S&P Flash Composite PMIs

• Japan: 52.6 (Jul 52.2)

• UK: 47.9 (Jul 50.8)

• Australia: 47.1 (Jul 48.2)

• Eurozone: 47.0 (Jul 48.6)

• France: 46.6 (Jul 46.6)

• Germany: 44.7 (Jul 48.5)

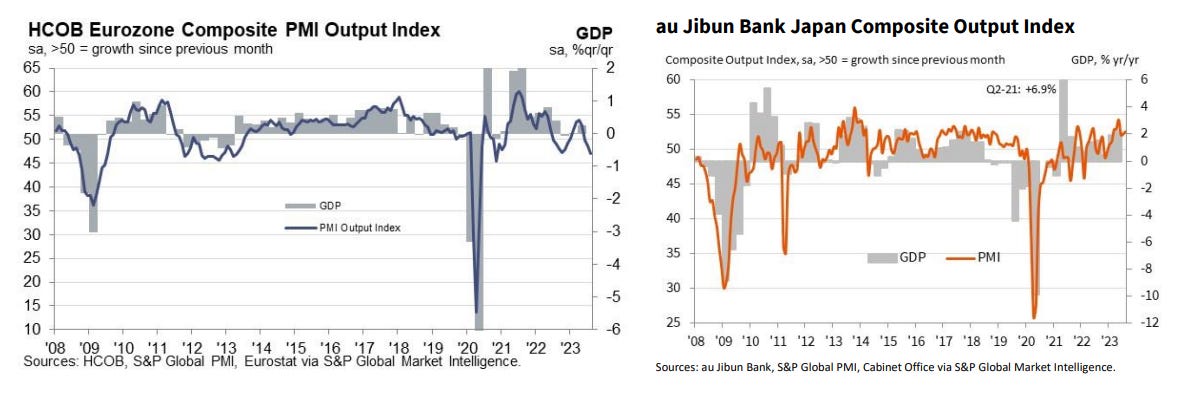

The global economy is in the midst of a slow squeeze, caught in the constricting hands of the major central banks which are fixated on monetary tightening. It appears that the last gasps of the post-pandemic expansion are wheezing out of a majority of developed market economies this summer as they succumb to the gradual decline. Flash August PMIs for the major European countries and Australia all fell significantly (with the exception of France which was already low). The Eurozone PMI reached a 33-month low of 47.0 as the services sector turned from slight growth to a moderate contraction at 48.3 (a 30-month low). In the UK, signals of economic deterioration were even sharper. The UK Composite PMI dropped -2.9 pts to a 31-month low of 47.9 with the services sector flipping to contraction at 48.7 and the manufacturing sector crashing to a 39-month low of 42.5. Similar trends were visible in the Australian PMI where services and manufacturing both weakened, but the decline in the Composite PMI here was only to a 19-month low. The good news is that weak growth prospects led to softer inflation readings. The UK reported average prices charged inflation at the lowest since February 2021, and in the Eurozone, inflationary pressures were “far lower than seen over much of the past 2.5 years.”

The odd one out of all of these is Japan where monetary policy remains starkly divergent from the rest of the developed world. Japan’s Composite PMI saw a slight increase in August to a slightly higher economic expansion (up 0.4 pts to 2.6) thanks to a strong services sector that saw both healthy new order and output growth. The manufacturing sector was basically flat at 49.7, and the slight industrial contraction was not enough to put off the strength of services. It is clear that accommodative policy is driving the outperformance of the Japanese economy, and that policy setting is also supporting higher inflation. Input prices picked up in both sectors of the economy with most respondents pointing to a flare-up in energy prices as the main cause. Additionally, the strong services sector saw faster output price inflation. Despite being the trend in growth being choppy over the last year or so, it appears that the Japanese economy will remain strong relative to the rest of the developed world unless something changes at the Bank of Japan. There have been slight shifts in monetary policy already but so far rates remain sat at 0%.

Still to come…

9:45 am (EST) - US S&P Global Flash Composite PMI

10:00 am - EU Consumer Confidence Flash

10:00 am - US New Home Sales

10:30 am - US EIA Petroleum Status Report

Morning Reading List

Other Data Releases Today

German exports to non-EU countries fell -2.9% MoM to the lowest value so far this year in July. However, they are still up 1.1% YoY.

PMIs

Japan's economic growth quickens in August as service sector counters factory decline (S&P Global) - Growth across Japan's private sector economy quickened midway into the third quarter of 2023, according to flash PMI data. This extended the growth streak that began at the start of the year and was again supported by solid services activity growth. Manufacturing output, however, remained in contraction.

Eurozone PMI paints worrisome growth picture (ING) - Another weak PMI for the eurozone confirms a sluggish economy with recession as a downside risk. Inflation pressures for services remain stubborn as wage pressures continue to be a concern. The latter adds to our expectations that the ECB's hiking cycle is not over yet.

Eurozone downturn deepens according to flash PMI but inflation pressures tick higher (S&P Global) - Eurozone business activity contracted at an accelerating pace in August, according to the latest flash PMI survey data, as the region's downturn spread further from manufacturing to services. Both sectors reported falling output and new orders, albeit with the goods-producing sector registering by far the sharper rates of decline.

UK service sector enters contraction as rate hikes begin to bite (ING) - The latest UK PMIs are unquestionably bad, and will give the Bank of England pause for thought as it nears the end of its tightening cycle.

US Existing Home Sales

Existing Home Sales Fall in July as Higher Mortgage Rates Continue to Bite (Wells Fargo) - The impact of the recent resurgence in mortgage rates is becoming increasingly apparent. Existing home sales declined 2.2% during July, the second straight monthly decline. Since existing home sales reflect contract closings, July's data largely reflect activity in June when mortgage rates averaged 6.8%. So far in August, the average 30-year mortgage rate has marched even higher, climbing back above 7%.

Existing Home Sales Slide to 6-Month Low (NAHB) - Existing home sales in July fell to the lowest level since January as limited inventory and higher mortgage rates continued to weight on homebuyers, according to the National Association of Realtors (NAR). Low resale inventory and strong demand continued to drive up existing home prices, marking the first year-over-year price increase since January.

U.S. Existing Home Sales: Cold in July (BMO) - Existing home sales fell more than expected in July. With 30-year mortgage rates above 7%, many homeowners have been unwilling to put their homes up for sale and give up the low mortgage rates they already have, keeping activity muted.

Existing Home Sales Declined 2.2% in July (First Trust Portfolios) - Existing home sales data continued to look choppy in July, falling for the second month in a row to sit just above the low set back in January. It looks like the small rebound in sales from earlier this year has mostly reversed itself due to the housing market

facing a series of crosswinds.

Existing Home Sales Continue to Trend Lower (TD Bank) - Another month, another weak home sales report. With mortgage rates increasing further and averaging 6.8% in June and July – some 40 basis points higher than in the prior two months – it is no wonder that home sales activity remains near multidecade lows. The elevated rate environment doesn’t just hold back would-be buyers, it also poses a hurdle on the supply side, as existing homeowners with much lower mortgage rates have become reluctant to move.

US

Research US - Could investment boom pave the way for a soft landing? (Danske Bank) - The US economy's early 2023 has been characterized by a 'goldilocks' combination of inflation surprising to the downside, and even more so by growth holding up much better than anticipated. In this paper, we discuss the case for how the US economy could achieve a soft landing, with key focus on the recent stimulus-driven boom in both public and private investments, and on the implications for longer-term productivity.

Macro Insights: US regional banks on notice again (Saxo Bank) - It may be too soon to have put the US regional banking sector concerns on a backburner. While the bank ETFs rose after hitting their lows in early May, concerns are coming back to the sector with rating downgrades and negative watch announcements. Increasing funding risks and weakening profitability will translate into tighter lending standards from US banks, suggesting risks to the US economy at a time when consumers are also running out of pandemic-era savings.

US treasury auctions will test bond markets ahead of Jackson Hole (Saxo Bank) - Wednesday's 20-year US Treasury notes and Thursday’s 30-year TIPS auctions might be pivotal ahead of Jackson Hole on Friday. With Japanese investors returning home, the US Treasury increasing bills and bonds supply, and Quantitative Tightening (QT) still running, investors might find little reason to buy long-term US Treasuries.

Canada

When enough is enough: How to judge where the Bank of Canada sees it (CIBC) - When will the Bank of Canada decide that enough is enough, put away their interest rate hike weapon, and even start easing up on rates? That seems like an easy question to answer: they’re simply looking for 2% inflation. But in practice, they act today to shape inflation down the road. So to anticipate interest rate changes, we need to understand the keys to the central bank’s forecasts for the CPI, particularly for deviations from 2% that would be persistent.

FX

FX Update: Jackson Hole scenarios (Saxo Bank) - US treasury yields have cranked higher, with the long end of the US yield curve even posting new decade-plus highs in yields. The JPY is playing its usual hyper-sensitive role to yield developments, with EURJPY even posting a new post-2008 high today before retreating sharply today as bonds found a bid. But the yield and yen moves are merely a distraction ahead of a possibly critical message from Fed Chair Powell at the Jackson Hole conference on Friday.

Commodities

Gold finding support despite surging yields (Saxo Bank) - Gold prices, in a relatively steep decline for the past month, are showing signs of stabilizing after finding support around $1885. A development which is interesting as its unfolding while 10-year US Treasury yields have surged to a 16-year high on speculation the FOMC may have to hike rates further, and keep them higher for longer, as incoming economic data points to continued price pressure. Instead of yields the attention, for now at least, seems to focusing on a softer dollar, the Fed chairs speech at Jackson Hole on Friday and the BRICS meeting starting today.

Outlook

Global Monthly - A softer landing – but still a landing (ABN AMRO) - The major economies diverged in the first half of 2023, but overall, activity continued to expand, and inflation fell further back – albeit still well above central bank targets. Unexpected strength in the US has led us to drop our call for recession. We still expect tight monetary policy to drive a US slowdown later this year, and to continue to weigh on the eurozone. Even with rate cuts next year, tight monetary policy is likely to limit any post-slowdown rebound.

Divergence in monetary policy becoming more apparent (S&P Global) - S&P Global Market Intelligence's global real GDP growth forecast for 2023 has again edged higher — from 2.4% to 2.5% in August — primarily owing to upward revisions to the US forecast. The 2024 global growth forecast is unchanged at 2.4%, also supported by an upward revision to the US forecast. Elsewhere, the effects of tighter financial conditions are becoming increasingly apparent, with leading indicators generally showing an alarming loss of momentum.

Research

COVID-19 and Education: An Updated Survey of the Research (Cleveland Fed) - This Economic Commentary surveys research on COVID-19 in relation to education in the United States. It is a companion to an earlier survey (Hinrichs, 2021) and focuses on the consequences of the COVID-19 pandemic that might persist even after life has returned to a relative normal. The evidence suggests that the pandemic led to lower enrollment at public schools and negatively impacted student learning. In addition, teacher turnover did not rise at the beginning of the pandemic, but it has risen in the years since.

Growth-at-Risk is Investment-at-Risk (St Louis Fed) - We investigate the role financial conditions play in the composition of U.S. growth-at-risk. We document that, by a wide margin, growth-at-risk is investment-at-risk. That is, if financial conditions indicate U.S. real GDP growth will be in the lower tail of its conditional distribution, we know that the main contributor is a decline in investment. Consumption contributes under extreme financial stress. Government spending and net exports do not play a role.

Looking for a way to take advantage of higher interest rates? I recommend SoFi’s high-yield savings account which has a yield of 4.5% (subject to change) and includes FDIC deposit insurance for both its checking and savings accounts just like a traditional bank. Use my referral link to get a sign-up bonus and start earning that rate today. (This is also a great way to support me since I get a bonus too!)

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website. You can also see my feed on the PiQSuite platform as a partnered feed.