Solid June Jobs Gain Bolsters Arguments for July Rate Hike

Economics news and commentary for June 7, 2023

US Employment

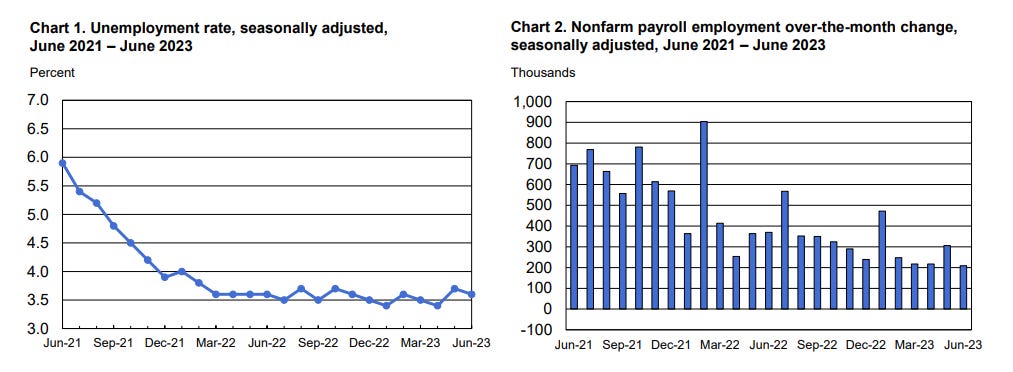

The US added 209,000 jobs in June which means that monthly employment growth has grown by at least 200,000 in each month of the year so far despite broad recession fears going into 2023. On top of the job gains, the unemployment rate fell slightly, down -0.1 ppts to 3.6%. The unemployment rate has ranged from 3.4% to 3.7% since March 2022 pointing to the entrenchment of labor market tightness that has been evident since the end of the pandemic. The total number of unemployed individuals fell back below 6 million to 5.96 million as that population fell by -140,000. Despite the show of hiring demand, the labor supply was mostly unchanged with the labor force participation rate stuck at 62.6% where it’s been for the last four months.

The government was the largest hirer in June, adding 60,000 jobs. Employment continued to trend up in state government (+27,000) and local government (+32,000). So far in 2023, the government has added an average of 63,000 jobs per month thus far in 2023, more than twice the average of 23,000 per month in 2022. Public employment growth has been very supportive of job growth this year and may be distracting from a weaker trend in private employment. In that segment, the largest hiring industry was healthcare with an increase of 41,000. Gains in business services (+21,000) and leisure & hospitality (+21,000) were more muted during the month as hiring has started to slow in the services sector. Regardless, there is still hiring happening since some labor shortages still persist.

The tightness of the labor market has kept the temperature up when it comes to wage pressures. Average hourly wages increased 0.36% MoM and 4.35% YoY in June which was essentially the same as 4.37% YoY in May. The reason for some stickiness in wage growth was because of a bump up in goods wages, reversing a trend of cooling in that sector. Goods sector wage growth was 0.50% MoM and 4.94% YoY, up from 4.64% YoY. Meanwhile, services sector wage growth cooled slightly, to 4.20% YoY from 4.31% YoY.

While not as strong as the nearly 500,000 job additions reported by the ADP employment report, the BLS report does provide some evidence of sturdiness in labor demand in the face of tight financial conditions. The main argument for a weakening labor market is the fact that the government was the largest hirer in June at 60,000 which means that private-sector hiring was only around 140,000. However, that is unlikely to be a selling point for the Fed. Wage growth did not make any meaningful progress this month, and in fact, the reversal of goods wage growth could be seen as a new inflationary force to consider. With that being said, this report reinforces the hawkishness seen in the FOMC minutes and probably keeps the Fed on track to hike by 25 bps in July

Still to come…

10:00 am (EST) - Canada Ivey PMI

10:30 am - US EIA Natural Gas Report

Morning Reading List

Other Data Releases Today

Real consumption expenditures in Japan were down -4.0% YoY in May, up from -4.4% YoY in April. At current prices, consumption was only down -0.4% YoY. Real incomes were down -7.5% YoY, a sharp decline from the -1.4% YoY previously.

German industrial production edged down -0.2% MoM in May but was still up 0.7% YoY. Capital goods production improved 1.3% MoM, and consumer goods production fell -1.2% MoM. In the last 3 months, production grew 0.2% vs the prev 3 months.

The UK Halifax House Price Index fell -0.1% MoM in June, the 3rd straight month of declines. House prices fell -2.6% YoY, down from -1.1% YoY. This is the largest YoY decline since June 2011.

Italy's retail sales (volumes) grew 0.2% MoM in May but were down -4.7% YoY.

The volume of food sales fell -0.5% MoM, and the volume of non-food sales improved 0.7% MoM. However, non-food sales were down -5.2% YoY.

Based on the S&P Global Global Sector PMI, the Technology and Financials sectors have improved to the strongest growing sectors in the global economy in June. They retake the position from Consumer Services where growth is fading.

The German truck toll mileage index fell -1.4% MoM and -3.3% YoY in June as industrial activity continues to decline in Germany.

In the UK, labor productivity declined -0.6% YoY in Q1 2023 which is the weakest since Q1 2013. Output per worker fell -0.9% YoY and output per job fell -1.0% YoY. Both were the weakest since Q3 2009.

German Industrial Production

German industrial production drops in May (ING) - German industry is still stagnating and needs an activity surge in June to avoid an extension of the recession.

US ISM Services PMI

ISM Shows Services Sector Resilience in June (TD Bank) - The U.S. services sector's resilience was on display in the June ISM Services survey. Demand for services is holding up better than on the goods side of the economy, as evidenced by a decline in the ISM Manufacturing index earlier this week.

Faster Expansion in Services Amid Growing Demand for Labor (Wells Fargo) - The service sector continues to benefit from robust demand; that is pushing many businesses to staff up in a way that has been lacking in recent months. Mercifully, service prices are rising at their slowest pace in years, though sustained demand highlights the upside risk for prices.

The ISM Non-Manufacturing Index Increased to 53.9 in June (First Trust Portfolios) - The two June ISM reports were a great display of the divergence in the US economy between the goods and services sectors. Earlier this week, we learned the ISM Manufacturing index continued to fall, missing consensus expectations, and remaining in contraction territory for the eighth month in a row.

US Trade

Net Export Drag in Q2 Despite Narrowing in May Trade Deficit (Wells Fargo) - The U.S. trade deficit widened to $69.0 billion in May amid a plunge in import growth. Net exports are still tracking to be a considerable drag on second-quarter growth, and the underlying import data demonstrate the domestic rotation away from goods and to services.

The Trade Deficit in Goods and Services Came in at $69.0 Billion in May (First Trust Portfolios) - The trade deficit in goods and services declined to $69.0 billion in May as both imports and exports declined. We like to focus on the total volume of trade, imports plus exports, as it represents the extent of business and consumer interactions across the US border. This measure fell by $9.6 billion in May, is down 5.2% versus a year ago, and is now 5.8% lower than last year's peak in June.

Canada Trade

Canada's Trade Accounts Flip to Deficit in May (TD Bank) - May's trade data provided further input for how net exports are shaping up in the second quarter of the year. Recall that in the first quarter, export volumes held up impressively well, up 10% quarter-on-quarter (q/q) annualized, while imports remained effectively flat. That trend appeared to be extending into the second quarter as export volumes continued to outpace imports in April. But May's trade data saw imports and exports move in the opposite direction, suggesting that trade activity contributions to Canada's second quarter GDP may be more muted.

Canadian trade (May): A big swing (CIBC) - Canada's goods trade balance swung sharply and unexpectedly into deficit territory in May, suggesting that net trade may not be the positive contributor to Q2 growth that was previously expected. The $3.44bn deficit was the largest since October 2020 and followed a downwardly revised $0.9bn surplus in the prior month. The large swing relative to the prior month reflected both a decline in exports (-3.8%) and a rise in imports (+3.0%).

Cdn. Merchandise Trade Balance (May) — Big Swings (BMO) - Trade numbers have a habit of swinging wildly, and this report is a clear example. From the perspective of our near-term growth outlook, the deterioration in merchandise trade flows suggests that net exports will contribute little to GDP growth, consistent with our call for Q2.

US

Fed minutes confirm members favor additional rate hikes (TD Bank) - Today's minutes emphasized that the Fed does not believe it is done its historic rate hiking campaign as the disinflationary process has been slow to gain traction. This has been acknowledged by Chair Powell, who has stated that the Fed "has a long way to go" in its fight against inflation. The Fed's "higher for longer" rhetoric has been reflected in financial markets, which have recalibrated their expectations for the trajectory of the fed funds rate higher.

Volume on Recession Murmurs Turned Down (BMO) - Don't ever take one job indicator as the be-all and end-all (example: payrolls, household employment, claims, job openings, layoffs, ADP, ISM surveys). But if, collectively, they're all (or the bulk of them) pointing in the same direction, then that is something you cannot ignore. In this case, they still point to a tight labor market. Good for workers, bad for business and for the Federal Reserve.

Existing Home Sales Up Slightly in May (NAHB) - After two consecutive monthly declines, existing home sales saw a modest increase in May as mortgage rates were relatively steady in April, according to the National Association of Realtors (NAR). However, elevated mortgage rates and limited inventory continued to weight on homebuyers. Low resale inventory and strong demand have contributed to the recent increases in new home sales.

U.S. vehicle sales continued to see strength in June (TD Bank) - Light vehicle sales continued to see solid growth in June, bringing the total sales for the second quarter to 4.10 million units – up 17.5% y/y, but roughly 8.0% below 2018-2019 levels. The supply picture continues to see steady improvements, as North American auto production in May hit its highest level since August 2019. This has helped to offset some of the pent-up demand that still exists in the market, particularly in the fleet segment.

Nonmetro Homeownership Affordability in Decline (Richmond Fed) - In recent years, home price growth exceeded household income growth nationally and in the Fifth District. Paired with rising interest rates over the past two years, this has considerably reduced affordability of homes on the market for the typical household.

Construction Job Openings Rise, But Long-Run Trend is Declining (NAHB) - The count of open, unfilled jobs for the overall economy moved lower in May, falling to 9.8 million. While ongoing tight labor market conditions have likely confirmed one to two more Fed rate hikes through the start of the Fall, the JOLTS survey is another data point indicating an ongoing but gradual cooling of macro conditions.

The EGIs: Analyzing the Economy Through an Equitable Growth Lens (Liberty Street Economics, NY Fed) - Inflation remains elevated, labor markets are close to the strongest they have been, real consumption is up year-over year, but all of these observations are with respect to averages. Behind these macroeconomic trends can be widely varying experiences across different demographic and socioeconomic groups that make up our society. To provide researchers, practitioners, and the public with timely, regularly updated and comprehensive answers to these questions, we launched the Equitable Growth Indicators (EGIs)—a new tool to help foster the evolving discussion about economic inequality and equitable growth.

Europe

European retail is finally getting over Covid (DWS Group) - Europe's retail sector was shaken up by Covid but we see good grounds to believe it is stabilizing, helping European economies in 2H23 along with a growing service sector.

Türkiye | Inflation will accelerate in near term (BBVA) - Consumer prices rose by 3.92% in June, lower than both our expectation (4.85%) and market consensus (4.3%), whereas annual inflation dropped to 38.2% from 39.6% in May on favorable base effects led by energy prices. We expect annual consumer inflation to increase now onwards and finish the year at 55%.

Inflation outlook in Poland should improve, leading to rate cuts (ING) - As expected, rates in Poland remained unchanged (reference rate still 6.75%). In the press release, the Council focused on 2H23 and 2024 – a period of more benign inflation prospects. The bank president should sound dovish at Friday's press conference, highlighting many disinflationary pressures and preparing the ground for rate cuts this year.

China

China - June PMIs point to slowdown in services (ABN AMRO) - China Macro: June PMIs show ongoing divergence. Services PMIs confirm reopening rebound is fading.

Mexico

Mexico | The Mexican economy is growing at a good pace (BBVA) - Everything indicates that the country's economic growth in the first half of this year will be good and higher than expected. The year's first quarter growth (QoQ) was 1%, which implies a growth rate greater than 4% in annualized rates.

Inflation

Labour costs keep inflation elevated worldwide in June (S&P Global) - The Global PMI data - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - showed companies' costs and selling prices continued to rise at historically elevated rates in June, buoyed in particular by rising wage costs, though rates of inflation ran well below last year's peaks.

Where Is Inflation Persistence Coming From? (Liberty Street Economics, NY Fed) - Elevated inflation continues to be a top-of-mind preoccupation for households, businesses, and policymakers. Why has the post-pandemic inflation proved so persistent? In a Liberty Street Economics post early in 2022, we introduced a measure designed to dissect the buildup of the inflationary pressures that emerged in mid-2021 and to understand where the sources of its persistence are. This measure, that we labeled Multivariate Core Trend (MCT) inflation analyzes whether inflation is short-lived or persistent, and whether it is concentrated in particular economic sectors or broad-based.

PMI

Global growth loses momentum as service sector slowdown accompanies factory downturn (S&P Global) - The global economy continued to expand in June, according to the S&P Global PMI surveys, based on data provided by over 27,000 companies. However, expansions slowed in almost all major economies as a broad-based weakening of service sector growth was accompanied by a renewed downturn in worldwide manufacturing output. The resulting rise in global business activity was the weakest since February.

Outlook

US inflation and UK GDP in focus as markets assess rate paths (S&P Global) - Inflation data in the US takes centre stage in the coming week as investors seek guidance on the Fed’s next steps after it paused its rate hikes in June. In Europe there will be new data for the hawkish-sounding Bank of England and ECB to digest via UK GDP and labour market data, as well as Eurozone industrial production and trade statistics. Key data releases will also add insights into whether Beijing will add more stimulus to help its struggling post-pandemic recovery. Central bank policy decisions are meanwhile due in Canada and South Korea, as are speeches from a series of FOMC members and RBA governor Lowe

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website.