Japan continues to grapple with weak consumption growth stemming from declining incomes, while the Reserve Bank of Australia maintains its stance on inflation progress. Italy experiences a surge in consumer confidence amidst a brighter economic outlook, contrasting with dismal retail sales and construction activity in the Euro Area.

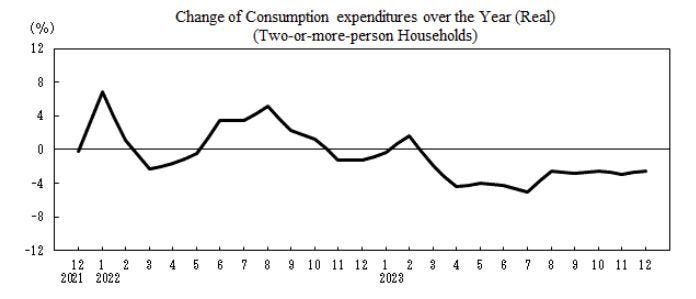

Japan: Weak Incomes Lead to Weak Consumption Growth

Japanese household consumption was up just 0.4% YoY in December, slightly better than the 0.3% YoY increase in November. Real consumption was actually down -2.5% YoY. The growth of spending on goods eased from 2.1% YoY to just 0.3% YoY while service spending growth picked up from -1.4% YoY to 0.2% YoY. On a constant currency basis, however, both were negative. The weak spending numbers are likely a result of even weaker income data. Japanese incomes have fallen -4.4% YoY, the worst in over two years, and on a constant currency basis are down a sharp -7.2% YoY. With the drop in income well below the consumption growth, the average propensity to consume jumped 1.2 ppts to 37.2%.

RBA: More Inflation Progress Needs to be Made

The RBA opted to leave the cash rate target unchanged at 4.35% as it continues to look for more progress on inflation. Goods price inflation did come in below what the RBA expected, but services inflation remains too high. Additionally, the RBA cites that they see the labor market as tighter than what is consistent with “sustained full employment and inflation at target.” The current forecasts have inflation returning to the range of 2-3% in 2025 and to the midpoint in 2026. In the guidance of future policy, the RBA says that it needs to be “confident” that inflation is moving towards the target and that “it will be some time yet before inflation is sustainably in the target range.” The announcement is a clear signal that the market should not expect rate cuts anytime soon as the RBA needs to see much more progress on inflation before it moves.

Italy: Consumer Confidence Higher on Better Economic Outlook

Italy’s Consumer Confidence index grew 0.6 pts to 96.4, the highest since 2021 in January. There was a notable increase in positive feelings about the economy as the Economic Climate index jumped 3.4 pts to 103.1, the highest since Q2 2023. Alternatively, feelings about personal financial situations soured slightly with that index falling -0.5 pts to 93.9. The divergence between consumers’ perception of the economy and their personal situations is a trend that seems to be pretty common in many developed nations. Consumers also noted that their positive sentiment came from expectations that conditions would improve (Future Climate index up 0.8 pts to 97.2) while they were slightly less bullish about the current situation (Current Climate index up 0.4 pts to 95.8).

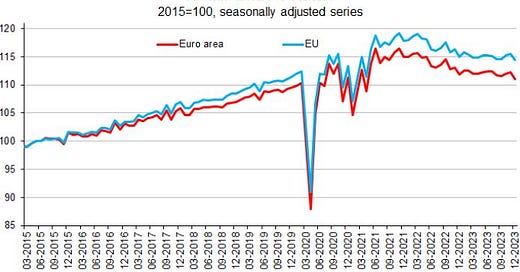

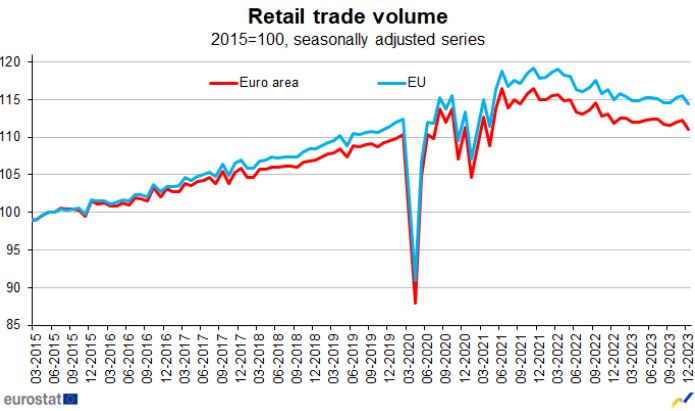

Euro Area: Dismal Retail Sales and Construction Activity

Euro area retail sales dipped 1.1% MoM and -0.8% YoY in December. The annual average level of trade in 2023 was -1.8% below the level in 2022. The decline in sales was broad as the food category noted the largest drop of -1.6% MoM and not far behind was non-food sales down -1.0% MoM. Gas sales were down -0.5% MoM. Mail order and internet sales were especially weak, down -3.7% MoM, despite the holiday month.

In another display of euro area weakness, the S&P Construction PMI found that construction activity fell at the sharpest rate since May 2020. The index dropped to 41.3 in January from 43.6 in December marking the 21st straight month of the PMI being in the contraction zone below 50. Weakness was extreme in the commercial sector where activity there was also the weakest since May 2020, and while housing construction did see that severity of a decline, it was still the weakest in five months. Germany and France both noted these levels of weakness in the construction sector while construction activity in Italy actually expanded. Looking to the future, construction businesses maintained negative confidence and saw further declines in activity in 2024.

In the News

Chinese Market Bounces

The Chinese market witnessed a significant rebound today, with the Shanghai Composite index surging by 3.23% and the CSI 1000 small-cap index recording an impressive 7% jump. Reports overnight hinted at forthcoming updates from regulatory bodies like the China Securities Regulatory Commission on various policy initiatives, potentially including direct stimulus measures or interventions in the real estate sector to bolster the economy. Over the weekend, Powell's insights during a 60 Minutes interview shed light on China's economic landscape, noting its shift away from a market-led growth model towards state-owned enterprises, particularly emphasizing concerns about overreliance on real estate investment. Despite this, Powell downplayed the direct impact of China's economic policies on the US financial system, suggesting that while there may be some effects, they are not expected to be significant.

Houthis Launch More Missile Attacks

This morning, the Houthis claimed responsibility for targeting two additional ships in the Red Sea using missiles. According to a spokesman for the group, the Houthis fired at two vessels they identified as American and British-owned. The first ship, which was Greek-owned, sustained damage as a result of the attack. However, the second vessel, owned by a British entity, emerged unscathed and proceeded along its intended route despite the incident.

Atlanta Fed President Speaks on US Labor Market

Atlanta Fed President Bostic delivered a speech focusing on the US labor market, addressing shifts and trends within it. Notably, he said that the Federal Reserve has revised its long-term estimate for the US jobless rate downwards, a reflection of the tightening labor market in recent years. While in 2017, full employment was perceived with an unemployment rate of 4.25%, the median long-term expected unemployment rate among FOMC members has since decreased to 4.1%. Additionally, Bostic highlighted the uneven distribution of benefits resulting from the shift to remote work, emphasizing disparities across various industries, occupations, locations, and demographic groups.

Border Policy Dispute Could Block Aid to Israel and Ukraine

Congress currently finds itself embroiled in a contentious debate over border conflicts, which threatens the approval of crucial aid packages destined for Ukraine and Israel. The Senate introduced a comprehensive bill intertwining border security measures with foreign aid, but encountered staunch opposition from Republican leadership in the House. While House Republicans advocate solely for aid to Israel, President Biden has vowed to veto any standalone bill in favor of Israel. Amidst this deadlock, political divisions exacerbate the situation, with Republicans split over support for Ukraine and Democrats similarly divided over backing for Israel. These opposing stances further entangle the debate, leaving the fate of foreign aid uncertain amidst the backdrop of border disputes.

Earnings

Spirit AeroSystems (SPR, aerospace manufacturing): Suspended guidance due to uncertainty surrounding the Boeing 737 MAX situation, with production suspended by the FAA.

Palantir (PLTR, technology) reported significant commercial growth in Q4, with US commercial revenue surging 70% YoY and commercial customer count increasing by 55% YoY. Total commercial contract value rose 107% YoY to $343M. Analysts note that the AI Platform's deal flow surpassed expectations. Q4 sales estimated at $612-616 million, slightly below expectations, while full-year 2024 sales forecasted at $2.65-2.66 billion, surpassing estimates.

Spotify (SPOT, consumer discretionary) exceeded expectations in Q4 with revenue growing 16% YoY, premium revenue up 17% YoY, and ad-supported revenue increasing by 12% YoY. Monthly active users surged 23% YoY to 602 million, surpassing guidance, and premium subscribers grew 15% YoY to 236 million, also exceeding expectations. Guidance anticipates further growth in active users and premium subscribers in 2024, with premium subscribers expected to reach 239 million.

For more macro and market commentary, check out my Reddit feed.