US Retail Sales Grow at Fastest Monthly Rate Since the Start of the Year

Economic news and commentary for September 14, 2023

US Retail Sales

US retail sales expanded once again in August, extending a streak of gains to five months. In August, the headline growth of retail sales was 0.6% MoM which is the fastest since January 2023. The annual rate of growth only slowed by -0.1 ppts to 2.5% YoY last month. The more core measure of total retail and food services sales was up just 0.2% MoM since gasoline sales played a significant impact in the headline number. No matter where the spending is going, one thing seems to be true, the US consumer is still spending and proving to be resilient in the face of increasingly murky economic waters.

As evidenced by the difference between the headline and core figures in August, there was a significant increase in gasoline sales of 5.2% MoM. The increase in gas sales was almost entirely the result of rising energy prices. In the CPI report yesterday, we saw that the gasoline index increased a sharp 10.6% MoM which meant that drivers in August were paying a hefty premium. Despite the jump to end the summer, the YoY growth in gas sales is still sharply negative at -10.3% YoY (though this is much higher than the -20.9% YoY in the month before).

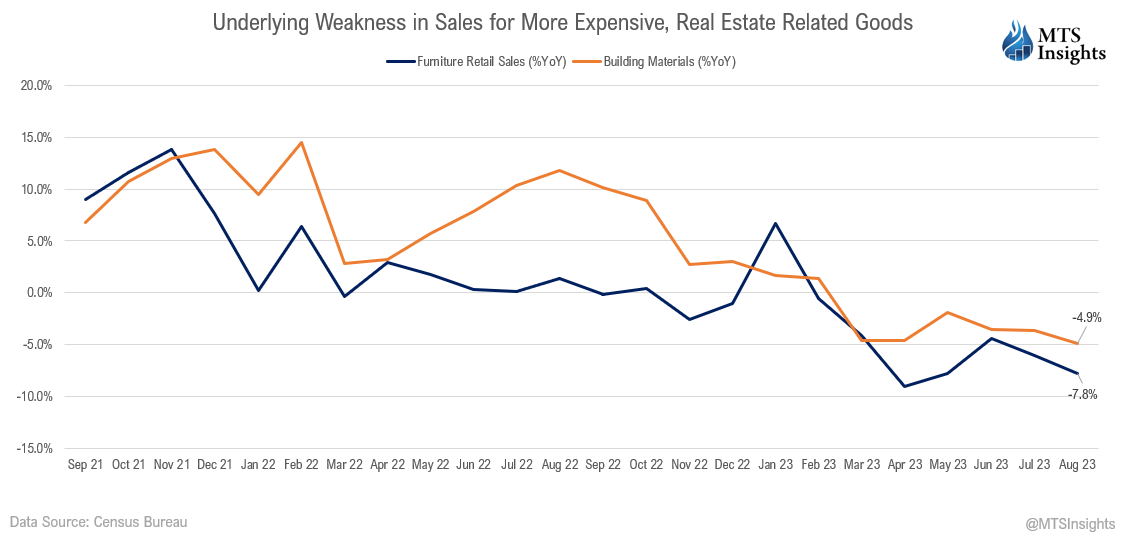

Growth rates in other categories were mixed. There was growth in clothing sales (0.9% MoM), electronics (0.7% MoM), and health & personal care sales (0.5% MoM). On the other hand, there were some categories that saw significant moves down like sporting goods sales(-1.6% MoM), miscellaneous store sales (-1.3% MoM), and furniture sales (-1.0% MoM). It is worth pointing out that the furniture and building materials store segments have the worst YoY growth rates (excluding gas sales) at -7.8% YoY and -4.9% YoY respectively because they are related to more expensive purchases that may require consumers to need access to credit to purchase. Additionally, both have some relation to the real estate industry which is currently the most struggling area of the economy. The fact that both of these categories saw their YoY declines intensify suggests that there is some underlying consumer weakness that is being hidden by rosier headline results.

The bottom line is that as long as consumers are spending, the economy is growing. And at the moment, retail spending is keeping pace with price growth and in some cases slightly ahead of it. There are some underlying trends that point to weakness ahead, but so far in Q3, it looks like consumption will be on track to be a positive contributor to GDP growth. Of course, things can and likely will change as tighter financial conditions eventually show out in full force. For now, resilience is the keyword.

Still to come…

10:00 am (EST) - US Business Inventories

10:30 am - EIA Natural Gas Report

4:30 pm - Fed Balance Sheet

9:30 pm - China House Price Index

10:00 pm - China Fixed Asset Investment, Industrial Production, Retail Sales

Morning Reading List

Other Data Releases Today

Australian employment rose by 0.5% MoM in August, with unemployment steady at 3.7%. However, underemployment ticked up to 6.6% as total hours worked dropped by 0.5% MoM. Despite the employment boost, the number of unemployed is still up 8.5% YoY.

Japanese machinery orders jumped 9.8% MoM in July, with private sector orders soaring 26.6%. Excluding volatile orders, there was a slight dip of -1.1% MoM. Manufacturing orders decreased by -5.3% MoM, while non-manufacturing orders rose 1.3% MoM, indicating a shift in demand patterns.

India's Wholesale Price Index grew 0.3% MoM but was down -0.5% YoY in August, up from -1.4% YoY in July. As expected, fuel & power prices grew 3.0% MoM. The Food Index reversed slightly, falling -0.8% MoM but still up 5.6% YoY.

The ECB has increased its key interest rates by 25 bps. The rate on refinancing operations is now 4.5%. Alternatively, the PEPP portfolio will continue to be reinvested until at least the end of 2024. The ECB staff has also revised down the path of core inflation to an average of 5.1% in 2023, 2.9% in 2024, and 2.2% in 2025 while the path of overall inflation was upgraded which reflects the expected rise in energy prices. Additionally, growth estimates for the euro area were also lowered. Now at 0.7% for 2023. The ECB seems to suggest that this will be the last hike, “the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.”

Jobless claims fell -13,000 to 216,000 last week. The insured unemployment rate was 1.1%, down -0.1 ppts. Continued claims fell -40,000 to 1.68 million.

US PPI grew 0.7% MoM and 1.6% YoY in August, up from 0.8% YoY in Sep.

Core PPI: 3.0% YoY (0.3% MoM)

Processed Goods: -4.3% YoY (2.1% MoM)

Unprocessed Goods: -26.9% YoY (1.3% MoM)

Services: 4.2% YoY (0.1% MoM)

Australia Employment

Australia: Strong labour report complicates Reserve Bank (RBA) rate decision (ING) - Although most of the jobs created this month were part-time, these have a habit of turning into full-time jobs, with all that this implies for higher spending power and other benefits. This pushes the pendulum back a little in favour of some further RBA tightening.

US CPI

Lingering US inflation fears leave a final rate hike on the table (ING) - After a couple of benign core CPI prints, we have a modest upside surprise in the August report while surging gasoline prices boosted headline inflation. The Fed will still keep rates on hold in September, but it means officials will almost certainly keep one final hike in their official forecasts, even though we don’t think they will carry through with it.

Despite the upside surprise, core inflation continues to trend favorably (TD Bank) - After two months of softer prints, core inflation surprised to the upside in August, highlighting what we have been saying for some time that progress is unlikely to come in a linear fashion. That said, even after accounting for the stronger monthly gain, the three-month annualized change on core still slipped to 2.4% – the slowest pace of growth since March 2021.

It Was a Hot August for U.S. Inflation (BMO) - The still relatively moderate core inflation reading for August—the third month in a row—combined with the cooling labor market seen in the August Employment Report likely seals the deal for a rate-hike pause at the September FOMC meeting. That said, with the uncomfortable rise in headline inflation and continued rise in oil prices to near $90 per barrel, the Fed will likely want to still keep another rate hike on the table if the inflation moderation we have seen this summer doesn’t continue.

US CPI: Somewhere between a boil and a gentle simmer (CIBC) - Somewhere between a boil and a gentle simmer, US CPI inflation came above expectations in August. Core prices rose by 0.3% m/m in August, slightly above consensus expectations of 0.2% m/m. In year-over-year terms, core inflation edged down to 4.3% from 4.7% the month prior due to favorable base effects. Headline prices rose 0.6% m/m and jumped to 3.7% in year-over-year terms reflecting the strength in gasoline prices in the month. The Fed’s preferred measure of prices tied to underlying demand, non-housing services, rose by 0.4% m/m from 0.2% in July.

The Consumer Price Index (CPI) Rose 0.6% in August (First Trust Portfolios) - The Federal Reserve may have gained some traction against inflation, but the inflation problem is far from finished. As expected, inflation came in hot in August with consumer prices up 0.6% for the month, largely driven by a 5.6% surge in energy prices. In turn, this pushed the twelve-month change for the headline index up to 3.7% versus 3.2% in July.

Inflation Accelerates for Second Straight Month (NAHB) - Consumer prices in August saw the largest monthly gain since June 2022, primarily driven by a surge in gasoline costs. Core service inflation excluding housing was little changed in August, suggesting that the path toward disinflation ahead still has some fluctuations. Meanwhile, shelter costs continued to remain at a high level and was the second-largest contributor to the increase in inflation.

Consumer price index (August 2023): En-core disinflating (EY Parthenon) - While the free disinflationary lunch is over, the slowdown in core inflation momentum remains encouraging. Headline Consumer Price Index (CPI) rose a strong 0.6% month over month (m/m) in August, but this mostly reflected a 10.6% surge in gas prices adding 0.4 percentage points (ppt) to headline CPI. Core CPI meanwhile saw a moderate 0.3% m/m advance. Factoring less favorable annual comparisons, headline inflation rose 0.5ppt to 3.7%, but core inflation moderated a notable 0.4ppt to 4.3% — its slowest pace since September 2021.

US

Assessing a potential United Auto Workers strike (S&P Global) - The four-year contract between the United Auto Workers (UAW) union, representing over 140,000 workers, and three major auto manufacturers will expire on Sept. 14. Currently, negotiations are ongoing, with pay, benefits and union representation all areas left to be concluded. While recent reports suggest movement in the talks, unless the companies or the union offer major concessions, a strike lasting several weeks appears probable. The current political and economic conditions increase the odds of a longer strike, and any strike is likely to affect all three companies.

Urban Renewal and Inequality: Evidence from Chicago’s Public Housing Demolitions (Chicago Fed) - This paper studies one of the largest spatially targeted redevelopment efforts implemented in the United States: public housing demolitions sponsored by the HOPE VI program. Focusing on Chicago, we study welfare and racial disparities in the impacts of demolitions using a structural model that features a rich set of equilibrium responses. Our results indicate that demolitions had notably heterogeneous effects where welfare decreased for low-income minority households and increased for White households.

Europe

Whatever the ECB decides, the answer lies with short-term sovereigns (Saxo Bank) - Long-term yields are poised to rise further amid hawkish central banks, quantitative tightening, and the BOJ looking to exit the yield curve control. We expect 10-year Bund yields to test March highs at 2.76% in the upcoming weeks despite Germany being in a recession. At the same time, the German yield curve is likely to bull-steepen as investors position in the front end amid expectations of the hiking cycle to end. Within this context, short-term sovereigns offer a win-win solution.

ECB preview: a hawkish pause will satisfy hawks and doves (Saxo Bank) - At this week's ECB rate decision, policymakers will likely opt for a pause. Despite the hawks arguing that another hike is warranted, a recession is underway in their own countries. The doves will maintain that we are finally seeing rate hikes feeding through the economy and that overtightening risk is rising. Yet, for the ECB to keep its hawkish bias, policymakers might need to turn to the Pandemic Emergency Purchase Program (PEPP) and stop reinvestments.

Germany needs more than a plan (Allianz) - Germany is the only major economy that looks set to contract in 2023, with headwinds such as slowing demand for its exports (particularly highly cyclical goods such as cars, machine tools and chemicals), lopsided global growth in services over goods, the industry slowdown in the US and China and an inventory correction.

Poland’s current account still in surplus (ING) - Poland’s current account is in surplus amid a sharp decline in import prices. The stagnating European economy is taking its toll on exports. In 2023, the current account may hit 1.5% of GDP vs. a deficit of 3.0% of GDP in 2022. The main downside risks include high spending on imported military equipment and further increases in crude oil and natural gas prices.

EUR rates: 75/25 for a hike going into the ECB meeting (Nordea) - Rates have moved sideways during the past week in the run-up to this week’s ECB meeting. A Reuters story this morning increases odds of a hike. Signals will be important too. We stick to expecting unchanged rates. Shift long-end rec vs 6s to €STR.

Canada

Canada's Labour Market is Less Sensitive to Downturns than America's but Often Recovers Slower (TD Bank) - The North American economy is not in recession but the risks are elevated given restrictive monetary policy geared at slowing economic growth. Rising unemployment is the most salient feature of recessions. Historically, the U.S. unemployment rate has shown more sensitivity to economic deterioration than the Canadian unemployment rate. During recessions high-productivity sectors in Canada often see larger declines than their U.S. counterparts. Meanwhile, U.S. recessions have been more widespread, resulting in larger overall job losses.

Canadian households' wealth climbs higher as assets grow faster than liabilities (TD Bank) - Canadian household net worth (the value of all assets less all liabilities) climbed higher for the third quarter in a row, rising by close to $256 billion or 1.6% quarter-on-quarter (q/q) to $16 trillion in the second quarter of 2023.

Income-ing (BMO) - A tight labour market powered a jump in household disposable incomes, which led to an improvement in household debt ratios in Q2. Looking ahead, however, a cooler job market will likely slow income growth in the coming quarters. And, high interest rates will keep service costs rising. Elevated household debt remains a notable headwind to consumer spending, especially as mortgages come to renewal, leading to an expected slowdown in broader economic activity through the rest of the year.

India

G20 Summit in India (S&P Global) - India, the current president of the Group of 20 (G20), hosted the G20 Leaders' Summit in New Delhi from Sept. 9 to Sept. 10. The summit began with a unanimous Leaders' Declaration, where participants affirmed the G20 as the "premier global forum for international economic cooperation." Russian President Vladimir Putin and Chinese President Xi Jinping did not attend the summit; both sent representatives instead.

Australia

AMW – How weak is consumer spending? (NAB) - This week we delve into the latest national accounts figures on consumer spending to try to assess just how weak consumer spending is. The national accounts measure of private consumption (50% of GDP) has a much broader coverage of consumer spending than the monthly retail sales data (17% of GDP). Private consumption in the national accounts also has much broader coverage of services spending than the retail sales release, which is heavily skewed towards goods spending.

Inflation

Global Inflation Watch - Underlying price pressures remain sticky (Danske Bank) - Inflation drivers continue to paint a mixed picture, but inflation is likely to head lower through 2023 in the US and euro area. Price pressures from food, freight and energy have clearly eased. Underlying inflation and wage growth have begun to ease in the US, but still remain uncomfortably high for now. In euro area, broader price pressures remain high, with tight labour markets continuing to point towards sticky core inflation going forward. We expect the ECB to hike rates for a final time in September, while the Fed is already likely done with its hiking cycle.

Globalization

The Rise of Deglobalization: Part 1 (Wells Fargo) - Globalization—the rising interconnectedness of the world's economies—has ended. The prior environment of frictionless trade and the free movement of capital, people, information etc. is over, and the global economy is currently in a period of deglobalization. In fact, deglobalization began in the wake of the 2008-2009 Global Financial Crisis; however, the fragmentation of the global economy has picked up pace over the last fifteen years with the rise of protectionist policies, escalating geopolitical tensions and COVID.

Real Estate

Mortgage Activity Low as Rates Remain Above Seven Percent (NAHB) - Per the Mortgage Bankers Association’s (MBA) survey through the week ending September 8th, total mortgage activity decreased 0.8% from the previous week and the average 30-year fixed-rate mortgage (FRM) rate rose six basis points to 7.27%. The FRM rate has remained above 7% since the start of August.

Markets

Time to bond with bonds (DWS Group) - Yields not seen in 15 years, central banks almost done with hiking and tepid growth expected ahead – a lot speaks for bonds these days. And if you fear inflation, equities might be worth a look.

Green

An analysis of five large sectors reveals that none is aligned to the 1.5 degrees C target (ABN AMRO) - We compared the Implied Temperature Rise score of Sustainalytics across different sectors. The banking sector scores better than energy-intensive sectors, such as utilities, but still lags behind the 1.5 degrees Celsius target required to meet the goals under the Paris Agreement. However, not all utility companies score as bad as the average – for instance, Ørsted A/S scores very well in comparison to its peers.

Looking for a way to take advantage of higher interest rates? I recommend SoFi’s high-yield savings account which has a yield of 4.5% (subject to change) and includes FDIC deposit insurance for both its checking and savings accounts just like a traditional bank. Use my referral link to get a sign-up bonus and start earning that rate today. (This is also a great way to support me since I get a bonus too!)

Subscribe to receive Econ Mornings every weekday at 9 am. More economic and finance content on Twitter, Reddit, and my website. You can also see my feed on the PiQSuite platform as a partnered feed.