Private Wage Growth Slows to the Lowest Rate Since 2021

Economic news and commentary for July 28, 2023

US Employment Cost Index

With so much data coming out this week, it is difficult to discern what should be the focus. For me, this key update on employment costs is one of the biggest releases given that it only comes out quarterly and is one of the focal points for the Fed in updating monetary policy. For Q2 2023, the Employment Cost Index, tracking all civilian workers’ compensation, grew 1.0% QoQ and was up 4.5% YoY. This was down from 4.8% YoY in Q1 2023 and 5.1% YoY in Q4 2022.

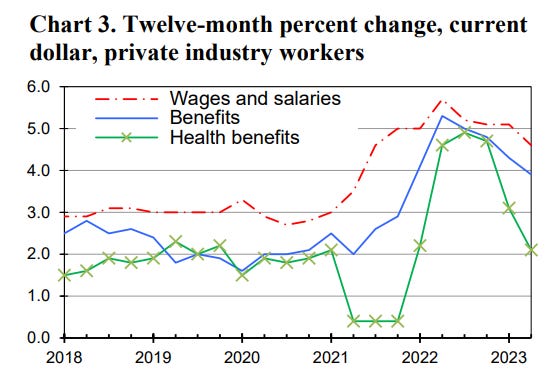

Results for private sector compensation were pretty much the same. That index grew 1.0% QoQ and 4.5% YoY which is a slower pace than the 4.8% YoY in the previous period. The annual rate of growth for private wages and salaries also slowed to 4.6% YoY, down from 5.1% YoY and the lowest since Q3 2021. The growth of benefits was even slower at 3.9% YoY. Public sector wage growth was stickier, up 0.8% QoQ and 4.7% YoY which is the same as the previous period. Public sector benefit growth was actually stronger at 5.2% YoY. Another notable result this quarter was that the ECI in constant dollars turned positive for the first time in a long time at 1.6% YoY, up from -0.2% YoY.

Both the service sector and goods sector employment cost growth (all civilian workers) cooled in the second quarter. Goods-producing industries’ wage growth was 4.0% YoY which is slower than the 4.3% YoY in Q1, and service-providing industries’ wage growth was 4.6% YoY, down from 4.9% YoY. The quarterly growth of service sector wages was the slowest in two years which is a great result for the Fed which is looking for wage growth to slow and help move services inflation lower.

The Fed hiked rates on Wednesday with its eyes on elevated services inflation and, in turn, hot wage growth that has been stoked by a tight labor market. Job growth has continued so far in 2023, but at the same time, the momentum in hiring has clearly started to fall away which is demonstrated by the smaller sizes of those job gains and the decline in job openings from record-high levels. As a result, the progress in slowing wage growth has been similar in that the decline has been gradual but consistent.

Still to come…

10:00 am (EST) - US Consumer Sentiment

Morning Reading List

Other Data Releases Today

The Bank of Japan tweaks monetary policy for the first time in years. The BoJ will allow for "greater flexibility" in its yield curve control by offering to purchase 10-year bonds at 1.0% (up from 0.5%) every business day. The Bank of Japan continues with monetary easing as it still does not see a "stable achievement" of the 2% price stability target. However, it highlights a notable increase in inflation expectations and upgrades its outlook for CPI in 2023 substantially.

Australia's PPI grew 0.5% QoQ and 3.9% YoY in Q2 2023, down from 4.9% YoY in Q1 2023. This is the slowest quarterly increase since Q1 2021. The PPI in construction (0.9% QoQ) and food services (1.7% QoQ) were the main contributors to the rise.

Australia's retail sales fell -0.8% MoM in June but were still up 2.3% YoY, reversing an 0.8% MoM gain in May. The YoY increase is the lowest since September 2021 (2.2%). Department and clothing store sales fell sharply, down -2.2% MoM and -5.0% MoM.

French GDP growth was 0.5% QoQ in Q2 2023, up from 0.1% QoQ in Q1 2023. Household consumption fell -0.4% QoQ, and GFCF edged up 0.1% QoQ. The growth in Q2 was mostly a result of exports jumping 2.6% QoQ offsetting imports up 0.4% QoQ.

French CPI was flat and up 4.3% YoY in July, down from 4.5% YoY in June.

Food: 12.6% YoY (prev 13.7% YoY)

Energy: -3.8% YoY (prev -3.0% YoY)

Goods: 3.4% YoY (prev 4.2% YoY)

Services: 3.1% YoY (prev 3.0% YoY)

German CPI grew 0.3% MoM and 6.2% YoY in July, down from 6.4% YoY in June.

Core CPI: 5.5% YoY (prev 5.8% YoY)

Food: 11.0% YoY (prev 13.7% YoY)

Energy: 5.7% YoY (prev 3.0% YoY)

Goods: 7.0% YoY (prev 7.3% YoY)

Services: 5.2% YoY (prev 5.3% YoY)

The EU Economic Sentiment Indicator fell -0.5 pts to 93.6 in July. The Employment Expectations Indicator fell -1.8 pts to 102.4. Consumer confidence increased 1.0 pts to -16.1 as it continues to recover from the all-time low in September 2022.

Italy's PPI fell -0.3% MoM and -5.5% YoY in June. Non-energy PPI fell -0.2% MoM but was still up 2.0% YoY. Durables (6.0% YoY) and non-durables (6.9% YoY) prices remain rising while energy and commodity prices drive the PPI decline.

US personal income grew 0.3% MoM in June, and real personal consumption grew 0.4% MoM. The PCE price index grew 0.2% MoM and 3.0% YoY (prev 3.8% YoY), and the core PCE price index grew 0.2% MoM and 4.1% YoY (prev 4.6% YoY).

Bank of Japan Announcement

Bank of Japan surprises the market with yield curve control tweak (ING) - Today we have seen two major surprises from Japan. First, the Bank of Japan has made a tweak to its yield curve control policy. Second, Tokyo inflation unexpectedly rose to 3.2% in July.

ECB Announcement

European Central Bank: Dovish and Data Dependent (Wells Fargo) - The European Central Bank (ECB) raised its Deposit Rate 25 bps to 3.75% at today's monetary policy announcement, matching widespread expectations. More significantly, the ECB sounded more downbeat on the economy and, in contrast to recent meetings, was cautious in offering any guidance about policy beyond this July meeting.

ECB hikes rates by 25bp (ING) - The European Central Bank hikes rates by 25bp and doesn't seem to blink, despite the latest batch of disappointing macro data.

Europe | Hike or pause in September, question not resolved (BBVA) - Our forecast still leans towards a further rate hike in September (reaching a terminal rate of 4% for the deposit rate); however, recent data weaknesses and ECB communications before and during the meeting have increased the likelihood of a potential pause and the possibility of no further hikes.

The ECB switches off autopilot (ING) - While the policy announcement earlier today left the door wide open for another rate hike in September, ECB President Christine Lagarde stressed during her press conference that anything was possible, including a pause.

ECB... Maybe We Will, Maybe We Won't (BMO) - Let's face it: everyone expected this 25 bp rate hike by the ECB, which brought the refi rate to a 14-year high (or Sept 2008) of 4.25%, the deposit rate to a 23-year high of 3.75% and the marginal lending facility to 4.50%. The press release again started off with "inflation continues to decline" as a teaser; then, reminded everyone that the central bank is data-dependent, and since "inflation is still expected to remain too high for too long", well, rates will stay at "sufficiently restrictive levels for as long as necessary".

EU Consumer Sentiment

Eurozone economic sentiment indicator confirms weak start to third quarter (ING) - The eurozone economy performed weaker than expected at the start of the third quarter, thereby increasing the recession risk. Inflation expectations ticked up slightly in the service sector though, indicating that data so far leave room for interpretation for the ECB regarding a possible September hike.

Germany GDP

German economy stagnated in the second quarter (ING) - The flash estimate of German GDP growth shows that the eurozone's largest economy stagnated in the second quarter and seems to be stuck in the twilight zone between stagnation and recession.

France GDP

Surprisingly strong second-quarter growth in France (ING) - French GDP grew by an above-consensus 0.5% in the second quarter on the back of strong exports, while domestic demand contracted. The third quarter started on a weaker footing.

US GDP

Broad-based Strength Behind Unexpected Pick-Up in GDP (Wells Fargo) - This morning's economic data offer the latest evidence that the U.S. economy is weathering the fastest rate hikes in a generation without much damage to the major gear-works of the economy. Second quarter GDP growth came in hot, fueled by a rebound in capex spending. June durable goods orders were stronger and fewer people are filing claims for jobless benefits in the latest weekly data. The path to avoiding recession looks clearer today than it did even a few weeks ago.

Real GDP Increased at a 2.4% Annual Rate in Q2 (First Trust Portfolios) - There was much to like in today’s report on second quarter GDP, but that doesn’t mean the risk of a recession has gone away. Real GDP grew at a 2.4% annual rate in Q2, beating consensus expectations. The growth in Q2 was led by consumer spending and business fixed investment, with all three major categories of business investment higher: equipment, commercial construction, and intellectual property (think research and development). Government purchases also accounted for some GDP growth while home building and net exports suffered small declines.

Nuanced optimism for the US economy (EY Parthenon) - Following a 2% advance in Q1, real GDP growth picked up to 2.4% in Q2. Final sales rose a moderate 2.3% while faster inventory accumulation added 0.1 percentage point (ppt) to GDP growth. Final sales to private domestic purchasers — showing the contributions from consumer spending, residential and business investment — also pointed to ongoing resilience in private sector activity, rising 2.3%.

US Q2 GDP: Challenging the Fed (CIBC) - The US economy didn't show the cooling in activity that the Fed has been hoping to see, as GDP advanced by 2.4%

annualized in the second quarter. That was above the consensus expectation of 1.8%, and the acceleration in activity from the first quarter was driven by a pickup in business investment and an increase in inventory accumulation.

Goldilocks GDP feeds the US soft landing narrative (ING) - GDP growth was a little stronger than expected in 2Q 2023, but inflation pressures continue to moderate, supporting the soft landing narrative. The Fed will leave the door open to further rate hikes, but the legacy of past rate hikes and tighter lending conditions will restrain activity and dampen price pressures, negating the need for further action.

U.S. GDP: Swift Business Investment Levels Up Growth (BMO) - With the U.S. economy a year removed from recording consecutive negative GDP growth, real GDP is up by 2.6%, the economy has added 3.8 mln new jobs, and headline inflation has fallen back to 4%. While the headline growth figure raises the odds the Fed may have to consider further hikes later this year, slowing consumer spending and inflation may give them comfort that higher interest rates are having the desired effect on the economy.

Real GDP expanded solidly in Q2, beating expectations (TD Bank) - The U.S. economy expanded for a fourth consecutive quarter in 2023Q2, marking a full year of growth since the brief slowdown at the start of 2022. The resilience in consumer spending – which makes up roughly two thirds of GDP – has kept the economy growing solidly during the first half of the year. With the labor market remaining strong, consumers have been able to weather the headwinds of higher prices and higher interest rates so far.

Looking for a way to take advantage of higher interest rates? I recommend SoFi’s high-yield savings account which has a yield of 4.4% (subject to change) and includes FDIC deposit insurance for both its checking and savings accounts just like a traditional bank. Use my referral link to get a sign-up bonus and start earning that rate today. (This is also a great way to support me since I get a bonus too!)

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website. You can also see my feed on the PiQSuite platform as a partnered feed.