The ECB Prepares to Address Excess Liquidity Through the MRR

Economic news and commentary for September 26, 2023

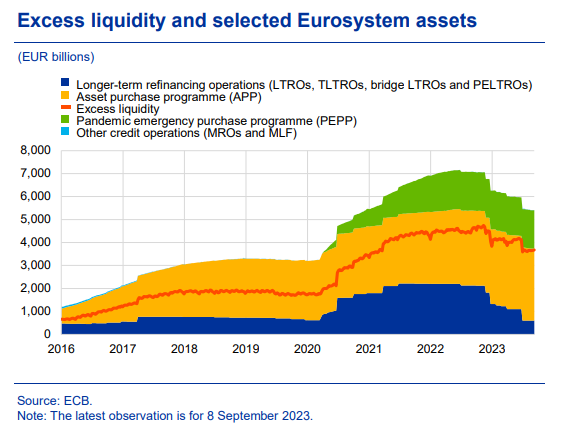

The European Central Bank (ECB) is actively exploring methods to curtail the excess liquidity within the euro area banking system. Among the strategies under consideration is a potential adjustment to the minimum reserve requirements ratio (MRR). Such an adjustment could see the MRR rise from its current 1% to either 3% or 4%. In monetary terms, this translates to an escalation in capital requirements from €165 billion to a staggering €500 billion or even €600 billion. A move of this magnitude would exert considerable pressure on bank profitability, primarily because it would limit the volume of funds on which banks can accrue interest within the ECB's deposit facility.

As the potential for this change in capital requirements is discussed by the media and analysts, ECB President Lagarde addressed the issue of excess liquidity in her speech in front of the Committee on Economic and Monetary Affairs of the European Parliament. She points out that a lot of excess liquidity has already been drained out of the economy (about €1 trillion) over the past year through the repayments of TLTRO III and the drawdown in securities held under the asset purchase programme (APP). She also shares that the “Eurosystem staff is analysing the optimal long-run size and composition of our balance sheet – and by implication, the adequate level of excess liquidity” which is likely a nod to the suspicions that the MRR is in the ECB’s target. The message seems clear here that there will be a general effort by the ECB to address excess liquidity concerns in the near future. She asserts that “this is not a trivial issue as it has implications for the way we implement monetary policy.”

A more general concern about an MRR hike is that the banking sector may be too fragile to just absorb the damage. As we saw during the banking crises earlier this year, balance sheets were quite vulnerable to major shifts in rates and liquidity that hadn’t been seen in decades. An overreaction by financial institutions to the further withdrawal of excess liquidity could accelerate a hard landing into a panic and a crash. Thus, it is crucial that the ECB walk a fine line here. Communication of potential policy changes has always been key, and it explains why three ECB officials have made speeches in the last two days including Lagarde’s direct mention of “excess liquidity.”

Still to come…

9:00 am (EST) - US Case-Shiller Home Price Index

9:00 am - FHFA House Price Index

10:00 am - US Consumer Confidence

10:00 am - US New Home Sales

10:00 am - US Richmond Fed Manufacturing Index

Morning Reading List

Other Data Releases Today

French construction costs were up just 0.2% QoQ and 2.7% YoY in Q2 2023.

The building sector specifically only saw costs go up 0.3% QoQ and 4.1% QoQ as input materials prices remain broadly stable after the post-pandemic surge.

US

U.S. Government Shutdown Breakdown (TD Bank) - The current budget impasse in Congress threatens to shut down non-essential government departments and agencies without independent funding at midnight on September 30th. This isn’t new territory. Prior shutdowns have led to limited negative impacts on economic growth despite being disruptive to agency functioning, government contractors and social services, thereby imposing costs on communities across the country.

U.S. Economic Outlook: Soft landing or soft recession? (DWS Group) - Odds of a soft landing have increased but lots of imbalances still linger. On top of uncertainties about inflationary dynamics and labor market conditions, we highlight measurement issues from various economic statistics to corporate profits. We still have reasonable doubts that the necessary adjustments can be smooth and expect what we call a soft recession.

US Weekly Economic Commentary: Strikes and shutdown threaten Q4 (S&P Global) - With growth above trend, and labor markets tight — and perhaps tightening — there can be little near-term relief from inflation pressures emanating from taut labor market conditions. Recent declines in inflation are certainly welcome news, but to the extent they merely reflect the unwinding of pandemic-era idiosyncratic price increases, they may soon fade, leaving core inflation rates still intolerably above the Fed's 2% objective.

Don’t Fall for the Q3 Head-Fake (First Trust Portfolio) - We have plenty of data reports to go, but, so far, the third quarter is shaping up to be a strong one for the US economy. The Atlanta Fed’s GDP Now model is tracking a Real GDP growth rate of 4.9% for Q3, which would be the fastest quarterly growth rate since the earlier part of the COVID recovery.

Bankers, regulators absorb lessons of Silicon Valley Bank failure as new tests emerge (Dallas Fed) - Ben Munyan is director of supervisory policy in the Banking Supervision Department at the Federal Reserve Bank of Dallas. He was previously a finance professor at Vanderbilt University. He discusses the challenges the banking industry faces in an era of rapidly rising interest rates and how Texas institutions have fared.

Can Economists Predict Recessions? (St Louis Fed) - When people ask questions about the economy, they often ask about predictions. Will there be a recession soon? When will inflation come down? Why didn’t economists see the 2008 crisis coming? And perhaps most importantly: Do economists have any idea what’s going to happen to the economy?

Europe

Increase in minimum reserves would hit bank liquidity at crucial moment (ING) - The European Central Bank is said to be considering an increase in banks' minimum reserve requirements. The impact of higher reserve requirements on banking sector profitability would be negative. This would also tie up a larger share of bank liquidity buffers and therefore have a substantially negative impact on LCR metrics.

Hearing of the Committee on Economic and Monetary Affairs of the European Parliament (Christine Lagarde, ECB) - Speech by Christine Lagarde, President of the ECB, at the Hearing of the Committee on Economic and Monetary Affairs of the European Parliament.

Money and inflation (Isabel Schnabel, ECB) - Thünen Lecture by Isabel Schnabel, Member of the Executive Board of the ECB, at the annual conference of the Verein für Socialpolitik.

Monetary policy transmission in the euro area (Philip Lane, ECB) - Presentation by Philip Lane at the Banque de France-CEPR-ECB Conference about Monetary Policy Challenges for European Macroeconomies.

Inflation

Global Inflation Uncertainty and its Economic Effects (Federal Reserve) - Policymakers, including Federal Open Market Committee (FOMC) participants, have been stressing the elevated level of uncertainty, especially related to inflation, and the challenge this poses for monetary policy. With few exceptions, FOMC participants see the level of uncertainty around their forecasts for core PCE inflation as high, compared to the average over the past 20 years. Policymakers are not the only ones.

Inflation Expectations, the Phillips Curve, and Stock Prices (San Francisco Fed) - During the 1970s and early 1980s, rises in inflation tended to coincide with weaker economic activity and lower stock prices. But in more recent decades, rises in inflation have tended to coincide with stronger economic activity and higher stock prices. The emergence of a pattern where inflation, economic activity, and stock prices all move together over the business cycle can be traced to the beneficial effects of well-anchored inflation expectations.

Inflation Monitor for September 25 (BMO) - Getting Canadian inflation back to the BoC’s 2% target may be more difficult amid underlying pressures even in the face of a stagnating economy.

Flash PMI signal unwelcome combination of economic contraction and rising prices (S&P Global) - Early PMI survey data for September from S&P Global showed the major developed economies collectively contracting for a second month. Falling business activity in the Eurozone and a deepening downturn in the UK was accompanied by a second month of near-stalled business activity in the US, leaving Japan as the only major developed economy which continued to enjoy robust growth.

Surging oil prices: a new concern for central banks (ING) - Life for the European Central Bank has become even more complicated as surging oil prices add to the trilemma of how to balance slowing economies, the delayed impact of the rate hikes so far and still too-high inflation.

Real Estate

New Homes Same Size but Higher Priced if Age-Restricted (NAHB) - Of the roughly 1,005,000 single-family and 547,000 multifamily homes started in 2022, 59,000 (28,000 single-family and 31,000 multifamily) were built in age-restricted communities, according to NAHB tabulation of data from the Survey of Construction (SOC, conducted by the U.S. Census Bureau and partially funded by HUD). A residential community can be legally age-restricted, provided it conforms the one of the set of rules specified in the Housing for Older Persons Act of 1995.

FX

Macro/FX Watch: Dollar remains bid on yield and safety (Saxo Bank) - King dollar remains heavily in demand, being the only relief in portfolios with both equities and bonds down. Momentum is likely to continue until US economic data or events signal risks to spending into Q4. We highlight the "Three S" risks stacking up into next week coming from student loan repayments, strikes and shutdown. These could make Gold outperform, but any hit to the USD will remain temporary for now. EUR and JPY face a double whammy of risks from USD strength and rising oil prices, while CAD outperformance continues.

Green

How Reform Can Aid Growth and Green Transition in Developing Economies (IMF) - New approaches to governance, business regulation, and trade can boost output by 4 percent in two years and help countries curb emissions.

New York Climate Week: It’s all about acting faster and together (ING) - Increased severe weather events have alerted us to act faster against climate change. We think New York Climate Week adds value by emphasising value chain partnerships, infrastructure building and quality reporting. And there needs to be more alignment between corporate sustainability teams and the C-suite to future-proof decarbonisation efforts.

Research

Estimating Duration Dependence on Re-employment Wages When Reservation Wages Are Binding (Cleveland Fed) - This paper documents a novel finding indicating that re-employment wages are elastic to the level of unemployment insurance (i.e., a binding reservation wage) and adapts the IV estimator for duration dependence in Schmieder et al. (2016) to account for this fact. Using administrative data from Spain, we find that unemployed workers lower their re-employment wages by 3 percent immediately after the exhaustion of unemployment insurance (UI) benefits. Workers’ characteristics and permanent unobserved heterogeneity cannot explain this.

Mean Group Distributed Lag Estimation of Impulse Response Functions in Large Panels (Dallas Fed) - This paper develops Mean Group Distributed Lag (MGDL) estimation of impulse responses in large panels with one or two cross-section dimensions. Sufficient conditions for asymptotic consistency and asymptotic normality are derived, and satisfactory small sample performance is documented using Monte Carlo experiments. MGDL estimators are used to estimate the effects of crude oil price increases on U.S. city- and product-level retail prices.

Banks’ capital distributions and implications for monetary policy (ECB) - Banks distribute capital to equity investors by either paying dividends or buying back shares, with ambiguous implications for the transmission of monetary policy via banks.

Looking for a way to take advantage of higher interest rates? I recommend SoFi’s high-yield savings account which has a yield of 4.5% (subject to change) and includes FDIC deposit insurance for both its checking and savings accounts just like a traditional bank. Use my referral link to get a sign-up bonus and start earning that rate today. (This is also a great way to support me since I get a bonus too!)

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website. You can also see my feed on the PiQSuite platform as a partnered feed.