The week starts with more troubling developments out of China and the Middle East which were the focus as we saw no major macro releases this morning.

China's Resilience Faces Tests

Evergrande's Ongoing Saga

The persistent instability in the Chinese real estate market has triggered economic concerns globally, and the pain is not over. A recent court order for China Evergrande to liquidate in order to cover over $300 billion in liabilities, is the latest update in the saga which started when the company first defaulted in 2021. Due to the news, shares of the company traded down -20% before trading was halted. The unwinding poses a new threat to the Chinese economy which is heavily reliant on the construction sector (25% of GDP). It also suggests that Beijing is not interested in intervening in debt situations like this even if there is economic significance.

Short Selling Restrictions

In conjunction with the Evergrande news, Chinese market regulators have taken proactive measures to stabilize the stock market. Short selling restrictions, implemented by both the Shenzen and Shanghai exchanges, aim to instill confidence in the face of a challenging -10% performance of the Shanghai Composite index over the past year. Today, the Shanghai Composite traded down -0.92%.

US Being Pulled Harder into Middle East Conflicts

A drone strike in Jordan resulting in the loss of three US Army soldiers has heightened geopolitical tensions further in the Middle East. The attack will likely increase more direct US involvement in Middle East conflicts that have started to reignite following the Israel-Hamas war. In response, President Biden has asserted a firm commitment to retaliation, stating, "We shall respond." He attributed the attack to radical Iran-backed militant groups operating in Syria and Iraq. However, the situation is marked by conflicting narratives, as Iran denies any involvement in the strike, which is purported to be carried out by Iran-backed militants in Syria that go by the name Islamic Resistance.

Fundamentals Push Soybeans Futures Lower

Soybean futures have reached a 26-month low at $12, driven by a interplay of supply and demand factors. Favorable weather conditions in Brazil and Argentina have bolstered supply expectations, leading to a bearish sentiment. Specifically, the Buenos Aires Grains Exchange raised Argentina's crop forecast by 1% over its previous estimate, and the USDA increased its production forecast for US soybeans in 2023/24 to 4,165 million bushels. The higher supply expectations includes projections of reduced demand for soy meal and oil. The decline in soybean pricing is good news for food inflation across the globe which is seeing a slower deceleration than other segments of inflation.

Quiet Macro Morning

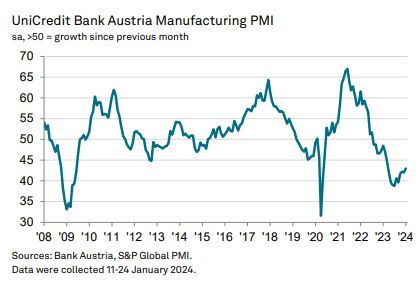

There were little to no macro releases this morning with the exception of a minor update out of Europe. Austria's S&P Manufacturing PMI for January, improving to 43.0 from December's 42.0, suggests a nuanced economic landscape. While still indicating a sharp contraction, this uptick is the highest in 10 months.

Ryanair Earnings Points to Solid Air Passenger Growth

In the corporate earnings space, Europe's largest airline, Ryanair, reported a 7% YoY increase in Q3 FY24 (three months to December) passenger numbers. Despite facing challenges such as slightly lower than expected Q3 load factors as a result of unusual circumstances surrounding booking trends, the overall FY24 YTD customer traffic is up 10%. With one quarter to go, the airline confirmed its outlook of 9% YoY traffic for the full year. Ryanair also reported a large rise in operating costs, primarily due to a substantial 35% increase in fuel costs.

For more macro and market commentary, check out my Reddit feed.