Tech earnings top estimates, especially Meta, and prove that the technology sector is thriving. Meanwhile, the BLS follows that up with a hot jobs report that is likely to dash any chances of a rate cut in March. “Soft landing” is turning into “no landing.”

US: Jobs Report Blows Out Consensus Estimates

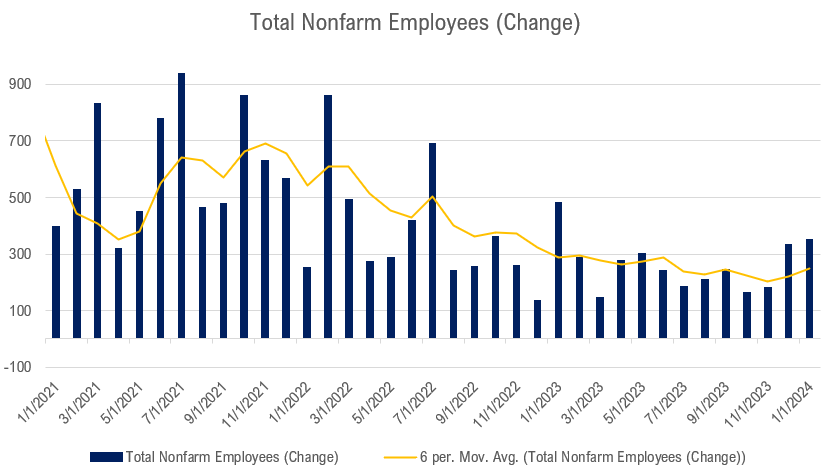

In a blowout jobs report, the BLS reported that the US added 353,000 jobs in January with the unemployment rate remaining at 3.7%. The consensus estimate of 180,000 was nearly doubled. There were several strong sectors that added more than 30,000 jobs in January, but the ones leading the way were business services added 74,000 jobs, and health care added 70,000 jobs. To add to the heat, the December jobs gain was revised up a whopping 117,000 for a second estimate of 333,000. This puts average hiring over the last 6 months at 248,000, the strongest since June 2023.

All of the heat came from the establishment data while the household data was a bit tamer. The number of employed in this part of the report actually fell -31,000 in January and is down over -700,000 since November. However, in the same period, the number of unemployed fell as well, down around -140,000. Trumping both of these changes is the drop of close to 850,000 in the labor force which kept the unemployment rate unchanged for all of Q4 2023. Another notable point of weakness is that long-term unemployment continued to pick up and is up over 200,000 in the last year. However, the slightly shorter-term segment of 15-26 weeks saw a sharp drop of -240,000 in January alone. The bottom line of the household data is that we shouldn’t be too quick to claim that the labor market is tightening based on establishment data alone.

However, if you look at the new wage data, there is further evidence of tightening that supports the notion of a hot jobs market. Average hourly earnings grew a strong 0.6% MoM and was up 4.5% YoY in Jan, up from 4.4% YoY in Dec. For Q4 2023, the quarterly growth rate was 1.6% QoQ, the hottest since the pandemic volatility in the three months to May 2020. Looking at sectors, goods wage growth did actually ease from 5.6% YoY to 5.2% YoY, but services wage growth picked up to 4.4% YoY from 4.1% YoY.

France: Industrial Production Bounces in December

French industrial production grew 1.1% MoM in December, adding to moderate growth of 0.5% MoM in November. Manufacturing production specifically also saw a nice gain of 1.2% MoM and was up a meager 0.1% QoQ in Q4 2023. The main source of manufacturing strength was in transport equipment up 1.6% MoM, pharma up 3.1% MoM, and rubber & plastics products up 5.7% MoM. Production of machinery (-2.4% MoM) and energy goods (-1.7% MoM) were the weak spots. The main takeaway from the report is the weakness in consumer durables production for the quarter and year, down -1.7% and -2.3% respectively, as it points to an underlying weakness in demand for more capital-intensive goods.

Australia: Market Soars on Mixed PPI Report

Australia’s ASX 200 index reached an all-time high on Friday with a gain of 1.47%. This is the second record high of the week. The bullish trading comes on the back of the release of PPI inflation rates which was reported at 0.9% QoQ and 4.1% YoY for the fourth quarter of 2023 (up from 3.8% YoY previously). The most positive part of the report was the manufacturing input numbers. That segment of PPI grew just 0.3% QoQ and was down -2.0% YoY, the second quarter of deflation. On the other hand, construction PPI continued its rise, up 1.9% QoQ and 5.4% YoY, due to skilled labor shortages and profitability concerns. In general, the market seems to view this report as disinflationary despite it being more mixed.

In the News

Donald Trump Says He Wouldn’t Reappoint Powell

Former President Trump has expressed his intention not to reappoint Jerome Powell as the Federal Reserve chair if he is elected in November when Powell's term ends in 2026. Trump attributes this decision to concerns about potential interest rate cuts, suggesting that Powell might act in favor of the Democrats. Powell, in response, has consistently maintained that political considerations do not influence his monetary policy decisions. He emphasizes a data-driven approach, asserting that economic indicators guide his decision-making process rather than partisan motives.

Large Tesla Recall Impacts Most US Vehicles

Tesla has initiated a recall of 2.2 million vehicles due to concerns about the small font size of warning lights on the display. This recall encompasses most Tesla vehicles on US roads. While significant, this recall is comparatively less impactful than others that Tesla has faced, particularly those related to issues with the vehicles' self-driving features.

Earnings

Apple (AAPL, technology) - Chinese iPhone sales disappoint and become the headline. Services revenue hit an all-time high, up 2% YoY. iPhone sales grew to $69.7 billion, topping expectations of $65.7 billion, but sales in China disappointed by about $2.5 billion. iPad, services, and wearables all came in slightly below expectations.

Amazon (AMZN, technology) - Revenue beats handily, up 13.9% YoY. North America sales up 13% YoY, and international sales up 17% YoY. AWS segment sees a jump of 13% YoY in sales. Net sales are expected to be up another 8-13% YoY in Q1 2024 with a strong operating income between $8-12 billion.

Meta (META, technology) - Heavy beat of EPS and solid revenue beat. Revenue increased 25% YoY in Q4 and 16% YoY for the full year of 2023. Daily active users grew 6% YoY to 2.1 billion, family daily active people up 8% YoY to 3.2 billion. Guidance for revenue in Q1 2024 is well above consensus, $34.5-37 billion vs $33.87 billion expected.

For more macro and market commentary, check out my Reddit feed.