over the last two years as the Federal Reserve has raised its policy rate to combat higher inflation. In this note, we clarify the redistributive effects of these asset price changes in terms of welfare, which contrast sharply with those of wealth.

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website.