Japanese Consumer Confidence Jumps to Highest Level in More than a Year

Economic news and commentary for April 10, 2023

Japan Consumer Confidence

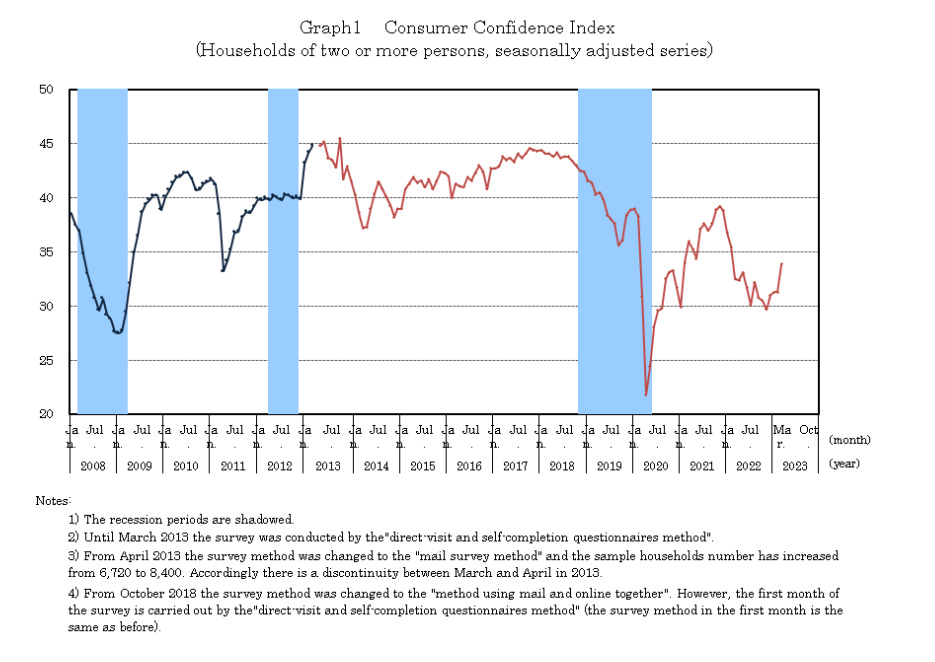

Consumers are feeling a lot better in Japan after they ended last year with a sour economic perspective. Japan’s Economic and Social Research Institute reported that the consumer confidence index jumped 2.6 pts to 33.9 in March. This is the highest it has been in over a year after a dip in confidence was seen throughout 2022. The sub-indexes have all followed similar trends reaching near-term highs not seen since early 2022 and late 2021. The index tracking the overall livelihood of Japanese consumers increased 2.6 pts to 30.3, and the index tracking consumers’ willingness to buy durable goods jumped 3.2 pts to 26.4. Both the employment and income indexes saw comparable gains.

The consumer survey also asks about Japanese individuals' inflation expectations over the next year, an important measure for the Bank of Japan to track the development of one of the key drivers of actual inflation. The percentage of respondents expecting prices to “Go up” has been at all-time highs (survey data goes back to 2004) since February 2022 and remained in that territory in March where it fell just -0.2 ppts to 94.1%. The Bank of Japan does consider inflation good, but runaway inflation would be an undesirable effect of its exhaustive campaign to keep borrowing rates ultra-low. Consumers seem to think that there is a strong possibility of that as 61.1% of them responded that they expect year-ahead inflation to be 5% or more. This measure has been elevated ever since it jumped from 39.7% in February 2022 to 53.1% in March 2022. After a year, however, the measure is starting to ease as the 61.1% reported percentage is a -5.7 ppts decline from the all-time high set in February 2023.

These results are the first that the new Bank of Japan governor, Kazuo Ueda, will get to digest before he considers how to leave his mark on Japan’s monetary policy. For now, it seems that he will maintain the current state of things, but the recent developments in inflation should have him and his peers looking to normalize policy as soon as this year. A rebound in consumer confidence and the general Japanese economy will give the BoJ some support to make that decision to reduce some of its quantitative easing. The recent surge in inflation expectations will provide the impetus for making this decision sooner rather than later since a feedback loop can develop between expectations and actual price changes which make inflation harder to control.

Still to come…

10:00 am (EST) - US Wholesale Inventories

12:30 pm - US Investor Movement Index

8:30 pm - Australia Westpac Index of Consumer Sentiment

9:30 pm - Australia NAB Business Survey

9:30 pm - China CPI & PPI

Morning Reading List

US Employment

A Good Friday Jobs Report (Wells Fargo) - Hiring in the U.S. economy is slowing but not collapsing. Nonfarm payrolls in March rose by 236K. That marked the smallest gain in over two years but was still well-above the past cycle's average and was sufficiently strong to help push the unemployment rate back down to 3.5%. The labor market is moving back toward balance not just through weaker labor demand, as has been evident in earlier reports on job openings and layoffs, but also through improving labor supply.

Hiring remained strong in March, but employment gains are becoming increasingly narrow (TD Bank) - The U.S. economy added 236k jobs in March, slightly stronger than the consensus forecast of 225k. Revisions to the two months prior were modestly negative, subtracting 17k from the previously- reported figures. Hiring over the last three-months averaged 345k, basically unchanged from February's 346k.

Tight US jobs market favours 25bp Fed rate hike (ING) - The US economy added 236,000 jobs in March with the unemployment rate dropping to 3.5%. With next week's core inflation number likely to come in at 0.4% month-on-month the odds must favour a final 25bp Fed rate hike in May. However, economic challenges are mounting with higher borrowing costs and reduced credit flow heightening the chances of a hard landing.

US Labor market: cooler, but not cold (CIBC) - Hiring cooled in the US in March, but the labor market remained strong enough to justify a final quarter point rate hike from the Fed in May. The 236K pace of hiring was in line with the consensus expectation and reflected gains in the leisure and hospitality sector, government, and professional/business services.

US - Labour market cooling, but still hot (ABN AMRO) - Payrolls growth slowed to 236k in March, down from 326k in February, and continuing the broad cooling trend in the labour market of the past year or so.

Job Gains Slow in March (NAHB) - Job growth slowed in March, along with higher interest rates and increased economic uncertainty. After a revised 326,000 job gain in February, total nonfarm payroll employment increased by 236,000 in March, and the unemployment rate declined to 3.5% from 3.6% in February. Average hourly earnings have increased by 4.2% on a year-over-year basis. It marks the lowest wage gain since June 2021, suggesting inflationary pressures are easing.

India

Reserve Bank of India's Hawkish—and Uncertain—Hold (Wells Fargo) - The Reserve Bank of India (RBI) opted for a hawkish hold at its April meeting; however, mixed signals complicate the outlook for Indian monetary policy. We now believe the RBI will be on hold through Q3-2023, but is still on track to initiate an easing cycle in Q4 of this year.

Australia

RBA & RBNZ: Policy Divergence Down Under (Wells Fargo) - The Reserve Bank of Australia (RBA) paused its monetary tightening in April, holding its policy rate at 3.60%. The RBA also softened its guidance in regard to further rate hikes, stating that "some" further tightening of monetary policy "may well be needed". In contrast with the RBA, the Reserve Bank of New Zealand (RBNZ) was more hawkish than expected at its April monetary policy meeting, delivering a 50 bps rate hike to 5.25%. Policymakers said that inflation is still too high and persistent, while employment is beyond its maximum sustainable level.

Turkey

Weak Turkish capital flows add pressure to international reserves (ING) - While the current account deficit continued its widening path, capital flows have remained quite weak in the absence of unidentified solid inflows, and that's leading to pressure on international reserves this year.

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website.