The top macro report of the morning showed a huge drop in the US trade deficit in 2023 as exports grew and imports fell. Meanwhile, industrial production in Germany weakened toward the end of the year, signaling challenges in key sectors. On the housing front, the UK witnessed a surge in housing prices at the start of 2024, driven by favorable market conditions. Additionally, retail sales data from Italy shed light on the ongoing impact of inflation on consumer behavior.

US: Trade Deficit Tumbles in 2023

The US trade deficit grew 0.5% MoM in December to $62.2 billion. Exports were up 1.5% MoM to $258.2 billion, and imports grew 1.3% MoM to $320.4 billion. Industrial supply exports, up $3.3 billion, and consumer goods imports, up $3.3 billion, led the gains in each trade flow. When looking at volume, the deficit fell -1.4% MoM as the volume of goods exports were actually up 3.7% MoM while the growth of volume of imports was roughly similar to the value. In 2023 as a whole, the US goods and services deficit dropped a huge $177.8 bil, or -18.7%, with exports up 1.2% and imports down -3.6%. In total, US imported $130.8 billion less in industrial supplies and $80.7 billion less in consumer goods. Meanwhile, there was a strong jump in services exports of 8.0% in 2023. This was a huge tailwind for GDP growth over the course of the year.

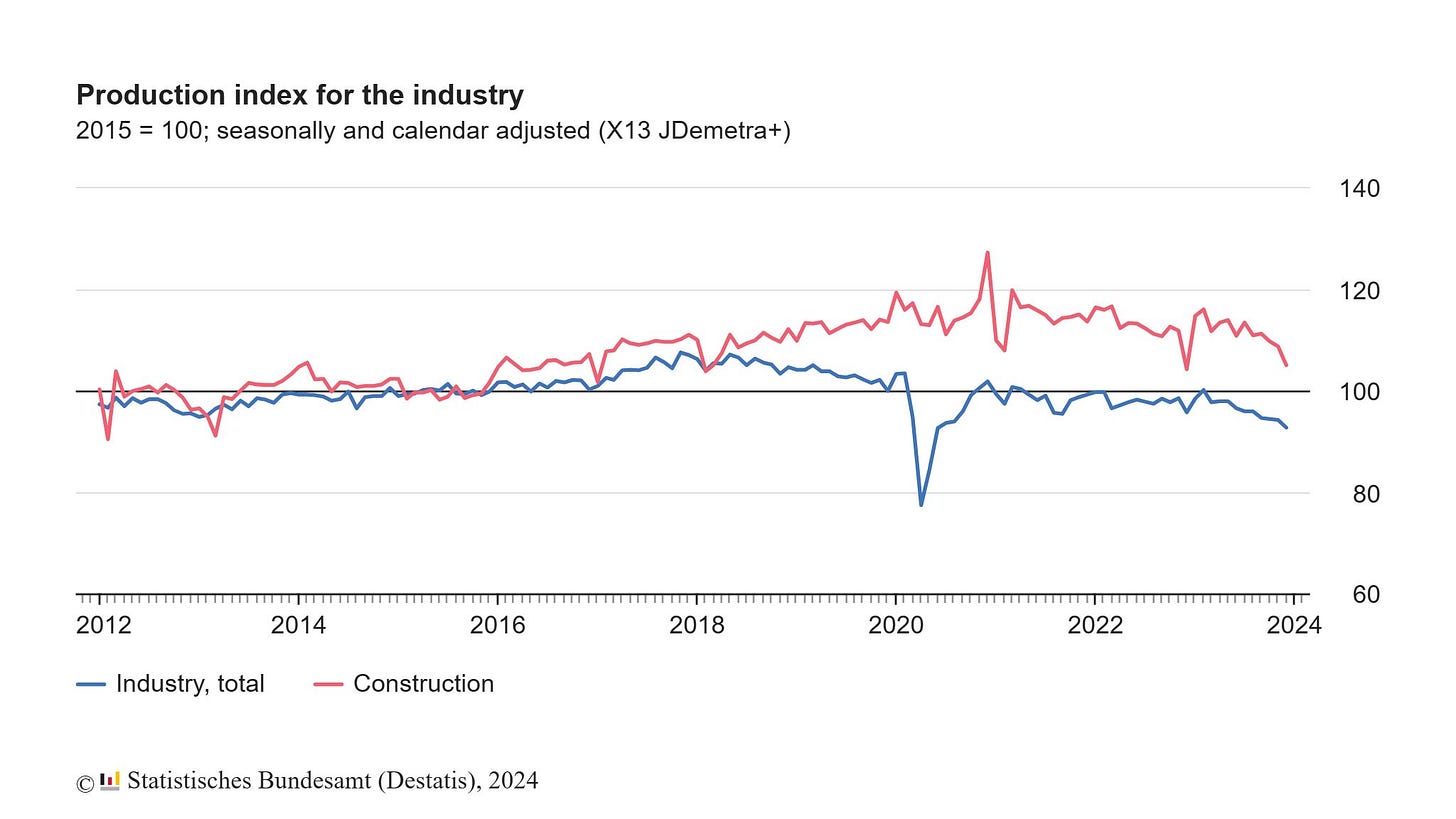

Germany: Industrial Production Weakens to End 2023

German industrial production ended the year on a weak note, declining -1.6% MoM and -3.0% YoY in December. The deepest decline was in the intermediate goods sector where production fell -5.2% MoM. Consumer goods consumption also fell but to a lesser extent, down -0.9% MoM. Energy-sensitive industries remained vulnerable to swings in energy commodity prices, and production in those industries dropped a sharp -5.8% MoM in December. For the full year 2023, industrial production declined -1.5%. A notable result was that the chemical industry saw production fall to the lowest level since 1995, down -10.6% compared to 2022. The chemicals industry is designated as one of the energy-intensive industries used in that special aggregated index.

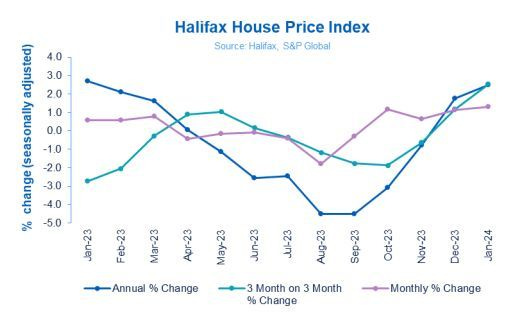

UK: Housing Prices Jump to Start 2024

The UK Halifax House Price index jumps 1.3% MoM in January, the fourth straight monthly increase. For the quarter, the index is up 2.5% (previously 1.2%), and for the year, the index is up 2.5% (previously 1.8%) as well. The quarterly gain is higher than at any point in 2023, and the annual gain is the highest since January 2023. Falling rates and easing inflationary pressure has helped the UK housing market to a positive start in 2024.

Italy: Retail Sales Show Inflation is Still a Factor for Consumers

Italian retail sales edged down -0.1% MoM, and in terms of volume, were down -0.5% MoM. On an annual basis, the value of sales was up 0.3% MoM, but in volume terms was down -3.2% YoY. Both food and non-food volumes were down, -0.9% MoM and -0.2% MoM respectively. Weak categories in December include household appliances (-4.1% YoY), tools (-3.6% YoY), and furniture and other household furnishings (-3.1% YoY). The lingering inflationary pressure is still keeping consumers at bay in Italy, however, households are still spending the same amount of money, just settling for less.

In the News

Cleveland Fed Mester and Minneapolis Fed Kashkari Speak on Monetary Policy

Cleveland Fed President Mester delivered a speech on monetary policy, emphasizing the current robustness of the labor market and spending. She noted that this strength affords the Federal Reserve an opportunity to maintain interest rates at their current levels while awaiting further inflation data. Mester stressed the importance of balance, cautioning against the premature reduction of rates, which could jeopardize progress on inflation. Conversely, she warned that prolonged maintenance of rates at their current level could inadvertently tighten the Fed's policy stance. Mester expressed confidence that if the economy continues along its current trajectory of moderation, the Fed will be sufficiently emboldened to consider lowering rates later in the year.

Additionally, Minneapolis Fed President Kashkari delivered a speech emphasizing that progress on inflation has not yet reached its desired level. Despite acknowledging recent strong data, Kashkari expressed optimism that the United States is poised to avoid a recession this year barring any external shocks. He observed that consumers' savings are depleting at a slower pace than anticipated. Additionally, Kashkari addressed concerns regarding the national debt, labeling the current legislative framework as unsustainable. Both Mester and Kashkari pushed back against the market narrative that rate cuts are coming soon.

Biden and “None of These Candidates” Top Nevada Primaries

In Nevada's official Republican primary, Nikki Haley faced defeat even as the ballot excluded Donald Trump, resulting in a victory for the option known as "none of these candidates." Haley has criticized the primary process in Nevada, alleging it was rigged in Trump's favor. The outcome of Tuesday’s Republican primary is inconsequential, however, as a party-run caucus is set to determine delegate allocation on Thursday that will include Trump. On the Democratic side, Joe Biden secured a dominant win, garnering 89.3% of the vote, while "None of these candidates" came in second with 5.8%.

Hamas Ceasefire Proposal

Hamas has proposed a ceasefire lasting four and a half months, contingent on the release of all Israeli hostages and the withdrawal of Israeli troops from the Gaza Strip. This proposal comes following an offer from Israel mediated by Qatar and Egypt, endorsed by the US. The ceasefire doesn't necessitate a permanent end to hostilities, but in order for all hostages to be released, the proposal requires an agreement on halting the war. In the background, hardline factions within the Israeli government, advocating for Hamas's destruction, pose challenges to finding common ground as they consider some of Hamas' demands unacceptable Meanwhile, amidst negotiations, conflict persists, with Israel advancing its military operations in Gaza, targeting cities like Khan Younis and planning further offensive actions into Rafah, the last Palestinian refuge.

The EU Appeases Farmers by Pausing on Pesticide Restriction Proposal

The European Union has halted a long-debated proposal aimed at imposing restrictions on pesticide use for farmers, signaling a willingness to pause efforts to address environmental concerns to ease unrest. This decision comes amidst ongoing protests by farmers across Europe, who have been demonstrating against climate policies that would cause a significant economic burden. With EU parliamentary elections looming in June, agricultural issues have gained prominence in the political discourse. The protests, impacting millions of citizens and causing significant economic disruptions, persist across Europe despite the shelving of the pesticide restrictions proposal.

For more macro and market commentary, check out my Reddit feed.